Analyzing Competitive Dynamics- A Porter Five Forces Assessment of Tesla Inc

Business Strategy and Policy

Tesla’s Situational Analysis

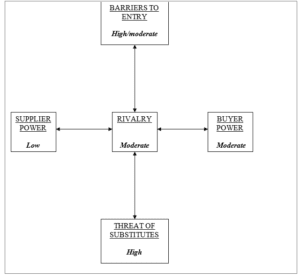

Porter’s Five Forces

Barriers to Entry

The entry barriers that exist in the car manufacturing industry are high for new players and moderate for current manufacturers. For the new industry players, the high costs that are required to set up a car manufacturing plant and acquire technologies that enable the production of alternative fuel motor vehicles are prohibitive. The lack of economies of scale, an important benefit for the current players, is unavailable to new entrants during the initial years of operation. In addition, the new players who wish to enter this market will encounter the performance-cost challenge (Dudovskiy). Finding an innovative way to produce electric vehicles that cost less and perform better than Tesla’s is a challenge even for established players. Therefore, these aspects reduce the likelihood of competition from new entrants.

Established industry players such as General Motors, Toyota, Ford, BMW, and others present a moderate threat to Tesla as new entrants in the manufacturing of alternative fuel vehicles. Each of these players already enjoys economies of scale and has a reliably good and dependable market share. However, they lack innovative solutions that should balance cost with performance. The time of entry into the market is an attractive competent for entrants who are already well established. According to Wood McKenzie’s findings, the desire to own an electric vehicle may increase by 38 per cent as the decline in oil’s global demand begins to reduce significantly by 2025. This means that electric car manufacturers will have a chance to sell part of the estimated 8.5 million such vehicles by 2040 (Dudovskiy). Such industry statistics present a moderately growing risk for competition from new entrants who are already established (McCain 4).

Rivalry

Current competition in the electric vehicle manufacturing sector is moderate. This conclusion is because Tesla is a first mover in this aspect (Dudovskiy). The main threats that would shake up Tesla’s stability in the niche are established players such as GM, Fiat-Chrysler, BMW, Toyota, and Ford (McCain 6). One of the aspects that may accelerate this threat is the presence of innovative solutions that lead to the production of more affordable or better-performing electric vehicles. The existence of such knowledge, coupled with the expected demand for electric vehicles in the future, remains a formidable threat for Tesla. The other aspect is the expected reduction in demand for oil, which will affect the sale of vehicles that rely on oil products for fueling (Dudovskiy). In addition, as the environmental awareness of consumers grows, most are likely to buy electric vehicles. Thus, Tesla should find innovative solutions and technologies that ensure it produces efficient electric vehicles that meet the consumers’ needs effectively. Creating a positive and desirable brand as the first niche player is important in battling growing competition in the future.

Supplier Power

The bargaining power of suppliers is relatively low for various reasons. Firstly, suppliers who work with Tesla are advantaged due to the company’s brand recognition and entry into the niche market (Shipley). Thus, suppliers are almost assured of business with Tesla as the industry’s statistics project growth of demand for electric vehicles. However, Tesla can easily replace its suppliers, which reduces their bargaining power (Dudovskiy). The production of car parts for Tesla is highly customized, because they cannot be sold to other manufacturers (McCain 6). Being a vertically integrated company, Tesla bears greater bargaining power than its suppliers do because it chooses whom to contract for various components. In addition, the expected increase in the volume of production is likely to reduce the suppliers’ bargaining power further (Dudovskiy). The increasing volume reduces the suppliers’ ability to increase their margins. Since Tesla is currently the main manufacturer of electric vehicles, suppliers lack alternative clients that they can supply. Tesla is able to downplay any upcoming competition through its high volumes and ability to change suppliers to meet their needs.

Buyer Power

The bargaining power of buyers is currently moderate. However, the possibility of intensifying exists due to various reasons. Clients need electric vehicles and can only buy them from Tesla; they are not in a position to bargain for better prices. The electric vehicle market currently lacks alternative options. This means that clients lack the chance to develop loyalty towards a specific company. The bargaining power may increase as clients switch from one manufacturer to the next in the future (McCain 5). The lack of switching costs, in this case, acts as a disadvantage to the company. In addition, the likelihood of additional and progressive innovations may lead to better electric vehicles in the future from other players. This situation will offer clients the chance to bargain for better prices and demand superior quality as companies compete to gain a considerable market share. Therefore, Tesla currently enjoys a significant monopoly, an aspect that is expected to change in the future and increase competition and product differentiation exponentially.

