Evaluating Firm Behavior and Industry Performance with Imperfect Competition

Natural Monopolies

A natural monopoly is distinguished from other monopolies based on the initial investment cost. The firm becomes a natural monopoly when the investment cost is higher, making other firms opt not to enter the market. An example of such is an oil and extraction company that requires massive capital investment before going operational. A natural monopoly is advantageous because it offers higher volumes of commodities with standardized prices (Saglam, 2021). However, such monopolies are supplemented with government subsidies to provide those prices, putting them in a risky position if not offered. Notably, a market environment with inelastic demand requires regulation, while regulation can be forgone in a market with elastic demand.

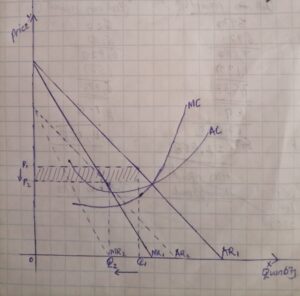

Acme’s Corporation Average and Marginal Cost Graph

Given in the diagram is MR, which stands for the monopoly’s marginal revenue. According to Gulaliyev et al. (2020), MC = MR is the equilibrium (E). Q1 and P1 represent the equilibrium level of quantity produced and price offered, respectively. During times of recession, the total market demand will decline. The result is a downward shift by the MR curve, which influences the equilibrium point. Q2 and P2 become the new equilibrium quantity demanded and price level, respectively. Therefore, a recession results in a fall in a monopoly’s profits, quantity and price.

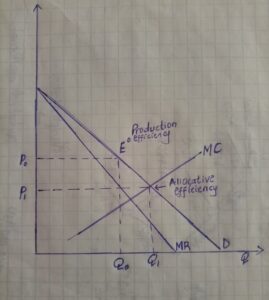

Public Local Utility: Typical Price and Output Graph

A public utility can be equated to the case of a natural monopoly. Since public utilities serve public interests, they are often subject to regulation. Notably, the regulation ensures that the firm does not misuse the public and fails to meet their needs. The graph indicates that the equilibrium will be at E0, with the quantity level at Q0 and the price level at P0, representing a case when the company is not regulated. Thus, the public utility will not benefit the public.

At the point where P = MC, the allocation efficiency occurs, while consistent production occurs when profits are maximized. Thus, even though profits will not be maximized at a regulatory price level, allocation efficiency will be achieved. The openness of the market to free entry will attract as many as possible firms with an interest in serving the public. As a result, competition will increase, and fair prices will be charged (Dhingra & Morrow, 2019). Therefore, the community’s best interest will be served when many firms enter and operate in the market.

Characteristics of Oligopoly and Monopolistic Competition Market Structures

There is intense competition between a few sellers, which characterizes oligopoly competition. Also, there are restrictions to entry due to high sunk costs and branding names. Firms operating in such a market offer homogenous products from which they can derive positive economic gains (Häckner & Herzing, 2022). The film industry is an excellent example of such a market whereby there are restrictions to market entry while those in the market build their brands. In contrast, monopolistic competition is a market containing many companies or sellers offering differentiated commodities. There is total freedom to enter or exit, and participant firms can make profits eventually. The textile industry is an example of a monopolistic market, with companies such as Polo, Zara, and Gucci competing in closely differentiated clothing products.

The Uniqueness of Monopolistic Competition Model

Monopolistic competition has no restrictions on entry or exit. Also, in monopolistic competition, similar products with a high degree of differentiation are offered. On the other hand, a monopoly competition model entails a sole firm in a given market with restrictions to entry. The monopoly wields powers to set prices. Both monopolistic and monopoly can make an economic profit, normal profit, or even economic loss in the short run (Durand & Milberg, 2020). However, monopolistic firms can only earn normal profits or zero economic profit in the long run due to free entry into the market. In contrast, monopoly firms can make profits above the normal profit and positive economic profit.

Payoff Matrix for Company A and Company B

The Expected Outcome of the One-Time Game

Both companies are expected to opt for lower prices in the one-time game. Notably, this is so because the Nash equilibrium of the game is maintaining low prices. When one company maintains low prices, the other company will also have to keep its prices low because it lacks an option. Thus, if company A opts for low prices, company B will lack an option other than keeping low prices.

The highest prices or prices above the lowest level will be the best outcome in a repeated game. Notably, this will be repeated indefinitely when the game is played, and companies will have a chance to make a pricing agreement. For instance, they can agree to higher prices since both will stand to gain.

There is no explicit conclusion for companies A and B in the given scenario. However, when the game is played repeatedly in the long run, both can cooperate and agree because they will all benefit in the form of higher profits.

