Strategic Financial Management Positioning Report – Part IV

Effective financial management and strategic oversight are of paramount importance for the economic success and long-term survival of the healthcare organization. This report outlines significant areas of financial operations. It seeks to answer questions on the usage of financial statements, the identification of a hospital’s performance, and the application of data in this process. Also, it focuses on the details of revenue cycle management and the significance of post-audits.

Purpose of Financial Statements

Financial statements aim to give a qualitative view of the past financial activities of an organization and its present financial performance to make a proper decision (Bautista-Bernal et al., 2024). Its importance in evaluating profitability, liquidity, and business solvency makes it essential to enhance accountability in the reporting of financial statements. The financial statements aid the management in strategizing and integrating resources in planning through the revelation of strengths and dangers.

How to Assess the Financial Performance of a Hospital

When evaluating the financial performance of a hospital, it is essential to work with such financial ratios as profitability (operating margin, net margin), liquidity (current ratio, quick ratio), and solvency (debt-to-equity ratio). Comparative analysis of the trends of revenues, expenses, and cash flows reveals the overall financial health status and operating efficiency of a hospital (Horváthová & Mokrišová, 2020). Benchmarking these key metrics makes it possible to gain a shared understanding of key strengths and weaknesses in relation to the industry.

Uses of Data to the Hospital Manager and the Securing of Patient Data

Hospital managers use data to increase productivity and quality of care and make effective managerial and organizational decisions given patient statistics, resource consumption, and revenue trends. They also provide information for compliance with regulatory demands and further analyze the quality profile of products. Protection of patients’ data is essential since it helps the patient maintain confidence in the healthcare service and conform to the law on the regulation of data protection, which is done through practices like encryption and daily checks on authorized access (Jain, 2023). To retain the privacy and security of information, it is possible to prevent leakage of vital information that could compromise sensitive information and harm the hospital’s reputation.

Importance of Financial Reports to the Health Services Sector

Financial reports for health services are essential as they communicate accurate and reliable information about healthcare organizations’ economic performance. They assist in providing solutions to various issues, including resource allocation, financial management, and investment to facilitate operations and quality patient services. Also, financial reports are essential for legal requirements and financing or investment by proving the company’s financial responsibility and efficiency.

Making Healthcare Decisions Based on Data Analysis

Making healthcare decisions based on data analysis leads to the use of evidence-based practices, meaning that interventions and strategies implemented have to be based on accurate and up-to-date data. Data-driven decision-making allows healthcare providers to learn trends, prognoses, and the most suitable plan for using healthcare resources to enhance patient care and healthcare delivery. Risk management is also accomplished through data-driven decision-making, which will, in return, reduce patient risk, promote safety, and increase the quality of healthcare.

Post Audit and the Importance of Postaudits in Healthcare Businesses

Postaudits are assessments made at the end of a financial transaction or project that aim to determine the efficiency relative to the earlier expectations (Eberhartinger & Zieser, 2021). Every post-audit is crucial for the healthcare business, enabling it to find discrepancies, display waste, and reveal opportunities for improvement in financial accountability and operations. They give necessary information about the organization’s budgeting and resource distribution efficiency and help make better decisions regarding future project plans. In addition, post-audits help increase the stakeholders’ transparency and confidence because they indicate that the organization seeks to improve its financial management and strives for quality improvement.

Revenue Cycle Management and the Four Phases of the Revenue Cycle

Revenue cycle management (RCM) is a concept that relates to managing all revenue-related activities, from patient registration to payment, to maximize the revenue in healthcare organizations and stabilize their monetary position (Wray & Dr. Uma Gupta, 2024). The four RCM phases are the pre-visit activities (scheduling and insurance confirmation), the patient registration together with billing (charging and coding), claims processing (e.g., submitting and managing claims), and collections and follow-up (e.g., managing payments and addressing denials). Successful RCM is very important in increasing revenue, minimizing billing deficiencies, and enhancing overall operational and financial performance.

Monitoring Overall Revenue Cycle Performance

Monitoring overall revenue cycle performance involves routinely measuring and comparing indicators like days in accounts receivable, discharge rate of claims, or actual money realized from customers during a given period. It assists in discovering constraints to flow, improving the efficiency of business processes, and improving patient and insurer receivables. By monitoring these metrics, healthcare organizations can increase their financial performance and boost the level of cash flows and efficiency of billing practices for continuous, more robust economic activity.

Accelerated Collection and Revenue Services Activities

The accelerated collection entails measures geared towards hastening the collection of payments from patients and insurance companies with a view of enhancing the medical facility cash cycle as well as reducing days accounts receivable. Revenue service activities refer to a list of business functions that involve billing, coding, filing, and monitoring claims to ensure that the facility receives the proper compensation for services rendered. Together, these activities improve financial Operations, reduce avoidable time, and improve revenue collection for the health care organizations.

