Yahoo Inc

The case study “Yahoo! Inc.: Marissa Mayer’s Challenge” focuses on Yahoo, Inc., one of the top internet services companies in the United States. The company has recently experienced some significant changes in its structure. The company has just hired a new CEO, Marissa Mayer, who is responsible for re-organizing the company and improving its product development, profitability, and market performance. A case analysis is essential to evaluate the company’s current positive aspects and potential improvement areas.

Do you need an original copy of “Yahoo Inc essay”? Contact us

Company Overview

Yahoo, Inc. was founded in 1994 by two Stanford University graduate students, David Filo and Jerry Yang. Their original goal was to create a website where they could track their favourite websites on the internet. The list of websites got larger, and hence, they created a search platform to categorize the different websites. They called it Yahoo!, named after the dictionary meaning of the word “rude, unsophisticated, and uncouth”. The company went public in an IPO in 1996. Yahoo has since grown significantly. It is currently estimated to have around 12,000 employees across 25 countries. The company is led by Marissa Mayer, a former Google, Inc. executive on a board of 11 other members. The CEO has the vision to manage the company’s challenges to improve its profitability.

SWOT Analysis

The SWOT analysis is a critical strategic analysis tool that can be used to understand the factors that affect a business. This tool examines the issues in the internal and external environment of the business that affects the business’s operations and goals or has the potential to affect it depending on the actions of the business. This SWOT analysis will help understand the factors in Yahoo’s local and international environments affecting the business’s performance.

Strengths

Yahoo is one of the leading companies in the internet services market. Yahoo is also one of the top search engines that attract some of the highest numbers in terms of internet traffic. According to the 2012 internet traffic data, Yahoo had the third highest traffic in the United States market. The following table summarizes the top five companies with the highest traffic.

Being a market leader gives this company a competitive advantage over many other companies in the market. A competitive advantage is an aspect that allows a business to outperform its competitors (Huggins & Izushi, 2011). Yahoo’s size and market position are factors that many businesses cannot compete with.

| Site | Unique Visitors (Millions) | Reach Percentage |

| 187.368 | 85.1 | |

| Microsoft | 179.220 | 81.4 |

| Yahoo | 177.249 | 80.5 |

| 163.505 | 74.3 | |

| Amazon | 109.997 | 50.0 |

Table 1: U.S. Internet Traffic Data (2012)

Another major strength of the company is its global recognition. Yahoo is a known brand in most parts of the world. The company has worked hard to establish itself in the international market. The company has developed three main geographical segments: Americas, EMEA (Europe, Middle East, and Africa), and Asia Pacific. Yahoo sites are translated into 45 languages with a presence in 60 countries. The advantage of such a diversified market is increased revenue. Market diversity offers businesses a larger income stream, increasing the companies’ stability (Thompson, Strickland, & Gamble, 2015). For example, if anything were to happen in a single market, Yahoo could enjoy income security from the rest of the markets.

Most importantly, Yahoo has recently had new leadership, which increases the strengths of the company’s corporate governance capabilities. The appointment of Marissa Mayer as the new CEO means it will have new guidance to achieve the company’s strategic goals. Leadership is critical to strategic success. Leadership is a crucial organizational management function that helps improve efficiency in achieving strategic goals (Rothaermel, 2016). With the new leadership, Yahoo can finally achieve its goals of improving monetization and increasing profitability.

Weaknesses

Yahoo has some internal issues that have prevented its progress in the past few years. One of the major problems affecting the company is its corporate governance issues. In recent months before hiring its new leader, the company experienced a series of negative events affecting its leadership. The issues started when Microsoft offered to buy the company in 2008. Microsoft offered to buy the company at $31 per share, valuing the company at $44.6 billion. Yahoo rejected the offer, prompting Microsoft to increase the offer to $33 per share. This offer was also rejected. A final offer of $37 was made. Yahoo’s executives still thought the offer was not in the company’s best interests. This event motivated Carl Icahn to start a proxy fight to replace all board members so that he could sell the company to Microsoft. Icahn settled the fight with Yahoo after the board appointment but rapidly decreased investment in the company. Another Proxy fight was started by Daniel Loeb, who thought the company had forgotten about its media focus. He wanted the replacement of technology-oriented board members. The most significant issue was the resignation of the company’s CEO, Scott Thompson, after the revelation that he had misrepresented his educational background. Leadership misunderstandings can lead a company to failure. Leadership conflict is often associated with decreased employee morale and declining productivity (Torchia et al., 2015). If the leaders cannot trust each other to lead the company, then it isn’t easy to guide the employees to achieve the company’s goals.

