Strategic Financial Management

Comment on the suitability of the expected value criterion for this decision using the data provided by the company.

The company seeks an 18% cost reduction on purchases of materials from a new supplier for the new product on the condition that Beta Ltd agrees to a guaranteed minimum purchase from the new supplier as a standard business operation. The management of Beta Ltd wishes to consider this offer by preparing a payoff table that could be used to decide on the number of units to be purchased for the coming year based upon the maximax, maximin, and minimax regret approaches risk.

Are you seeking a unique copy of “Strategic Financial Management”? Reach out to us for any inquiries or support.

The expected value is the amount that is anticipated for investment at a particular time in the future. The suitability of the expected value criterion is essential in a purchase. The measure used in the determination of the expected value for Beta Ltd furniture company is scenario analysis. The analysis is suitable; it depicts the risk level that the investment has. There are three options for purchase based on the state of the market growth. Each of the states has a probability. The first state is high, with a 30% chance; the second state is moderate, with a possibility of 50%; and the last is low, with a probability of 20%. The circumstances indicate the risk level of the venture. The higher the chance, the lower the risk level. For instance, the intermediate state of market growth’s risk level is much lower than in the other two conditions. Thus, Beta Ltd furniture company should focus more on moderate market growth as the expected value is likely higher due to the high probability level.

The expected value criterion is one of the strategies that can be used in the decision-making process. The ability to make decisions from the model makes the expected value suitable. The decision can be easily made by picking on the most considerable expected value from all the computed. From the data provided, the most immense expected value is 20,000. The cost is obtained by getting the product of the units and probability in the moderate market growth state. From the information, a decision can be easily made. Beta Ltd furniture company should aim at introducing the new product reasonable state of market growth as the outcomes are favorable.

Explain how Total Quality Management (TQM) would enable TMZ to gain a competitive advantage in the fast food sector.

Total Quality Management mainly focuses on the ability of the management of an organization to improve the level of satisfaction of the consumers. All the organization members will have to take part in fixing the processes and maintaining the organization’s culture. Total Quality Management (TQM) will enable TMZ to gain a competitive advantage by improving its fast-food quality. Enhancing product quality is the best way to get a competitive advantage over other companies operating in the same industry. With TQM, the organization can effectively and efficiently monitor the status of the fast food they give the consumers.

The advantage can be obtained through the branding of their products. Branding will ensure their products are unique and of the required quality standards. Also, TQM will introduce the concept of absolute advantage. The workers can produce fast food with superior quality to the other fast-food restaurants. Such will ensure consistency in their fast food supply to the consumers (Zehir et al., 2012). Consumers have usually attracted by-products of high quality, affordable, and always in supply. A decline in the collection will mean the company will lose some consumers to the adjacent fast-food company. To avoid that, TMZ should use TQM to ensure a continuous supply to meet public demand. Culture is the other component of TQM that will ensure TMZ maintains a competitive advantage. This will ensure that the consumers are provided with the required services of high standards.

Recommend with financial and non-financial reasons whether the company should accept the proposal.

The company should consider the two proposals. The quality inspector will play a key role in ensuring the product’s quality is up to standard and competitive. With an increased rate, the company will be able to gain market share that will eventually increase its profits. They will attract a more extensive client base, which will be vital in expanding company profits. Also, the company should consider accepting the proposal due to the long-term implications. The offer looks costly initially and in the short run, but the company will benefit in the long run. An increase in the number of consumers of the goods will not only take place in the short run but will be a continuous process due to increased quality. Financially, the organization will reduce the number of faulty items delivered to the customers from 3,429 units to 3,188.97. The amount is a 7% decrease. Also, the company will be able to reduce the number of faulty products before dispatch to consumers from 5,143 units to 4628.7 units, which is a reduction of 10%. The overall cost of the decline is £325,000. The amount included £25,000 for hiring the quality inspector per annum and £300,000 for training the production workers per annum. The profit margin is still favorable if the two additional costs are considered. The company would have an investment in consumer satisfaction, and its expense does not exceed its profit. TMZ will not operate on debt, and its operations will be efficient and effective.

What is the trade-off theory of capital structure? To what extent does empirical evidence support this theory?

The trade-off theory of capital structure refers to the concept where a company decides on the amount of debt and equity finance they should use to balance the costs and benefits. The classical version of the theory tries to balance the bankruptcy cost of the dead weight and the savings from the debt. In most instances, the agency costs are also incorporated into the balance. The theory mainly functions as a competitor theory where there is a comparison with other companies operating in the same industry line. The idea’s primary purpose is to explain why corporations are partly financed by debt and the other part by equity. There are advantages to supporting corporations with debt (Frank and Goyal, 2011). The marginal cost also increases when there is a further increase in debt. Such a strategy allows the corporation to be in a position to optimize the overall value, and the main focus will be on the trade-off. The trade-off is where a decision has to be made on the amount of debt and equity that should be used in the financing process.

