Strategic Analysis for Bed Bath and Beyond Company

Bed Bath & Beyond’s Current Financial Plan

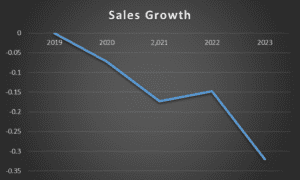

Sales Growth

Figure 1

Sales Growth Graph

The sales figures over the previous four years indicate a continuous drop. Sales growth rates have steadily declined since 2019, when there was no increase, with a significant decline of -32.07% in 2023. This downward pattern suggests that the business may have trouble bringing in money. Declining sales growth rates directly impact the revenue of a corporation. Bed Bath & Beyond’s top-line revenue is probably declining, which may impact its capacity to pay bills, invest in expansion possibilities, or pay off debt (Raviv et al., 2017). A tendency to drop sales may signal heightened competition or a change in customer preferences. Bed Bath & Beyond should, therefore, examine tactics to adjust to shifting market conditions and thoroughly evaluate its competitive posture.

Bed Bath & Beyond has to concentrate on effective cost management as a remedy for falling sales. This entails assessing costs, streamlining processes, and lowering overhead to retain profitability or reduce losses. If Bed Bath & Beyond has a lot of debt, a downward sales trend might make it easier to pay. The business should constantly monitor its debt levels and, if required, look into refinancing or restructuring possibilities (Raviv et al., 2017). Investor confidence may be badly impacted by declining sales growth. Therefore, the company should explain its strategic strategy and attempt to reverse the sales slump to keep or rebuild investor faith. To stop the decrease in sales, Bed Bath & Beyond should consider launching strategic initiatives (Raviv et al., 2017). This can entail developing new products, entering new markets, enhancing the online purchasing experience, or updating marketing and branding plans.

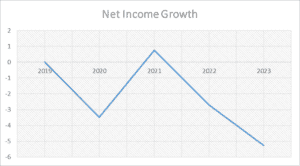

Net Income Growth

Figure 2

Net Income Growth Graph

Over the five years, there have been considerable variations in the net income data. The corporation saw significantly negative growth in 2020 and 2023, with net income falling by -347.31% and -525.21%, respectively. These startling numbers show how unstable the company’s financial performance has been. Bed Bath & Beyond experienced losses in 2020, 2022, and 2023. The losses were terrible between 2020 and 2023. These losses show that the company’s spending and costs over these years surpassed its revenue, which may be short-term sustainable. The business’s profitability is under much stress (Lawrence, 2022). An ongoing reduction in net income growth and losses over several years raises the possibility that Bed Bath & Beyond is dealing with severe competitive challenges or operational inefficiencies.

Moreover, investor confidence can be harmed by declining net income, which can also decrease shareholder value. Investors can start to worry about the business’s capacity to make money, distribute dividends, or finance expansion plans (Lawrence, 2022). The corporation may have established effective tactics to increase profitability in 2021, judging by the company’s favorable net income growth for that year. Focusing on locating and reenacting the elements that led to this growth should be the main objective of the financial strategy.

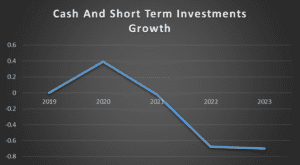

Cash and Short-Term Investments Growth

Figure 3

Cash and Short-Term Investments Growth Graph

A significant rise of 39.33% in cash and short-term investments was seen by Bed Bath & Beyond in 2020. This implies that the business successfully produced a large quantity of cash during that year, either due to cost-cutting initiatives or adjustments to its operational activities. However, the positive cash growth in 2020 was immediately followed by back-to-back years of negative cash and short-term investment growth in 2021, 2022, and 2023. The unfavourable patterns show that the firm’s cash situation has been deteriorating, which may be the reason for the alarm. The long-term viability of cash flow should be considered in Bed Bath & Beyond’s financial strategy (Holman, 2023). It is crucial to know if the positive cash growth in 2020 was a one-time occurrence or if it may be repeated in subsequent years. The ensuing negative growth can signify enduring difficulties with financial management.

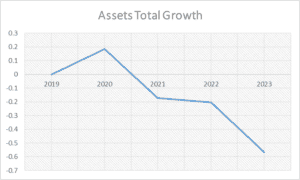

Assets Total Growth

Figure 3

Assets Total Growth Graph

The corporation saw a significant rise in total assets of 18.57% in 2020. This may indicate increasing investments, acquisitions, or better asset management, among other things. Bed Bath & Beyond then saw negative asset growth three years in a row, from 2021 to 2023. This pattern suggests that the company’s assets have been declining, which might raise questions about its long-term capacity to maintain its financial stability (Holman, 2023). Declining total assets may impact the ability of a corporation to operate. It could make paying debts, financing expansion, or supporting growth plans harder.

Recommendations for Improvement

It is recommended that the company carefully monitor its debt to avoid the tendency of a drop in sales, making it difficult for Bed Bath & Beyond to pay off the debts. In addition, to maintain the inventors’ faith in the company, the company must publicly discuss its strategic strategy and attempts to turn around the sales drop. Also, to stop the fall in revenue, Bed Bath & Beyond should consider taking strategic measures. This might entail developing new products, entering new markets, enhancing the online shopping experience, or updating marketing and branding plans. Additionally, it is recommended that the corporation should specify how it wants to divide up its cash and short-term investments in the financial strategy. It should consider whether investments are being made to promote economic efforts, reduce debt, or preserve financial stability during trying times.

