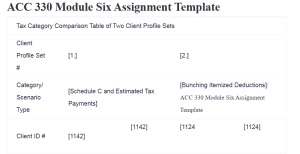

ACC 330 Module Six Assignment Template

| Tax Category Comparison Table of Two Client Profile Sets | ||||

| Client Profile Set # | [1.] | [2.] | ||

| Category/ Scenario Type |

[Schedule C and Estimated Tax Payments] | [Bunching Itemized Deductions]: ACC 330 Module Six Assignment Template | ||

| Client ID # | [1142] | [1142]

|

[1124

|

[1124]

|

| Primary Taxpayer Name | Joanna | Roman | Tavaris | Johnson |

| Filing Status | Single | Single | ||

| Spouse’s name (if applicable) | N/A | N/A | ||

| Dependents (list) | N/A | N/A | ||

| 1040 Income Streams (list) | i. A designer of one-of-a-kind clothing.

ii. Sales through platforms like Etsy, local consignment shops, and festival stalls. iii. These income streams are classified as business income under Schedule C. |

i. Employed as a steel mill worker. His income is reported as wages on his Form W-2, reflecting consistent earnings with no additional income streams such as investments, side jobs, or other activities | ||

| 1040 Deductions (list) | i. Business expenses like materials for clothing design, marketing costs (e.g., for social media campaigns), travel expenses for attending festivals, and potential home office deductions.

ii. While Joanna tracked many of her expenses using a spreadsheet, she admits she likely missed some deductible costs, presenting an opportunity for better recordkeeping in the future (House,2020). |

i. Tavaris has historically taken the standard deduction but has significant charitable contributions ($4,500 annually) that could allow for itemized deductions under the right circumstances.

ii. His strategy involves “bunching” donations by combining two years’ contributions into a single tax year to exceed the standard deduction threshold. iii. Other possible deductions could include state and local taxes and unreimbursed medical expenses, but these were not specified in his profile.

|

||

| 1040 Tax Credits (List) | i. Joanna may qualify for various credits associated with small business operations, such as the self-employment tax deduction.

ii. If her business incurs specific startup costs or environmental sustainability expenses (e.g., using eco-friendly materials), she might also be eligible for specialized credits. |

i. Tavaris does not currently utilize specific tax credits but may qualify for general credits, such as the Earned Income Credit or Saver’s Credit, depending on his overall income and retirement contributions. | ||

| Tax planning topics to research (List) | i. Explore methods for robust expense tracking to ensure all business deductions are captured for future tax years.

ii. Assess eligibility for the Qualified Business Income (QBI) deduction, which can provide a significant tax reduction for sole proprietors. iii. Develop a strategy for making quarterly estimated tax payments, especially as Joanna’s profitability increases. iv. Investigate how changes in her filing status or the addition of dependents in the future may impact her tax obligations (Hayashi et al.,2023). v. Review self-employment tax implications and available relief measures.” |

i. Analyze the financial benefits of “bunching” charitable contributions versus taking the standard deduction.

ii. Calculate the threshold for maximizing itemized deductions compared to the standard deduction amount. iii. Examine other possible deductions Tavaris might be eligible for, such as medical expenses exceeding 7.5% of his AGI.

|

||

References

Hayashi, A., & Hopkins, J. J. (2023). The Charitable Tax Deduction and Civic Engagement. U. Ill. L. Rev., 1179. https://illinoislawreview.org/wp-content/uploads/2023/08/Hayashi-.pdfv

House, W. (2020). Qualified Business Income Deductions in the Sharing Economy. Colo. Tech. LJ, 18, 453. https://ctlj.colorado.edu/wp-content/uploads/2021/02/18.2_6-House_06.25.2020.pdf

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

ACC 330 Module Six Assignment Guidelines and Rubric

Overview

Tax planning is the process of exploring ways to reduce an individual’s tax liability. It requires careful analysis of an individual’s financial situation coupled with extensive tax research to determine the most efficient way to reduce tax liability. This assignment is designed to prepare you for Project Two by allowing you to select a set of cases to research and identify ways to reduce tax liability. Each case leads you into a particular area of research into tax credits.

Directions

Review the Client Tax Profiles B Descriptions found in the Supporting Materials section below. Each of the five sets of profiles is linked to a tax planning scenario category. Each category provides you with two client scenarios to review. Identify two different categories to compare for this assignment.

They are grouped by tax planning category. The categories range from education tax credits to self-employment tax credits. The profiles link directly to each client’s Form 1040. Form 1040 will provide a level of detail that is not called out in the profile alone.

Complete the table for both categories you choose. Each category contains information about two different primary taxpayers. You will compare the two clients within each category.

Look at the Module Six Assignment Template found in the What to Submit section for a better understanding of how to complete this comparison. Once you complete the comparison table you will select the category that most interests you as the topic for Project Two.

The template contains a table with three parts. Begin by filing in the high-level information for each of the clients in the first category. Then, dig deeper by opening the 1040’s for each of the primary taxpayers to complete the grey section. This will provide deeper insights into client income streams, deductions, and tax credits.

In the final part you will list tax planning topics to research. Complete all three parts of the comparison for the first category. Then, repeat this process using a second category.

Once you have completed the table, you will have enough information to determine which category interests you most. You will choose one as your topic for Project Two.

Note: There are five sets of client data contained in the Client Tax Profiles B document. Each set represents a category within tax planning. To show how each category may be applied to clients, there are two client profiles within each category that provide different tax scenarios.

This allows you to compare two client scenarios within a single category of tax planning. The words category and scenario are used interchangeably in this assignment.

Specifically, you must address the following rubric criteria by completing the template provided:

- Complete the high-level view of the client tax profiles.

- Identify the category.

- Identify the client IDs within the category.

- Enter taxpayer’s names.

- Enter filing status.

- Enter the spouse’s name if applicable.

- List the dependents.

- Perform an analysis based on reviews of the additional information from client profiles and Form 1040.

- Income Streams: Consider all forms of income, look at the AGI or taxable income.

- Deductions: Review deductions for the tax year.

- Tax Credits: Review tax credits for the tax year.

- List multiple tax planning factors.

- Make a client tax profile selection on the template (Client Profile Set #). This scenario will be the category you use for Project Two.

ACC 330 Module Six Assignment Template

What to Submit

Submit your completed Module Six Assignment Template for grading. Sources should be cited according to APA style.

Supporting Materials

The following resources support your work on the project:

Resource: Client Tax Profiles B Descriptions