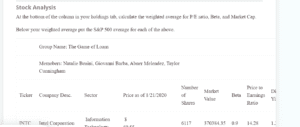

Stock Analysis

At the bottom of the column in your holdings tab, calculate the weighted average for P/E ratio, Beta, and Market Cap. Below your weighted average put the S&P 500 average for each of the above.

| Group Name: The Game of Loans | |||||||||||

| Memebers: Natalie Beaini, Giovanni Barba, Abner Melendez, Taylor Cunningham | |||||||||||

| Ticker | Company Desc. | Sector | Price as of 1/21/2020 | Number of Shares | Market Value | Beta | Price to Earnings Ratio | Dividend Yield | Dividend Yield | Market Capitalization(Billions) | Portfolio Weight |

| INTC | Intel Corporation | Information Technology | $ 60.55 | 6117 | 370384.35 | 0.9 | 14.28 | 1.32 | 1.96% | 287.714 | 3.70% |

| CRM | salesforce.com,inc. | Information Technology | $ 185.27 | 2000 | 370540 | 1.22 | 212 | 0 | 0.00% | 168.486 | 3.71% |

| AAPL | Apple Inc. | Information Technology | $ 316.57 | 1170 | 370386.9 | 1.28 | 25.8 | 3.08 | 0.95 | 1422 | 3.70% |

| TXN | Texas Instruments Incorporated | Information Technology | $ 130.86 | 2830 | 370333.8 | 1.21 | 25.25 | 3.6 | 2.71% | 123.224 | 3.70% |

| ADBE | Adobe Inc. | Information Technology | $ 350.00 | 1058 | 370300 | 1.05 | 63.28 | 0 | 0.00% | 185.175 | 3.70% |

| VGT | Vanguard Info Tech EFT | $ 259.30 | |||||||||

| DVA | DaVita Inc. | Health Care | $ 79.90 | 4635 | 370336.5 | 1.77 | 16.27 | 0 | 0.00% | 10.795 | 3.70% |

| JNJ | Johnson & Johnson | Health Care | $ 149.27 | 2481 | 370338.87 | 0.71 | 26.67 | 3.8 | 2.53% | 392.507 | 3.70% |

| BDX | Becton, Dickinson and Company | Health Care | $ 277.53 | 1335 | 370502.55 | 1.09 | 94.18 | 3.16 | 1.25% | 70.565 | 3.71% |

| VHT | Vanguard Health Care EFT | $ 196.80 | |||||||||

| C | CitiGroup | Financials | $ 76.74 | 4826 | 370347.24 | 1.77 | 9.8 | 2.08 | 2.58% | 166.5 | 3.70% |

| JPM | JpMorganChase | Financials | $ 132.20 | 2801 | 370292.2 | 1.14 | 12.82 | 3.6 | 2.61% | 423.927 | 3.70% |

| AIG | American International Group | Financials | $ 50.13 | 7388 | 370360.44 | 1.07 | 24.1 | 1.28 | 2.51% | 42.175 | 3.70% |

| VFH | Vanguard Financials EFT | $ 76.42 | |||||||||

| NFLX | Netflix | Communication Services | $ 338.11 | 1095 | 370230.45 | 1.48 | 92.11 | 0 | 0.00% | 166.922 | 3.70% |

| CHTR | Charter Communications, Inc. | Communication Services | $ 503.59 | 735 | 370138.65 | 1.06 | 71.8 | 0 | 0.00% | 112.31 | 3.70% |

| EA | Electronic Arts Inc. | Communication Services | $ 112.41 | 3294 | 370278.54 | 1.05 | 11.55 | 0 | 0.00% | 31.77 | 3.70% |

| VOX | Vanguard Comm. Services EFT | $ 183.14 | |||||||||

| NKE | Nike | Consumer Discretionary | $ 100.26 | 3694 | 370360.44 | 0.84 | 36.2 | 0.98 | 0.95% | 161.25 | 3.70% |

| LOW | Lowes | Consumer Discretionary | $ 120.04 | 3085 | 370323.4 | 1.27 | 33.59 | 2.2 | 1.76% | 96.131 | 3.70% |

| SBUX | Starbucks | Consumer Discretionary | $ 88.63 | 4179 | 370384.77 | 0.53 | 30.58 | 1.64 | 1.90% | 103.101 | 3.70% |

| VCR | Vanguard Consumer Disc. EFT | $ 194.02 | |||||||||

| RTN | Raytheon Company | Industrials | $ 228.99 | 1617 | 370276.83 | 0.83 | 19.05 | 3.77 | 1.66% | 63.256 | 3.70% |

