Sustainable Growth Rate

Sustainable Growth Rate = Return on Equity (ROE)* Business Retention Rate

In this case, Sustainable Growth Rate = Earnings retention ratio (1-dividend rate) *total asset turnover (sales/total assets) *net profit margin (net income/sales) *financial leverage ratio (Viguerie, Smit & Baghai, 2008).

Thus, Sustainable Growth Rate for 2011 to 2015 can be calculated as follows;

Sustainable growth rate for 2011 = 0.17 *(1-0.38) *1.64*0.261= 4.5%

Sustainable Growth rate for 2012 = 0.17* (1-0.49)*1.44*0.401= 5.0%

Sustainable Growth rate for 2013 = 0.793*(1-0.55)*1.79*0.435= 27.8%

Sustainable Growth rate for 2014 =0.228*(1-0.63)*1.99*0.40= 6.7%

Sustainable Growth rate for 2015 = 0.236*(1-0.62)*2*0.263= 4.7%

Do you require an Unplagiarized copy of “Sustainable Growth Rate”? Do not hesitate to reach us.

Recommendations to the firm

Based on the analysis of the sustainable growth rate from 2011 to 2015, it is clear that the firm has an average sustainable growth rate of about 9% the five years old. Despite registering a 9% average growth rate in the five years, the firm can register a higher growth rate, as in 2013, where the growth rate registered at 27.8%. However, the firm needs to ensure that it does not acquire new debt because by doing so, the growth rate will not be sustainable (Viguerie, Smit, & Baghai, 2008).

Equallyregardingto external capital, the firm can raise an amount equivalent to the sustainable growth rates for five years, around 9% of the total assets. However, funding by debt will not be a good option for the firm since the sustainable growth rate is not uniform for all the years; rather, it keeps fluctuating (Viguerie, Smit, & Baghai, 2008). The only viable option is equity financing, where the firm can issue shares to the public or, better still, split the current shares.

Similar Post: Create a Budget and Financial Plan for a Vacation Trip

Reference

Viguerie, P., Smit, S., & Baghai, M. (2008). The granularity of growth: How to identify the sources of growth and drive enduring company performance. Hoboken, N.J: John Wiley & Sons.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Sustainable Growth Rate

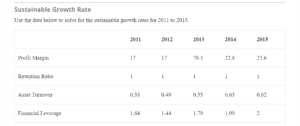

Use the data below to solve for the sustainable growth rates for 2011 to 2015.

Sustainable Growth Rate

| 2011 | 2012 | 2013 | 2014 | 2015 | |

| Profit Margin | 17 | 17 | 79.3 | 22.8 | 23.6 |

| Retention Ratio | 1 | 1 | 1 | 1 | 1 |

| Asset Turnover | 0.38 | 0.49 | 0.55 | 0.63 | 0.62 |

| Financial Leverage | 1.64 | 1.44 | 1.79 | 1.99 | 2 |

| Sustainable Growth Rate | |||||

| Actual Growth Rate | 26.1 | 40.1 | 43.5 | 40 | 26.3 |

What is the sustainable growth rate for each year? Based on your analysis of the sustainable growth rate between 2011 and 2015, what are your recommendations for the firm?