Tax Consequences,Income or gain, Accumulated Adjustment, 1099DIV and Alternatives

Question 1: Tax Consequences

Selling the piece of land for the business presents tax gain for all the company shareholders. However, the tax on capital gain differs based on different elements. According to the tax laws, selling a piece of land that is not a person’s home is treated as a capital gain; therefore, selling the land will cause a tax liability of up to 20%, depending on the tax brackets (Internal Revenue Service). This shows that selling the company’s land will present the element of capital gain, thus causing significant tax implications.

a) The land has appreciated since it was acquired. Selling the land will lead to the company’s cash gain of 200,000 (800,000-600,000). If the company sells the land in December 2022, 200,000 will be the capital gain. Therefore, selling the land in December 2022 will attract less tax liability for all the shareholders of the company for the property sold because the capital gain will be above the margin for taxable capital gain associated with the property. On the other hand, the non-recourse mortgage is not considered an income, so it won’t be taxed (Internal Revenue Service, Home foreclosure and debt cancellation). Get in touch with us at eminencepapers.com. Our homework help will save you tons of time and energy required for your assignment papers.

According to the case of Company A, the company will make a $40,000 distribution towards the tax liabilities for the four shareholders. This means that the distribution will cover $10,000 for each of them on December 1ST, 2022. This amount will be taxable as it will be counted as income allocated to all the company shareholders (SECURITIES AND EXCHANGE COMMISSION). However, the four shareholders have different tax margins. This means that their tax consequences will differ accordingly.

The details of the company’s shareholders show that the income gained from the land sale will be shared equally among the shareholders. This means that the income of each shareholder will increase significantly in December 2022. From the sale of the land, the shareholders will all have a $50,000 increase in their income from the land sale and the operations of the company. However, Bob will pay more tax compared to the children due to his employment and full engagement in the operations of the firm. In general, the table income of the shareholders will be as follows for December 2022:

Bob: 50,000+10,000+$20,000 = $80,000

Justin: 50,000+10,000 = $60,000

Madeline: 50,000+10,000 = $60,000

Erica: 50,000+10,000 = $60,000

These are the taxable incomes for all the shareholders associated with the company’s operations. This shows that buying the land will cause significant taxation for the shareholders but will affect bob more.

b) However, according to the appreciation value, the company acquired the land in 2018 meaning it has had the land for 4 years (2018-2022). However, the details also presented that Bob would make a distribution worth 40,000 to be shared equally among the shareholders’ tax liabilities. This value will be applicable for 2022 and not 2023. This presents the element of the coinciding of the company’s taxable year and fiscal years. This means that selling the land in January 2023 will reduce the taxable income for all the shareholders in the company. This will affect all four shareholders of company A based on their marginal tax brackets.

Therefore, the land sold by the company will cause a significant rise in the income of the shareholders in January 2023 because due to the significant reduction of the taxable income associated with the selling of the land. The following presents the taxable income of the shareholders if the land was sold in January 2023:

Bob: 50,000

Justin: 50,000

Madeline: 50,000

Erica: 50,000

Therefore, it is well established that the taxable income associated with the selling of the land will reduce if sold in 2023 for all four shareholders.

Question 2:

a) Based on the company’s details, it is evident that it had income gain from its operations and the selling of the land. The organization made a profit of 180,100 in the financial year ending March 31, 2023. On the other hand, selling the land also increased the shareholders’ income as Bob distributed the value of the land equally among them. The $180,100is an income from profit or gain of business operations, and the $200,000 from selling the business land is the income from capital gain. These are the characters of the income associated with the operations of Company A in the taxable year 2022.

b) Based on the income listed above from the business, sit is evident that the company retains significant amounts by selling the land and gaining income from the operations of the company. Since the shareholders in the business are equal partners owning 100 shares of the company, it is evident that the performance of the business increases their stakes in the company due to increased finance retained. The case presents that after additional expenses and financial activities, the company had total retained earnings of $114,000 and a shareholder’s equity of $154,000.