| WM | Waste Management | Industrials | $ 120.41 | 3076 | 370381.16 | 0.59 | 32.16 | 2.05 | 1.65% | 53.348 | 3.70% |

| RHI | Robert Half International Inc. | Industrials | $ 62.58 | 5918 | 370348.44 | 1.38 | 15.44 | 1.24 | 2.05% | 6.989 | 3.70% |

| VIS | Vanguard Industrials EFT | S&P 500 Industrials | $ 157.75 | ||||||||

| COST | Costco | Consumer Staples | $ 313.26 | 1182 | 370273.32 | 0.9 | 37.76 | 2.6 | 0.08% | 140.616 | 3.70% |

| PG | Proctor & Gamble | Consumer Staples | $ 125.35 | 2955 | 370409.25 | 0.36 | 70.71 | 2.6 | 0.82% | 311.496 | 3.70% |

| VDC | Vanguard Consumer Staples EFT | S&P 500 Consumer Staples | $ 163.45 | ||||||||

| XOM | Exxon Mobile Corporation | Energy | $ 67.58 | 5480 | 370338.4 | 1.03 | 18.06 | 3.48 | 5.71% | 256.791 | 3.70% |

| RDS-A | Royal Dutch Shell plc | Energy | $ 57.46 | 6456 | 370961.76 | 0.82 | 12.95 | 3.76 | 7.37% | 185.976 | 3.71% |

| VDE | Vanguard Energy EFT | S&P 500 Energy | $ 78.19 | ||||||||

| EIX | Edison International | Utilities | $ 78.20 | 4736 | 370355.2 | 0.21 | 0 | 2.55 | 3.30% | 27.662 | 3.70% |

| VPU | Vanguard Utilities EFT | S&P 500 Utilities | $ 148.49 | ||||||||

| HST | Host Hostels & Resorts | Real Estate | $ 16.65 | 22245 | 370379.25 | 1.28 | 10.91 | 0.8 | 4.74% | 12.127 | 3.70% |

| VNQ | Vanguard Real Estate EFT | S&P 500 Real Estate | $ 95.62 | ||||||||

| NUE | Nucor Corp | Materials | $ 49.19 | 7530 | 370400.7 | 1.64 | 11.39 | 1.61 | 3.36% | 14.23 | 3.70% |

| VAW | Vanguard Materials EFT | S&P 500 Materials | $ 131.77 | 0 | |||||||

| Weighted Averages | 87.7821188 | 0.0003 | 0.009030267 | ||||||||

| S&P 500 Averages | 43891.0594 | 0.125 | 4.515133693 | ||||||||

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Stock Analysis

At the bottom of the column in your holdings tab, calculate the weighted average for P/E ratio, Beta, and Market Cap.

Stock Analysis

Below your weighted average put the S&P 500 average for each of the above.

| Group Name: The Game of Loans | |||||||||||

| Memebers: Natalie Beaini, Giovanni Barba, Abner Melendez, Taylor Cunningham | |||||||||||

| Ticker | Company Desc. | Sector | Price as of 1/21/2020 | Number of Shares | Market Value | Beta | Price to Earnings Ratio | Dividend Yield | Dividend Yield | Market Capitalization(Billions) | Portfolio Weight |

| INTC | Intel Corporation | Information Technology | $ 60.55 | 6117 | 370384.35 | 0.9 | 14.28 | 1.32 | 1.96% | 287.714 | 3.70% |

| CRM | salesforce.com,inc. | Information Technology | $ 185.27 | 2000 | 370540 | 1.22 | 212 | 0 | 0.00% | 168.486 | 3.71% |

| AAPL | Apple Inc. | Information Technology | $ 316.57 | 1170 | 370386.9 | 1.28 | 25.8 | 3.08 | 0.95 | 1422 | 3.70% |

| TXN | Texas Instruments Incorporated | Information Technology | $ 130.86 | 2830 | 370333.8 | 1.21 | 25.25 | 3.6 | 2.71% | 123.224 | 3.70% |

| ADBE | Adobe Inc. | Information Technology | $ 350.00 | 1058 | 370300 | 1.05 | 63.28 | 0 | 0.00% | 185.175 | 3.70% |

| VGT | Vanguard Info Tech EFT | $ 259.30 | |||||||||

| DVA | DaVita Inc. | Health Care | $ 79.90 | 4635 | 370336.5 | 1.77 | 16.27 | 0 | 0.00% | 10.795 | 3.70% |

