Mortgage-backed securities

In this paper, we first discuss mortgage-backed securities, the primary security responsible for the great financial crisis, in order to lay the foundation for the upcoming discussions. Later, we discuss the features of regulation in financial markets, as well as the specifics of the great financial crisis, such as what led to it, as well as the regulatory response after. In particular, our discussion will focus on the Dodd-Frank Wall Street Reform and Consumer Production Act, its intended effects, actual effects as well as how it fits into the general theme of regulation. Finally, we conclude with an argument for regulation and the neutrality of derivatives. Hire our assignment writing services in case your assignment is devastating you.

Given the extensive role they played in the financial collapse, it is important to understand them as a security. Mortgage-backed securities (MBS) are a type of asset-backed security (ABS) secured by the principal and interest payments of a set of mortgage loans. The mortgages are aggregated by banks and sold to government agencies or investment banks that package the loans together into a security that investors can buy in the secondary market. Residential MBS and commercial MBS are two types of MBSs that are distinguished by the nature of the real property underlying the mortgages.

The traditional MBS is known as a ‘pass-through MBS,’ where the fair value of interest and principal payments from the borrower are passed through to the MBS holder. As the MBS market grew, commercial and investment banks developed new ways of securitizing subprime mortgages by packaging them into Collateralized Debt Obligations (CDOs) and then dividing the cash flows into different tranches to attract investors with different tolerances for risk. From 2003 to 2006, CDO sales rose almost tenfold from $30 billion to $225 billion (Carla).

Most MBSs are issued and guaranteed by a federal government agency like Ginnie Mae or a government sponsored-enterprise (GSE) like Fannie Mae or Freddie Mac. However, the explosive growth of the private, non–GSE backed mortgage-backed securities (MBS) market lies at the heart of the 2007–2009 global financial crisis.

Advantages of MBS

Although they played a devastating effect on the GFC, MBS is not without benefits. Like regulations, they are neutral and depend upon those who wield them. Here, we argue for their benefits.

From the banks’ perspective, if they can securitize their debts and sell them in the secondary market, they can convert long-term debt assets into short-term liquid assets and reduce the risk of interest rate changes due to their asset-liability mismatch. Debt securitization also provides banks with another financing channel, which can reduce banks’ dependence on deposits and increase the flexibility of bank operations.

Further, externalizing their balance sheet also reduces risky assets, which can increase their capital ratio to comply with legal regulations and enhance the liquidity of the balance sheet. When banks undertake deposits, their credit rating affects the cost of obtaining funds since they rely on their capital to absorb the deposit. However, when they securitize these loans, the underlying loans become the guarantee and enable the securities to obtain a higher credit rating than the bank itself; in addition, since the funds raised do not require deposit provisions and there are no deposit insurance payment costs, the cost of capital can be reduced.

Lastly, banks can specialize in projects that they are better at to utilize comparative advantage. Banks with strong lending capabilities can undertake large amounts of real estate loans and then transfer them to other investors through securitization. Investors who want to participate in the real estate market but do not have the means to do so can then participate. Through the form of debt securitization, the principle of comparative interest is used to pursue the greatest benefits for the entire financial system.

For investors who require compensation for a long time horizon and want an alternative to stocks and bonds, these real estate securities differ from bonds in risk characteristics. They can be used to diversify asset class-specific risks. For borrowers, securitization can reduce their cost of capital. Since the banks can sell these mortgage securities to investors to obtain more funding, the supply of mortgage loans is always sufficient.

Features of financial markets which often need regulation

The features of financial markets that often need regulation involve consumer protection, where competitive forces alone cannot be relied upon to protect consumers from information asymmetry or principal-agent problems. Regulation, therefore, focuses on the major access points between unsophisticated consumers and the sophisticated financial sector (Wolak).

Other aspects of regulatory oversight govern interactions between parties to ensure fairness. Also, regulatory processes focus on policies that best protect consumers and other financial players from contagion effects when sophisticated financial players fail (Wolak).

Lastly, regulations target problems of social externalities. Since a large bank failure could undermine the entire financial system and the cost of failure is more than the costs to the failed bank’s shareholders, it is a social externality. Regulatory responses include government insurance for depositors and enforced safety capital for banks to avoid moral hazard behaviors.

Market features and conditions that constitute a financial crisis

Conditions prevalent during a financial crisis include a steep decline in value for asset prices, the inability of debtors to service their debt payments, and financial institutions suffering from liquidity shortages (Kenton).

A financial crisis is often associated with a panic or a bank run during which investors sell off assets or withdraw money from banks because they fear that the value of those assets will drop (Aliber and Kindleberger).

Primary causes and market conditions that lead to GFC

The primary causes of the financial crisis can be traced back to a number of things, such as deregulation within the financial industry, the creative securitization of mortgages, and the increase in the number of subprime mortgages as a result of deregulation as well as banks relaxing their policies on mortgages. These causes, combined with the low-interest rate environment, allow for excessive risk-taking in the assumption of perpetually favorable economic conditions (Amadeo).

