Desjardins Financial Services Company

Data Strategy

Desjardins Financial Services Company was formed in 1900 in the USA. The company has emerged to be one of the leading cooperative financial institutions in the North of America (Desjardins, 2020a). The financial institution has expanded to produce other affiliate companies, such as insurance companies and charity foundations, to impact society. Desjardins continues to promise customers and clients better services and diverse products that fulfill their needs (Desjardins, 2020a). The bank was ranked first in Canada by the Top 1000 World Banks in terms of growth. The financial institution employs data analytics for financial market insights that contribute to the bank’s success in the industry.

Basically, Desjardins’ data strategy refers to the processes and tools that guide a company on how to manage, analyze, and act upon the available data. According to Davenport and Mule (2017), data strategy falls under two major categories. These include an offensive and a defensive data strategy. A defensive data strategy entails the processes and tools that aim at protecting the company from downside risks associated with data by protecting the business. These include processes such as ensuring that the business is compliant with the rules and regulations, detecting and eliminating vulnerabilities in the system, and developing anti-theft systems. On the other hand, an offensive data strategy entails the processes aimed at growing the business through insights derived from data analytics. An offensive data strategy focuses on increasing revenue, customer satisfaction, improving the quality of goods, and subsequently profitability. The overarching goal is to support managerial decisions.

Desjardins Company employs a hybrid of the two data strategies, whereby the company focuses on in-depth analysis to understand deeply not only the information from the data but also the sources and how much trust they can put in such data while also ensuring compliance and data security (Desjardins, 2020b). The company acknowledges the importance of striking a balance between the two methods to benefit from data. Ideally, costs due to data security breaches and non-compliance are detrimental to the company’s profitability and reputation, especially for healthcare and financial companies. The financial industry is a competitive field, which makes Desjardins equally strategize on the offensive strategy as the defensive strategy. The balance is achieved under big data analytics, blockchain, Artificial Intelligence (AI), and machine learning that improve service delivery and secure important data (Desjardins, 2020a). Under the company’s offensive data strategy, Desjardins uses data for economic growth forecasts. In the financial sector, data obtained from trusted and reliable financial organizations is used to offer insights into the relationships between the various economic and financial variables (Heisig, 2020). This aids in establishing and projecting market conditions that enhance risk aversion for both domestic and global economies. Within the organization, the time series data also forms the basis of reviewing financial results and comparing different parameters over time. Financial statements also rely on data collected pertaining to different outcomes.

Open banking has had a significant effect on financial market data, especially at a time when the lack of consumer data has barred many players from entering the financial market. Open banking has changed the narrative and is making consumer data more available through debit cards, credit cards, mortgages, and deposit accounts (Deloitte, 2018). Financial authorities require banks to implement the strategy, which will enhance partnership networks, provide more effective mobile services to improve customer service, and bring about several other advancements. Customer data can be transmitted to third parties with their consent to improve the services. Open banking will impact both offensive and defensive data strategies through new data security and privacy opportunities as well as addressing the changing needs of customers. Customer data will be more secure since third-party companies will be authorized before accessing customer data (Kaul, 2020). Therefore, open banking is beneficial for both customers and financial institutions.

Challenges

Desjardins Company’s management acknowledges that a company’s ability to manage torrents of data is imperative for its success. The current business world has increasingly become reliant on data and analytics critical decisions. Commendably, the Desjardins Company implements a balance between the two data strategies to ensure that the company competes favourably. However, data strategy in the company is not without challenges. The two major challenges associated with Desjardins’ strategy are threats of data breach and minimal feasibility of the data analytics and management systems.

With the increasing spread of technological awareness, cases of data breaches have become rampant, and companies dealing with large data analytics ought to strategize on the establishment of more secure data methods. Moreover, the shift to digital financial records implies that more data is generated and stored in the company’s databases, mobile banking, and cloud storage services. Besides, cybersecurity is a costly venture, which means that the company may compromise some of the aspects to focus on IT-related processes (Nadeau, 2021). This creates a loophole for data breaches. Poor security in third-party applications also presents a threat for the bank. With the introduction of open banking, organizations need to be more vigilant to ensure proper encryption and security. The effects of data breaches are far-reaching for a company. This exposure of customer data such as mortgage documents, real estate documents, license numbers, social security numbers, and other details to suspicious individuals threatens customers in several ways. This leads to the loss of customers due to such insecurities. Breaches also lead to huge financial losses. According to Nadeau (2021), data breach costs have hit an all-time high in 2021, which suggests the need to secure data more.