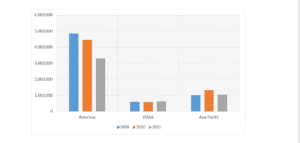

Another major weakness of Yahoo is its overdependence on the United States market. Although this company has established an international presence, most of its revenue comes from the American market. The chart below summarizes the company’s income from different segments.

Company Income Chart

Chart 1: Yahoo revenue breakdown by geographical location

Overdependence on a single market is a risky strategy. When a business’s survival is highly dependent on a single market, its stability is threatened by changes that might occur in that market. For example, the entire organization will be affected if there is a shift in the market structure or consumer preferences (Lindström & Regland, 2012). For Yahoo, a change in the U.S. market can affect the company significantly regardless of how well the international markets are doing.

Opportunities

Yahoo has an opportunity to maximize income from the Internet advertising market. The Internet advertising industry is a fast-growing opportunity for businesses in the market. 2006 the market was valued at $1.6 billion, after a 149% growth from 2011. Thus growth is partly because of the increasing affordability of digital products. More people can afford smartphones and computers than ever before. Therefore, companies offering Internet services have more opportunities to grow their businesses. Additionally, the search engine and portal companies accounted for 71% of the revenues in the industry. Being set up in this market, Yahoo has an opportunity to create strategies that bring more advertising revenue into the company.

This company also has an opportunity to diversify its products into growing markets. The African and Asian internet markets are growing the fastest, with growth percentages of 2,988.4% and 789.6%, respectively. The world’s internet usage and penetration are growing in general. This company has an opportunity to take advantage of this growth. Growing markets usually mean an opportunity to grow a company’s market share. The business only needs to find ways to penetrate new markets.

This company also has a great opportunity to increase its income streams. There are great monetization opportunities that the business is yet to focus on. For instance, the company can focus more on its media business, which has not been a major source of income in recent years. Using a multi-strategy can be very beneficial to a company’s performance. A diversified product portfolio allows a business to focus on differentiated market segments. This increases revenue sources and can also enhance the stability and sustainability of a business (Damoiseau et al., 2011). Yahoo can benefit from such a strategy.

Threats

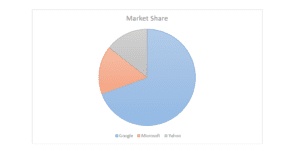

One of the biggest threats to the performance of Yahoo is increasing competition. As of 2012, this company was among the top three search engine companies. Yahoo was the third largest company in the global market by market share.

Market Share

Chart 2: Search engine market share

While a third position globally may seem like a good position, it can be easily threatened by other businesses. Yahoo was in second position in this market until Microsoft launched its search engine Bing, which easily displaced Yahoo to the third position. Seeing that many businesses have noticed the opportunity in this market, there is an increased risk that other competitors may further surpass Yahoo. Competition can easily overwhelm a business and force it out of the market. When new businesses with a better competitive advantage are developed, they displace existing ones (Gershon, 2013). This has happened to many businesses that were once leaders but no longer exist. For instance, Blockbuster was once a leader in the entertainment industry. Then came Netflix, which offered consumers more convenience and took over the market (Gershon, 2013). Therefore, Yahoo needs to be careful of the potential impact of the constantly increasing competition.