| JNJ | Johnson & Johnson | Health Care | $ 149.27 | 2481 | 370338.87 | 0.71 | 26.67 | 3.8 | 2.53% | 392.507 | 3.70% |

| BDX | Becton, Dickinson and Company | Health Care | $ 277.53 | 1335 | 370502.55 | 1.09 | 94.18 | 3.16 | 1.25% | 70.565 | 3.71% |

| VHT | Vanguard Health Care EFT | $ 196.80 | |||||||||

| C | CitiGroup | Financials | $ 76.74 | 4826 | 370347.24 | 1.77 | 9.8 | 2.08 | 2.58% | 166.5 | 3.70% |

| JPM | JpMorganChase | Financials | $ 132.20 | 2801 | 370292.2 | 1.14 | 12.82 | 3.6 | 2.61% | 423.927 | 3.70% |

| AIG | American International Group | Financials | $ 50.13 | 7388 | 370360.44 | 1.07 | 24.1 | 1.28 | 2.51% | 42.175 | 3.70% |

| VFH | Vanguard Financials EFT | $ 76.42 | |||||||||

| NFLX | Netflix | Communication Services | $ 338.11 | 1095 | 370230.45 | 1.48 | 92.11 | 0 | 0.00% | 166.922 | 3.70% |

| CHTR | Charter Communications, Inc. | Communication Services | $ 503.59 | 735 | 370138.65 | 1.06 | 71.8 | 0 | 0.00% | 112.31 | 3.70% |

| EA | Electronic Arts Inc. | Communication Services | $ 112.41 | 3294 | 370278.54 | 1.05 | 11.55 | 0 | 0.00% | 31.77 | 3.70% |

| VOX | Vanguard Comm. Services EFT | $ 183.14 | |||||||||

| NKE | Nike | Consumer Discretionary | $ 100.26 | 3694 | 370360.44 | 0.84 | 36.2 | 0.98 | 0.95% | 161.25 | 3.70% |

| LOW | Lowes | Consumer Discretionary | $ 120.04 | 3085 | 370323.4 | 1.27 | 33.59 | 2.2 | 1.76% | 96.131 | 3.70% |

| SBUX | Starbucks | Consumer Discretionary | $ 88.63 | 4179 | 370384.77 | 0.53 | 30.58 | 1.64 | 1.90% | 103.101 | 3.70% |

| VCR | Vanguard Consumer Disc. EFT | $ 194.02 | |||||||||

| RTN | Raytheon Company | Industrials | $ 228.99 | 1617 | 370276.83 | 0.83 | 19.05 | 3.77 | 1.66% | 63.256 | 3.70% |

| WM | Waste Management | Industrials | $ 120.41 | 3076 | 370381.16 | 0.59 | 32.16 | 2.05 | 1.65% | 53.348 | 3.70% |

| RHI | Robert Half International Inc. | Industrials | $ 62.58 | 5918 | 370348.44 | 1.38 | 15.44 | 1.24 | 2.05% | 6.989 | 3.70% |

| VIS | Vanguard Industrials EFT | S&P 500 Industrials | $ 157.75 | ||||||||

| COST | Costco | Consumer Staples | $ 313.26 | 1182 | 370273.32 | 0.9 | 37.76 | 2.6 | 0.08% | 140.616 | 3.70% |

| PG | Proctor & Gamble | Consumer Staples | $ 125.35 | 2955 | 370409.25 | 0.36 | 70.71 | 2.6 | 0.82% | 311.496 | 3.70% |

| VDC | Vanguard Consumer Staples EFT | S&P 500 Consumer Staples | $ 163.45 | ||||||||

| XOM | Exxon Mobile Corporation | Energy | $ 67.58 | 5480 | 370338.4 | 1.03 | 18.06 | 3.48 | 5.71% | 256.791 | 3.70% |

| RDS-A | Royal Dutch Shell plc | Energy | $ 57.46 | 6456 | 370961.76 | 0.82 | 12.95 | 3.76 | 7.37% | 185.976 | 3.71% |

| VDE | Vanguard Energy EFT | S&P 500 Energy | $ 78.19 | ||||||||

| EIX | Edison International | Utilities | $ 78.20 | 4736 | 370355.2 | 0.21 | 0 | 2.55 | 3.30% | 27.662 | 3.70% |

| VPU | Vanguard Utilities EFT | S&P 500 Utilities | $ 148.49 | ||||||||

| HST | Host Hostels & Resorts | Real Estate | $ 16.65 | 22245 | 370379.25 | 1.28 | 10.91 | 0.8 | 4.74% | 12.127 | 3.70% |