Benefits of Corporate Social Responsibility (CSR) and Shared Value Strategies

Various benefits will accrue to a firm when corporate social responsibility and shared value strategy are implemented. First, when companies implement corporate social responsibility, they save significantly on operational costs. Notably, this is so because corporate social responsibility plays a role in ensuring companies utilize their resources effectively while maintaining minimal wastage levels. Second, corporate social responsibility assists firms in gaining better brand recognition, earning customer loyalty, and increasing sales. Third, a shared value strategy will help organizations acquire a competitive advantage against their competitors (Moon & Parc, 2019). Notably, this will occur because of expansion to new markets, technology upgrades, and innovation.

TOMS and Deloitte have both embraced corporate social responsibility. TOMS introduced the campaign “One for One,” which aimed to donate one pair of shoes for a given pair purchased. The initiative improved the image of the company significantly. On the other hand, Deloitte has remained focused on promoting environmental sustainability and driving social change. Also, the company improved its reputation by encouraging its employees to donate time to pro bono work, something that has increased job satisfaction for the employees.

References

Dhingra, S., & Morrow, J. (2019). Monopolistic competition and optimum product diversity under firm heterogeneity. Journal of Political Economy, 127(1), 196-232.

Durand, C., & Milberg, W. (2020). Intellectual monopoly in global value chains. Review of International Political Economy, 27(2), 404-429.

Gulaliyev, M. G., Yuzbashiyeva, G. Z., Mamedova, G. V., Abasova, S. T., Salahov, F. R., & Askerov, R. R. (2020). Consumer surplus changing in the transition from state natural monopoly to the competitive market in the electricity sector in the developing countries: Azerbaijan case. International Journal of Energy Economics and Policy, 10(2), 265.

Häckner, J., & Herzing, M. (2022). Tax incidence in oligopolistic markets. Economics Letters, 213, 110352.

Moon, H. C., & Parc, J. (2019). Shifting corporate social responsibility to corporate social opportunity through creating shared value. Strategic change, 28(2), 115-122.

Saglam, I. (2021). Bridging bargaining theory with the regulation of a natural monopoly. Review of Economic Design, 1-38.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Evaluating Firm Behavior and Industry Performance with Imperfect Competition

What distinguishes a natural monopoly from other monopolies? What are the pros and cons of regulating natural monopolies? Does your answer differ depending on the specific product or industry being regulated? Your response should be at least 75–150 words (1–2 paragraphs) in length.

Assume Acme Corporation is a typical monopoly:

Construct a graph illustrating Acme’s average and marginal cost curves and the demand curve facing it. Identify profit-maximizing output and price, total revenues, total costs, and total profits.

Assume the economy moves into a recession and the demand for Acme’s product falls. The same graph shows the effect of the recession on equilibrium prices, output, and profits.

Your response should be one graph and at least 75 words (1 paragraph) that includes an explanation for the graph.

Consider a local public utility, such as the water utility or scavenger company, that is regulated. Provide a diagram or graph illustrating the typical price and output set by regulators. Then respond to the following questions:

What might happen if the company was not regulated?

To what extent does regulation lead to equilibrium price and output levels that are consistent with production and allocation efficiencies?

Do you think the local community would be better served if the industry was no longer regulated and entry was available to any other company wanting to serve the community?

Your response should be at least 150–225 words (2–3 paragraphs) in length, including a graph with an explanation.

What are the key differentiating characteristics of a market characterized by oligopoly versus monopolistic competition? Provide one specific example of each type of industry and defend your assignment of the industry to monopolistic competition or oligopoly. Your response should be at least 75–150 words (1–2 paragraphs).

What makes the monopolistic competition model different from the monopoly model? Explain how the differences affect short- and long-run equilibrium. Your response should be at least 75 words (1 paragraph).

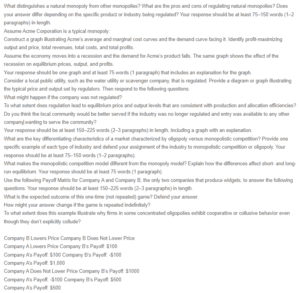

Use the following Payoff Matrix for Company A and Company B, the only two companies that produce widgets, to answer the following questions. Your response should be at least 150–225 words (2–3 paragraphs) in length.

What is the expected outcome of this one-time (not repeated) game? Defend your answer.

How might your answer change if the game is repeated indefinitely?

To what extent does this example illustrate why firms in some concentrated oligopolies exhibit cooperative or collusive behavior even though they don’t explicitly collude?

Company B Lowers Price Company B Does Not Lower Price

Company A Lowers Price Company B’s Payoff: $100

Company A’s Payoff: $100 Company B’s Payoff: -$100

Company A’s Payoff: $1,000

Company A Does Not Lower Price Company B’s Payoff: $1000

Company A’s Payoff: -$100 Company B’s Payoff: $500

Company A’s Payoff: $500

Describe at least two benefits to companies implementing corporate social responsibility (CSR) and shared value strategies. Include at least two examples of companies that have adopted CSR or shared value, and discuss how they benefited from them. Your response should be at least 150–225 words (2–3 paragraphs) in length.