Intel Corporation Future Financial Health

Intel Corporation We’ll maintain a highly competitive advantage in the technology industry by manufacturing, designing, and selling high-quality computer components, flash memory, ch sets, and other computer-related products. The company has established a reputation of innovativeness by prioritizing being a leader in every category it competes in, meeting its commitments flawlessly, and reigniting its culture to innovate and attract the best technology and engineers worldwide. The company has also maintained good relations with its customers and the community, being at the forefront of dealing with issues affecting them. For instance, after the outbreak of the COVID-19 pandemic, the company invested $50 million to help increase access to the technology required to deal with the pandemic (Intel Corporation, 2021). The company also directly supported local communities through their Pandemic Response Technology Initiative. The company has also been active in fighting racism and promoting social equity by funding new social equity and external policy engagements and partnerships.

The current COVID-19 pandemic has increased the demand for technology and technological products. Organizations are adjusting their cultures to promote working from home due to the economic pressures affecting their profitability and the need to protect their employees from infection. The increased computer demand will significantly impact Intel Corporation’s revenue and profit margins. Therefore, the company needs to conduct a detailed analysis of its current and projected market share and design measures to increase the market share for long-term financial growth. This analysis will focus on evaluating Intel Corporation’s future financial health. One of the assumptions made in this research is that the demand for computers, network and communication, digital imaging products, and systems management software will increase due to the trend of working from home. The second assumption is that the company will maintain a high competitive advantage because it has already created a good reputation in the technology industry and acquired a large customer base.

Analysis of Fundamentals

Goals

Intel Corporation’s primary goal is to create unique technology that improves people’s lives worldwide. The company’s other goal is to offer high-quality products that meet the customers’ needs and preferences. Another goal is to apply lessons from past experiences and work within the technology sector to accelerate and broaden the creation of sourcing standards for more minerals across many high-risk and conflict-affected areas. The company also intends to maintain a good reputation by maintaining responsibility, inclusion, and sustainability in its operations (Intel Corporation, 2021). Over the years, it has maintained responsibility by using minerals responsibly and mobility. Responsible minerals include expanding efforts beyond conflict minerals to source all minerals used in manufacturing semiconductors and applying to learn to lead the technology industry in developing new sourcing standards.

Responsible mobility includes collaborating with the ecosystem and technology industry partners to advance the implementation of safety technology and open standards to minimize traffic industries worldwide (Intel Corporation, 2021). Inclusion entails promoting accessibility and inclusion across the technology sector by developing and implementing a global inclusion index with shared metrics to enhance progress and expanding the inclusion process of acquiring talent in the technology sector through innovative universal education initiatives and STEM programs for underrepresented groups and girls (Intel Corporation, 2021). Sustainability includes sustainable manufacturing and enabling circular and greener chemistry strategies across the value chain in the technology sector by transforming the methodology in the chemical footprint.

Strategy

Intel Corporation’s strategy entails delivering the best semiconductors in the world for a rapidly becoming data-centric world. The strategy is founded on improving execution to strengthen its core, extend its reach, increase its growth, and redefine its position in the technology sector. The company has also been re-energizing its culture to create better business outcomes for its customers by promoting a growth mentality, increasing accountability around common company goals, implementing new operational procedures, and renewing a sense of value and purpose to create an environment of growth and innovation (Intel Corporation, 2021). It has also developed innovative xPU platforms uniquely serving various new workload opportunities. It has also transformed into a platform to deal with customers’ issues by providing complete solutions. The company extends its reach by focusing on a diverse product portfolio to maximize profits by investing in opportunities in the fastest-growing technologies (Intel Corporation, 2021). The company’s capital allocation tactic emphasizes creating stockholder value by prioritizing the investment in capital spending and research and development to strengthen its competitive position, returning money to shareholders in the form of share buybacks and dividend programs, and investing in companies worldwide that will complement its strategic goals and promote the growth of data-centric prospects.

Market

Intel Corporation’s market is divided into PC-centric and Data-centric markets. Data-centric markets include market opportunities in storage and servers, connectivity and networking, and the Internet of Things. PC-centric market opportunities include client chipsets and CPUs, discrete graphics, connectivity devices, phones, storage media, memory, and USB cards. The company anticipates growing its market to $300 billion by leading significant technology inflections that significantly change communications and computing. Its primary focus in increasing the market share is investing in artificial intelligence with the potential to unlock data value and make new business experiences and models possible. The company has already tapped into the artificial intelligence market by offering software and hardware technologies that provide broadband capabilities to support storage, computing, tuning, and transmission.