The Items Under Before-Service Activities, At-Service Activities, and After-Service Activities

Before-service activities include tasks such as patient scheduling, confirmation of insurance, and pre-certification for covered services to avoid anything that may lead to issues in the billing processes. At-service activities include charge capture, accurate coding, and co-payment or deposit from the patient on the visit to bill on time and correctly. After-service activities include charging the client’s account for services, submission of the claim, follow-up of the unpaid claim, and lastly, managing patients’ accounts with respect to the collection of outstanding balances.

Conclusion

In summary, thoroughly comprehending the financial statements, such as performance indicators and revenue cycle management, can help improve the hospital’s financial sustainability. Adopting high levels of data utilization and conducting proper post-audits also contribute to the principles of good decision-making and productivity. When these elements are integrated, the hospital’s financial position will improve, patient satisfaction will increase, and the facility’s long-term stability will be guaranteed.

References

Bautista-Bernal, I., Quintana-García, C., & Marchante-Lara, M. (2024). Safety culture, safety performance and financial performance. A longitudinal study. Safety Science, 172, 106409. https://doi.org/10.1016/j.ssci.2023.106409

Eberhartinger, E., & Zieser, M. (2021). The Effects of Cooperative Compliance on Firms’ Tax Risk, Tax Risk Management and Compliance Costs. Schmalenbach Journal of Business Research, 73(1), 125–178. https://doi.org/10.1007/s41471-021-00108-6

Horváthová, J., & Mokrišová, M. (2020). Comparison of the Results of a Data Envelopment Analysis Model and Logit Model in Assessing Business Financial Health. Information, 11(3), 160. https://doi.org/10.3390/info11030160

Jain, D. (2023). Regulation of Digital Healthcare in India: Ethical and Legal Challenges. Healthcare, 11(6), 911. https://doi.org/10.3390/healthcare11060911

Wray, T., & Dr. Uma Gupta. (2024). AIB-5 Transformative Trends: Integrating General AI in Revenue Cycle Management for Healthcare Optimization. Scholar Commons. https://scholarcommons.sc.edu/scurs/2024symposium/2024posters/5/

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

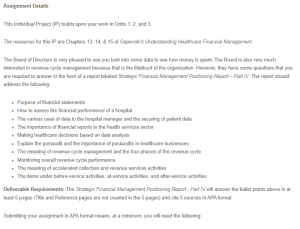

Assignment Details

This Individual Project (IP) builds upon your work in Units 1, 2, and 3.

The resources for this IP are Chapters 13, 14, & 15 of Gapenski’s Understanding Healthcare Financial Management.

The Board of Directors is very pleased to see you look into some data to see how money is spent. The Board is also very much interested in revenue cycle management because that is the lifeblood of the organization. However, they have some questions that you are required to answer in the form of a report labeled Strategic Financial Management Positioning Report – Part IV. The report should address the following:

Core Competencies for Effective FNP Practice

- Purpose of financial statements

- How to assess the financial performance of a hospital

- The various uses of data to the hospital manager and the securing of patient data

- The importance of financial reports to the health services sector

- Making healthcare decisions based on data analysis

- Explain the postaudit and the importance of postaudits in healthcare businesses

- The meaning of revenue cycle management and the four phases of the revenue cycle

- Monitoring overall revenue cycle performance

- The meaning of accelerated collection and revenue services activities

- The items under before-service activities, at-service activities, and after-service activities

Deliverable Requirements: The Strategic Financial Management Positioning Report – Part IV will answer the bullet points above in at least 5 pages (Title and Reference pages are not counted in the 5 pages) and cite 5 sources in APA format.

Submitting your assignment in APA format means, at a minimum, you will need the following:

- Title page: Remember the running head. The title should be in all capitals.

- Length: 5 pages minimum

- Body: This begins on the page following the title page and must be double-spaced (be careful not to triple- or quadruple-space between paragraphs). The typeface should be 12-pt. Times Roman or 12-pt. Courier in regular black type. Do not use color, bold type, or italics, except as required for APA-level headings and references. The deliverable length of the body of your paper for this assignment is 5 pages. In-body academic citations to support your decisions and analysis are required. A variety of academic sources is encouraged.

- Reference page: References that align with your in-body academic sources are listed on the final page of your paper. The references must be in APA format using appropriate spacing, hanging indent, italics, and uppercase and lowercase usage as appropriate for the type of resource used. Remember, the Reference page is not a bibliography but a further listing of the abbreviated in-body citations used in the paper. Every referenced item must have a corresponding in-body citation.

Please submit your assignment.

Assignment Reminders:

- Please submit your assignment.

- Make sure you submit this assignment by the listed due date. Late deductions will apply for this assignment. Please refer to the Late Submission of Assignment policy.

- If you need assistance, please view the Troubleshooting tips.

- Resave in the proper format per the Assignment Detail instructions and resubmit.

- Submit with a different Web browser.

- Submit from a different computer.

- Call Technical Support at 877-221-5800, Menu Option 2. They are open 24/7.

- If you are still having difficulties after trying steps 1-4, please contact your course instructor.