SWOT analysis -Netflix Inc

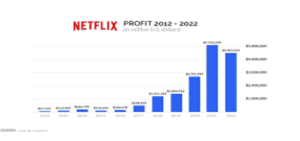

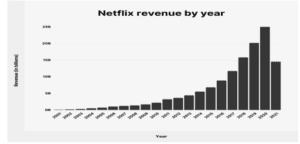

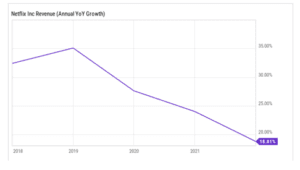

Netflix Inc. is selected for this paper’s strategic analysis. The company is one of the top sellers of entertainment services globally. Headquartered in Los Gatos, California, U.S.A, the company is a giant that offers TV shows and movies. The company promotes and markets its services via streaming entertainment providers, video programming distributors, and mobile operators. Although the company is not facing a bankruptcy threat, it has faced financial difficulties recently. The difficulties are indicated in the company’s efforts to hunt for customers with the same account and charge them. Further, the company’s subscribers are declining, reducing the possibility of higher revenues. The net income for common shareholders of the company declined from $5,116,228 in 2021 to $4,491,924 in 2022, prompting a decline in stock price.

If the trend continues in 2023, Netflix Inc. will face even more financial difficulties in 2023. Notably, this paper conducts a strategic analysis of the company by evaluating the current financial plan of the company. It makes recommendations for improvement, determines strategies for enhancing a sustainable competitive advantage, and creates a plan for implementing the strategies established.

Current Financial Plan

Netflix Inc. reported revenue earnings for 2023’s first quarter, which ended in March 2023, offering an outlook of their current financial plan. Sales for the quarter were $8,161,500, which is higher than last year’s $7,867,770. However, there was a decline in net income which was $1,305,120 in 2023, lower than last year’s $1,597,450.

Netflix Inc. (2022)

The earnings per share (EPS) for operational activities declined to $2.88 from $3.53 one year ago. Lastly, the basic earnings per share also reduced from $3.6 a year ago to $2.93. The charts below show trends in annual revenue and earnings per share.

Netflix Inc. seeks to change its current financial plan’s downward trajectory in earnings and financial performance in various ways. First, the company seeks to stop subscribers from sharing accounts for increased subscriptions. Second, the company seeks to diversify its income channels by engaging in advertising to cover for revenues not achieved through the sale of movies. Third, the company is considering cost reduction measures, including layoffs. Notably, this will reduce the company’s wage bill.

Recommendations For Improvement and Increasing Financial Performance

Netflix should consider the following four recommendations to enhance its financial performance. First, the company should offer cheaper-priced ad-supported versions of their services. Even though the company is resistant to adopting this strategy, it has no option because market competitors have adopted it and improved their competitive advantage. Second, Netflix Incorporation should incorporate limited account access for the maximum number of accounts to be attained and, thus, more revenues. According to the company’s internal reports, over 100 million account holders share their subscriptions with others (Ahmed & Nobanee, 2020). Essentially, this reflects a significant loss of revenue that can be avoided by implementing limited account access.

Third, the company should launch movies and series weekly, moving from the traditional mechanism of simultaneously launching everything. Notably, this will enhance people waiting to watch and avoid instances where customers consume all content simultaneously in a single sitting. When a weekly launch is implemented, customers are likely to pay more than when content is released all at once because it will not be possible for customers to watch everything and pause their subscriptions. Lastly, Netflix Inc. should release blockbusters first on the big screen. Revenue is lost through the current strategy of releasing movies straight to the streaming service because competitors make revenue by first releasing blockbusters on the big screen.

Strategies For Achieving a Sustainable Competitive Advantage in the Marketplace

Netflix can consider four strategies to achieve a sustainable competitive advantage. First, Netflix needs to keep investing in a variety of high-quality content to maintain its competitive advantage. Netflix can reach a wider audience by diversifying the genres, languages, and forms of its original programming. Partnerships with well-known production companies, gifted writers, and A-list celebrities can also help the library’s content. In order to provide its members with a distinctive and exclusive streaming experience, Netflix places a strong emphasis on original content. Notably, this allows the company to control distribution rights and lessen its reliance on licensed content. Second, the technological prowess of Netflix has been a key component of its success. The company should invest in cutting-edge technology like augmented reality (AR), virtual reality (VR), and interactive storytelling to keep a competitive edge (Khoo, 2023). Netflix can attract more viewers and differentiate itself from rivals by offering immersive experiences. Additionally, a company can improve its service quality, speed, and reliability by investing in cloud infrastructure, cutting-edge encoding algorithms, and effective streaming technologies, guaranteeing a higher user experience.