Competitive Technology

Intel Corporation has invested in technology to guarantee the manufacturing of high-quality products. The company’s competitive technology is evident in health and safety. For instance, the company invented the Pandemic Response Technology Initiative to help healthcare providers to reach and treat Covid-19 patients. It also collaborated with healthcare providers to deploy Intel server and client solutions for less expensive and faster genome sequencing and COVID-19 testing (Intel Corporation, 2021). The company also built remote ventilators to enable doctors to monitor many ventilated patients without exposure to the virus. Intel Corporation’s competitive technology has also extended to creating safer work environments and manufacturing. The company introduced artificial intelligence-based social distancing and occupancy controls in collaboration with Johnson Controls to replace human observation social distancing monitoring with environmental data and sensors for optimizing air quality and analysis of physical distancing.

Regulatory Characteristics

Various federal and industrial regulations regulate Intel Corporation’s operations, and the company has maintained compliance with these regulations by sticking to specific regulatory characteristics. The company has an internal environmental, health, and safety policy that provides an injury-free and safe workplace to its employees and contractors. The company also observes ISO 14001 and 45001 standards to ensure its manufacturing sites maintain a fully integrated, comprehensive health, environmental, and safety management system (Intel Corporation, 2021). The company also condemns bonded and forced labour by using a system that detects and addresses bonded and forced labour risks among its recruiting agents and suppliers.

Operating Characteristics

The company’s operating characteristics include creating an inclusive environment, sustainability, and enabling. Its core values are equity, diversity, and inclusion. The company advances a culture of accountability and inclusion by integrating measures across its compensation programs, performance management systems, and hiring processes. The company has developed a set of practices to be followed in the hiring process to mitigate the impact of unconscious bias in the hiring process. It also conducts employee surveys to allow employees to express their viewpoints on the company and work experiences, including views on inclusion and diversity (Intel Corporation, 2021). Sustainability includes environmental management, climate, and energy management, promoting product energy efficiency, water stewardship, creating a circular economy and water solutions, sustainable chemistry initiatives, and manufacturing and accomplishing carbon-neutral computing.

The company provides an annual report of waste transfers from its sites, emissions, and treatment of chemicals in the United Nations by the US and state Environmental Protection Agency (Intel Corporation, 2021). Its engineers have also incorporated green design into renovating and constructing its facilities regarding water use, energy consumption, and recycling. The company has also significantly reduced its operational carbon footprint by around 28% by focusing on alternative and renewable energy. The company’s water strategy focuses on conserving water by reducing the water used in operations, collaborating with local water initiatives, and creating technological solutions to help reinvent how other people in the community conserve and use water (Intel Corporation, 2021). A waste and circular economy has been created by recovering and selling copper and other metals that were initially part of the company’s waste from the planting process.

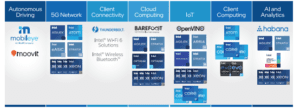

Sustainable chemistry and manufacturing include designing chemical processes and products to minimize the creation and use of dangerous materials. The company also collaborates with PC manufacturers to create sustainable designs. Enabling involves a skills-based volunteer program to make a positive social impact, offering grants for volunteer projects, and collaborating to enhance the positive impact of technology on communities and people worldwide (Intel Corporation, 2021). The company also maintains an end-to-end product portfolio that provides innovative solutions between computing, the cloud, and emerging technologies such as autonomous driving and artificial intelligence, as shown in Figure 1.

Revenue Outlook

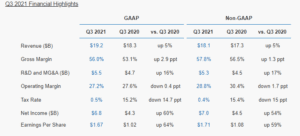

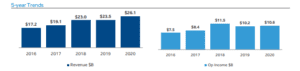

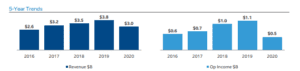

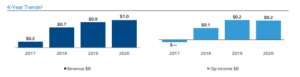

Intel Corporation’s revenue has been increasing over the years. In the third quarter of 2021, the company generated $19.2 in GAAP revenue. This was a significant rise because, during the third quarter of 2020, the company’s revenue was $18.3. The company’s non-GAAP revenue during the third quarter of 2020 was 17.3, and it rose to $18.1 in 2021, as shown in Figure 2(Intel Corporation Press Release, 2022). The revenue was distributed differently across the critical business units. In 2021, the CCG revenue was $ 9.7 billion, Internet of Things revenue was divided into Mobileye $326 million, IOTG $1.0 billion, PSG $478 million, and NSG $1.1 billion, as shown in Figure 3. CCG is a platform designed for factors in the end-user form that focus on higher growth segments of thin-and-light,2-in-1, and gaming and commercial graphics and connectivity (Intel Corporation Press Release, 2022).