Based on the shareholder’s equity and retained earnings of the company, it is evident that the shareholder’s bases increased significantly. On the other hand, all the shareholders have equal shares showing that their bases increased equally in the company. In general, the total shareholders’ equity shows that the shareholder base was $38,500 ($154000÷4). Therefore, the bases were significantly affected by the financial performance of the fiscal year.

c) The tax implications of transfers made by businesses that accrue income and profits are determined using the Accumulated adjustment account (AAA). Usually, AAA represents the company’s total revenue, less unpaid costs. On the first day of Company S’s first day of the taxable year, AAA equals zero. This value is affected by different transactions within the company. Due to this, the value is likely to rise or drop across the taxable year due to these transactions. Some of the reason for the rise in the AAA value includes all corporate income items that are recorded separately and passed to shareholders.

This aspect presents the distributions of the corporation. The company will accumulate more income from the sales of the land. These amounts are attributed to shareholders but most of it will be retained in the company. However, the amount will be taxed by the shareholders thus increasing the AAA value. From the details about AAA, it is evident that AAA presents the net post-tax returned earnings that the company retails. The amount from the sales of the land is an increased income, and most of the shareholders are likely to re-invest the amount in the company, or the money is likely to be retained by the company since it is a family business where most of the shareholders are students (§1.1368-2, Accumulated adjustments account (AAA)).

Therefore, in general, the activities of the business that increased the base of the employees present that the company will retain more income that will be taxed based on the specific shareholders’ marginal tax brackets. This will present the post-tax income by the company will significantly increase the Accumulated Adjustment Account company. The Accumulated Adjustment Account of company A is likely to increase with the taxation activities that move the tax liabilities to the shareholders.

Question 3:

Amounts reported to the shareholders of the company are also very important because their bases of the company increased by selling the land. In general, all the taxable dividend incomes have to be reported to the shareholders of the company. Some of the financial records that the company has to report under form 1099-DIV include the total amount of ordinary dividends received, all the ordinary dividends that are considered to be qualified dividends, all the capital gains distributions, and the state or federal taxes withheld from the distributions of the shareholders (Internal Revenue Service Instructions for form 1099-div (01/2022)). These are the major financial aspects that have to be reported to all the shareholders.

Question 4:

A single scale is crucial in both the planning and international income tax systems as a measure of company revenue. Typically, various taxes are assessed in line with predetermined schedules on income from employment, business, and investment. Therefore, the tax system that applies depends on how income items behave. The majority of business revenue kinds are those that are included in total income, using the international schedule. Although the idea of income is universal, there may be distinct laws, particularly tax regulations, that apply to commercial income. Individuals’ other sources of income may also be determined using other formulas (Burns and Krever, 2).

Increasing tax Results can adopt several methods for the company and Bob. Generally, the first step in improving the tax results is understanding the firm’s deductions and credits and making tax-friendly investments. Company A can reduce tax liabilities in many ways. Some of the methods recommended here include employing a family member and maximizing deductions (Internal Revenue Service, Tax treatment for family members working in the family business). Therefore, reducing the company’s taxable income is one of the most important strategies that Company A can use to improve the tax situation. The company can reduce taxable income through different methods.

The income and expense system and the balance sheet system are the two major models that taxpayers use to calculate the taxes produced by entrepreneurial activities (also known as the “taxpayer’s income from entrepreneurial operations”). According to the income and expenditure system, in nations with normal legislation, the calculation of all confirmed income received by the taxpayer during the taxpayer period and all deductions made by the taxpayer during the taxpayer period is generally based on the determination of income from tax operations (Burns and Krever, 3). These are some of the major elements of consideration for Company A as an incorporated family business for reducing the taxable income and tax liability.