The empirical relativity of the trade-off theory has always been questioned. If the trade-off theory were to be considered to be accurate, then it is possible that organizations would have much higher debts than they are in reality. Despite the existence of some criticism of the theory, the theory still is considered to be relevant in the corporate capital structure. There is flexibility in the data provided by the idea, and it is tough to empirically reject the verbal arguments presented on the dynamic models of the trade-off.

Explain the key findings (stylized facts) of John Lintner’s empirical study of firms’ dividend policies. To what extent do these findings tell us that information asymmetry determines dividend policy? What other market imperfections are consistent with Lintner’s findings?

Dividends refer to the share of profits paid out to investors as the return on their investment and are issued through either stock or cash. Ideally, the dividends paid out by the company directly influence the company’s share value in the market, hence the need for an effective dividend payment policy. Lintner developed a standard model based on three principles, which companies can implement in dividend payout (Andres, Doumet, Fernau, and Theissen, 2015, pg.56). Firstly, companies have established long-term targets for paying out dividends. Secondly, the executive emphasizes dividend changes rather than absolute levels. Thirdly, dividend changes are more suspensible in the long run than short-term shifts. Lastly, managers are less likely to change dividend payments that may be reversed in the short term (Andres et al., 2015, p. 56). The first tenet states that companies usually set long-term dividend payout objectives to facilitate efficient long-term financial planning. This is why shifts in dividends are oriented in the long term. Also, managers tend to focus on dividend changes since it directly impacts the share value in the capital market. The fact that managers’ decisions influence dividends illustrated information asymmetry since the public does not know about these decisions. Those who access this information would be at an advantage since they would make decisions to maximize their wealth. The market is imperfect because managers focus on dividend changes rather than absolute levels. Hence they may undertake actions that would influence shareholders’ earnings, directly affecting the capital market. For instance, if they decide to increase the dividend payout, the share value would increase in the market, and investors would earn more capital gains and dividends.

Assume that the tax treatment of capital gains is not the same as that of dividend income. Explain how specific groups of investors will have differing dividend policy preferences. How will firms react to this?

In the event whereby the tax treatment of capital gains is different from that of dividends, investors would make different decisions. If the tax treatment of dividend income results in higher expenses for the investors, they will maximize profits from the capital gains. If the capital gains are charged at a higher rate, the investors would prefer earning dividends to capital gains (Veliotis, 2019, p. 345). These changes would influence companies’ shaping of dividend policies. For instance, if dividend income incurs lower tax expenses, the firm would establish a favorable dividend policy to attract more investors. On the other hand, if capital gains earned fewer tax expenses, companies would develop dividend policies that favor this aspect in attracting more investors.

‘The Modigliani-Miller theorems imply that firms’ dividend policy does not affect their value in the slightest.’ What assumptions underlie this statement?

The Modigliani-Miller theorem is based on various suggestions that include the irrelevant to the company’s value. This theory assumes that a company’s total market value is independent of its capital structure. Notably, dividends are a part of the capital structure since firms raise funds through equity issuance by selling the shares to the public (Aboura, and Lepinette, p. 5). The investors receive a return on the investment through capital gains or dividends payouts. Unlike other schools of thought, such as Lintner, Modigliani contends that the firm’s dividend policy is independent of its capital structure. Lintner argued that investors’ decisions are considerably influenced by the dividend decisions executed by the company. On the other hand, Modigliani states that investors are indifferent to the company’s fiscal policy.

Related Posts: Surprise

References

Aboura, S. and Lepinette, E., 2017. New Developments on the Modigliani–Miller Theorem. Theory of Probability & Its Applications, 61(1), pp.3-14.

Andres, C., Doumet, M., Fernau, E. and Theissen, E., 2015. The Lintner model revisited: Dividends versus total payouts. Journal of Banking & Finance, 55, pp.56-69.

Frank, M., & Goyal, V., (2011), Trade-off and Pecking Order Theories of Debt, Handbook of Empirical Corporate Finance: Empirical Corporate Finance. Elsevier. Pp. 135-202.

Veliotis, S., 2019. Equating US Tax Treatment of Dividends and Capital Gains for Foreign Portfolio Investors. American Business Law Journal, 56(2), pp.345-390.

Zehir, C., Ertosun, G., Zehir, S., & Muceldillii, B. (2012), Total Quality Management Practices’ Effects on Quality Performance and Innovative Performance, Social and Behavioral Science, Vol. 41, Pp. 273-280.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Strategic Financial Management

QUESTION 1

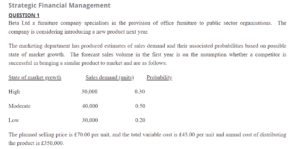

Beta Ltd, a furniture company, specializes in providing office furniture to public sector organizations. The company is considering introducing a new product next year.