Threat of Substitutes

The threat of substitutes is high because of the numerous forms of transportation and sources of energy that exist. Hybrid vehicles are the closest comparison to electric vehicles. These are more attractive to the high-end clients that Tesla appeals to due to the reduced differences when compared to the electric vehicles (Furr and Dyer). However, such vehicles, which include the Toyota Prius, stand little chance of competing with electric vehicles when viewed from an environmental perspective (Levin, Zhang and Mohan 12). However, other modes of transport, such as subways, aeroplanes, bikes, trains, and public buses, must compete with electric vehicles. Successful adoption of electric vehicles is dependent on their efficiency, affordability, and reliability (McCain 5). The lack of these aspects will lead to low uptake in the market.

Summary

The main competitive aspects that face Tesla include the increasing threat of competition, buyers’ and suppliers’ bargaining power, the threat of substitutes, and entry barriers. Each of these aspects is likely to increase competition in the future. Being the first electric vehicle manufacturer, Tesla enjoys a monopoly in the niche. However, as technology improves, the possibility of new manufacturers. At this time, the bargaining power of suppliers will increase alongside the buyers’ power. Thus, it is important for Tesla to establish a positive brand during this time to obtain some level of loyalty from clients. Creating affordable electric vehicles is important in expanding the current market and getting a stable share. The projected electric vehicle demand is expected to lead to a complete shift towards environmentally sensitive vehicles. Thus, the affordability of these vehicles is important in fueling the growth.

Works Cited

Dudovskiy, John. “Tesla Porter’s Five Forces Analysis.” Business Research Methodology 2021.

Furr, Nathan and Jeff Dyer. “Lessons from Tesla’s Approach to Innovation.” Harvard Business Review 2020. <https://hbr.org/2020/02/lessons-from-teslas-approach-to-innovation>.

Levin, Harris, Shiwei Zhang and Vijay Mohan. “Tesla Corporation Client Report.” 2014.

McCain, Cody. “A Strategic Audit of Tesla, Inc.” Honors Theses, University of Nebraska-Lincoln. 2019.

Shipley, Lou. “How Tesla Sets Itself Apart.” Harvard Business Reviews 2020.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Business Strategy and Policy Assignment #2 Research your company and its industry and perform a Porter Five Forces analysis. For this assignment, you should acquire a minimum of five separate pieces of research material, which can include periodical articles, investor analysis, and trend analysis for your company’s industry.

Analyzing Competitive Dynamics- A Porter Five Forces Assessment of Tesla Inc

Please use both your book and the article on Canvas for reference. You should also read the IBIS World profile of your industry completely before you begin your piece. This is an essential element of research that you must read to help get your analysis correct. IBIS World can be accessed through the school library online databases link. From the Engage/Berkeley College home page, click the ‘Library’ link. Click ‘A-Z Databases’ 3. Click ‘I’ in the alphabetical list. Click ‘IBIS World’, which should be the first link that you see. Type in the NAICS Code of the primary industry for your firm. A Five Forces chart should begin your analysis to serve as a quick reference point. Beneath each of the forces, you should provide a brief one or two word description of what you will present on the pages following (see example on the following page). Each of the Five Forces should then be discussed beneath its own headings in your paper, using as much space as you deem necessary to complete your analysis. For each force, you will wish to determine the following information:Barriers to Entry: What barriers, if any, exist, and what is the effect on rivals and competition?Rivalry: What elements influence intensity the most (3-5 elements probably suffice), and what must a generic firm do to succeed?Supplier Power: Does supplier power exist, and in what ways does it affect competition?Buyer Power: Same as above, does buyer power exist, and in what ways does it affect competition?Threat of Substitutes: Define the basic need being met by rival goods and services. How easily is this need met by non-rivals; that is, to what extent do non-rivals pull trade away from your industry? Please see the sample project to get an idea of what I am looking for here. Also, please conclude your paper with a brief (1-3 paragraphs are probably good) summary of the key competitive forces that are facing your company.12pt. Font, Double spaced3-6 pages (excluding chart) uploaded to Canvas *All papers MUST be fully cited using the proper format are online via Canvas in the space provided