Strategic Financial Management Positioning Report – Financing and Financial Sources

In the dynamic landscape of healthcare, strategic financial management plays a pivotal role in ensuring the sustainability and growth of hospitals. Understanding the nuances of corporate capital choices, capital budgeting, and the associated costs is indispensable for hospitals aiming to thrive in an ever-evolving industry. As the hospital embraces a new phase of growth and potential investment, this report serves to illuminate the financial landscape. The Chairman’s invitation to potential investors warrants a comprehensive exploration of the hospital’s financial strengths and opportunities. By dissecting key financial concepts by Gapenski and Pink (2015), this report seeks to provide the Board with insights crucial for making informed decisions that align with the hospital’s financial goals.

Sources of Corporate Capital Choices for Hospitals

Corporate capital choices for hospitals encompass a range of options that significantly impact their financial health. These choices involve decisions about how to fund operations, undertake strategic initiatives, and manage long-term obligations. Understanding the importance of these choices is central to steering hospitals toward financial success. Hospitals can tap into diverse sources of corporate capital, each with its unique implications. Equity, debt, and contributions represent primary choices. Equity entails ownership stakes, debt involves borrowed funds, and contributions encompass philanthropic support. The impact of these choices on hospital operations is profound and multifaceted.

Equity provides hospitals with a form of capital that does not require regular repayment, but it dilutes ownership (Becchetti, 2018). Debt, while offering financial leverage, comes with the obligation of repayment and interest. Contributions, often from donors or foundations, inject capital without imposing immediate financial burdens. Each choice shapes the hospital’s financial structure, influencing aspects from decision-making autonomy to financial risk.

Advantages and Disadvantages of Various Sources

Contributions, a vital source of capital for hospitals, offer distinct advantages. The infusion of financial resources without incurring interest obligations provides flexibility in resource utilization. However, the reliance on contributions introduces an element of volatility contingent on the willingness of donors. The unpredictability of donor support can create challenges in long-term financial planning and strategic decision-making.

Furthermore, engaging with creditors through debt instruments provides hospitals with immediate access to capital, a crucial advantage for timely financial needs. However, this advantage comes with a significant caveat—the cost of debt. Interest payments associated with borrowed funds impact the hospital’s bottom line, potentially leading to financial strain if not managed judiciously. The challenge lies in balancing the need for immediate capital with the long-term financial implications of debt financing.

Banks also play a pivotal role as financial partners, offering loans that provide hospitals with quick access to funds. This expeditious access is advantageous, especially in urgent situations or for strategic initiatives. Nevertheless, this financial convenience is not without its drawbacks. Interest payments, coupled with potential constraints on financial flexibility, create a complex dynamic. The benefits of quick capital need to be weighed against the long-term impact on the hospital’s financial health and autonomy.

Collaborating with suppliers for financing represents another avenue for hospitals to streamline operations. This collaborative approach can enhance efficiency and foster mutually beneficial relationships. However, it introduces a nuanced challenge—potential limitations on negotiating power. Relying on suppliers for financing may constrain the hospital’s ability to negotiate favorable terms, impacting procurement strategies and overall financial efficiency.

Further, understanding the components of the cost of debt is crucial for hospitals navigating financial decisions. Interest payments, influenced by factors such as creditworthiness, constitute a significant portion of the cost of debt. Careful consideration of these components is essential to fully comprehend the financial implications of debt financing. Hospitals must assess the trade-offs between the advantages of immediate capital and the inherent costs associated with servicing debt.

While financing provides hospitals with immediate capital, it introduces a set of obligations and potential constraints. The infusion of resources comes at the expense of some financial autonomy. Hospitals must carefully evaluate the terms and conditions associated with financing to ensure alignment with their long-term financial goals. Striking a balance between immediate capital needs and the preservation of financial autonomy is a delicate yet critical aspect of financial management.

Steps in Capital Budgeting Financial Analysis

Capital budgeting financial analysis is a systematic evaluation crucial for determining the financial viability and impact of potential expenditures on fixed assets. This process is integral to effective financial management and strategic decision-making within the hospital. The first step involves the identification and definition of proposed capital investment projects, outlining their objectives, scope, and potential benefits. Subsequently, the estimation of cash flows associated with each investment is evaluated, considering revenue generation, cost savings, and other financial implications. Risk assessment follows, where factors such as uncertainties in cash flow projections, market conditions, and external influences are considered.

Determining the cost of debt and equity is the next critical step, taking into account the hospital’s capital structure. When calculating the present value of future cash flows, this estimate acts as the discount rate. Utilizing the Net Present Value (NPV) method comes next, calculating the present value of expected cash flows and deducting the initial investment. An increase in NPV suggests that the project may be profitable. An internal rate of return (IRR) analysis is then conducted to determine the project’s percentage rate of return. The payback period analysis assesses the time required for the project’s cash flows to recoup the initial investment, offering insights into liquidity and breakeven characteristics (Kim et al., 2013). Additionally, consideration of the project’s strategic value is essential in evaluating its alignment with organizational goals and long-term strategic objectives (Marr & Creelman, 2011).

Notably, rigorous financial analysis is of paramount importance, providing decision-makers with comprehensive insights for well-informed and strategic decision-making. This includes the optimization of resource allocation, identification and mitigation of potential risks, and the enhancement of financial performance by directing resources toward projects with the highest potential for financial returns and positive impacts on hospital operations. Stakeholders, including investors and the board, gain confidence in the hospital’s financial management when presented with a transparent and well-supported capital budgeting financial analysis.