Another challenge in data strategy that the company faces is the minimal usability of the collected data in line with the company’s objectives and goals, which reduces the feasibility of the project. According to a report by Harvard Business Review, most companies use less than half of the structured data for insights and decision-making (Mulle, L.& Davenport, 2017). Further, the report indicates that less than 1% of the unstructured data is used for decision-making skills. This indicates that a company may implement a data strategy and end up not maximizing the benefits that can be accrued from the analytics system. Similar to the report by the Harvard Business Review, the company does not utilize most of the data obtained, especially the unstructured. Since data analytics and encryption systems are expensive, it is crucial to ensure maximum utilization of data for decision-making to make the projects feasible.

Besides, without a good data management strategy, the company may not benefit significantly from a data strategy. Besides, due to rapidly emerging technologies and analytics methods, some of the analytics systems may not be tested extensively and in different contexts. As such, the company faces a cost risk of implementing a system that may not satisfactorily serve the interests of the company in its particular context. To avoid such unfeasible investments, the company can conduct a benchmark before committing to such investments.

Summary of the Analytics

The financial industry is swiftly moving towards data-driven optimization. Financial data can be analyzed from several perspectives to derive useful insights. In the current analysis, a quantitative non-complex analysis will be performed on the available data to understand the credit liabilities of households in Canada using some of the strategies employed at Desjardins Company. More particularly, the analysis will focus on comparing trends in mortgage and non-mortgage loan liabilities owed by households. The data used contains time series monthly data for the various variables since 2010. For the sake of the current analysis, a sample of 21 months covering January 2020 to September 2021 is considered.

Mortgage Loans

Figure 1: Mortgage Loans for Canadian Households

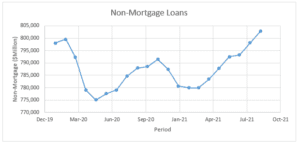

Figure 2: Non-Mortgage Loans for Canadian Households

Since January 2020, mortgage loans have assumed an upward trend, which is the reason there is a strong positive relationship between residential mortgages and mortgage loans with total liabilities. The increase in mortgage loans indicates an increasing need for people to finance their properties. The loans are mostly sanctioned against high-value immovable properties. The banks are placed at a position to earn more from the interests payable from the high mortgages. However, since the interests for the mortgages are repaid after a long period, a bank that has lent huge amounts of money in mortgages can find other alternative investment methods. Non-mortgage loans do not represent a regular trend similar to non-residential mortgages. Generally, the trends indicate an increasing debt burden from a household level.

Figure 3: Residential Mortgages for Canadian Households

Figure 4: Non-Residential Mortgages for Canadian Households

The results indicate an upward trend in residential mortgages since 2020. This would insinuate the affordability of repaying the mortgages was increasing and that people were unable to pay. This is also another form of implication for the banks that they needed to act according to the outcomes of further investigation. There is no regular trend for non-residential mortgages. The total non-residential mortgages decreased between January 2020 and July 2020. However, the value increased between September 2020 and September 2021. Among the factors that might have contributed to the decrease in the mortgages was due to a fall in interest rates, making it possible for households to refinance their mortgage debts. When total mortgages are low, the banks are encouraged to lend at more favorable rates by lowering the bank’s funding costs. Low mortgage rates also increase the disposable income for each household and spending, which boosts the GDP.

Total Credit Liabilities of Households

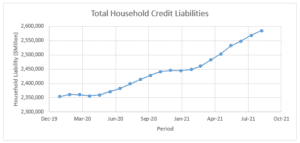

Figure 5: Total Credit Liabilities for Canadian Households

The total trend shows an increase in total household debt. The upward trend is partly attributable to the economic effects brought about by the Covid-19 pandemic. This forced more people to borrow more from banks and other financial institutions. For financial institutions such as Desjardins Company, this may signal a possibility of loan defaulters, which guides the bank on the strategies to employ to secure the loans. This also implies to financial institutions that the demand for loans is high, and the liquidity ratio for banks should be maintained to be high enough to afford to lend money. The steady increase in household liabilities also provokes the bank to conduct deeper research on the factors that may be driving the spending for the citizens. This helps the banks to regulate their loan liabilities accordingly.

