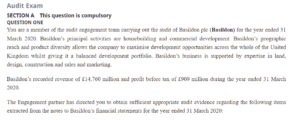

Audit Exam

SECTION A This question is compulsory

QUESTION ONE

You are a member of the audit engagement team carrying out the Basildon plc (Basildon) audit for the year ended 31 March 2020. Basildon’s principal activities are house building and commercial development. Basildon’s geographic reach and product diversity allows the company to maximize development opportunities across the whole of the United Kingdom whilst giving it a balanced development portfolio. Basildon’s business is supported by land, design, construction, sales, and marketing expertise.

Do you need help with your “Audit Exam accounting homework”? Get in touch with us.

Basildon recorded revenue of £14,760 million and profit before tax of £909 million during the year ended 31 March 2020.

The Engagement partner has directed you to obtain sufficient appropriate audit evidence regarding the following items extracted from the notes to Basildon’s financial statements for the year ended 31 March 2020:

Development Costs

Intangible non-current assets include development costs of £50 million for new materials and building technology developed within the company.

Intangible assets under development are tested annually for impairment.

Basildon applies relevant International Financial Reporting Standards in the financial statements recognition, measurement, and presentation of development costs. The estimates used in calculating the recoverable amount depend on assumptions specific to Basildon’s activities.

Other Investments

| 31 March 2020

£m |

|

| Non-current investments | |

| Equity securities at fair value through other comprehensive income | 1,340 |

| Equity securities available for sale | 100 |

| Fixed income securities at fair value through profit or loss | 60 |

| Total | 1,500 |

| Current investments | |

| Fixed income securities at fair value through profit or loss | 800 |

| Fixed deposits | 50 |

| Total | 850 |

Investments held at Fair Value through Other Comprehensive Income include equity securities not held for trading and which Basildon has irrevocably elected at initial recognition to recognize in this category—investments held at fair value through profit or loss comprised income securities that Basildon holds to sell.

Fixed deposits are held at amortized cost, with carrying value being a reasonable approximation of fair value given their short-term nature.

Inventories

| 31 March 2020

£m |

|

| Land held for development | 3,070 |

| Construction work in progress | 1,700 |

| Part-exchange properties and other inventories |

120 |

| Total | 4,890 |

Basildon’s internal controls are designed to identify developments where the land and work-in-progress balance sheet value exceeds the projected lower-cost or net realizable value. During the year, the company has conducted six-monthly reviews of the net realizable value of specific sites at high risk of impairment based upon several criteria, including low site profit margins and sites with no forecast completions.

Where a site’s estimated net realizable value was less than its current carrying value, the company has impaired the land and work-in-progress value.

Trade and other payables

| 31 March 2020

£m |

|

| Trade payables | 1,080 |

| Value added and payroll taxes and social security | 50 |

| Rebates, charges, and other revenue accruals | 400 |

| Contingent consideration | 65 |

| Total | 1595 |

Included within Rebates, chargebacks, returns, and other revenue accruals are contract liabilities of £97m (2019: £126m)

Required:

Describe SIX substantive audit procedures that should be performed about each of the above matters.

(Note: 15 marks per item)

The basis of audit opinion is reflected in the sufficient and appropriate audit evidence obtained during the audit. To form this opinion, substantive audit procedures need to be conducted to obtain audit evidence. Substantive audit procedures are tests done during an audit to confirm and conclude whether management assertions reported in the financial statements show an accurate and fair view of the entity’s affairs. Thus, the following will be necessary substantive procedures to be carried out in the various specific items of financial statements. Management assertions include the existence, occurrence, completeness, and accuracy.

These procedures include tests of details whereby verification is done on the balances of accounts, disclosures, and transactions. In contrast, analytical procedures include checking the relationships between some non-financial and financial information to obtain the audit trail.

Development costs, an intangible asset, will only be recognized at cost when and only when the company controls it, and there’s a probability that future economic benefits will flow into the entity. The substantive procedures should ensure that the development costs be amortized based on the sale or use of the product. For disclosure and presentation, these costs and movements during the audit year should be disclosed as separate items from the current assets.

Checking the intangible assets schedule should include opening balances, amounts capitalized for the current year’s movements, amortization charges, closing balances, recalculations of amortization charges, and a check on the application of amortization policy. Another test to be conducted is the inquiry from management on whether some costs have been capitalized or expensed, ensuring they agree with the invoices.

On investments, substantive procedures will include tests of arithmetic accuracy, analysis of the debt, and equity ratios to assist in determining the leverage level of the firm. Similarly, checks should be done to confirm whether the discount rates applied are reasonable. Equity securities account balances and fixed deposits are verified using bank confirmation letters from the company’s bank, indicating the fixed deposit amount at the end of the year.