Employing Family members and Investing in more employees

Employing Family Members: Hiring family members is one of the finest strategies to lower taxes for family companies. The alternatives offered by Internal Revenue Services include tax receipts where the children of a family are employable in the family’s business. The originator of sound accounting claimed that small business owners can either pay a lower marginal tax rate or avoid paying taxes on money received from their children. This is a viable element for Bob and the family company shown above. From the case details, Justin is old enough to be employed in the business. Employing him in the company will significantly affect the taxable income value. This element is evident from the salary paid to bob.

Bob’s salary of 20,000 is deducted from the gross income used in the company’s taxable income calculations. This means that employing more of the children of the company will reduce the taxable income and retain some income for the company. On the other hand, this concept also applies to the strategy of investing in more employees. Bob can invest in more employees to enhance the company’s performance, thus increasing the company’s income and reducing the tax liabilities.

Maximizing Deductions

Wali (2021) argued that deductions have a significant impact on the financial statements of companies. They impact income tax as a significant incentive for companies’ financial management endeavors.

Maximizing Deductions is another aspect of consideration for the business. There are several deductions that the company can utilize to reduce taxable income (Wali, 2021). Some of these deductions include health insurance, property taxes, and travel expenses.

On the other hand, Bob and the other shareholders can increase the amount of retirement saving to reduce taxable income, thus deducting the amount from the company’s taxable income. This is another important strategy for maximizing deductions for the company.

Deducting advertising expenses and payments to legal and professional bodies is also important to Bob and his business’ tax. This is because this allows him to deduct the amount paid to these individuals, thus reducing the taxable income for the company.

On the other hand, interest made from financing activities done by credit is deductible from taxable income. This shows that the company can obtain loans and use them to finance the activities and then pay the loans later. This is important as the interest will be deducted from the taxable income, thus reducing the company’s tax liability.

Also, the company can focus on giving and receiving charitable contributions. The amount associated with charitable contributions is always deducted from the final taxable income value. Engaging in such activities would go a long way in reducing the taxable income of the company, thus reducing the final tax value.

Works Cited

“Topic No. 409 Capital Gains and Losses.” Internal Revenue Service, Internal Revenue Service, 4 Oct. 2022, www.irs.gov/taxtopics/tc409.

1.1368-2, Accumulated adjustments account (AAA). “Distributions” CCH Answer Connect. https://www.govinfo.gov/content/pkg/CFR-2020-title26-vol13/pdf/CFR-2020-title26-vol13-sec1-1368-2.pdf

Burns, Lee., and Krever, Richard. “Taxation of Income from Business and Investment.” Tax Law Design and Drafting, vol. 2, Chapter 16, International Monetary Fund, 1998. Print. https://www.imf.org/external/pubs/nft/1998/tlaw/eng/ch16.pdf

Internal Revenue Service. “Home Foreclosure and Debt Cancellation.” Internal Revenue Service, Internal Revenue Service, 28 Mar. 2022, www.irs.gov/newsroom/home-foreclosure-and-debt-cancellation.

Internal Revenue Service. “Instructions for Form 1099-Div (01/2022).” Internal Revenue Service, 15 Dec. 2021, www.irs.gov/instructions/i1099div#en_US_2022_publink1000278746.

Internal Revenue Service. “Tax Treatment for Family Members Working in the Family Business.” Internal Revenue Service, 11 July 2022, www.irs.gov/newsroom/tax-treatment-for-family-members-working-in-the-family-business.

SECURITIES AND EXCHANGE COMMISSION. “Tax Distributions Attributable to Pro Rata Allocations.” Schedule 13D/A Amendment No. 12, SECURITIES AND EXCHANGE COMMISSION, 19 May 2005, https://www.sec.gov/Archives/edgar/data/943320/000119312505113169/dsc13da.htm.

