Tax Issues

Question 1

(a) Will the current year’s tax payment by Wheelie Corporation fall within the same range as its recent average tax payments, or will it deviate from the norm by increasing or decreasing? More importantly, what would be the implication of a massive capital gain from the land sale on Wheelie Corporation’s tax declaration?

(b) Should Wheelie Corporation treat the sold investment land as capital or inventory asset? Which IRS tax codes guide its taxation?

Do you need a new and original copy of “Tax Issues”? Contact us.

Question 2:

(a) Can Aloha Inc. use the installment method to report its gain from the sale of the timeshare to Gerry when evaluating and filing its tax returns?

(b) How will Aloha Inc. offset the interests and accrued maintenance fee during the seven years when filing annual tax returns?

Similar Post: LGMT 420 Week 1 Quiz Production vs. Productivity

References

Allen, SC (2016). Helping clients with IRS payment agreements. Journal of Accountancy.

Available online at https://www.journalofaccountancy.com/issues/2016/sep/irs-payment-agreements.html

Internal Revenues Service (2017). Installment Agreements. Available online at

https://www.irs.gov/irm/part4/irm_04-020-004

Jones, D (20120, Inertia and Over withholding: Explaining the Prevalence of Income Tax

Refunds, American Economic Journal: Economic Policy, 4 (1), 158-85

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Tax Issues

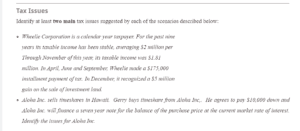

Identify at least two main tax issues suggested by each of the scenarios described below:

Tax Issues

- Wheelie Corporation is a calendar-year taxpayer. For the past nine

years, its taxable income has been stable, averaging $2 million per

Through November of this year, its taxable income was $1.81

million. In April, June, and September, Wheelie made a $175,000

installment payment of tax. In December, it recognized a $5 million

gain on selling investment land. - Aloha Inc. sells timeshares in Hawaii. Gerry buys a timeshare from Aloha Inc, He agrees to pay $10,000 down, and Aloha Inc. will finance a seven-year note for the purchase price balance at the current market interest rate. Identify the issues for Aloha Inc.

Instructions:

Your answers should be phrased in the form of a question. Do not answer the question.

Note that the question you pose should be a question that can only be answered by conducting tax research, such as reviewing the tax code or case law. It should not be a question of fact that can be answered by asking the client or reviewing the transaction documents.