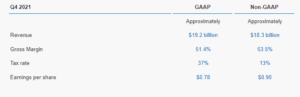

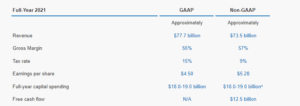

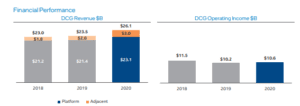

NSG IOTG incorporates high-performance computer solutions for embedded applications and targeted verticals in market segments such as industrial, retail, vision, and healthcare.PSG includes programmable semiconductors, mainly structured ASICs and FPGAs, and related products for enterprise, cloud, communications, and embedded market sectors.NSG incorporates storage and memory products such as Intel 3D NAND technology, which is mainly used in SSDs.Mobileye is an eye technology needed for autonomous driving.DCG includes platforms for optimizing workload and related products structured for governments, enterprises, cloud services, and communication providers. Intel Corporation generated approximately $19.2 billion in GAAP revenue and $18.3 billion in non-GAAP revenue during the fourth quarter, as shown in Figure 3. The annual GAAP revenue in 2021 was approximately $77.7 billion, and the non-GAAP revenue was approximately $73.5 billion, as shown in Figure 4.

Investment to Support the Business Unit Strategy

Intel Corporation has many experts, including designers, engineers, distribution agents, and quality assurance agents. These experts need to be compensated well to maintain the production of high-quality products and proper relations between the company and its customers. One of the investments that should be made to support the unit strategy is creating subcontractor partnerships to reduce production costs and enhance production process sustainability. The partnerships will also support the company’s enabling strategy by effectively responding to global environmental and social challenges, broadening access to opportunity, and supporting community needs.

The company should fund grants to support communities and create a good reputation. For instance, the company should ensure that enough funds are set aside to support employee-initiated community service ventures such as farming projects and creating employment for young people and people with disabilities. Another significant investment that needs to be considered is the Intel Foundation, which focuses on promoting STEM education, responding to natural disasters and humanitarian crises, and amplifying employees’ generosity and time (Intel Corporation, 2021). The company also needs to invest in the RISE initiative that focuses on building deeper relations with the company’s partners and customers to create shared value.

Future Profitability and Competitive Performance

Intel Corporation’s future profitability is expected to be high due to its move to build two new factories to increase production. The company also focuses on manufacturing 7nm chips to create a competitive advantage over other manufacturing chips in the technology sector (Lempel, 2011). According to Jennewine (2021), manufacturing the chips will create a competitive advantage over Taiwan Semiconductor, among the major competitors that have significantly reduced Intel Corporation’s market share. Its future profitability will also increase due to its recent investment in eye technology. The technology includes comprehensive solutions for autonomous driving, including computer vision, compute platforms, mapping and localization, machine-learning sensing, active sensors, and driving policy. Therefore, the company may sell the technology to manufacturers of autonomous and connected cars, increasing profits. The company anticipates increasing revenue by 10% to 12% by 2026, with a 51% to 53% increase in gross margin (Intel Corporation Press Release, 2022). The company has also maintained an upward trend in revenue generation in the data centre group, as shown in Figure 5, hence the possibility of increased profitability in the future.DCG, Internet of Things, Mobileye, NSG, PSG, and CCG revenue are also expected to rise, as shown in Figures 6,7,8.9,10, and 11.