Estimation of the Cost of Debt and Cost of Equity

Estimating the cost of debt and equity is a fundamental aspect of strategic financial management. The cost of debt reflects the expense of borrowed funds, while the cost of equity represents the return expected by investors (Fargher et al., 2018). Accurate estimation is vital for prudent decision-making. The cost of debt is influenced by factors like interest rates and creditworthiness. It involves interest payments and is crucial for understanding the financial implications of debt financing. The cost of equity, representing the return expected by investors, can be estimated through various methods, including the Capital Asset Pricing Model (CAPM) and the Dividend Valuation Model (DVM).

Components Included in the Corporate Cost of Capital

The corporate cost of capital (CCC) serves as a weighted average that encompasses various types of permanent capital utilized by the hospital. It provides a comprehensive reflection of the overall expense associated with capital for the institution, considering both debt and equity components (Gapenski & Pink, 2015). When delving into the components that constitute the CCC, one crucial element is the cost of debt. This component is significantly influenced by prevailing interest rates, tax considerations, and the hospital’s creditworthiness. The second vital element is the cost of equity, representing the anticipated return expected by investors. Various methods, including CAPM, DVM, and the debt-cost-plus-risk-premium approach, are employed to estimate the cost of equity, contributing to the holistic determination of the corporate cost of capital.

Importance of Capital Budget Decisions to Hospitals

Capital budget decisions are pivotal in shaping the hospital’s strategic financial management. They influence long-term viability, determine the financial structure, and impact the institution’s ability to undertake strategic initiatives (Gapenski & Pink, 2015). The decisions made in capital budgeting reverberate through the hospital’s long-term viability. Prudent choices lead to sustainable growth, while poor decisions can result in financial strain and instability.

Problems of Investing Too Little and Too Much

Underinvestment may impede expansion prospects, jeopardize the hospital’s competitive edge, and restrict its capacity to adjust to changing healthcare demands. Overinvestment, while reflecting ambitious growth, can lead to financial strain, inefficient resource allocation, and increased vulnerability to market fluctuations. Striking a balance between underinvestment and overinvestment is a perpetual challenge. It requires an in-depth comprehension of the hospital’s financial capability, market dynamics, and strategic goals.

Conclusion

In conclusion, this report comprehensively explores key financial considerations for the hospital. It navigates through corporate capital choices, the intricacies of capital budgeting, and the estimation of the cost of debt and equity. The hospital can unlock its financial potential by leveraging contributions, engaging creditors, collaborating with banks, and establishing relationships with suppliers. This report serves as a foundation for the Board to understand the financial landscape and make informed decisions as they navigate potential investments. As the Chairman invites potential investors, this report is a call to action for the Board to capitalize on the hospital’s strengths and opportunities. Embracing prudent capital budgeting practices and acknowledging the risks of underinvestment and overinvestment will guide the hospital toward sustainable growth and success.

References

Becchetti, L. (2018b). Equity dilution, small ticket problem and coordination inefficiency in venture capital financing of Innovation. Finance, Investment and Innovation, 67–87. https://doi.org/10.4324/9781351068284-3

Fargher, N., Sidhu, B. K., Tarca, A., & van Zyl, W. (2018). Accounting for financial instruments with characteristics of debt and equity: Finding a way forward. Accounting & Finance, 59(1), 7–58. https://doi.org/10.1111/acfi.12280

Gapenski, L. C., & Pink, G. H. (2015). Understanding Healthcare Financial Management. Health Administration Press.

Kim, B., Shim, E., & Reinschmidt, K. F. (2013). Probability distribution of the project payback period using the equivalent cash flow decomposition. The Engineering Economist, 58(2), 112–136. https://doi.org/10.1080/0013791x.2012.760696

Marr, B., & Creelman, J. (2011). Aligning financial management with strategic goals. More with Less, 134–156. https://doi.org/10.1057/9780230300408_7

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Strategic Financial Management Positioning Report Part III

Assignment Details

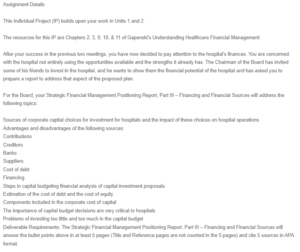

This Individual Project (IP) builds upon your work in Units 1 and 2.

The resources for this IP are Chapters 2, 3, 9, 10, & 11 of Gapenski’s Understanding Healthcare Financial Management.

After your success in the previous two meetings, you have now decided to pay attention to the hospital’s finances. You are concerned with the hospital not entirely using the opportunities available and the strengths it already has. The Chairman of the Board has invited some of his friends to invest in the hospital, and he wants to show them the financial potential of the hospital and has asked you to prepare a report to address that aspect of the proposed plan.

For the Board, your Strategic Financial Management Positioning Report, Part III – Financing and Financial Sources will address the following topics:

Sources of corporate capital choices for investment for hospitals and the impact of these choices on hospital operations

Advantages and disadvantages of the following sources:

Contributions

Creditors

Banks

Suppliers

Cost of debt

Financing

Steps in capital budgeting financial analysis of capital investment proposals

Estimation of the cost of debt and the cost of equity

Components included in the corporate cost of capital

The importance of capital budget decisions are very critical to hospitals

Problems of investing too little and too much in the capital budget

Deliverable Requirements: The Strategic Financial Management Positioning Report, Part III – Financing and Financial Sources will answer the bullet points above in at least 5 pages (Title and Reference pages are not counted in the 5 pages) and cite 5 sources in APA format.