| VNQ | Vanguard Real Estate EFT | S&P 500 Real Estate | $ 95.62 | ||||||||

| NUE | Nucor Corp | Materials | $ 49.19 | 7530 | 370400.7 | 1.64 | 11.39 | 1.61 | 3.36% | 14.23 | 3.70% |

| VAW | Vanguard Materials EFT | S&P 500 Materials | $ 131.77 | 0 | |||||||

| Transaction | Company Name | Shares | Transaction Price | Amount | Cash Balance | Notes | ||

| Cash Deposit | $10,000,000.00 | $10,000,000.00 | ||||||

| BUY | Intel Corporation | 6117 | $ 60.55 | $370,384.35 | $9,629,615.65 | 6116.769123 | 370370.3704 | |

| BUY | salesforce.com,inc. | 2000 | $ 185.27 | $370,540.00 | $9,259,075.65 | 1999.084419 | ||

| BUY | Apple Inc. | 1170 | $ 316.57 | $370,386.90 | $8,888,688.75 | 1169.947785 | ||

| BUY | Texas Instruments Incorporated | 2830 | $ 130.86 | $370,333.80 | $8,518,354.95 | 2830.279462 | ||

| BUY | Adobe Inc. | 1058 | $ 350.00 | $370,300.00 | $8,148,054.95 | 1058.201058 | ||

| BUY | DaVita Inc. | 4635 | $ 79.90 | $370,336.50 | $7,777,718.45 | 4635.42391 | ||

| BUY | Johnson & Johnson | 2481 | $ 149.27 | $370,338.87 | $7,407,379.58 | 2481.211029 | ||

| BUY | Becton, Dickinson and Company | 1335 | $ 277.53 | $370,502.55 | $7,036,877.03 | 1334.523728 | ||

| BUY | CitiGroup | 4826 | $ 76.74 | $370,347.24 | $6,666,529.79 | 4826.301412 | ||

| BUY | JpMorganChase | 2801 | $ 132.20 | $370,292.20 | $6,296,237.59 | 2801.591304 | ||

| BUY | American International Group | 7388 | $ 50.13 | $370,360.44 | $5,925,877.15 | 7388.198092 | ||

| BUY | Netflix | 1095 | $ 338.11 | $370,230.45 | $5,555,646.70 | 1095.413831 | ||

| BUY | Charter Communications, Inc. | 735 | $ 503.59 | $370,138.65 | $5,185,508.05 | 735.460137 | ||

| BUY | Electronic Arts Inc. | 3294 | $ 112.41 | $370,278.54 | $4,815,229.51 | 3294.816923 | ||

| BUY | Nike | 3694 | $ 100.26 | $370,360.44 | $4,444,869.07 | 3694.099046 | ||

| BUY | Lowes | 3085 | $ 120.04 | $370,323.40 | $4,074,545.67 | 3085.391289 | ||

| BUY | Starbucks | 4179 | $ 88.63 | $370,384.77 | $3,704,160.90 | 4178.837531 | ||

| BUY | Raytheon Company | 1617 | $ 228.99 | $370,276.83 | $3,333,884.07 | 1617.408491 | ||

| BUY | Waste Management | 3076 | $ 120.41 | $370,381.16 | $2,963,502.91 | 3075.910393 | ||

| BUY | Robert Half International Inc. | 5918 | $ 62.58 | $370,348.44 | $2,593,154.47 | 5918.350437 | ||

| BUY | Costco | 1182 | $ 313.26 | $370,273.32 | $2,222,881.15 | 1182.309808 | ||

| BUY | Proctor & Gamble | 2955 | $ 125.35 | $370,409.25 | $1,852,471.90 | 2954.689831 | ||

| BUY | Exxon Mobile Corporation | 5480 | $ 67.58 | $370,338.40 | $1,482,133.50 | 5480.473074 | ||

| BUY | Royal Dutch Shell plc | 6456 | $ 57.46 | $370,961.76 | $1,111,171.74 | 6445.707803 | ||

| BUY | Edison International | 4736 | $ 78.20 | $370,355.20 | $740,816.54 | 4736.193995 | ||

| BUY | Host Hostels & Resorts | 22245 | $ 16.65 | $370,379.25 | $370,437.29 | 22244.46669 | ||

| BUY | Nucor Corp | 7530 | $ 49.19 | $370,400.70 | $36.59 | 7529.383419 | ||

| $9,999,963.41 |