Project Planning – Reverse Mortgages are No Longer Just For Homeowners Short On Cash

Financial planning is greatly aided by understanding the time value of money since it enables both people and organizations to plan their cash flow and make wise decisions about their investments. The concept of the time value of money acknowledges how inflation, interest rates, and opportunity costs affect how much money is worth over time. The maximization of one’s financial well-being is guided by this fundamental financial concept, which applies to both people and businesses. Additionally, it becomes clear how crucial it is to comprehend and put the time worth of money into practice via the story of Marjorie Fox, a financial planner who encountered unforeseen life circumstances. Marjorie opted to postpone important financial choices, such as retiring and selling their home, in the wake of her husband’s unexpected death. In order to safeguard her assets and ensure her financial stability at this time, she cleverly used a reverse mortgage. In particular, retirement planning and asset management are two areas where Marjorie’s narrative emphasizes the need to consider the time value of money in decision-making processes.

Article Summary

Marjorie Fox’s husband passed away suddenly in 2016, and she made the decision to put off making significant financial decisions. She held off on retiring for two years, selling her home, and moving into a townhouse by a lake for three years (Hansen, 2023). She decided to take out a reverse mortgage on her brand-new home in order to increase her financial stability. The time value of money theory had a role in Marjorie’s choice since she was aware of the dangers involved with liquidating her assets while the market was in a slump.

The reverse mortgage was Marjorie’s fallback plan after originally setting aside $150,000 as a cash reserve. She made the decision to open a line of credit so she could use the money as she saw fit. Her cash reserve was exhausted within a year, and she began utilizing the reverse mortgage to pay for things like an emergency dental procedure and the deposit for a retirement community (Hansen, 2023). The line of credit’s unused funds are subject to interest accrual, which should be noted.

Marjorie chose to use the reverse mortgage rather than selling other assets or taking taxable distributions from her retirement account (IRA). This is a clear example of the time value of money theory in action. Using a reverse mortgage, she could protect her investment portfolios from market declines and postpone paying immediate taxes (Hansen, 2023). The idea of boosting retirement income while reducing the effect of probable losses on investment portfolios is consistent with this method.

Time Value of Money

A fundamental financial concept known as the Time Value of Money (TVM) affirms that a dollar earned now is worth more than one obtained tomorrow. According to this idea, a dollar obtained now is worth more than a dollar acquired at a later time, which is founded on the knowledge that money can produce returns over time (Dragotă, 2022). As it aids in determining the influence of interest rates and the timing of cash flows, an understanding of TVM is crucial when assessing financial decisions like Marjorie’s reverse mortgage. The idea of TVM is applicable in Marjorie’s situation when figuring out the loan debt and the amount of equity that would eventually be left. The reverse mortgage’s interest accrual increases the loan balance yearly. The interest builds up over time, increasing the loan debt relative to the original loan amount. This is so because interest is based on the growing balance of the outstanding loan.

The TVM idea enables one to comprehend how time affects the loan balance and equity that is still available. The loan sum will increase if Marjorie keeps the reverse mortgage longer, decreasing the amount of equity she still has in the house. This is due to the fact that when the loan’s interest accrues, it continues to compound and raise the sum owed. The value of Marjorie’s remaining shares is likewise significantly influenced by TVM (Dragotă, 2022). Marjorie’s equity is declining as the loan sum rises. This is so because the amount of equity still in the house represents the difference between its value and the loan balance. Marjorie’s financial situation is impacted when the loan debt rises and the equity decreases.

Moreover, one can determine Marjorie’s exact borrowing costs and whether a reverse mortgage is best for her by comprehending TVM. Marjorie may more accurately assess how a reverse mortgage would affect her financial condition by taking into account the interest rates, the loan’s term, and any prospective increases or decreases in the value of her property (Arifin et al., 2021). The future worth of Marjorie’s remaining stock should also be taken into account when assessing TVM. The TVM idea underlines that if Marjorie intends to leave the property to her descendants, the value of the residual equity may be considerably diminished in the future as a result of the loan balance’s increasing value over time. This aspect must be taken into account while evaluating the potential effects on Marjorie’s estate and the inheritance she wants to leave behind.