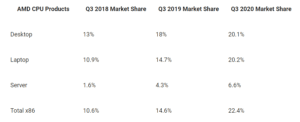

Intel Corporation’s competitive performance is expected to decrease due to increased pressure from its main competitors. The company is gradually losing customers in the markets it has controlled for years, such as PC and data centre markets, because of a shift in buyer preference, given that competitors produce better products (Verial, 2022). For instance, Apple recently announced that they would replace the Intel chips in their MacBook Pro and MacBook Air laptops with its newly developed Apple M1 chips, which have better performance than Intel’s chips. In 2020, one of Intel’s major competitors, NVIDIA, acquired Mellanox, a networking solutions company with better performance than Intel, hence capturing a larger market share. Another major competitor, AMD, introduced Ryzen 5000 chips with better performance than Intel chips. The company has also gained dominance in the server market and is gradually increasing its market share in CPU products, as shown in Figure 12.

Future External Financing Needs

Intel Corporation will require financing to support its intelligent capital strategy that focuses on increasing funds while creating flexibility and offering high returns on investment. The company will need government incentives that focus on partnering with the local governments and federal governments in Europe and the United States to enhance incentives for the company’s capacity to maintain domestic manufacturing for advanced semiconductors as it manufactures advanced fabs that secure local supply and offer opportunities for supporting economic growth in local communities. The company will also require collaboration with potential customers and create their willingness to make advanced payments to secure manufacturing capacity. Intel Corporation will also need financing to implement new technology to stay ahead of the competition. The company’s success relies on securing its market share and maintaining its reputation for manufacturing high-quality semiconductors and chips (Thomas, 2011). Therefore, it needs to invest in research and development to invent products that meet its existing customers’ changing needs and preferences to avoid losing customers to competitors. The company may also need to train its staff to equip them with new knowledge and skills required to improve the quality of its products and hire new talent.

Viability of the 3-5 Year Plan

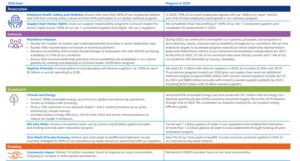

Intel Corporation’s 3-5-year plan is to implement the RISE strategy, which focuses on creating a more inclusive, responsible, and sustainable world through technology, employee passion, and expertise. The plan also includes fully taking advantage of the power of technology to solve highly interconnected and complex global challenges, setting ambitious goals, advancing transparency, and incorporating corporate social responsibility across all aspects of the business, as shown in Table 1. The company intends to implement the RISE strategy by improving employee health, wellness and safety, promoting employee inclusion and supply diversity, achieving zero waste targets, protecting the environment, and positively impacting the community.

The employee health, wellness, and safety plan ensures that more than 90% of the workforce believes that the company has a strong safety culture and that 50% of the workforce participates in the company’s global wellness program (Intel Corporation, 2021). The employee inclusion plan includes doubling the number of underrepresented minorities and women in senior leadership roles, advancing accessibility, and increasing the percentage of employees with a disability to 10% of the total workforce, exceeding 40% women representation in technical positions and ensuring that accountability and inclusive leadership practices are incorporated into the company’s culture globally by developing and implementing an inclusive leader certification program.

The supplier diversity plan includes increasing global annual spending with suppliers from diverse groups by 100% to reach a yearly expenditure of $2 billion by 2030. The environmental sustainability plan includes reaching a 100% renewable use target across the company’s global manufacturing operations, increasing product energy efficiency ten times more, and reducing emmissions.Net zero water plan includes funding external projects aimed at restoring water and conserving 60 billion gallons of water and the zero waste plan includes minimizing waste from manufacturing points. The company also plans to impact the community by providing 10 million volunteer hours to improve local communities.

The plan is viable because it has already made significant progress toward achieving its goals. For instance, the company has conserved 7.1 billion gallons of water and supported the restoration of 1.3 billion gallons by funding water restoration initiatives. The company has also achieved 82% use of renewable energy and made the company one of the companies with a reputation for proper employee relations. A survey conducted in 2020 indicated that 79% of the company’s workforce agreed with its metrics on safety as a measure of value, and 22% participated in the company’s wellness program. The company has additionally provided 910,000 hours of volunteering to local communities.

Stress test under scenarios of adversity

Intel Corporation is expected to face many adverse situations due to the uncertainty in its market share and technological advancements. The primary stress test that the company may face is catching up with the technology being used by competitors to manufacture high-quality semiconductors and chips. Competitors have already demonstrated their ability to partner with the best companies in the technology industries, enabling them to exchange ideas and manage high-quality productions at a cheaper cost by exchanging resources. Intel Corporation will, therefore, have no highly innovative company to partner with, thus making it difficult to manufacture high-quality products that compete favourably with existing products.