Strategic Financial Management

The marketing department has produced estimates of sales demand and their associated probabilities based on the possible state of market growth. The forecast sales volume in the first year is on the assumption whether a competitor is successful in bringing a similar product to market and are as follows:

State of market growth Sales demand (units) Probability

High 50,000 0.30

Moderate 40,000 0.50

Low 30,000 0.20

The planned selling price is £70.00 per unit, the total variable cost is £45.00 per unit, and the annual cost of distributing the product is £350,000.

Required

(a) Calculate the expected profit value of distributing the new product for the coming year.

(b) Comment on the suitability of the expected value criterion for this decision using the data provided by the company.

The company seeks an 18% cost reduction on purchases of materials from a new supplier for the new product on the condition that Beta Ltd agrees to a guaranteed minimum purchase from the new supplier as a standard business operation. The management of Beta Ltd wishes to consider this offer by preparing a payoff table that could be used to decide on the number of units to be purchased for the coming year based upon the maximax, maximin, and minimax regret approaches risk.

(c) Prepare a payoff table for each possible combination of purchase volume and demand for the product and indicate the number of units purchased in the coming year based on the maximax, maximin, and minimax regret approaches to a risk decision rule.

QUESTION 2

TMZ specializes in providing Just-Eat restaurant services in the fast-moving consumer goods industry and is about to open its first branches. TMZ believes it needs to offer potential customers a new fast food experience to win customers from other fast food restaurants.

Whereas other fast food restaurants have focused on speed of service and very cheap meal deals, TMZ believes that food quality, clean restaurant environment, and availability of service are essential factors in the choice made by customers.

Required

(a) Explain how Total Quality Management (TQM) would enable TMZ to gain a competitive

advantage in the fast food sector. (10 marks)

(b) Kwality Ltd manufactures a single product. The selling price, production cost, and contribution

per unit for this product for 2020 have been predicted as follows:

£ per unit

Selling price 75.00

Direct materials (components) 20.00

Direct labor 25.00

Variable overhead 10.00

55.00

Contribution 20.00

The company has forecast that demand for the product during 2020 will be 20,000 units.

However, to satisfy this level of demand, production of 28,572 units will be required because:

. 12% of the items delivered to customers (3,429 units) will be rejected as faulty and require free replacement. The cost of delivering the replacement item is £5.50 per unit;

. 18% of the items manufactured (5,143 units) will be discovered faulty before they are despatched to customers.

In addition, before production commences, 10% of the components the company purchases are damaged while in storage.

Because of all the above, total quality costs for the year amount to £601,088.

The company is now considering the following proposal:

- Spending £25,000 per annum on a quality inspector would reduce the percentage of faulty items delivered to customers to 7%; and

- I am spending £300,000 per annum on training courses for the production workers, which management believes will reduce and sustain faulty production by 10%.

Required

(i) Prepare a statement showing the quality costs the company would expect to incur if it accepted the above proposal. Your answer should clearly show the costs analyzed using the four recognized quality cost headings.

(ii) Recommend, with financial and non-financial reasons, whether the company should accept the proposal.

QUESTION 4

Global plc is a multinational company (MNC) from the United Kingdom. The government, in an attempt to attract more investors to the country, has just announced that corporation tax is reduced from 33% per year to 30% per year and the directors of Global plc wish to know the likely effect of this change on the company’s share price and cost of capital.

The company’s current capital structure is as follows:

£m

Ordinary shares (50 pence per share) 30

Share premium 50

Other reserves 70

Shareholders’ equity 150

9.25% debenture (irredeemable) 60

210

Global plc shares are trading at 200 pence ex-div, and the debentures at £115 ex-interest. Before the tax change, the company’s beta is 1.5. The market return is 11% annually, and the risk-free rate is 4%. The tax rate reduction will likely increase the net present value of Global plc’s operating cash flows by £20.7 million.

Assume that the cost of debt and the market price of debt does not change because of this tax change and that Global’s debt may be assumed to be risk-free.

Required

(a) Estimate the company’s current cost of capital.

(b) Using Modigliani-Miller’s theory of capital structure (with tax) estimate:

(i) the expected share price after tax change.

(ii) the company’s expected cost of capital after the tax change.

(c) What is the trade-off theory of capital structure? To what extent does empirical evidence support this theory?

QUESTION 5

(a) Explain the key findings (stylized facts) of John Lintner’s empirical study of firms’ dividend policies. To what extent do these findings tell us that information asymmetry determines dividend policy? What other market imperfections are consistent with Lintner’s findings?

(b) Assume that the tax treatment of capital gains is not the same as the tax treatment of dividend income. Explain how specific groups of investors will have differing dividend policy preferences. How will firms react to this?

(c) ‘The Modigliani-Miller theorems imply that firms’ dividend policy does not affect their value in the slightest.’ What assumptions underlie this statement?