Planning for Retirement

Retirement planning is a critical and often complex issue that requires careful attention because it has a significant impact on an individual’s quality of life in their later years. When confronted with this difficulty, it is critical to obtain relevant information that can influence decision-making and eventually improve one’s retirement condition. This essay delves into the many facets of retirement planning, discussing critical issues such as how to approach this topic and the different solutions available to aging adults. Furthermore, it dives into the concept of stakeholders in retirement planning, evaluating who else should have a say in this major life decision and emphasizing the interconnection of our options in this regard. Furthermore, the essay recognizes the numerous factors that influence retirement preparation, including not only monetary savings but also aspects such as marital status, health status, and a variety of other variables that play a crucial part in molding the retirement experience.

Information to Improve the Situation

As an older adult faced with the subject of retirement planning, it is critical to analyze a plethora of issues and obtain relevant information in order to make informed decisions and improve my retirement status. Financial preparation, including a thorough examination of savings, investments, and retirement accounts, as well as an awareness of Social Security benefits, pension plans, and accessible retirement income sources, are important considerations. Furthermore, I should research healthcare alternatives and prices in retirement, including long-term care insurance and Medicare, to cover prospective healthcare costs. Staying up to date with changing laws and regulations, seeking professional advice from financial planners, and learning from the experiences of peers who have gone through similar situations are invaluable sources of information for making well-rounded decisions and ensuring a secure and fulfilling retirement. Further, emotional and social considerations, such as participating in community activities or pursuing meaningful post-retirement projects, must also be considered.

How to Approach this Issue

To effectively address the issue of retirement planning, I would employ a diversified approach. To begin, I would establish clear financial goals and develop a budget to manage my savings and investments, ensuring a regular income during retirement. To make informed decisions about investments and retirement accounts, it is important to seek professional guidance from financial planners or advisors (Bajtelsmit & Coats, 2023). Furthermore, I would actively participate in social and community activities in order to establish a supportive network and keep a sense of purpose, thus reducing feelings of isolation or boredom. Finally, my proposal would take a comprehensive approach, balancing financial prudence, healthcare planning, and social participation in order to provide a joyful and pleasant retirement.

Stakeholders in the Decision

The decision to plan for retirement involves various stakeholders, all of whose opinions should be taken into account. First and foremost, my immediate family, including my spouse and children, are important stakeholders since my retirement decisions can have a substantial impact on their financial and emotional well-being. It is critical to consult with them and understand their expectations and worries. Financial advisors and experts are important stakeholders because their advice can have a substantial impact on the success of a retirement plan (Coffi & George, 2022). Employers or pension plan administrators may be stakeholders as well, especially if I have employer-sponsored retirement benefits. Moreover, the government plays a significant role in my retirement planning through Social Security laws and tax regulations, and I should be informed about their changing impact. Finally, my community and social network are stakeholders since my participation in community events or volunteer work might affect my mental and social well-being during retirement.

Factors Impacting this Issue

A variety of factors, in addition to monetary resources, have a considerable impact on the issue of retirement planning. Consequently, marital status is important because it influences collaborative financial planning, spousal benefits, and the emotional support system in retirement (Hutchinson & Kleiber, 2023). Another crucial issue is one’s health status, which influences healthcare costs, long-term care planning, and general quality of life during retirement. The time and viability of retirement can be influenced by job status, including access to employer-sponsored retirement programs and age-related employment discrimination (Ghadwan et al., 2023). Furthermore, the current economic environment, inflation rates, and investment market circumstances all have a direct impact on retirement fund growth and sustainability. Family dynamics, such as the presence of dependent children or the burden of caregiving, can also influence retirement decisions. In addition, cultural and societal norms, as well as individual preferences and expectations, can further influence retirement choices.

Conclusion

To summarize, the path of retirement planning is a multidimensional undertaking that necessitates careful consideration of a wide range of circumstances. It is critical to obtain relevant knowledge about financial preparation, healthcare possibilities, and the emotional and social components of retirement in order to make well-informed decisions and improve one’s retirement condition. Individuals can ensure a comfortable and joyful retirement by taking a comprehensive strategy that includes all of these factors. Furthermore, the engagement of stakeholders such as family, financial advisors, employers, and the government, as well as an understanding of the various aspects influencing retirement, is crucial to developing a successful retirement plan. A thorough awareness of these components, as well as a proactive and adaptable strategy, are essential for navigating the complicated landscape of retirement planning and ensuring a high quality of life in later years. Finally, the road to retirement should be carefully planned, taking into account not only financial prudence but also the pursuit of well-being, fulfillment, and a meaningful post-work life.

References

Bajtelsmit, V. L., & Coats, J. (2023). Designing behavioral prompts to improve saving decisions: Implications for retirement plans. Financial Planning Review, 6(2). https://doi.org/10.1002/cfp2.1163

Coffi, J., & George, B. (2022). The Fintech Revolution and the Changing Role of Financial Advisors. Journal of Applied and Theoretical Social Sciences, 4(3), 261–274. https://doi.org/10.37241/jatss.2022.66

Ghadwan, A., Marhaini, W., & Mohamed Hisham Hanifa. (2023). Financial Planning for Retirement: The Moderating Role of Government Policy. 13(2). https://doi.org/10.1177/21582440231181300

Hutchinson, S., & Kleiber, D. (2023). On Time, Leisure, and Health in Retirement: Implications for Public Health Services. International Journal of Environmental Research and Public Health, 20(3), 2490. https://doi.org/10.3390/ijerph20032490

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Planning for Retirement

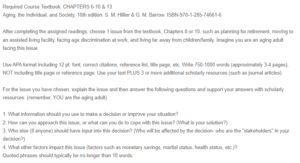

Required Course Textbook: CHAPTERS 6-10 & 13

Aging, the Individual, and Society, 10th edition. S. M. Hillier & G. M. Barrow. ISBN-978-1-285-74661-6

After completing the assigned readings, choose 1 issue from the textbook, Chapters 8 or 10, such as planning for retirement, moving to an assisted living facility, facing age discrimination at work, and living far away from children/family. Imagine you are an aging adult facing this issue.

Use APA format including 12 pt. font, correct citations, reference list, title page, etc. Write 750-1000 words (approximately 3-4 pages), NOT including title page or reference page. Use your text PLUS 3 or more additional scholarly resources (such as journal articles).

For the issue you have chosen, explain the issue and then answer the following questions and support your answers with scholarly resources: (remember, YOU are the aging adult)

1. What information should you use to make a decision or improve your situation?

2. How can you approach this issue, or what can you do to cope with this issue? (What is your solution?)

3. Who else (if anyone) should have input into this decision? (Who will be affected by the decision- who are the “stakeholders” in your decision?)

4. What other factors impact this issue (factors such as monetary savings, marital status, health status, etc.)?

Quoted phrases should typically be no longer than 10 words.