A Critical Evaluation of Delta Air’s Financial Performance

Company’s Background

Delta Air Lines is a logistics company specializing in the provision of freight services for both passengers and cargo. Notably, the airline offers direct services through Delta Air Lines while utilizing joint ventures on some occasions (1). Delta Air has set up hubs in various regions, including Amsterdam, London Heathrow, Mexico City, Paris-Charles de Gaulle, and Seoul-Incheon. The company also issues maintenance and engineering support for the regional aircraft and freight services (3). Notably, the company is headed by Glen Hauenstein, who serves as the president, and Paul Jacobson, Delta’s CEO cum CFO. Delta Air’s revenue averages $17000 million per month, which is saved for economic recession periods such as 2020. Our assignment writing help is at affordable prices to students of all academic levels and disciplines.

Price Earnings Ratio (P/E Ratio) depicts the relationship between a firm’s stock price and the Earnings per Share (EPS). P/E is a popular ratio that offers investors value for their money. It illustrates the market expectations and the price that investors should pay for the current and future earnings (2). Notably, earnings play a crucial role in making investment decisions because they reflect a company’s future profitability. In case the company fails to grow and maintains its growth, this ratio is utilized to determine the period it would take for the company to reimburse each share’s value. This ratio is computed by dividing the market value price per share by the earnings per share. In the past thirteen years, the highest PE ratio recorded was 685.5, while the lowest was zero. The lowest was 0.00. And the median was 9.66. In 2020, Delta’s share plunged by 39% due to the tough economic times and the implementation of lockdowns restricting air travel (4). On 31st December 2021, Delta Air recorded a 4.33 P/E, expected to appreciate it in the coming years.

Price to Book Ratio

The price-to-book ratio is also referred to as the market-to-book ratio. It is a financial instrument that determines the extent to which a company’s stock is over or undervalued by comparing the outstanding shares with the firm’s net assets (2). This ratio measures the difference between the firm’s share price and the book value. It is computed by dividing the market price per share by the book value per share. Delta’s price to book ratio is 2.41, suggesting its share is overpriced, seeing that investors pay for two times the company’s real value. Thus, Delta’s share is overvalued, suggesting that investors pay for more than the share’s actual worth.

Price to cash flow is a financial ratio that compares the company’s share price against its underlying cash flow. This ratio is comprised of a metric that indicates a company’s worth, depending on the cash flow generated from the activities. This ratio illustrates the dollar value investors are willing to pay for the company’s share P/C is computed by dividing the price per share by the operating cash flow per share. The firm’s ratio was 7.56 in 2020, suggesting that investors are willing to pay $7.50 for every dollar for the business operations’ cash flow (4). This ratio suggests that investors are confident in Delta’s business operations and are willing to pay a higher price for its investment.

The Price to Dividend Ratio

The price-to-dividend ratio is a financial ratio that calculates the cash dividends that are distributed to the common shareholders and are relative to the market value per share. This ratio determines the cash flows generated from shareholders’ investments. It is computed by dividing the cash dividends per share by the market value. Delta’s dividend yield was 2.8%, suggesting the company generates 2 cents for every dollar invested by the shareholders (5).

Income Statement Analysis

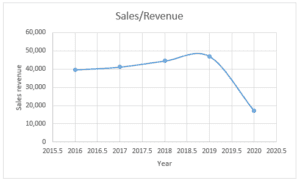

The chart below illustrates Delta’s financial performance in the past half-decade. In 2015-2018, the company exhibited exemplary financial performance, as illustrated by the revenue growth. In 2019-2020, the company’s revenue plunged due to the pandemic. The revenue is expected to escalate in 2021 as the flight operations resumed in most global regions.

Net Income Analysis

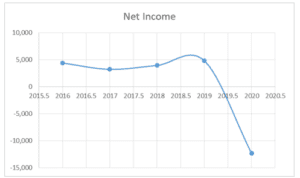

Delta air featured rising income in 2016-2019, as illustrated in the chart below. The net income declined to a negative in 2020 due to the financial distress resulting from the economic recession caused by the pandemic.

Recommendation

Delta’s shares are a suitable investment option because they feature promising prospects. The firm’s share price plunged owing to the economic downturn resulting from the COVID-19 pandemic. Moreover, this epidemic led to the implementation of lockdowns that limited international travel. Subsequently, Delta’s operations were disrupted, leading to a decline in revenue that adversely affected its share price. The lifting of travel restrictions and the economy’s opening is expected to enhance its operations, leading to improved financial performance. Delta anticipates an increase in revenue and enhanced profitability, leading to the appreciation of the company’s share. Thus, the investor would reap substantial benefits from investing in the company’s stock during the economy’s recovery period. Moreover, the poor financial performance reflected across the industry illustrates the financial distress resulting from the macro-environment conditions. The systematic risk associated with Delta’s stock is the occurrence of a global recession that would adversely affect the stock market. History has illustrated the devastating impacts of economic downturns, for example, the stock market crash in the Great Depression in the 1930s and the Great Recession in 2007. This risk also stems from the occurrence of a pandemic, such as COVID-19. The potential returns include capital gains and dividend payouts from the share.

Source List

Luo, D. (2014). The price effects of the Delta/Northwest Airlines merger. Review of Industrial Organization, 44(1), 27-48.

Monahan, S. J. (2018). Financial statement analysis and earnings forecasting. Foundations and Trends® in Accounting, 12(2), 105-215.

Perez, J. (2019). The Game of Identity Politics: Delta Airlines Performs Neutrality. Journal of Management Policy & Practice, 20(1).

(2020, November 17). Delta Airlines. [Stock quote]. Retrieved from https://finance.yahoo.com/quote/MSFT

(2020). Why Delta (DAL) Could Be a Top Value Stock Pick. Retrieved 6 March 2021, from https://www.nasdaq.com/articles/why-delta-dal-could-be-a-top-value-stock-pick-2020-01-09

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Imagine that you are a potential investor researching a U.S. investment of your choice. Your choice can be any investment that is highly marketable, which means that you must be able to sell it at a market price very easily and develop a strategic diversification plan for a great return. Publicly traded stocks, corporate bonds, government bonds, real estate, mutual funds, and derivatives are all examples of highly marketable investments. However, for this assignment, select the stock of a publicly traded U.S. corporation.

Critical Evaluation of Delta Air’s Financial Performance

You will be required to collect financial statements, relevant financial information, or both that detail the past three years (fiscal or calendar) of the chosen investment. (These statements can usually be located within the organization’s website under “investor information” or something similar. Many times, these statements can also be found on Yahoo! Finance, Google Finance, or MSN Money. You may also visit the Strayer University Library)

You will also be required to research your chosen investment’s price for the past five years, as well as a related market index for this investment for the past five years. An example of an applicable market index is the Standard and Poor’s Stock Market Index, commonly called the S&P 500.

To complete this assignment, write a 3–5 page paper in which you do the following:

Select the stock of a publicly traded U.S. corporation that you wish to research for your portfolio diversification, with at least two supporting fundamental reasons such as price to earnings (P/E), price to book (P/B), price to cash flow from operation (P/CFO), and price to dividend (P/D). Provide at least one technical screen, such as uptrend.

Provide a brief (one-paragraph) explanation of the systematic risk and potential return associated with the investment you’ve selected.

List five resources to demonstrate that there is enough information to support your decision regarding your selected investment.