PayPal Holdings – Acquisition of Paidy

Do you need urgent assignment help ? Reach out to us. We endeavor to assist you the best way possible.

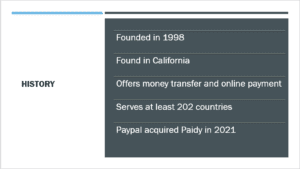

PayPal Holdings is a financial technology company that was founded in 1998. it is headquartered in California, San Jose. The company offers money transfer services through its online platform to at least 200 countries. It deals with more than 25 currencies. There are at least 325 client accounts . In 2021, PayPal acquired Paidy, a Japanese financial platform that allows clients to buy now and pay later. The acquisition was valued at approximately $2.7 billion (CNBC LLC., 2021).

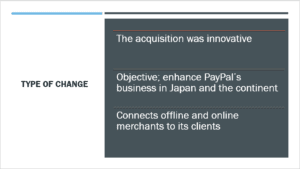

The change is innovative because it was intended to increase the company’s market share in Japan and the Asian region using a recent innovation. PayPal has at least six million clients. Paidy offers BNPL services to its clients and is a leading provider. Connecting these registered clients to the online and offline merchants should enable each to pay through PayPal. Paidy serves Japan, which is ranked third among e-commerce markets around the world. The services it offers shift clients away from the use of credit cards and increase their buying ability while reducing cart abandonment rates for websites. Therefore, PayPal’s move sought to benefit from the BNPL innovation within its business model (Park, 2021).

The acquisition can be categorized as proactive because it does not necessarily respond to any crisis or event. Instead, it seeks to incorporate the BNPL innovation in its current platform. This move will expand its market share, offer alternative services to clients who do not use credit cards and increase payments through PayPal. These aspects will not only expand the market that PayPal serves, but also increase business efficiency (PayPal, 2022).

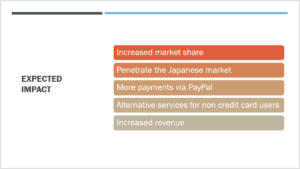

The acquisition is expected to positively impact PayPal. It will use Paidy to penetrate the Japanese market, which has significant potential for increasing revenue. Japan is a renowned region for e-marketing. The large number of people who use online platforms to purchase items will expand the company’s market share. The process of making payments via PayPal will increase the amount of money that PayPal handles on behalf of clients and merchants. The provision of alternative services for individuals who do not use credit cards is innovative because it serves various growing market needs (Park, 2021).

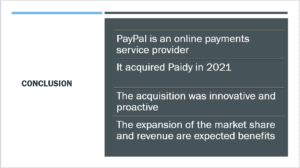

PayPal is a global service provider that facilitates online payments. It acquired Paidy in 2021, a proactive and innovative move. The expected benefits included expanding the market share, revenue, and service portfolio. Paidy provides an ideal platform to penetrate the Japanese market. Besides, online merchants may benefit as business increases due to payment flexibility.

CNBC LLC. (2021). PayPal heats up buy now, pay later race with $2.7 billion Japan deal.

Park, K. (2021). PayPal acquires Japan’s Paidy for $2.7B to crack the buy now, pay later market in Asia.

PayPal. (2022). About Us. Retrieved from Paypal: https://www.paypal.com/ke/webapps/mpp/about

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Describe the company’s history and identify the change.

Select the type of change – adaptive, innovative – or radically innovative, and explain your rationale for your selection.

Describe if the change is reactive or proactive.

Ex: Reactive type of change – BP’s reactive approach to the April 2010 explosion led to the loss of 11 lives and is the largest oil spill in US waters.

Ex: Proactive – Walt Disney investing $1 billion in wearable technology – wristbands that interact with scanners throughout the theme park, which it hopes will revolutionize the way visitors spend money at Walt Disney World.

Explain how the change has or will impact the company (positively, negatively, or both).

Conclusion – provide any recommendations or ideas that can help the company overcome the change.

Requirements

Your presentation should be approximately five slides. Have approximately 4–6 bullets per slide, and be sure to include a reference slide to show your research. at minimum, you need to have two scholarly sources. Include graphics or animations to enhance your presentation.