Trade payables verification will be done on the creditor’s statement at year-end and obtaining related party ledgers on the balance confirmation. This assists in ensuring the completeness of information on all the trade payables included in the books of accounts.

For the VAT analysis, a comparison should be done on the sales as per the general ledger and as per returns for completeness assertion and seeking reconciliations. Comparisons on the Z report sales and return sales should be recalculated to ensure that all value-added tax output is declared.

The payroll taxes and social security verification will be ascertained through the payroll summaries ensuring taxes and statutory deducted are computed correctly. This accuracy test will be achieved by recalculations using the tax calculator.

Management should inquire about the costing system used to determine work in progress for the work in progress. Observing the physical inventory count and checking the stock valuation report will also be conducted.

Work in progress is measured per inventory policy, which is the lower cost and net realizable value. The inspection will include assessing land held for development, ensuring the book value matches the latest valuers’ report, and checking ownership documents.

QUESTION TWO

Your firm, Phillip and Phillipa, has been the Highbury Topps Ltd (Highbury) auditor for many years. Highbury manufactures a range of washing machines, fridges, and microwave cookers.

You are part of the audit engagement team for the audit of Highbury’s financial statements for the year ended 31 March 2020.

- At the commencement of the audit, you noticed a discrepancy between projected and actual sales.

You discovered that one washing machine brand showed projected sales of £5 million but had actual sales of only £100,000 during the year under audit.

The Chief Finance Officer (CFO) did not initially disclose this matter during the earlier briefing sessions held with the Audit Engagement Team. When you enquired further from the CFO, she told you that the production of the particular washing machine was halted at the beginning of the year due to a technical defect, but this was later rectified. Production resumed in the last quarter of the year. She assured you that, based on market research, the brand would achieve good sales in the current year.

Required:

Explain the implications of this discrepancy and describe FOUR audit procedures you would carry out to obtain sufficient appropriate audit evidence about the matter.

(10 marks)

- ISA 520 Analytical Procedures requires that the auditor apply analytical procedures as risk assessment procedures to understand the entity and its environment and in the overall review at the end of the audit.

From the draft financial statements of Highbury for the year ended 31 March 2020, the following financial ratios for the year and the comparative for the previous year were calculated:

Accounting ratios for the year ended 31 March:

2020 2019

Increase in revenue (%) 30 –

Increase in cost of sales (%) 5 –

Selling expenses to revenue (%) 15 20

Receivable days 70 40

Payable days 60 30

Required:

For each ratio, consider its implications and identify a possible audit risk to consider in planning the audit.

Sales Discrepancy

Highbury Topps Ltd.’s experienced a variance of 50 times unfavourable change in sales revenue. Budgeting for costs usually is proportional to revenue forecasts. If actual sales vary from the budgeted amount by a higher percentage, then the total profit for that period can be highly affected. As a result of the discrepancy in sales, the company’s profitability will be lower than the estimated performance because fixed costs remain the same as long as the washing machine brand is not shut down. Variable costs might reduce with the reduction in the frequency of operation, but the fixed costs will remain the same. Another implication of the brand is that shareholders’ returns are adversely affected due to lower turnover than anticipated.

Audit procedures

The first procedure to be performed is to confirm if the brand of the washing machine exists or is owned by the company. The second procedure is to confirm the machine’s technical status with the period ending 31 March 2020. The third procedure is to track the production information of the machine for the past financial years to determine the average production per year or its capability to generate sales amounting to £5 million. The fourth procedure is to perform an arithmetic calculation on the sales figure to determine its accuracy and correctness.

ISA 520 Analytical Procedures

An increase in revenue is an implication of positive performance. The company’s sales increased by 30% while its cost of sales increased by only 5%. It implies that the company’s gross profit increased by 25%, thus increasing profitability. Selling expenses to revenue decreased in 2020, indicating that the company’s operating income increased in 2020. An increase in operating income implies that the company’s profitability increased during the year. Receivables turnover increased in 2020 by 30 days; this implies that the company loosened its credit policies and negotiated for a more extended period of cash collection on its accounts. An increase in receivable days decreases a company’s liquidity due to a more extended cash collection period. Payable turnover increased in 2020 by 30 days; this implies that the company negotiated for more extended credit payments with its suppliers. However, the period is less than the receivable days; this indicates that the company pays off its creditors fully before collecting all the outstanding debts.

For the increase in revenue, cost of sales, and selling expense-to-sales ratios, detection risk should be considered when planning the audit. Control risk should be considered when planning for the receivable and payable days audit.