The role MBS played in the GFC and how it unfolded

With the growth of mortgage-backed securities and with Fannie Mae and Freddie Mac supporting the mortgage market, lenders no longer assumed the risk of loan default. As a result, lenders started to loosen their restrictions on mortgage applicants and started to lend to subprime borrowers, those with below-average credit scores. Banks offered mortgages to anyone; many of them were unsuitable debtors who couldn’t afford conventional mortgages but were approved for interest-only loans. This was partly motivated by the Financial Institutions Reform, Recovery, and Enforcement Act, which incentivized banks to lend money to previously poor neighborhoods (Federal Deposit Insurance Corporation). By 2006, around 80% of subprime loans were made with private-label MBS.

Moreover, some innovative products were devised by lenders, such as Adjustable Rate Mortgages (ARMs). It required a low-interest rate and no down payments and some even allowed the borrower to postpone the interest due each month and add it to the loan’s principal. This new group of eligible borrowers increased housing demand and helped inflate home prices. In 2006, housing prices peaked. With large speculative opportunities, financial institutions borrowed more and more money (i.e., increased leverage) to finance their purchases of mortgage-related securities.

When the feds raised interest rates from 2005 to 2006, these owners of subprime mortgages could not afford the payments in interest, which in turn made the mortgage-backed securities worthless. Adjustable-rate mortgages began to reset at higher rates, resulting in almost doubled monthly payments. Some homeowners owed more than their house was worth. Therefore, the foreclosure rate rose, and mortgage delinquencies grew substantially. By August 2008, around 9% of all mortgages in the U.S. were in default.

Further, in 2005, supply for homes outpaced demand, causing home prices to fall (Haughwout et al.). Mortgage holders thus could not sell their homes to cover their outstanding loans. Since the home loans were intimately tied to the derivatives and the credit default swaps, the crash in the housing industry set off a contagion effect that rendered all these securities toxic as their value plummeted.

Not being able to afford the payments in mortgage interest, as well as the steep decline in the complex derivatives, which led to rapid liquidation of other portions of their portfolio as investors scrambled for cash in panic, are reminiscent features of financial crises. Financial institutions also suffered from liquidity and solvency problems as their balance sheet contained many positions against them, leading to many financial institutions declaring insolvency. Liquidity had virtually disappeared from important markets, and stock markets plunged. Credit tightened, causing many banks and financial institutions to teeter on the brink of insolvency. Following the collapse of Lehman Brothers, the entire financial sector rapidly destabilized (Julia).

Why mortgage-backed securities were not beneficial in GFC

Here, we study why the MBS might not have provided the benefit they were supposed to have in the GFC. In the GFC, MBS were speculative investments that were a product of creative financial engineering, and their inherent risks were poorly understood (Yeager). This meant that often the holders of these derivatives did not completely understand the intrinsic risks they were holding on to. Further, because the MBS were sold to hedge funds who sold to investors, the risk of default was transferred to investors, but they were unconcerned as the derivatives were hedged with credit default swaps. This meant that they explicitly assumed that these securities were risk-free and the excess returns were abnormal. This assumption would lead to reckless risk-taking instead of a careful, detailed analysis of the risk-return characteristics of the MBS.

Further, MBS was supposed to reduce the risk for the banks by converting long-term debt assets into short-term liquid assets and externalizing their balance sheet to increase their capital ratio. Instead of utilizing MBS to reduce risk, banks instead increased the risk they undertook by loading their balance sheet up with MBS, both to sell and also to speculate, and their risk models didn’t accurately model the risks they were undertaking; therefore, they took on much more risk than they were legally and operationally allowed to take. This was especially true for the broker-dealer banks, who could write the MBS and hold inventory to function as market makers.

Lastly, MBS should have allowed banks better at lending to utilize their comparative advantage so the whole financial system could benefit. Instead of a few niche banks writing the products, almost every major bank wrote the MBS or was deeply involved in lending mortgages. As a result, the entire financial system was deeply interwoven with the MBS. The deep inventory of MBS throughout the financial system meant many portfolios of the financial institutions were correlated with each other as a result of them all owning MBSs. This meant that as the value of the MBSs plummeted, a contagion effect threatened the entire financial system.

Thus, it can be observed that MBS were not beneficial during the GFC because they were not utilized to maximize their benefits and instead used as a tool for speculation and reckless risk-taking.

Response of Policymakers and regulators to GFC

During the crisis, governments worldwide structured rescue packages to support financial institutions in distress. The US Fed Reserve cut Fed Funds Rate from 5.25% to a range of 0 – 0.25%, and Congress enacted the Emergency Economic Stabilization Act (EESA) to create the Troubled Asset Relief Program (TARP) in October 2008. In addition to TARP, the Federal Reserve and Federal Deposit Insurance Corporation (FDIC) implemented broad lending and guaranty programs.

The response could be categorized into programs that served different purposes, such as increasing market liquidity through direct lending facilities by the Federal Reserve or the FDIC’s Temporary Liquidity Guarantee Program.