Intel Corporation also faces the risk of losing its best talent to competitors because the competitors can offer better pay without affecting their profitability. Intel Corporation is also competing with its competitors for raw materials, creating a threat of limited access to the raw materials if a competitor can purchase most of them quickly. Another stress test that the company may face is the reduction in its value in the stock market. Stock markets play a vital role in communicating a company’s financial strength to investors. The technology industry is among the most profitable sectors, and investors closely monitor the stock prices of various companies. Therefore, reduced financial profitability will automatically reduce Intel Corporation’s stock value, reducing the investors’ interest in the company.

Current financing plan

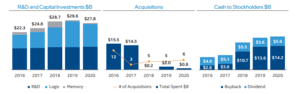

Intel Corporation’s financing plan includes building stockholder value by investing in research and development to improve competitive advantage. The company also invests in other companies worldwide to complement its strategic objectives and enhance the growth of opportunities in the data-centric market. The company also has share repurchase and dividend programs to return investments to stockholders. For instance, the company has returned 95% of its free cash flow to investors over the past five years. The company distributes financing across the acquisition, returning money to stockholders and investing in the business based on business needs, as shown in Figure 13. The primary investments in research and development focus on product leadership areas such as packaging and process, xPU architecture, interconnection, memory, software, and security.

List of Figure, Table, and Addenda

Figure 1: Intel Corporation’s Product portfolio

Figure 2: Intel Corporation’s Third Quarter Revenue Outlook

Figure 3: Revenue outlook in Intel Corporation’s main business areas

Figure 3: Intel Corporation’s Fourth Quarter Revenue Outlook

Figure 4: Intel Corporation’s 2021 Full-Year Revenue Outlook

Figure 5: Intel Corporation’s Data Center Group Revenue Outlook

Figure 6: Intel Corporation’s DCG Revenue Outlook

Figure 7: Intel Corporation’s Internet of Things Revenue Outlook

Figure 8: Intel Corporation’s Mobileye Revenue Outlook

Figure 9: Intel Corporation’s NSG Revenue Outlook

Figure 10: Intel Corporation’s PSG Revenue Outlook

Figure 11: Intel Corporation’s CCG Revenue Outlook

Figure 12: AMD Market Share in CPU Products

Table 1:3-5 Year Plan

Figure 13: Intel Corporation Financing Plan

Assumptions

One of the assumptions made in this research is that the demand for computers, network and communication, digital imaging products, and systems management software will increase due to the trend of working from home. The second assumption is that the company will maintain a high competitive advantage because it has already created a good reputation in the technology industry and acquired a large customer base.

References

Intel Corporation Press Release. (2022). Intel Reports Fourth-Quarter and Full-Year 2021 Financial Results. https://www.intc.com/news-events/press-releases/detail/1522/intel-reports-fourth-quarter-and-full-year-2021-financial

Intel Corporation. (2021). 2020-21 Corporate Responsibility Report.

Jennewine, T. (2021, January 15). Why Intel’s competitive edge is crumbling. The Motley Fool. https://www.fool.com/investing/2021/01/15/why-intels-competitive-edge-is-crumbling/

Lempel, O. (2011). 2nd generation Intel® core processor family: Intel® core i7, i5, and i3. 2011 IEEE Hot Chips 23 Symposium (HCS). https://doi.org/10.1109/hotchips.2011.7477509

Thomas, K. P. (2011). Industry case studies: Steel, Biofuel production, semiconductors, automobiles, call centres. Investment Incentives and the Global Competition for Capital, 49-66. https://doi.org/10.1057/9780230302396_4

Verial, D. (2022, January 19). Intel’s future depends on its competitor’s failure (INTC). SeekingAlpha. https://seekingalpha.com/article/4480425-intel-future-depends-on-competitors-failing

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Intel Corporation Future Financial Health

1. Analysis of fundamentals: goals, strategy, market, competitive technology, and regulatory and operating characteristics.

2. Analysis of fundamentals: revenue outlook.

3. Investment(s) to support the business unit(s) strategy(ies).

4. Future profitability and competitive performance.

5. Future external financial needs.

6. Access to target sources of external finance.

7. Viability of the 3-5-year plan.

8. Stress test under scenarios of adversity.

9. Current financing plan.

Reference

Piper, T. R. (2010). Assessing a company’s future financial health. Boston,

MA: Harvard Business School.