The Findings and Implications of the IFE Data

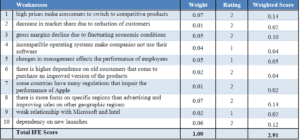

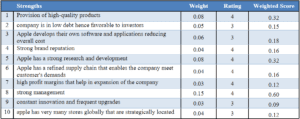

The internal factor evaluation (IFE) matrix compares strengths and weaknesses within a company. The matrix weighs various strengths, which implies to the firm the strengths that can produce the most significant impact (Leliga et al., 2019). Regarding weaknesses, the weaknesses with the highest score should receive more attention because they present the greatest threat to the company. Strong management has the highest score of 0.6 from the subject IFE matrix. Essentially, this indicates that the company has a considerable advantage in management and should utilize the management for a competitive advantage. The following aspects that Apple Inc. should consider are providing high-quality products and the company’s strong research and development to derive a competitive advantage. The two have a weighted score of 0.32, which is significant. The other internal strengths, such as solid brand reputation, constant innovation, considerable market presence, refined supply chain, low debts, and substantial profit margins, have a relatively low weighted score, and not much attention should be accorded to them. However, they should not be ignored entirely.

The IFE matrix indicates that the most significant weaknesses of Apple Inc. entail competitive pressure due to high prices, focus on specific regions, and dependency on new launches. Apple Inc. should work on these weaknesses because they present the most significant threat from within. Some weaknesses are better addressed by concentrating on the company’s strengths so consumers will not identify the weaknesses (Yie et al., 2021). For instance, the high strength of competitive pressure on the company due to high prices can be washed by the quality of product strengths. The IFE matrix identifies other weaknesses with less significance, such as gross margin decline, decrease in market share, specific country regulations, and weak relationships with other companies such as Intel and Microsoft. Notably, the weighted score of these weaknesses is minimal, but they should be monitored periodically.

References

Leliga, F. J., Koapaha, J. D., & Sulu, A. C. (2019). Analysis of Internal Factor Evaluation Matrix, External Factor Evaluation Matrix, Threats-Opportunities-Weaknesses-Strengths Matrix, and Quantitative Strategic Planning Matrix on Milk Products and Nutrition Segment of Nestlé India. East African Scholars Journal of Economics, Business and Management, 2(4), 186-191.

Yie, C. E., Zhi, C. E., & Ping, N. T. S. (2021). A Critical Analysis of Internal and External Environment: Case Study of Apple Inc. Journal of International Business and Management, 4(10), 01-14.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

The Findings and Implications of the IFE Data

In 250-300 words, write a brief explanation of the findings and implications of the data identified in the IFE.

Financial Ratio Analysis and Internal Factor Evaluation (IFE) Matrix

Financial Ratio Analysis

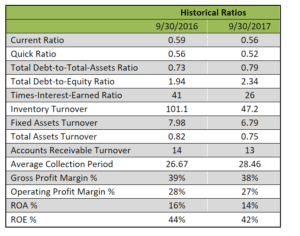

Below are the Historic Ratios of 2016 and 2017.

Internal Factor Evaluation Matrix