Strategic Financial Management Positioning Report – Financing And Financial Sources

Effective financial management is essential to increase growth in hospitals and improve their overall operations. This paper examines the different corporate capital sources, including equity, debt, and retained earnings, to evaluate their impact on the running of hospitals. It also looks at the benefits and drawbacks of the financing sources, such as contributions, creditors, banks, suppliers, debt costs, and general financing. Furthermore, it focuses on proper capital budgeting financial analysis, estimating the cost of debt and equity, corporate cost of capital components, and the significance of capital budget decisions in sustainable hospital competency and proficiency.

Sources of Corporate Capital Choices for Investment for Hospitals

The conventional sources of corporate finance for hospitals include equity financing, debt financing, and retained earnings. Equity financing includes selling shares in an organization by using equity securities, which has the disadvantage of reducing ownership while it does not involve paying back. Debt financing involves loans or funding through bonds and dominates, causing regular interest payments and final repayment of money. It may also impact on the cash flow and financial risk. Retained earnings and reinvested profits from the operation are always available sources of funds but have limitations in expanding the hospital. These capital structure decisions define the ability to finance new initiatives and the variability of the cost, which remains the primary source and cost of funds for new initiatives, extended services, and, most critically, stability.

Advantages and Disadvantages of Sources

Every source of hospital financing has its merits and demerits. Capital in the form of contributions, usually donations or grants, is non-repayable, but it may need to be consistent or restricted. Creditors also give credit, which offers immediate finance, but this credit has to be repaid along with some interest, which affects the financial risk. Structured financing is available through banks and comes with an opportunity to access large amounts of capital, but it comes with steep repayment schedules and steep interest rates. Suppliers might extend the payment terms, helping cash flow, but this comes with the disadvantage of reducing bargaining power and flexibility (Parviziomran & Elliot, 2023). The cost of debt is crucial, as it allows for leveraging investments but increases the financial burden with interest payments. Financing means expansion and growth; however, it poses higher expectations on the operational management of hospitals in terms of meeting financial commitments that negatively influence stability.

Steps in Capital Budgeting Financial Analysis of Capital Investment Proposals

The steps in capital budgeting financial analysis for capital investment proposals involve several critical phases. Firstly, the process involves screening and assessing probable investment projects, emphasizing their expected cash returns and relevance to the hospitals’ strategic orientation. After that, financial analysts determine the cost of the initial expenses required for the commencement of the project and other anticipated cash flow that would be generated or spent within the first year, which include revenues, operating expenses, and taxes, among others (Hendrickson et al., 2024). They measure the proposals’ profitability and financial feasibility using net present value (NPV), internal rate of return (IRR), and payback period. Finally, the analysis involves comparing these metrics to the hospital’s cost of capital and risk tolerance for investment decisions and choosing projects that will increase the profit and productivity of the hospital.

Estimation of the Cost of Debt and the Cost of Equity

The cost of debt is estimated by identifying the interest rate that the hospital pays for borrowing funds, which may be from the yield on outstanding bonds or debt, as well as from the interest rates of current and available debt securities. However, This rate is adjusted for taxation since interest is an effect of taxation, so the firm has an effective cost of debt. On the other hand, the cost of equity is approximated using standard models such as the Capital Asset Pricing Model (CAPM), which factors in the risk-free rate, expected market rate, and the beta of equity, which measures the risk that the hospital enterprise has in the market (Ayub et al. 2020). These estimates indicate the overall cost of capital needed to make a correct decision on investment and funding.

Components Included in the Corporate Cost of Capital

The corporate cost of capital includes the cost of debt, which is the cost of the borrowed money, and the cost of equity, which is the expected return on equity funds. Furthermore, the weighted average cost of capital (WACC), where one or more of these costs are integrated, is a holistic approach to determining the firm’s total cost of funding (Arhinful et al., 2024). These components are fundamental to any investment project. They are employed in the evaluation of a project as well as to guarantee that the resultant returns surpass the cost of capital.

The Importance of Capital Budget Decisions Being Very Critical to Hospitals

Capital budget decisions are essential in hospitals because hospitals require sufficient resources to adopt the right structures and instrumentations that influence the outcomes of operations and patients’ productivity. Capital budget decisions ensure a proper assessment of resource utilization through proper consideration of the strategies needed to support the hospital and its financial capability (Homauni et al., 2023). Investment errors may lead to severe economic problems in a hospital and ultimately affect its capacity to provide good care, which makes it crucial to have the right capital budgeting.

Problems of Investing too Little and too Much in the Capital Budget

If little is invested in the capital budget, the equipment and facilities available therein become outdated, thus exposing the patients to low-quality service delivery and low productivity. Conversely, those investing too much place a lot of emphasis on the monetary side of the equation. In so doing, they compromise it and generate more of an economic burden. More investment has to be made so that it operates at its full potential and is financially sustainable to continue delivering services in the future.