In summary, Marjorie’s example and the appraisal of her reverse mortgage are particularly important to the idea of the time value of money. Marjorie may make better choices regarding her financial future if she knows that money is time-based and how interest rates affect loan balances and equity. It enables her to think about the long-term effects of the reverse mortgage, weigh the pros and drawbacks of accessing her home equity versus protecting her remaining equity, and examine the possible effects on her estate and inheritance.

Time Value of Money in Financial Planning

Financial planning involves setting objectives, allocating resources, and making calculated judgments. In this process, the time value of money is a crucial instrument that helps people make educated decisions and improve their financial well-being (Brigham & Houston, 2021). There are various situations where financial planning relies heavily on the time value of money. A great illustration of how the time value of money is used is in retirement planning. To guarantee a pleasant retirement, people must take into account their projected income demands, calculate the necessary funds, and choose the best investment plan. By taking into consideration the time worth of money, people may determine how much they should save on a monthly basis and select acceptable investment options that will provide a greater rate of return over time.

Further, when making an investment, one commits money with the hope of earning money back later. When analyzing investment prospects and gauging their likelihood of being profitable, the time value of money is crucial. People may make wise judgments about how to allocate their money by taking into account variables like risk, time horizon, and projected rate of return (Shim, 2022). One can determine whether the investment has a better value over time using the time value of money, for instance, when comparing two investment alternatives with differing predicted returns. Investors can calculate the present value of the returns by discounting the future cash flows of each option, allowing them to select the investment that will produce the best results.

Moreover, for both people and corporations, managing cash flow is essential. In order to assess cash flow patterns and make choices that maximize liquidity and financial stability, it is essential to consider the time value of money (Shim, 2022). People may choose the ideal timing for inflows and outflows, spot future financial gaps, and make contingency plans by considering the time value of money. Businesses may also use the time value of money principles to analyze new enterprises’ profitability, decide on the best financing structure, and establish the viability of investment initiatives. Businesses may make educated choices that enhance their long-term financial success by discounting future cash flows and taking into account variables like interest rates and the cost of capital.

Numerical Analysis

The reverse mortgage calculator calculated that Marjorie would initially be eligible for $370,000 based on her age, interest rate, and house valuation. However, she only used a part of this money. Thus, the balance remained on the credit line. Her maximum borrowing amount is now $329,000 after interest has been added. When the market was in a slump, Marjorie used a well-coordinated approach to safeguard her investment holdings (Hansen, 2023). Assuming she has $1 million worth of investments, she avoids depleting her portfolio by paying bills during downturns with the help of the reverse mortgage, allowing it to rebound once the market starts to recover.

In addition, Marjorie thought about using the reverse mortgage to leave a legacy for her children. Assuming she decided against entirely exhausting her portfolio and instead went with the coordinated approach, theoretical calculations would show that this strategy may leave her heirs with around $2.2 million in after-tax assets instead of $1.8 million in tax-free home equity if the reverse mortgage was established after exhausting funds.

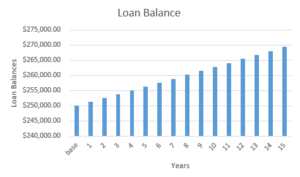

Marjorie obtains a reverse mortgage, enabling her to borrow money while still owning her property. A loan of $250,000 is agreed upon by the lender, based on a loan amount of 50% of the home’s worth. Marjorie intends to stay in the house for another 15 years, and she and the lender have agreed on an interest rate of 6% annually. By multiplying by 12, one can determine the interest rate due each month. The interest rate would be 6% divided by 12 to equal 0.005 per month in this scenario.

