J. C. Penney Strategic Analysis

J.C Penney is an American department store company that operates in different parts of the United States. The company specializes in selling conventional products and jewellery. The company filed for bankruptcy in mid-May 2020 after experiencing an extended period of sales decline and business disruptions caused by the Covid-19 pandemic. It stated that it would be closing around 29% of its stores to manage meeting the cost of operating its department stores where there was a high concentration of customers. The company was, however, not the only department store that has been adversely affected by the COVID-19 pandemic based on the fact that it was the fourth major national retailer to become bankrupt in May 2020. The decision was considered the best move because the company could no longer manage meeting the operation costs and was incurring losses due to reduced sales. The company owners, therefore, decided to offer bonuses amounting to almost $10 million to senior managers. The company was then removed from the New York Stock Exchange and was listed in the OTC Pink. On 4th June, the company released a list of stores that would be closed. The list included 148 stores in different parts of the United States that were not performing well at that time.11 more stores were closed on 22nd June, and two other stores were closed on 7th July. The offer attracted various buyers, including the Sycamore partners, Amazon, and another group of Authentic Brands. Some mall owners, such as Brookfield Properties and the Simon Property Group, were also interested in buying the company. On 9th September 2020, the Simon Property Group and the Brookfield Property Partners agreed to buy the company for approximately $800 million. $300 million would be in cash, while $500 million was assumed to be in debt. The purchase was approved by the court on 10th November 2020. This review provides an overview of the company’s current financial plan and makes recommendations for improvement. The review also suggests various strategies that the company can use to achieve sustainable competitive advantage in the marketplace and increase financial performance.

The company’s current financial plan, including charts and/or graphs showing financial data from the struggling company, and make recommendations for improvement

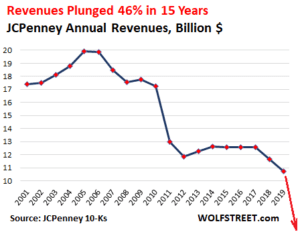

J.C Penney is among the companies that have been experiencing poor financial performance for a long time (Hoffman, 2014). The company began experiencing a decline in its revenue in 2016, as shown in Figure 1 below. Since then, the company has been struggling to stay in business, particularly due to stiff competition and changing customer preferences and needs (Eades et al., 2017). The final blow was the Covid-19 pandemic which resulted in a sharp decline in sales, thus prompting the company to close down many stores and finally file for bankruptcy due to a large accumulation of debt.

By the time the company was filing for bankruptcy, it had approximately $500 million in cash and had received $900 million commitments in debtor-in-possession financing from its existing first-lien leaders. This amount included $450 million in new lendings (Business Wire, 2020). After the court approved the bankruptcy filing, the company began its journey to recovery. The current financing and the cash flow generated by the company’s ongoing operations are anticipated to be sufficient to meet the company’s operational and restructuring needs. The company is also exploring new opportunities to maximize value as part of the debtor-in-possession commitment from existing lenders. Such opportunities include a third-party sale process, including filing various customary first-day motions with the bankruptcy court in the United States seeking authorization to support its operations during the financial restructuring phase(Business Wire, 2020). The company also filed a motion to pay non-furloughed associates wages, offer certain benefits to all associates, and pay vendor partners for all goods and services provided on or after filing for bankruptcy(Business Wire, 2020). The bankruptcy process has given the company the lifeline required by reducing its debt and the number of stores to below 700 from 846. The restructuring has also played a significant role in raising the money needed to restock and run television and online ads. I would therefore recommend focusing on how to increase sales to increase profitability, given the fact that an increase in sales is associated with increased revenue and a significant increase in profitability. I would also recommend reducing operational costs by eliminating some expenses that could be avoided until the company regains a high financial position. For instance, the company should consider using online ads and stop using television ads.

Strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance

According to Huang et al.(2015), sustainable competitive advantage arises when a company provides the same customer benefits as competitors but at a lower price, thus creating a low cost of production. Sustainable competitive advantage also occurs when a company offers superior customer benefits compared to what is offered by competitors but at the same price, hence bringing greater economic value than other companies in the same sector. Companies that are able to develop strategic competitive advantage can create differentiated value, thus performing better than their competitors (Kumar, 2016). Despite its current financial issues, J.C Penney could utilize various strategies to gain a sustainable competitive advantage and increase financial performance. One of the strategies that can be used is product differentiation. The company should consider introducing a new chain of cheaper products to acquire a new customer base. Product differentiation will also enable the company to increase its customer base and sales, thus improving financial performance. The second strategy is the liquidation of its stores to create an even distribution of profit. The company needs to consider connecting with popular brands to sell their products in the stores to attract customers who are loyal to the brand. This will play a significant role in increasing sales. For instance, the company should create a reputation for offering original high-end brands such as Nike, which are easily counterfeited. This will attract high-end customers and encourage more brands to sell their products through the store, hence increasing sales, and resulting in an increase in customer performance. The company spud also considers closing the stores with the least sales to cut operational costs and gain strategic and financial standing. The company can then use the funds that were being directed to closed stores to improve existing stores, especially those in busy areas, to ensure that there is a wide range of products that customers can purchase at a favourable price. J.C Penney should also change the location of stores located in low customer traffic areas to avoid having dead stock in stores where the customer base is small. Another strategy that J.C Penney should use is promoting advertisements displaying low-cost products to catch the attention of customers who may visit the stores to check out the products and purchase other products due to impulse buying. Prompting more customers to visit the stores also enables them to view a wide range of products hence increasing sales.

Plan to Implement the Selected Strategies

Implementing the strategies identified above requires the collaboration of all company stakeholders, including manufacturers who supply the company with the products it sells in its stores. The company needs to ensure that the manufacturers provide unique products that will attract the target market when the product is displayed in the stores and on online ads. The company also needs to collaborate with local manufacturers to get more products at a lower price so that it can set favourable prices for its customers. It is also important for the company to conduct a quality inspection to ensure that the products being supplied by manufacturers meet the quality expected by customers.

In the implementation of the liquidation strategy, the company needs to conduct a thorough background check on the brands it intends to collaborate with to acquire its products. The background check should focus on the brand’s ability to pay, credit terms, and any special requirements needed to stock its products in the company’s stores. This will help in deciding whether the brand is an ideal partner and prepare the company for any problems that may arise from working with the brand.

The company also needs to conduct market research to identify where its customers are concentrated before relocating its stores. It is also important to consider the stock available in the stores before closing them to avoid being stuck with products that customers are no longer interested in. The company may also sell products at a discounted rate before closing a store to avoid moving the stock to other stores that may already be equipped with different products.

References

Business Wire. (2020, May 15). J.C Penney to reduce debt and strengthen financial position through restructuring support agreement. https://www.businesswire.com/news/home/20200515005598/en/%C2%A0JCPenney-to-Reduce-Debt-and-Strengthen-Financial-Position-Through-Restructuring-Support-Agreement

Eades, K. M., Glazer, D., & Eyal, S. (2017). J. C. Penney company. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2974528

Hoffman, A. N. (2014). J.C. Penney Company, Inc.: Surviving the Ron Johnson (CEO) era. https://doi.org/10.4135/9781526427489

Huang, K., Dyerson, R., Wu, L., & Harindranath, G. (2015). From temporary competitive advantage to sustainable competitive advantage. British Journal of Management, 26(4), 617-636. https://doi.org/10.1111/1467-8551.12104

Kumar, D. (2016). Building sustainable competitive advantage. https://doi.org/10.4324/9781315570488

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

J. C. Penney Strategic Analysis

In Wk 2, you completed a SWOT analysis on a successful company that demonstrated a sustainable competitive advantage in the marketplace. Now, you will shift your focus to look at a company that is failing or experiencing challenges in the area of financial performance.

Select and research a company that is having financial difficulties or is on the brink of bankruptcy.

Review “Where Can I Find a Company’s Annual Report and Its SEC Filings?” from Investopedia.

You can also access specific information about a variety of businesses in the University Library by searching the following databases:

University Library > Databases > B > Business Source Complete

University Library > Databases > E > EDGAR

University Library > Databases > P > Plunkett Research Online

Conduct a strategic analysis of the company’s current financial operations. Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

Write a 1,050- to 1,400-word analysis. When writing your analysis, complete the following:

Evaluate the company’s current financial plan, including charts and/or graphs showing financial data from the struggling company, and make recommendations for improvement.

Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

Create a plan to implement the strategies you selected.

Include APA-formatted, in-text citations, and a reference page with at least 3 sources.