Third, Netflix has a global reach and needs to concentrate on growing internationally to sustain its competitive advantage. Netflix can reach new markets and grow its audience by translating its content offerings into various languages and cultural contexts. The company can raise brand recognition and boost subscriber growth by adapting its marketing tactics and pricing structures to local preferences. Lastly, Netflix plans to increase and maintain its market dominance by creating original content that is unavailable on competitors’ apps or services. Compared to pure online content distributors, Netflix will have a little more influence over consumers thanks to the creation of this material and its loyal fan base. Notably, this is so because customers hooked on shows like House of Cards and Stranger Things will keep their membership active rather than turning it on and off.

Plan for Implementation

The plan for implementing the above strategies entails various aspects. Netflix should prioritize the identification of key genres, languages, and formats with growth potential and demand to implement content diversification. By investing in original programming and collaborating with renowned creators, production houses, and A-list celebrities, Netflix can expand its content library and cater to a wider audience. Regular analysis of viewer preferences and feedback will enable diverse and engaging content creation. At the same time, continuous monitoring of industry trends and competitor offerings will ensure Netflix’s selection and acquisition of the most relevant and appealing content. Further, to investigate cutting-edge technologies like augmented reality (AR), virtual reality (VR), and interactive storytelling, Netflix should create a specialized research and development team. Netflix can improve the user experience by regularly performing market research, working with startups and technological partners, and investing in cloud infrastructure, encoding techniques, and streaming technologies. These technological developments will set Netflix apart by giving consumers seamless, immersive entertainment experiences.

For successful international expansion, Netflix should conduct comprehensive market research to identify target regions with untapped potential. Netflix may successfully enter fresh markets by adjusting its content offers, marketing plans, and price structures to suit regional preferences and market conditions. Partnering with local content producers, production companies, and distribution networks will facilitate the development of regionally tailored content, increasing Netflix’s market presence and brand awareness globally. Notably, regular evaluation and monitoring will be essential to determine the success of the adopted strategies. Key performance indicators, including subscriber growth, engagement metrics, customer happiness, and market share, should be monitored to evaluate the strategy’s effectiveness and make the required corrections. Additionally, the company should promote continuous improvement and keep a sustainable competitive edge in the dynamic entertainment business by fostering a culture of innovation and collaboration.

References

Ahmed, H. M., & Nobanee, H. (2020). Financial Statement Analyses of Netflix. Available at SSRN 3647452.

Khoo, O. (2023). Picturing Diversity: Netflix’s Inclusion Strategy and the Netflix Recommender Algorithm (NRA). Television & New Media, 24(3), 281-297.

Netflix, I. (2022). “2022 Annual Report”. Retrieved July 03, 2022, from https://www.sec.gov/Archives/edgar/data/1065280/000106528018000069/

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Week 5 Signature

Wk 2, you completed a SWOT analysis on a successful company that demonstrated a sustainable competitive advantage in the marketplace. Now, you will shift your focus to look at a company that is failing or experiencing challenges in the area of financial performance.

SWOT analysis -Netflix Inc

Select and research a

company that is having financial difficulties or is on the brink of bankruptcy.

Review “Where Can I Find a Company’s Annual Report and Its SEC

Filings?” from Investopedia.

You can also access specific information about a variety of

businesses in the University Library by searching the following

databases:

University Library > Databases > B > Business Source Complete

University Library > Databases > E > EDGAR

University Library > Databases > P > Plunkett Research Online

Conduct a strategic analysis of the company’s current

financial operations. Determine strategies for achieving a

sustainable competitive advantage in the marketplace and increasing financial performance.

Write a 1,050- to 1,400-word analysis. When writing your

analysis, complete the following:

Evaluate the company’s current financial plan, including MULTIPLE charts and/or graphs (four or more) showing financial data from the struggling company, and make recommendations for improvement.

Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

Create a plan to implement the strategies you selected.

Include WORD APA-formatted, in-text citations, and a

reference page with at least 3 sources.