A Correlation Matrix of the Liabilities

| Total Credit Liabilities | Mortgage Loans | Non-Mortgage Loans | Residential Mortgages | Non-Residential Mortgages | |

| Total Credit Liabilities | 1 | ||||

| Mortgage Loans | 0.994726366 | 1 | |||

| Non-Mortgage Loans | 0.425757605 | 0.330708225 | 1 | ||

| Residential Mortgages | 0.994640863 | 0.999997271 | 0.329945555 | 1 | |

| Non-Residential Mortgages | 0.247333411 | 0.213846114 | 0.389226505 | 0.211563214 | 1 |

Table 1: Correlation Matrix for the Liabilities Variables

The correlation table models the relationship between the variables, where total credit liabilities are taken as the response variable while the other liabilities are explanatory variables. The results indicate that the variables are positively correlated, implying that an increase in one of the liabilities automatically contributes to the increase in the total liability load for Canadian households. Further, the data indicate that mortgage loans and residential mortgages are the strongest predictors of the total credit liabilities for households. The correlation values close to 1 indicate an almost perfect positive relationship between the variables. On the other hand, non-residential mortgages have the weakest positive relationship with total credit liabilities. This information is significant for financial institutions such as Desjardins Company since the bank can predict one of the variables by observing the trends depicted by one variable. For instance, the bank can come up with a model to predict the change in total household liabilities based on the change in mortgage loans. This facilitates decision-making.

References

Deloitte. (2018). Open banking What does it mean for analytics and AI?. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/au/Documents/financial-services/deloitte-au-fs-open-banking-analytics-ai-060918.pdf

Desjardins. (2020a). Financial report: Desjardins Group records surplus earnings of $285 million for the first quarter. Retrieved from https://www.desjardins.com/ressources/pdf/d50-rapport-trimestriel-mcd-2020-1-e.pdf?resVer=1589387807000

Desjardins. (2020b). 2020 Annual Report Desjardins Group Together for 120 years. Available online at: https://www.desjardins.com/ressources/pdf/d50-rapport-annuel-mcd-2020-t4-e.pdf?resVer=1615485982000

Heisig, M. (2020). The Two Types of Data Strategies Every Company Needs. Retrieved from https://indatalabs.com/blog/data-strategies-every-company-needs

Kaul, A. V. (2020). Open Banking: Who will really get benefitted? Retrieved from https://teknospire.com/open-banking-benefits/

Mulle, L. D., & Davenport, T. H. (2017). What’s Your Data Strategy? Retrieved from https://hbr.org/2017/05/whats-your-data-strategy

Nadeau, A. (2021). Making and Finance Data Breaches: Costs, Risks and More to Know. Retrieved from https://securityintelligence.com/articles/banking-finance-data-breach-costs-risks/

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

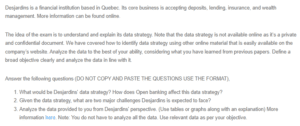

Desjardins is a financial institution based in Quebec. Its core business is accepting deposits, lending, insurance, and wealth management. More information can be found online.

Desjardins Financial Services Company

The idea of the exam is to understand and explain its data strategy. Note that the data strategy is not available online as it’s a private and confidential document. We have covered how to identify data strategy using other online material that is easily available on the company’s website. Analyze the data to the best of your ability, considering what you have learned from previous papers. Define a broad objective clearly and analyze the data in line with it.

Answer the following questions (DO NOT COPY AND PASTE THE QUESTIONS USE THE FORMAT),

- What would be Desjardins’ data strategy? How does Open banking affect this data strategy?

- Given the data strategy, what are two major challenges Desjardins is expected to face?

- Analyze the data provided to you from Desjardins’ perspective. (Use tables or graphs along with an explanation) More information here. Note: You do not have to analyze all the data. Use relevant data as per your objective.