ACG510-Liabilities and Equity

Analysis of Long-Term Liabilities and Equity of American Eagle Outfitters, Inc.

Significant Liabilities: Current and Long-Term

American Eagle Outfitters, Inc. (AEO) has current and non-current liabilities that are crucial to the organization’s present and future performance. Accounts payable and accrued expenses are current liabilities that exhibited an increase in the total amount in the year ended March 31, 2009. Additionally, the current portion of long-term debt is a part of current liability. These are generally the obligations that are payable within a year and relate to the trading activities of the business, such as the cost of goods and other working expenses. These are the long-term debt, lease obligations, and the deferred taxpayers’ Malaysia lab report writing service tax credit (American Eagle Outfitters, 2020). The amount of long-term debt and lease obligations shows AEO’s obligations concerning financing its stores and distribution centers, investments in infrastructure, and technology. Any current and long-term liabilities have to be managed efficiently for any business in order to maintain its liquidity position as well as its solvency.

Types of Financing

AEO utilizes debt and equity to fund its operations and expansion endeavors. Due to the characteristics of sources of financing, it could be classified under short-term and long-term borrowings. Revolving credit facilities and term loans are the sources of working capital and capital investments within the organization (Herrmann et al., 2019). The technique benefits AEO in its ability to maintain a less rigid operating structure while at the same time managing interest expenses. It also has an operating lease commitment for its retail outlet and distribution centers, which is a part of the long-term borrowings. Equity financing, on the other hand, involves issuing out common stocks and the retained profits. AEO usually repurchases the shares occasionally to give cash dividends to its shareholders while regulating its equity base with the desire to work for the value of its shareholders. In this regard, the examination of the accounts confirms the fact that through the maintained split between the debt and equity finances, AEO can capture growth opportunities without incurring much financial risk.

Equity Structure

The major components of AEO’s equity comprise common stock, additional paid-in capital, retained earnings, and treasury stock. It is the residual equity of the firm or the residual interest in the company assets owned by shareholders with voting rights on the shareholders’ matters. Other categories of shareholders’ equity include additional paid-in capital that notes the amount received over the par value of issued stock. In contrast, retained earnings denote the net income retained within the business for reinvestment or dividend purposes (Schwager et al., 2020). Treasury stock refers to the stock bought back by the company from investors and held in the firm’s kitty, thus shrinking the number of shares. The AEO equity structure has been structured in a way that shareholders’ returns are accorded an equal measure of consideration as the part that demands that the business reinvest in itself (Lee, 2020). The company’s share repurchases and dividend payout policy shows that it follows the policy of returning value to shareholders. However, at the same time, they maintain an adequate amount of earnings to support growth capital.

Comparison with Industry Peers

Analyzing AEO’s total liabilities and equity in relation to its competitors, one can understand that the company adheres to rather conservative policies. Essentially, most retail firms have relatively high amounts of debt to support growth and operations, and this was the same at AEO. However, AEO’s credit management to avoid unnecessary debts and its healthy equity position were suggestive of balance in the method of financing. For example, Gap Inc. and Abercrombie & Fitch, with similar balance sheet structures regarding the common stock and retained earnings, use both a mix of debt and equity financing (Schroeder et al., 2022; Scott & O’Brien, 2023). These companies face comparable industry challenges, such as fluctuating consumer demand and economic uncertainty, which necessitate a flexible yet prudent financial strategy.

References

American Eagle Outfitters. (2020). Annual Report. American Eagle Outfitters Investor Relations.

Herrmann, D., Thomas, W., & Spiceland, J. D. (2019). Financial Accounting. McGraw-Hill Education.

Lee, T. A. (2020). Financial accounting theory. In The Routledge Companion to Accounting History (pp. 159–184). Routledge.

Schroeder, R. G., Clark, M. W., & Cathey, J. M. (2022). Financial accounting theory and analysis: text and cases. John Wiley & Sons.

Scott, W. R., & O’Brien, P. C. (2023). Financial accounting theory. Zhongguo ren min da xue chu ban she.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

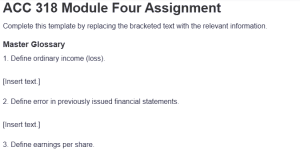

ACG510-Liabilities and Equity

Textbook:

Assignment Details

This IP builds upon your work in Units 1, 2, and 3.

You will continue your industry research by evaluating long-term liabilities and equity using industry examples. Using the financial statements (located in Appendix A: American Eagle Outfitters, Inc., 2020 Annual Report of the required textbook: Financial Accounting), review and compare the liabilities and equity of each company. Consider the following questions:

- What are the significant liabilities of each company? Are they current or long-term?

- What types of financing does each company rely on?

- What is the equity structure of each company?

Deliverable Requirements: Your Long-Term Liabilities and Equity section should have at least 5 pages (the title and reference pages are not counted in these 5 pages) as well as follow the requirements below for using the APA style.

- Address the questions above, and consider their implications to American Eagle Outfitters, Inc.

- Do not forget to review the notes to the financial statements for additional information about the company’s liabilities and equity structure.

Submitting your assignment in APA format means that you will need the following at a minimum:

- Title page: Remember the running head. The title should be in all capitals.

- Length: There should be at least 5 pages.

- Body: This begins on the page following the title and abstract pages and must be double-spaced (be careful not to triple- or quadruple-space between paragraphs). The typeface should be 12-point Times New Roman or 12-point Courier in regular black type. Do not use color, bold type, or italics, except as required for APA-level headings and references. The deliverable length of the body of your paper for this assignment is 5 pages. In-body academic citations to support your decisions and analysis are required. Using a variety of academic sources is encouraged.

- Reference page: References that align with your in-body academic sources are listed on the final page of your paper. The references must be in APA format and use appropriate spacing, hanging indentation, italics, and uppercase and lowercase for the type of resource used. Remember that the reference page is not a bibliography but a further listing of the abbreviated in-body citations used in the paper. Every referenced item must have a corresponding in-body citation.

Please submit your assignment.

Assignment Reminders:

ACG510-Liabilities and Equity

- Please submit your assignment.

- Make sure you submit this assignment by the listed due date. Late deductions will apply for this assignment. Please refer to the Late Submission of Assignment

- If you need assistance, please view the Troubleshooting tips.

- Resave in the proper format per the Assignment Detail instructions and resubmit.

- Submit with a different Web browser.

- Submit from a different computer.

- Call Technical Support at 877-221-5800, Menu Option 2. They are open 24/7.

- If you are still having difficulties after trying steps 1-4, please contact your course instructor.

For assistance with your assignment, please use your text, Web resources, and all course materials.