Conclusion

In summary, analyzing and managing available sources of corporate capital is a critical activity to enhance the companies’ financial sustainability and operating performance of the hospitals. Adjusting different types of financing and carrying out comprehensive capital budgeting analysis ensure that the financing approaches match the organization’s strategic targets and contribute to its growth. The cost of debt and cost of equity must be determined with great accuracy as they are important determinants in any decision-making.

References

Arhinful, R., Mensah, L., Amin, M., & Hayford Asare Obeng. (2024). The influence of cost of debt, cost of equity and weighted average cost of capital on dividend policy decision: evidence from non-financial companies listed on the Frankfurt Stock Exchange. Future Business Journal, 10(1). https://doi.org/10.1186/s43093-024-00384-8

Ayub, U., Kausar, S., Noreen, U., Zakaria, M., & Jadoon, I. A. (2020). Downside Risk-Based Six-Factor Capital Asset Pricing Model (CAPM): A New Paradigm in Asset Pricing. Sustainability, 12(17), 6756. https://doi.org/10.3390/su12176756

Hendrickson, C., Haas, C., & Au, T. (2024). Cost Estimation. Ecampusontario.pressbooks.pub. https://ecampusontario.pressbooks.pub/projectmanagementforconstructionanddeconstruction/chapter/cost-estimation/

Homauni, A., Moghaddam, N. M., Mosadeghkhah, A., Noori, M., & Abbasiyan, K. (2023). Budgeting in healthcare systems and organizations: A systematic review. Iranian Journal of Public Health, 52(9). https://doi.org/10.18502/ijph.v52i9.13571

Parviziomran, E., & Elliot, V. (2023). The effects of bargaining power on trade credit in a supply network. Journal of Purchasing and Supply Management, 29(1), 100818. https://doi.org/10.1016/j.pursup.2023.100818

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Description

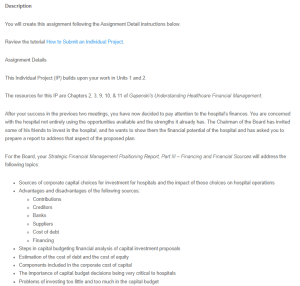

You will create this assignment following the Assignment Detail instructions below.

Review the tutorial How to Submit an Individual Project.

Assignment Details

This Individual Project (IP) builds upon your work in Units 1 and 2.

The resources for this IP are Chapters 2, 3, 9, 10, & 11 of Gapenski’s Understanding Healthcare Financial Management.

After your success in the previous two meetings, you have now decided to pay attention to the hospital’s finances. You are concerned with the hospital not entirely using the opportunities available and the strengths it already has. The Chairman of the Board has invited some of his friends to invest in the hospital, and he wants to show them the financial potential of the hospital and has asked you to prepare a report to address that aspect of the proposed plan.

Strategic Financial Management Positioning Report – Financing And Financial Sources

For the Board, your Strategic Financial Management Positioning Report, Part III – Financing and Financial Sources will address the following topics:

- Sources of corporate capital choices for investment for hospitals and the impact of these choices on hospital operations

- Advantages and disadvantages of the following sources:

- Contributions

- Creditors

- Banks

- Suppliers

- Cost of debt

- Financing

- Steps in capital budgeting financial analysis of capital investment proposals

- Estimation of the cost of debt and the cost of equity

- Components included in the corporate cost of capital

- The importance of capital budget decisions being very critical to hospitals

- Problems of investing too little and too much in the capital budget

Deliverable Requirements: The Strategic Financial Management Positioning Report, Part III – Financing and Financial Sources will answer the bullet points above in at least 5 pages (Title and Reference pages are not counted in the 5 pages) and cite 5 sources in APA format.

Submitting your assignment in APA format means, at a minimum, you will need the following:

- Title page: Remember the running head. The title should be in all capitals.

- Length: 5 pages minimum

- Body: This begins on the page following the title page and must be double-spaced (be careful not to triple- or quadruple-space between paragraphs). The typeface should be 12-pt. Times Roman or 12-pt. Courier in regular black type. Do not use color, bold type, or italics, except as required for APA-level headings and references. The deliverable length of the body of your paper for this assignment is 5 pages. In-body academic citations to support your decisions and analysis are required. A variety of academic sources is encouraged.

- Reference page: References that align with your in-body academic sources are listed on the final page of your paper. The references must be in APA format using appropriate spacing, hanging indent, italics, and uppercase and lowercase usage as appropriate for the type of resource used. Remember, the Reference page is not a bibliography but a further listing of the abbreviated in-body citations used in the paper. Every referenced item must have a corresponding in-body citation.