Financials

Yahoo’s financial performance has declined significantly in the past year. The company recorded a gross profit of $3,697,106 in 2010. The company’s income declined to $3,481,549 in 2011. However, looking into the company’s financial health shows a chance for improvement, though the company is doing well in some areas. The following is a summary of the company’s financial ratios.

| Ratio | |

| Return on Asset | 0.07 |

| Net Profit Margin | 0.21 |

| Debt to Equity Ratio | 0.19 |

Table 2: Yahoo Financial Ratios (2011)

The return on asset ratio tells how much a company makes relative to its assets. This ratio examines how well the company utilizes its assets (Altman, 2013). A ratio of 0.07 means that the company only uses 7% of its asset potential. Yahoo can improve how it changes its possessions into some income. On the other hand, the net profit margin tells how well the company can convert its sales into actual profit (Altman, 2013). A positive net profit margin indicates that the company is making some profit. Yahoo turns at least 21% of its sales into profits. Lastly, the debt-to-equity ratio examines how much a business is being financed by lenders relative to shareholders (Altman, 2013). A ratio of 0.19 shows that the business gets only 19% of its funding from debt.

Recommendations

One of the recommendations for this company is geographical market diversification. This company needs to establish itself in international markets. The analysis showed that there are new markets, such as in Africa and Asia, that are growing at a very rapid pace. The company should take advantage of these markets to achieve greater revenue. Market diversification is beneficial for business growth. The diversified international market allows the business to grow its global market share and increase sales (Damoiseau et al., 2011). This recommended strategy will also help the company to reduce its dependence on the American market, which has been seen to be a great risk to the business’s stability. The business will have more standing to be successful if the international market has a strong bearing on its revenue.

This company can also improve its financial performance by finding ways to monetize other areas of its business. A majority of the company’s revenue comes from advertisements. The company needs a focus strategy to help grow its other products’ competitive advantage. For instance, the business can benefit from growing its media business as recommended by one of its board members David Loeb. A diversified product and service portfolio gives businesses a chance to have a diversified stream of income. The company will be more stable when it gets income from different sources.

Implementation

Implementing the recommendations mentioned above requires a lot of input from the leaders and employees. The company needs a team to develop strategies to implement the recommended actions. Having an implementation team is important for a change process in an organization. The team will evaluate the company’s current status and determine the right strategies to implement the new strategy successfully.

Implementing the new strategies will also require good leadership and communication. The company’s CEO should be directly involved in communicating the required changes and why they are being made. Good communication enables the organization’s members to understand the importance of the new strategies (Cameron & Green, 2011). If they can agree with the strategies, they will likely be committed to the success of the implementation process.

Similar Post: IBM and Multibusiness Strategy

References

Altman, E. I. (2013). Predicting Financial Distress Of Companies: Revisiting The Z-Score And ZETA® Models. In Handbook Of Research Methods And Applications In Empirical Finance. Edward Elgar Publishing.

Cameron, E., & Green, M. (2019). Making Sense Of Change Management: A Complete Guide To The Models, Tools And Techniques Of Organizational Change. Kogan Page Publishers.

Damoiseau, Y., Black, W. C., & Raggio, R. D. (2011). Brand Creation Vs Acquisition In Portfolio Expansion Strategy. Journal of Product & Brand Management.

Gershon, R. A. (2013). Innovation Failure: A Case Study Analysis of Eastman Kodak and Blockbuster Inc. In Media Management And Economics Research In A Transmedia Environment (pp. 62-84). Routledge.

Huggins, R., & Izushi, H. (Eds.). (2011). Competition, Competitive Advantage, And Clusters: The Ideas Of Michael Porter. Oxford University Press.

Lindström, E., & Regland, F. (2012). Modelling Extreme Dependence Between European Electricity Markets. Energy Economics, 34(4), 899-904.

Rothaermel, F. T. (2016). Strategic Management: Concepts (Vol. 2). McGraw-Hill Education.

Thompson, A., Strickland, A. J., & Gamble, J. (2015). Crafting and executing strategy: Concepts and readings. McGraw-Hill Education.

Torchia, M., Calabrò, A., & Morner, M. (2015). Board Of Directors’ Diversity, Creativity, And Cognitive Conflict: The Role Of Board Members’ Interaction. International Studies of Management & Organization, 45(1), 6-24.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

[u06a2] Unit 6 Assignment 2

Draft – Case Analysis

The draft of your course project is due.

Yahoo Inc

Complete the draft using the Case Analysis course project description and your text to guide your work. When complete, submit your draft as an attachment in the assignment area.