QUESTION FOUR

Your firm, Ace & Ace, is the auditor of Whitstable Laboratories Ltd (Whitstable), a medical facility with a turnover of £1,500 million for the year ended 30 April 2020. Shortly after the year-end, Whitstable’s Chief Finance Officer (CFO) met with your audit partner to review the preliminary results.

After a review of relevant information, materiality for the current audit of Whitstable was determined at £200,000 at the commencement of the audit.

During the audit, the audit team discovered that individual expenditures of less than £50,000 were not capitalized but expensed to the statement of profit or loss per the company’s policy. In recent years, Whitstable’s capital expenditure has been relatively constant each period. In the prior two years, which ended 30 April 2018 and 2019, expending capital expenditures totalled £40,000 and £45,000, respectively. However, the year ended on 30 April 2020, and Whitstable built a new laboratory at Luton. As a result, Whitstable incurred ten independent expenditures of less than £50,000 each, which were not capitalized but totalled £400,000.

Required:

- What are some of the factors that the auditor should consider in determining the overall audit strategy for the audit engagement (6 marks)

- Discuss the significance of determining the appropriate materiality level for the audit of Whitstable (8 marks)

- Comment on the accounting treatment of the Luton Laboratory capital expenditure and describe FOUR audit tests that should be carried out. (6 marks)

Part A

There are several factors that the auditor should consider. One of the parts is the auditor’s responsibility per the terms of engagement. The engagement partner will be responsible for the meeting and the level of performance. The engagement partner should plan the audit and, if necessary, seek to form the relevant engagement teams. Also, the auditor should determine the characteristics of the engagement as well as determine the scope. This factor is essential before starting any of the audit works. For instance, there is a possibility that the client’s financial statements were audited based on international standards. That might have resulted in errors identified during the review, as the client may have prepared the United States GAAP’s financial statements. The auditor also needs to consider the objectives of reporting the audit engagement for a practical setting of the audit timing. Such will also assist in figuring out the nature of communication that is needed. For example, the leading company might have required the audit report, which may not be published online. In most instances, the auditor will state the disclaimers as indicated in the audit report. Lastly, the auditor should identify and determine the main sections of the engagement that require professional judgment. If several areas need a professional appraisal, the auditor should determine if the resources available are enough. Also, the resources should be highly competent in carrying out the relevant tasks. If that’s not the case, withdrawal from the engagement will be the best option to seek other significant resources.

Part B

Appropriate materiality level is significant in measuring and disclosing significantly larger transactions. The transactions are of great concern to the users of the company’s financial statements. Thus, the company needs to make an account of such substantive amounts in a way that is per the auditing principles. Materiality will allow the company to measure which items in the financial statements are materials in its level of operation. Such will assist in the justification of labour costs while adhering to the principles of auditing (Carnegie and Napier, 2017, 6). As is the basis of the auditor’s opinion, ISAs need auditors to gather reasonable assurance on whether or not the financial statements are free to form the materials. Thus, the right materiality level will assist in the planning and auditing stages. There will be an evaluation of the effect of the misstatement that has been identified and those that need to be corrected in any of the financial statements. Documentation is the other importance of an appropriate materiality level to the company. The concept of materiality ensures there is an elimination of errors and misstatements in financial documents. The company will be able to effectively create a balance in the books of accounts without difficulties. Lastly, a significant materiality level ensures that the company can effectively measure and determine its liquidity level by calculating its ratio.

Part C

Luton Laboratory’s capital expenditure should be treated as expenses. The charges should have been recorded only after the cash payment or transaction in cash basis accounts. In the double-entry of bookkeeping, the expenses incurred during the laboratory construction should have been recorded on the debit side in a specific expense account. One of the audit tests that should have been carried out is the compliance test. The audit test is set to determine the policies and procedures of the organization. The practices should be per either the internal or regulatory standards of operation. Another test that would have been carried out is the construction audit test. The test would have been mainly done for the constructed Luton Laboratory. The test would have analyzed the costs incurred during the construction process (Carnegie and Napier, 2017, 4). Some of the activities that would be explored include the contracts given to the contractor and the amount paid out. Also, there would be an analysis of the overhead costs allowed in the reimbursement, the change orders, and the project completion time. The third audit test is a financial audit. The test involves the analysis of the fairness of the data and information found in the company’s financial statements. The test would have been conducted by an audit firm, such as Ace and Ace, that is accredited and recognized. The last audit test is the investigative test shown in the review process. The test allows for the identification of errors and recommends a remedy control.