Wali, Kawa. “The Detection Of Earnings Management Through A Decrease Of Corporate Income Tax.” Future Business Journal, vol. 7, Article No. 36, 2021. https://doi.org/10.1186/s43093-021-00083-8

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

A Company A sells Equipment. The business was incorporated in 2010 and it’s shareholders filed a valid subchapter S election for the corporation’s fiscal year beginning on April 1, 2015. Because company A could demonstrate that it’s taxable year coincides with it’s natural business year, it retained a fiscal year ending on March 31. Bob, age 49 and single owns the 100 outstanding shares of the company A’s voting common stock. Bob’s three children, Justin (age 24), Madeline (age 21), and Eric (age 19), each own 100 shares of nonvoting common stock. All four shareholders are calendar year, cash basis taxpayers.

Tax Consequences,Income or gain, Accumulated Adjustment, 1099DIV and Alternatives

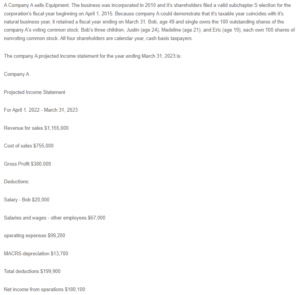

The company A projected income statement for the year ending March 31, 2023 is:

Company A

Projected Income Statement

For April 1. 2022 – March 31, 2023

Revenue for sales $1,155,000

Cost of sales $755,000

Gross Profit $380,000

Deductions:

Salary – Bob $20,000

Salaries and wages – other employees $67,000

operating expenses $99,200

MACRS depreciation $13,700

Total deductions $199,900

Net income from operations $180,100

Notes:

1. The above figures do not reflect any tax consequences of the proposed distribution of land.

2. The corporation will make pro-rate cash distributions totaling $40,000 ($10,000 to each shareholder) on December 1, 2022.

Bob has served a president of Company A since it’s incorporation. Bob’s log-term goal is to increase the value of the corporation to increase his wealth and that of his children. Pursuant to this goal, the corporation makes pro-rata csh distributions to the four shareholders only to the extent necessary to allow them to pay their individual tax liabilities on their income. To meet these needs, Company A will make $40,000 distribution on December 1, 2022. Bob is accustomed to making all business decisions that concern Company A without consulting his children, and the children are very comfortable with this situation. The children are not employed in the family business. Justin just began working full-time. Madeline and Erica full-time students at University and are fully supported by Bob. Bob is in the top marginal tax bracket, Justin is in the 22% marginal tax bracket, and the other two children are in the 12% marginal tax bracket.

On April 1, 2022, the equity section of Company A balance sheet appeared as follows:

Capital stock $40,000

Accumulated adjustments account ($21,000)

Other retained earnings $135,000

Total retained earnings $114,000

Total shareholders’ equity $154,000

The balance in the “other retained earnings: account equals Company A’s accumulated earnings and profits as of March 31, 2015. The deficit in the accumulated adjustments account is attributable to an operating loss incurred when Company A failed in an attempt to move into a new market in 2020. The corporation is now operating profitably again and Bob expects it to continue to do so in the future.

Bob tells you that he plans to have Company A transfer legal title to a 2-acre tract of land to the shareholders in a pro-rata distribution sometime in either December 2022 or January 2023. The corporation purchased the land in 2018 in anticipation of construction its own warehouse. However, Company A recently negotiated a very favorable long-term lease for its current space and has no need for the land. Bob decided to have Company A distribute the land because he wants to develop the property commercially through a limited liability company (which will be owned by the Company A shareholders). Currently, the property has a fair market value of $800,000, a basis to Company A of $600,000, and is subject to a $400,000 non recourse mortgage.

Questions:

1) Bob has consulted you about any tax consequences (to himself and the other Company A shareholders) of the proposed distribution of the corporate land planned for either a) December 2022 or b) January 2023 (address the tax consequences for each date).

2) a)Bob specifically wants to know if there is any income or gain (and if yes, its amount and character) and b)how the basis for each shareholder is affected (c)as well as the impact of the distribution on the corporation’s accumulated adjustment account).

3. He also wants to know what amount (if any) must be reported to each shareholder on Form 1099-DIV for 2022.

4. In addition, he would like to know if you have any recommendations that would improve the overall tax result (provide at least two alternatives) and if you have identified any additional issues that should be addressed.