Resources

- Draft – Case Analysis Scoring Guide.

- Capella Writing Center.

- Guide to Strategic Management Case Analysis and Case #3.

Draft – Case Analysis Scoring Guide

Due Date: End of Unit 6.

Percentage of Course Grade: 10%.

| CRITERIA | NON-PERFORMANCE | BASIC | PROFICIENT | DISTINGUISHED |

| Analyze the strategic fit between the business vision and the key elements of the business strategy, considering domestic and global environments. 12% |

Does not analyze the strategic fit between the business vision and the key elements of the business strategy. | Analyzes strategic fit between the business vision and the key elements of the business strategy but does not consider domestic and global environments. | Analyzes the strategic fit between the business vision and the key elements of the business strategy, considering domestic and global environments. | Analyzes the strategic fit between the business vision and the key elements of the business strategy, considering domestic and global environments, and provides supporting evidence and examples. |

| Analyze the alignment between business strategy, customer needs, and overall teaching and learning model to determine how organizational value has been established. 12% |

Does not describe the alignment between business strategy, customer needs, and overall teaching and learning model to determine how organizational value has been established. | Describes but does not analyze the alignment between business strategy, customer needs, and overall teaching and learning model to determine how organizational value has been established. | Analyzes the alignment between business strategy, customer needs, and overall teaching and learning model to determine how organizational value has been established. | Evaluates the alignment between business strategy, customer needs, and overall teaching and learning model to determine how and the degree to which organizational value has been established. |

| Create organizational value in the recommendations provided. 12% |

Does not create organizational value in the recommendations provided. | Does not fully correlate the creation of organizational value in the recommendations provided. | Creates organizational value in the recommendations provided. | Creates organizational value in the recommendations provided and provides a detailed description of how value is created through decisions made. |

| Demonstrate the ability to plan strategically in domestic and global environments in the recommendations provided. 13% |

Does not demonstrate the ability to plan strategically in domestic and global environments in the recommendations provided. | Demonstrates a limited or inconsistent ability to plan strategically in domestic and global environments in the recommendations provided. | Demonstrates the ability to plan strategically in domestic and global environments in the recommendations provided. | Demonstrates an excellent ability to plan strategically in domestic and global environments in the recommendations provided. |

| Employ high-performing business management techniques in the analysis and recommendations; the techniques consistently promote the delivery of value-added, bottom-line results. 13% |

Does not employ high-performing business management techniques in the analysis and recommendations; the techniques do not promote delivering value-added, bottom-line results. | Inconsistently employs high-performing business management techniques in the analysis and recommendations; the techniques inconsistently promote delivering value-added, bottom-line results. | Employs high-performing business management techniques in the analysis and recommendations; the techniques consistently promote the delivery of value-added, bottom-line results. | Integrates high-performing business management techniques in the analysis and recommendations; the integrated techniques consistently promote the delivery of value-added, bottom-line results. |

| Solve problems within professional standards. 13% |

Does not solve problems within professional standards. | Inconsistently solves problems within professional standards. | Solves problems within professional standards. | Consistently solves problems within professional standards and provides supporting evidence and examples. |

| Use appropriate financial models and principles to support decisions and recommendations. 13% |

Does not use financial models and principles to support decisions and recommendations. | Uses financial models and principles to support decisions and recommendations, but the models and principles are either inappropriate or inadequate in providing support. | Uses appropriate financial models and principles to support decisions and recommendations. | Uses and integrates multiple appropriate financial models and principles to support decisions and recommendations. |

| Use proper APA style and formatting, effective written communication skills, and supporting evidence to communicate effectively; the frequency of style and formatting errors does not affect the writing. 12% |

Improperly uses APA style and formatting to communicate; the frequency of style and formatting errors obstructs clarity. | Inconsistently uses proper APA style and formatting to communicate; the frequency of style and formatting errors detracts from the strength of the writing. | Uses proper APA style and formatting, effective written communication skills, and supported evidence to communicate effectively; the frequency of style and formatting errors does not affect the writing. | Demonstrates excellent use of proper APA style and formatting, effective written communication skills, and supported evidence to communicate effectively; there are no style or formatting errors. |