Similar Post: Essential Human Resources Management Practices

Reference

Carnegie, G., & Napier, C., (2017), The Accounting, Auditing & Accountability Journal Community in its Thirtieth Year, Accounting Auditing & Accountability Journal, Vol. 30,

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Audit Exam

SECTION A This question is compulsory

QUESTION ONE

Audit Exam

You are a member of the audit engagement team carrying out the Basildon plc (Basildon) audit for the year ended 31 March 2020. Basildon’s principal activities are house building and commercial development. Basildon’s geographic reach and product diversity allows the company to maximize development opportunities across the whole of the United Kingdom while giving it a balanced development portfolio. Basildon’s business is supported by land, design, construction, sales, and marketing expertise.

Basildon recorded revenue of £14,760 million and profit before tax of £909 million during the year ended 31 March 2020.

The Engagement partner has directed you to obtain sufficient appropriate audit evidence regarding the following items extracted from the notes to Basildon’s financial statements for the year ended 31 March 2020:

Development Costs

Intangible non-current assets include development costs of £50 million for new materials and building technology developed within the company.

Intangible assets under development are tested annually for impairment.

Basildon applies relevant International Financial Reporting Standards in the financial statements recognition, measurement, and presentation of development costs. The estimates used in calculating the recoverable amount depend on assumptions specific to Basildon’s activities.

Other Investments

| 31 March 2020

£m |

|

| Non-current investments | |

| Equity securities at fair value through other comprehensive income | 1,340 |

| Equity securities available for sale | 100 |

| Fixed income securities at fair value through profit or loss | 60 |

| Total | 1,500 |

| Current investments | |

| Fixed income securities at fair value through profit or loss | 800 |

| Fixed deposits | 50 |

| Total | 850 |

Investments held at Fair Value through Other Comprehensive Income include equity securities not held for trading and which Basildon has irrevocably elected at initial recognition to recognize in this category—investments held at fair value through profit or loss comprised income securities that Basildon holds to sell.

Fixed deposits are held at amortized cost, with carrying value being a reasonable approximation of fair value given their short-term nature.

Inventories

| 31 March 2020

£m |

|

| Land held for development | 3,070 |

| Construction work in progress | 1,700 |

| Part-exchange properties and other inventories |

120 |

| Total | 4,890 |

Basildon’s internal controls are designed to identify developments where the land and work-in-progress balance sheet value exceeds the projected lower cost or net realizable value. During the year, the company has conducted six-monthly reviews of the net realizable value of specific sites at high risk of impairment based upon several criteria, including low site profit margins and sites with no forecast completions.

Where a site’s estimated net realizable value was less than its current carrying value, the company has impaired the land and work-in-progress value.

Trade and other payables

| 31 March 2020

£m |

|

| Trade payables | 1,080 |

| Value added and payroll taxes and social security | 50 |

| Rebates, charges, and other revenue accruals | 400 |

| Contingent consideration | 65 |

| Total | 1595 |

Included within Rebates, chargebacks, returns, and other revenue accruals are contract liabilities of £97m (2019: £126m)

Required:

Describe SIX substantive audit procedures that should be performed about each of the above matters.

(Note: 15 marks per item

SECTION B: This section has three questions; you should answer ANY TWO.

QUESTION TWO

Your firm, Phillip and Phillipa, has been the Highbury Topps Ltd (Highbury) auditor for many years. Highbury manufactures a range of washing machines, fridges, and microwave cookers.

You are part of the audit engagement team for the audit of Highbury’s financial statements for the year ended 31 March 2020.

- At the commencement of the audit, you noticed a discrepancy between projected and actual sales.

You discovered that one washing machine brand showed projected sales of £5 million but had actual sales of only £100,000 during the year under audit.

The Chief Finance Officer (CFO) did not initially disclose this matter during the earlier briefing sessions held with the Audit Engagement Team. When you enquired further from the CFO, she told you that the production of the particular washing machine was halted at the beginning of the year due to a technical defect, but this was later rectified. Production resumed in the last quarter of the year. She assured you that, based on market research, the brand would achieve good sales in the current year.

Required:

Explain the implications of this discrepancy and describe FOUR audit procedures you would carry out to obtain sufficient appropriate audit evidence about the matter.

(10 marks)

- ISA 520 Analytical Procedures requires that the auditor apply analytical procedures as risk assessment procedures to understand the entity and its environment and in the overall review at the end of the audit.

From the draft financial statements of Highbury for the year ended 31 March 2020, the following financial ratios for the year and the comparative for the previous year were calculated:

Accounting ratios for the year ended 31 March:

2020 2019

Increase in revenue (%) 30 –

Increase in cost of sales (%) 5 –

Selling expenses to revenue (%) 15 20

Receivable days 70 40

Payable days 60 30

Required:

For each ratio, consider its implications and identify a possible audit risk to consider in planning the audit.