The calculations are as follows for up until 15 years;

| Years | Loan Balance |

| Base | $250,000.00 |

| 1 | $251,250.00 |

| 2 | $252,506.25 |

| 3 | $253,768.78 |

| 4 | $255,037.63 |

| 5 | $256,312.81 |

| 6 | $257,594.38 |

| 7 | $258,882.35 |

| 8 | $260,176.76 |

| 9 | $261,477.64 |

| 10 | $262,785.03 |

| 11 | $264,098.96 |

| 12 | $265,419.45 |

| 13 | $266,746.55 |

| 14 | $268,080.28 |

| 15 | $269,420.68 |

Marjorie’s Loan Balance after 15 years was estimated to be 269,420.68; therefore, to calculate the remaining equity, one would need to subtract the loan balance from the house’s value, which was 500,000.

= 230,579.32

The calculations give a general idea of how a reverse mortgage’s loan debt may rise over time while the amount of equity in the house that is still owed to the borrower may decline. The calculations use a set interest rate and no extra payments from Marjorie throughout the 15-year term, which is crucial to note. In actuality, variables like interest rate changes, changes in the house’s value, and any voluntary repayments made by the borrower can affect the loan balance and the amount of equity still in the home. Moreover, it is essential for those thinking about a reverse mortgage to thoroughly assess the conditions, such as interest rates, fees, and the effect on their overall residual equity over time. Individuals can get more individualized information and assistance in making decisions based on their unique situations by consulting with a financial expert who specializes in reverse mortgages.

Conclusion

In conclusion, homeowners like Marjorie who want to access the equity in their houses while still residing there may find that a reverse mortgage is a good solution. Individuals may make decisions that align with their financial objectives and long-term plans by having a thorough grasp of the calculations and ramifications of a reverse mortgage. This research considered variables, including the original loan amount, interest rate, loan balance over time, and residual equity, looking at Marjorie’s reverse mortgage situation throughout the research. Due to the monthly interest rate and lack of monthly payments, this report shows yearly growth in loan debt. Additionally, the research found that when the loan total increased, the residual equity shrank, representing the cost of borrowing against the house’s value.

Moreover, it is also essential to keep in mind that these estimates are based on certain presumptions and situations. In truth, a number of variables, including changes in interest rates, shifts in the house’s value, and future voluntary repayments, can affect the loan balance and residual equity. Individuals should carefully analyze their financial status and goals before deciding whether to get a reverse mortgage. They need to think about how it would still affect their equity on the books, anticipated future costs, and other options they have. One can receive individualized advice and assistance in making well-informed decisions by speaking with a certified financial expert who focuses on reverse mortgages.

In addition, it is crucial to investigate the reverse mortgage agreement’s terms and conditions, such as the interest rates, costs, and possibilities for repayment. In order to choose the best alternative for their needs, people may be empowered by comparing several lenders and comprehending the long-term effects of the loan. It is important to weigh a reverse mortgage’s advantages and potential disadvantages because it might offer financial freedom. The effect on home equity, potential inheritance issues, and possible effects on borrowers’ long-term financial security should all be considered by borrowers. Therefore, a reverse mortgage may be a helpful instrument for gaining access to one’s home equity, but it should be made with time. People may make decisions that are in line with their financial well-being and long-term objectives by completing extensive research, getting expert guidance, and carefully weighing the calculations and repercussions.

References

Arifin, S., Lestari, D. M., & Furwati, R. (2021). Riba in Time Value of Money Concept Perspective of Sharia Law.

Brigham, E. F., & Houston, J. F. (2021). Fundamentals of financial management: Concise. Cengage Learning.

Dragotă, V. (2022). How important is the Time Value of Money in Decision Making? Results of an Experiment. Prague Economic Papers, 30(3-4), pp. 259–275.

Hansen, S. (2023). The stock market’s ‘strong start’ to 2023 could signal good news for the rest of the year: money. Retrieved June 3, 2023, from https://money.com/stock-market-strong-start-forecast/

Shim, J. K. (2022). Financial management. Professor of Finance and Accounting Queens College City University of New York.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Reverse Mortgages Are No Longer Just For Homeowners Short On Cash

Research an article from a newspaper, the internet, or a magazine. The essay should be related to our class study of the time value of money and financial planning. You need to demonstrate the essay topic with your numerical calculations, either with your numerical calculation or replication of the numbers in the essay. Remember to illustrate the role of the time value of money in decision-making. Summarize your work into a short paper in Word file.