Stockholder Rights, Cash Flow, and Company Valuation

Legal Rights and Privileges of Common Stockholders

Common stockholders enjoy various rights and privileges under the law. First, they have the right to influence an organization’s decision-making process and have voting rights. Second, they have the right to ownership of the company and a right to free transfer of ownership. Third, common stockholders have the right to inspect corporate documents. Finally, common stockholders enjoy the privilege of suing for illegal acts.

Free Cash Flow (FCF), Weighted Average Cost of Capital, and Free Cash Flow Valuation Model

Free cash flow is an organization’s funds in its accounts after paying capital expenditures and operating expenses. When the free cash flow of a company is high, it is likely to explore growth opportunities and allocate dividends (Dirman, 2020). The weighted average cost of capital (WACC) is the rate an organization is expected to pay on average to all holders of financial instruments such as shares, securities, and debt. Often, WACC is also known as the organization’s cost of capital. The free cash flow model is a method that approximates the value of a company at present by discounting the future cash inflows of the company using the weighted average cost of capital. The model states that the intrinsic value of a firm equals the present value of its free cash flow.

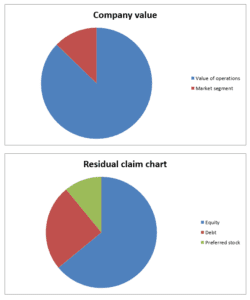

Company Value and Residual Claim Pie Chart

The first chart indicates two potential sources that comprise a firm’s total value. They include the market segment served by the company and that of its operations. The second chart indicates that there are three claims on the company value. The claims are made by equity holders, debt holders, and preferred stockholders. Notably, equity holders have the most considerable portion of the claim in the company. Debt holders should come first in making a claim, followed by preferred stockholders and equity holders.

Present Value

Present value of expected cash flow= FCF 1/ (WACC-gL)

Present value of expected cash flow= FCF 0(1+gL)/ (WACC-gL)

References

Dirman, A. (2020). Financial distress: the impacts of profitability, liquidity, leverage, firm size, and free cash flow. International Journal of Business, Economics and Law, 22(1), 17-25.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

This assignment aims to explain core stock concepts, analyze the ethical implications of decisions, and promote ethical standards within organizations.

Stockholder Rights, Cash Flow, and Company Valuation

Read Chapter 7, Mini Case in Financial Management: Theory and Practice. Using complete sentences and academic vocabulary, please answer questions A through d.

Using the mini case information, write a 250-500 word report presenting potential ethical issues that may arise from expanding into other related fields. In your discussion, proactively strategize about possible expansion by explaining opportunities to promote ethical standards within your organization.

While APA style is not required for the body of this assignment, solid academic writing is expected, and documentation of sources should be presented using APA formatting guidelines, which can be found in the APA Style Guide in the Student Success Center.

This assignment uses a rubric. Please review the rubric before beginning the assignment to familiarize yourself with the expectations for successful completion.

MINI CASE

Your employer, a midsized human resources management company, is considering expanding into related fields, including acquiring Temp Force Company. This employment agency supplies word processor operators and computer programmers to businesses with temporarily heavy workloads. Your employer is also considering the purchase of Biggerstaff & McDonald (B&M), a privately held company owned by two friends, each with 5 million shares of stock. B&M currently has a free cash flow of $24 million, expected to grow at a constant rate of 5%. B&M’s financial statements report short-term investments of $100 million, debt of $200 million, and preferred stock of $50 million. B&M’s weighted average cost of capital (WACC) is 11%. Answer the following questions:

- Describe briefly the legal rights and privileges of common stockholders.

- What is free cash flow (FCF)? What is the weighted average cost of capital? What is the free cash flow valuation model?

- Use a pie chart to illustrate the sources that comprise a hypothetical company’s total value. Using another pie chart, show the claims on a company’s value. How is equity a residual claim?

- Suppose the free cash flow at Time 1 is expected to grow at a constant rate of gL forever. If gL, WACC, what is a formula for the present value of expected free cash flows when discounted at the WACC? If the most recent free cash flow is expected to grow at a constant rate of gL forever (and gL, WACC), what is a formula for the present value of expected free cash flows when discounted at the WACC?