Peer Response

Responding to Elizabeth MacDonald

Hello,

Thank you for the discussion post. Your experience with the Econland rollercoaster scenario depicts a delicate balance between public approval and economic growth. I take note that investment rates and corporate taxes were increased resulting in a GDP growth, which is quite intriguing. Notably, this is so because this does not receive a higher approval rating: Peer Response.

It reflects the true world economic experience, whereby long-term growth is not always popular with the public. I agree with you that an open economy like Econland is highly influenced by external factors such as global interest rates and trade. I would like to add that consumer confidence should be highly considered because when people fear economic instability, their expenditure will reduce.

Notably, this will slow down economic growth (Mankiw, 2024). I wonder whether the reduction in economic activities during the COVID-19 pandemic as people faced economic uncertainty could be used as real-world applicability of the concept.

Reference

Mankiw N. G. (2024). Principles of economics (10th ed.). Cengage Learning.

Responding to Liam Bradbury

Hello,

Thank you for sharing your discussion post. Your success in the stagnation scenario is quite impressive. I am glad you achieved high economic growth while controlling unemployment and inflation. I think you mastered balancing government spending, interest rates, and tax adjustments, which is crucial in implementing an economic policy.

The fluctuations in budget deficits in your simulation highlight the true-world dilemma that drivers of economic policy face when attempting to stimulate growth without increasing national debt excessively. I agree with you that the global economic outlook shapes policy decisions. The provided example of the U.S. Federal Reserve adjusting interest rates in response to changes in international market conditions emphasizes how economies are interconnected.

Further, your discussion of consumer sentiment is in line with the findings of my discussion post, whereby economies use stimulus measures to restore confidence during economic downturns (Mankiw, 2024). Notably, this can be associated with real-world economic policies.

Reference

Mankiw N. G. (2024). Principles of economics (10th ed.). Cengage Learning.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Post by Elizabeth MacDonald

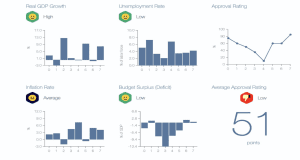

I chose the rollercoaster scenario for Econland. The simulation was interesting and eye opening to how small changes to policies can affect the economy and the health of Econland. For me, making the investment rate higher and also making the corporate tax higher led to more GDP growth. Unfortunately my approval rating was never high.

You need to think about how the global economy might impact your economy in an open economy. Because you are dealing in trade and imports and exports, you have to see how changing interest rates will affect Econland. With a closed economy, there is no trade. No exports or imports to deal with.

The simulation provides you with a global economic outlook each year because the global economy affects Econland, so you need to keep what is going on worldwide in mind and how it relates to us.

Consumer confidence plays a role in the economy because if people aren’t buying or investing, the economy gets impacted. People need to have reassurance that the economy is doing well so that they will spend money and invest, otherwise they will save their money incase of hard times. People spend less and money circulation slows down when the overall feel of the economy is uncertainty. This hurts the economy and the flow of commerce.

Mankiw N. G. (2024). Principles of economics (10th ed.). Cengage Learning.

Post by Liam Bradbury

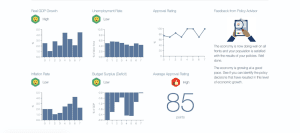

In my second run of Econland, I chose the Stagnation scenario, where I acted as the chief economic policy advisor tasked with reviving a slow-growing economy. My main challenge was to boost GDP growth while maintaining low inflation and unemployment rates. By carefully adjusting fiscal and monetary policies, I was able to achieve high economic growth, keep unemployment low, and control inflation, leading to an approval rating of 85 points.

Peer Response

Some of my most successful policy decisions included strategic government spending to stimulate demand, moderate tax adjustments to encourage investment, and managing interest rates to balance inflation and growth. Although the budget deficit fluctuated, my policies led to steady economic improvements.

The simulation provides a global economic outlook for each year because external factors, such as trade, foreign investment, and international financial conditions, significantly impact an open economy. In an open economy, government policies must account for global demand, exchange rates, and trade policies, as seen in real-world cases like the U.S. Federal Reserve adjusting interest rates based on global market conditions. In contrast, a closed economy would focus solely on domestic factors without external trade influences. In my simulation, global economic downturns made it harder to boost growth, requiring policy adjustments to maintain stability.

Consumer sentiment is a key economic indicator because it directly affects spending and investment decisions. When consumer confidence is high, people are more likely to spend, driving economic growth. When confidence is low, spending declines, leading to slower growth or even recessionary pressures. News sources often highlight consumer sentiment as a predictor of future economic conditions.

For example, during economic downturns, governments use stimulus measures to restore confidence, as seen during the 2008 financial crisis and the COVID-19 pandemic. In my simulation, monitoring consumer sentiment helped me adjust policies to maintain a stable economy, ultimately leading to positive results.

References:

Investopedia. (n.d.). Consumer sentiment. from https://www.investopedia.com/terms/c/consumer-sentiment.asp

Mankiw, N. G. (2024). Principles of economics (10th ed.). Cengage Learning