Moreover, it is recommended that the company should carefully assess its investment plan if it wants to expand. This might involve investing in technology, brand-new product lines, or market expansion to boost sales and asset growth. Also, Bed Bath & Beyond’s financial strategy should include a risk assessment considering external factors that influence asset growth, such as market conditions, competition, and regulatory changes.

Strategies for Achieving a Sustainable Competitive Advantage

Product and Merchandise Differentiation

To provide distinctive and popular goods, Bed Bath & Beyond can create original brands or collaborate with existing brands. The company should also invest in private-label goods of superior quality that are reasonably priced and give higher profits.

Customer Experience and Engagement

Bed Bath & Beyond should personalize the shopping experience, provide product recommendations, and present targeted discounts using data analytics. By adding engaging displays, knowledgeable employees, and welcoming places for customers to shop, stores may improve their in-store experience. To enable cross-platform shopping, returns, and service access for customers, the company can easily combine online and physical distribution channels.

Digital Transformation

Further, Bed Bath & Beyond should maintain the expansion of its online presence while enhancing the website’s user interface. It can create a mobile app that is easy to use for promotions, loyalty schemes, and buying. It can also utilize data analytics to discover patterns in consumer behaviour and preferences to guide marketing and stocking decisions (Thompson et al., 2013).

Supply Chain Optimization

Bed Bath & Beyond can reduce concerns with overstocking and understocking by implementing comprehensive inventory management technologies. Delivery times and costs can be reduced by optimizing order fulfilment procedures (Thompson et al., 2013). To simplify the supply chain and increase product accessibility, the company should work closely with suppliers.

Cost Management

For efficient cost management, Bed Bath & Beyond should continually evaluate and enhance operating procedures to cut expenses. The company should also reduce the cost of buying by negotiating advantageous terms with suppliers and making investments in energy-efficient devices to save operational costs.

Customer Loyalty

The loyalty program could be improved to provide more alluring incentives, exclusive discounts, and early access to deals. By providing rewards, consumers will be encouraged to recommend friends and family.

Marketing and Branding

The company can consider a rebranding strategy to update the brand’s image and appeal to a younger audience. To reach particular client categories and increase sales, Bed Bath & Beyond can use customized digital advertising.

Corporate Social Responsibility

Regarding corporate social responsibility, companies can adopt eco-friendly and sustainable business methods for product sourcing and retail operations (Thompson et al., 2013). Participating in community-based projects is also advisable to improve the company’s brand and foster goodwill.

The Plan to Implement the Strategies

The plan to implement the strategies should start with a detailed strategic review of the market conditions, consumer preferences, and competitive environment. The second step is reviewing the SWOT analysis of the current strategies, strengths, weaknesses, opportunities, and threats for Bed Bath & Beyond. The third step includes aligning the chosen tactics with the organization’s long-term mission, vision, and guiding principles. The fourth step is establishing clear, quantifiable, and time-bound objectives for each plan. Next, Bed Bath & Beyond should set objectives, for instance, for cost-cutting, customer happiness, market share increase, and revenue growth.

Furthermore, the fifth step includes establishing key performance indicators (KPIs) to gauge each strategy’s effectiveness and progress and establishing the funds and resources needed to implement each approach successfully. Next, the sixth step includes strategically allocating funds to ensure the most important programs get their support. Finally, the company should introduce referral schemes to increase client loyalty and add more significant incentives and prizes to the existing loyalty program.

References

Holman, J. (2023). A scramble to fill the gaps left by bed, bath &beyond. The New York Times, B1-L.

Lawrence, K. (2022). Bed Bath & Beyond: Down the drain? SAGE Publications: SAGE Business Cases Originals.

Raviv, A., Thompson, T., Gresh, P., & Hennessy, S. (2017). Bed Bath & Beyond: The capital structure decision. Kellogg School of Management Cases, pp. 1–14.

Thompson, A., Peteraf, M., Gamble, J., Strickland III, A. J., & Jain, A. K. (2013). Crafting & executing strategy 19/e: The quest for competitive advantage: Concepts and cases. McGraw-Hill Education.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Strategic Analysis for Bed Bath and Beyond Company

In Wk 2, you completed a SWOT analysis on a successful company that demonstrated a sustainable competitive advantage in the marketplace. Now, you will shift your focus to look at a company that is failing or experiencing challenges in the area of financial performance.

Select and research a company that is having financial difficulties or is on the brink of bankruptcy.

Review “Where Can I Find a Company’s Annual Report and Its SEC Filings?” from Investopedia.

You can also access specific information about a variety of businesses in the University Library by searching the following databases:

University Library > Research Databases > B > Business Source Complete

University Library > Research Databases > E > EDGAR

University Library > Research Databases > P > Plunkett Research Online

Conduct a strategic analysis of the company’s current financial operations. Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

Write a 1,050- to 1,400-word analysis. When writing your analysis, complete the following:

Evaluate the company’s current financial plan, including charts and/or graphs showing financial data from the struggling company, and make recommendations for improvement.

Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

Create a plan to implement the strategies you selected.

Include APA-formatted, in-text citations and a reference page with at least 3 sources.