QUESTION THREE

- You are the Audit manager of Davis & Davis. You are reviewing the work carried out by the audit teams concerning the audits of three unrelated clients, Swindon, Coventry Airlines, and Zola, all listed companies, for their accounting years, which ended on 30 April 2020.

The following matters have been highlighted about each audit client:

- Swindon

The directors included inventory in the financial statements for £12 million. Had each line of inventory been valued at the lower cost or net realizable value, per IAS 2, an amount of £3 million would have been required to be written off the inventory value.

Swindon’s profit before tax for the year ended 30 April 2020 was £30 million.

- Coventry Airlines

Coventry Airlines leases various aircraft, properties, and equipment. The company has not applied IFRS 16 Leases for reporting these leases in the financial statements. Had it applied IFRS 16, the company’s total assets would have increased by £400 million, and its lease liability would have increased by a similar amount. In addition, the net charge to the statement of profit or loss for the excess depreciation and finance charge would have been £45 million.

On 01 June 2019, Coventry Airlines invested £66 million in acquiring a 75% stake in Zoom, a rival airline struggling to survive under global lockdown conditions. Goodwill of £10 million was recognized at the date of the acquisition of Zoom, but no impairment review has since been carried out. The directors had justified the decision not to carry out an impairment review of goodwill on the acquisition of Zoom with the explanation that the current problems being faced by the aviation industry would be over very quickly.

Coventry Airlines reported profit before tax of £50 million for the year ended

30 April 2020; total assets of £600 million and total non-current liabilities of

£350 million.

- Zola

One of its customers has a pending lawsuit at the High Court against Zola. The customer is seeking damages for £6 million for breach of contract. Davis and Davis’s audit team sought the opinion of Zola’s solicitors about the likely outcome of the lawsuit. The solicitors have written a reply that the lawsuit would probably go against Zola. The directors of Zola believe that disclosure of the potential liability as a contingent liability would be sufficient as the judgment on the case has not yet been delivered, and even if the case goes against Zola at the High Court, they intend to appeal to the Supreme Court.

Zola’s profit before tax for the year ended 30 April 2020 was £30 million.

Required:

If each of the above cases remains unresolved at the date of preparing the audit report, explain the impact on the audit opinion to be expressed in the audit report.

Note: Audit report extracts are not required

- In reviewing the audit working papers of the engagement team on the audit of Moon Bank plc for the year ended 30 April 2020, you came across the following:

Provision for conduct redress costs (PPI)

Subjective estimate

Calculating the provision for Payment Protection Insurance (“PPI”) redress costs for the Group requires the Directors to make several critical assumptions regarding the redress still to be paid. The determination of these is judgmental and requires the Directors to consider a range of information.

Disclosure quality

The related PPI disclosures provide the key assumptions underpinning the provision’s calculation and the provision’s sensitivity to the changes in those assumptions. Therefore, they are vital in understanding the judgment that has been applied.

How we responded to the scope of our audit

The results of our testing were satisfactory, and we considered the provision recognized and sensitivity disclosures made acceptable.

Required:

Show how the above matter should be disclosed in the audit report and explain the purpose of such disclosure.

QUESTION FOUR

Your firm, Ace & Ace, is the auditor of Whitstable Laboratories Ltd (Whitstable), a medical facility with a turnover of £1,500 million for the year ended 30 April 2020. Shortly after the year-end, Whitstable’s Chief Finance Officer (CFO) met with your audit partner to review the preliminary results.

After a review of relevant information, materiality for the current audit of Whitstable was determined at £200,000 at the commencement of the audit.

During the audit, the audit team discovered that individual expenditures of less than £50,000 were not capitalized but expensed to the statement of profit or loss per the company’s policy. In recent years, Whitstable’s capital expenditure has been relatively constant each period. In the prior two years, which ended 30 April 2018 and 2019, expending capital expenditures totaled £40,000 and £45,000, respectively. However, the year ended on 30 April 2020, and Whitstable built a new laboratory at Luton. As a result, Whitstable incurred ten independent expenditures of less than £50,000 each, which were not capitalized but totaled £400,000.

Required:

- What are some of the factors that the auditor should consider in determining the overall audit strategy for the audit engagement (6 marks)

- Discuss the significance of determining the appropriate materiality level for the audit of Whitstable (8 marks)

- Comment on the accounting treatment of the Luton Laboratory capital expenditure and describe FOUR audit tests that should be carried out.

(6 marks)

(TOTAL: 20 MARKS)