Quantitative Easing during the Great Recession

The Effect of the Financial Crisis on the Financial Sector

The 2007/2008 financial crisis resulted from subprime mortgages transformed into collateralized debt and sold to foreign banks. In the short term, banks lost money due to mortgage defaults. That led to an interbank lending freeze since there was little money. Besides, lending to individuals and businesses dried up. In the long run, the crisis spawned new regulatory frameworks that affected the US and the global banking industry (Cecchetti, 2009). Measures implemented after the financial crisis sought to shield users and banks themselves. These measures revolved around allowances, debt management, and liquidity. Consequently, banks were held to high liquidity standards regarding assets and cash.

Quantitative Easing (QE)

The Federal Reserve used quantitative easing in the aftermath of the 2008 financial crisis as a monetary policy tool to normalize operations in the banking sector. Quantitative easing is an economic tool used by central banks to purchase assets from the open market to increase money circulation and credit availability (Schulze, 2017). The agency specifically targeted long-term securities from member commercial banks in the US. QE increased money circulation in the economy, thus reducing interest rates. Declining interest rates meant it was now cheaper for members to borrow money. As commercial banks traded through quantitative easing, they received cash, thus lending out the extra money.

Quantitative easing also sought to reduce bank reserve requirements. Banks sought to lower interest rates in a multipronged approach while increasing the money available for lending. Dwindling bank reserves encouraged them to lend more. That led to increased money circulation in public, which led to a reduction in interest rates. With reduced interest rates, more people are encouraged to borrow. For instance, a 10% bank reserve implies that a $ 1 trillion Federal Reserve credit could lead to $10 trillion in economic growth.

Impact of QE

One of the most profound impacts of quantitative easing is that it reduces bond yields. The demand rose as the Federal Reserve bought treasuries from banks and the federal government. Since there is a reverse relationship between bond prices and products, the yields will be low since costs are high (caused by increased demand) (Schulze, 2017). These effects are reflected in the interest rates for both average debt rates and long-term fixed rates like mortgage rates.

Quantitative easing also played a part in attracting foreign investment into US firms, including banks. Increasing the money supply keeps the currency value low, attracting foreign investors. Such investments are attractive because investors expect more money from US stocks (Villanueva, 2015). Also, the cost of exports tends to reduce after implementing quantitative easing.

Despite the positive benefits of QE, however, is that it can potentially lead to inflation. For instance, before the Great Recession, the Federal Reserve’s balance sheet stood at $1 trillion in 2008 but increased to $4.5 trillion by 2014 (Schulze, 2017). That means the Fed dollars were making more than those circulating in the economy. The dollar’s value drops with time, meaning it can only buy less.

Sustainability of QE

Although quantitative easing helped the US achieve its goals, it failed on some and created an asset bubble. The Fed restored trust by moving toxic mortgage loans from commercial banks’ balance sheets and allowed banking operations to continue. QE also helped revitalize the US economy by providing the funds needed to get the economy out of recession. The success shows that QE is effective in the long run since it restores confidence in the banking sector.

References

Cecchetti, S. G. (2009). Crisis and Responses: The Federal Reserve in the Early Stages of the Financial Crisis. Journal of Economic Perspectives, 23(1), 51–75. https://doi.org/10.1257/jep.23.1.51

Schulze, E. (2017, November 25). The Fed launched QE nine years ago — these four charts show its impact. CNBC; CNBC. https://www.cnbc.com/2017/11/24/the-fed-launched-qe-nine-years-ago–these-four-charts-show-its-impact.html

Villanueva, M. (2015). Quantitative Easing and US Stock Prices. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2656329

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Quantitative Easing during the Great Recession

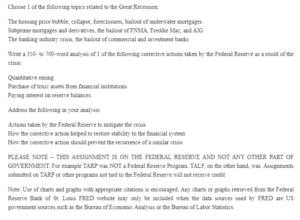

Choose 1 of the following topics related to the Great Recession:

The housing price bubble, collapse, foreclosures, bailout of underwater mortgages

Subprime mortgages and derivatives, the bailout of FNMA, Freddie Mac, and AIG

The banking industry crisis, the bailout of commercial and investment banks

Write a 350- to 700-word analysis of 1 of the following corrective actions taken by the Federal Reserve as a result of the crisis:

Quantitative easing

Purchase of toxic assets from financial institutions

Paying interest on reserve balances

Address the following in your analysis:

Actions taken by the Federal Reserve to mitigate the crisis

How the corrective action helped to restore stability to the financial system

How the disciplinary action should prevent the recurrence of a similar crisis

PLEASE NOTE – THIS ASSIGNMENT IS ON THE FEDERAL RESERVE AND NOT ANY OTHER PART OF GOVERNMENT. For example, TARP was NOT a Federal Reserve Program. TALF, on the other hand, was. Assignments submitted on TARP or other programs not tied to the Federal Reserve will not receive credit.

Note: Use of charts and graphs with appropriate citations is encouraged. Any diagrams or graphs retrieved from the Federal Reserve Bank of St. Louis FRED website may only be included when the data sources used by FRED are US government sources such as the Bureau of Economic Analysis or the Bureau of Labor Statistics.