Tax Application on Properties

List the primary authorities relied upon in answering parts b-d below:

- The Tax Cuts and Jobs Act — signed into law on December 22, 2017 — gave birth to a brand-new provision: Section 199A, which permits owners of sole proprietorships, S corporations, or partnerships to deduct up to 20% of the income earned by the business. While the provision has the potential to bestow a tremendous benefit upon owners of these pass-through businesses, since its enactment, no one has been able to

- The statutory language of Section 199A created more questions than answers, with those queries ranging from seemingly simple taxable items and non-taxable items. What do we do about a fiscal year business that crosses over January 1, 2018? — To the much more complex — what exactly is a “specified service business” for which a deduction is generally prohibited(Paul and JR, 2017)?

Are you looking for an original “Tax Application on Properties accounting essay” copy? Feel free to connect with us.

To what extent may JP deduct his net loss from the office building? Explain each type of loss limitation (and whether or not they apply).

Only the unadjusted basis of “qualified property” is counted towards the limitation. Qualified property is tangible property subject to depreciation; as a result, the basis of raw land and inventory, for example, would not be considered.

The basis of property used to determine the limitation is an unadjusted basis determined “immediately after acquisition.” Thus, the basis is not reduced for any subsequent depreciation.

A taxpayer may consider the property’s unadjusted basis only for a year for which the “depreciable period” of the property has not ended before the close of the tax year. The depreciable period begins on the date the property is placed in service and ends on the later of:

- 10 years after the date placed in service, or

- The last day of the last full year in the applicable recovery period that would apply to the property under Section 168 (ignoring the alternative depreciation system) (Szlezak, 2014).

In Year 2, the property generated $10,000 of net income. JP also earned $300,000 Of salary income during the year. No principal was paid during the year. Depreciation for the year (included in the net income amount) was $14,000. Analyze the tax treatment of the property income to JP.

Effective for tax years beginning after December 31, 2017, and before January 1, 2026, a taxpayer other than a corporation is entitled to a deduction equal to 20% of the taxpayer’s “qualified business income” earned in a “qualified trade or business.” The deduction is limited for taxpayers with income over a threshold, however, to the greater of:

The resulting deduction is then subject to a second limitation equal to 20% of the excess of:

- The taxable income for the year is calculated as ($300000-$1400)+$10000= $308600

Depreciation is subtracted because it is tax allowable.

The depreciation charge amount shall not be subjected to tax (Paul and JR).

At the beginning of Year 3, when the property was worth $460,000 – exactly equal to the number of outstanding mortgages – JP sold the property. The buyer took the property subject to the mortgages and paid no other consideration. What are the tax consequences of this sale to JP?

A property sale is a taxable event, regardless of whether a structure, such as a house, is attached to the land. If you profit from the sale, you may or may not be taxed on your profit. If your profits are taxable, you might be taxed at either ordinary income tax rates or capital gains tax rates. You may be eligible for a tax deduction if you sell your property at a loss (Szlezak, 2014).

Other Related Post: Training, Development, and a Succession Plan

References

“Application of an advanced eddy-current loss modelling to magnetic properties of electrical steel laminations in a wide range of measurements.” (2015): 10.

Paul, R Trigg, and JR. “Some Income Tax Aspects of Community Property Law.” (2017): 16.

Szlezak, Matusewicz J. “Tax-deductible expenses adjustment and failure to pay practical application and tax optimisation possibilities in Poland.” (2014): 7.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Tax Application on Properties

Question:

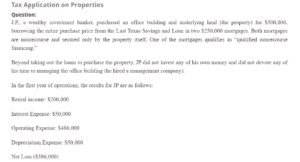

J.P., a wealthy investment banker, purchased an office building and underlying land (the property) for $500,000, borrowing the entire purchase price from the Last Texas Savings and Loan in two $250,000 mortgages. Both mortgages are nonrecourse and secured only by the property itself. One of the mortgages qualifies as “qualified nonrecourse financing.”

Tax Application on Properties

Beyond taking out the loans to purchase the property, JP did not invest any of his own money and did not devote any of his time to managing the office building (he hired a management company).

In the first year of operations, the results for JP are as follows:

Rental income: $200,000

Interest Expense: $50,000

Operating Expense: $486,000

Depreciation Expense: $50,000

Net Loss ($386,000)

In addition to the interest paid during the year, JP made a $20,000 principal payment on each note (total of $40,000 principal paid). JP has $800,000 of salary income from his investment banking job and $80,000 of dividend income from the portfolio investments. JP’s depreciation was not accelerated or otherwise subject to any recapture rules.

- List the primary authorities relied upon in answering parts b-d below:

- To what extent may JP deduct his net loss from the office building? Provide explanations as to each type of loss limitation (and whether or not they apply).

- In Year 2, the property generated $10,000 of net income. JP also earned $300,000 of salary income during the year. No principal was paid during the year. Depreciation for the year (included in the net income amount) was $14,000. Analyze the tax treatment of the property income to JP.

- At the beginning of Year 3, when the property was worth $460,000 – exactly equal to the amount of outstanding mortgages – JP sold the property. The buyer took the property subject to the mortgages and paid no other consideration. What are the tax consequences of this sale to JP?