One of the responses aimed at increasing market liquidity is the Term Auction Facility (TAF) introduced in December 2007. It was a monetary policy designed to increase liquidity in the U.S. Credit markets. TAF allowed the Federal Reserve to auction set amounts of collateral-backed short-term loans to depository institutions. Through it, the Fed started lending reserves in substantial quantities for a relatively long period, from an initial $20 to $75 billion per auction for terms of 28 or 35 days. Another response aimed at increasing market liquidity and avoiding the risk of a deflationary spiral included central banks worldwide purchasing US$2.5 trillion of government debt and troubled private assets from banks during the last quarter of 2008.

Other programs included providing financial institutions with equity to rebuild their capital following asset write-downs or purchasing illiquid assets from financial institutions to restore confidence in their banking system, such as the Public-Private Partnership Investment Program. Under the Capital Purchase Program, $125 billion in the capital in the form of preferred share purchases was immediately provided to the nine largest banks, with another $125 billion reserved for smaller banks. Lastly, the response also included intervention in specific markets that had ceased functioning smoothly (Webel and Labonte).

After the crisis, regulators measured and studied the events and responded with policies to restore lost confidence in the banking system by providing a new compliance framework for managing traditional and alternative assets by increasing market transparency and reducing the risk in the derivatives market.

Specifically, the Alternate Investment Fund Managers Directive (AIFMD) required managers in buy-side firms to hold permissions to manage investments (Eurpopa), and the Undertakings for the Collective Investment in Transferable Securities (UCITS) is a regulatory framework based on European Union law that lays down common standards for management and sale of investment funds. Asset managers needed to meet multiple legal and regulatory criteria, so UCITS came with high levels of investor protection (Eurobank).

Further, the “US Dodd-Frank Act” was enacted to protect investors and taxpayers by prohibiting proprietary trading and investments in some private equity funds and hedge funds.

Dodd-Frank Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act (or the ‘Dodd-Frank Act’) are generally regarded as one of the most significant laws enacted since the Great Recession. It provides significant changes to the structure of federal financial regulation, which affects all Federal financial regulatory agencies and almost every aspect of the nation’s financial services industry. The Act is comprehensive in scope. It includes consumer protections with authority and independence, executive compensation and corporate governance reforms, credit rating agency regulation, new registration requirements for hedge fund and private equity fund advisers, and heightened regulation of over-the-counter derivatives and asset-backed securities. It mandates significant changes to the authority of the Federal Reserve and the Securities and Exchange Commission, as well as enhanced oversight and regulation of banks and non-bank financial institutions (David et al.).

In order to streamline the regulatory process, the law also creates some financial agencies such as the Consumer Financial Protection Bureau, the Office of Financial Research, and the Office of National Insurance. Of the existing agencies, new powers are proposed; those tasked with creating new rules and conducting studies include the Federal Deposit Insurance Corporation, the Commodity Futures Trading Commission, the Federal Housing Finance Agency, etc.

Intended Effects and Context for Necessity

The context for the necessity of the act stems from wanting to address many of the most glaring regulatory shortcomings made obvious by the GFC.

One example includes reducing the potential costs of crises by providing the legal framework for taking over failing firms of systemic importance and giving regulators broader powers and mandates with higher prudential standards, which should reduce the risk of crisis occurring. The act also requires hedge funds and private equity advisors to register with the SEC as investment advisers and provide information about their trades to assess systemic risk, as one of the suspected causes of the 2008 financial crisis was the sophistication and complexity of hedge funds.

Next, credit rating agencies were thought to have done poorly with mortgage-related securities, as many investment-grade securities later defaulted beyond their statistical probability. To improve the credit rating system, the act directed the SEC to establish a new Office of Credit Ratings to oversee and examine credit rating agencies and promulgate new rules for internal controls, independence, transparency, and penalties for poor performance.

Moreover, the Act created a new independent watchdog, the Consumer Financial Protection Bureau, with authority to ensure American consumers get clear, accurate information about mortgages, credit cards, and other financial products and protect them from hidden fees and abusive terms (Amedeo).

Further, the act introduced the Volcker Rule to prohibit insured depository institutions and bank holding companies from engaging in proprietary trading or investing in speculative alternate investments. This discouraged banks from taking too much risk, which further protected banks’ customers.

Lastly, the act also introduces significant regulation on OTC derivatives due to the involvement of credit default swaps in the GFC. The act aims to minimize the systemic risk of derivative trading and improve transparency by requiring swaps to be cleared through either exchanges or clearing houses.

How the act fits into the general theme and rationale of financial regulation

Financial regulation is a form of regulation or supervision which subjects financial institutions to certain requirements, restrictions, and guidelines, aiming to maintain the stability and integrity of the financial system. The objectives of financial regulators are usually to inspire market confidence, introduce financial stability, and as discussed above, protect consumers (FCA).

As discussed above, the act subjected institutions such as hedge funds, banks, and credit rating agencies to additional regulation and supervision to protect consumers and inspire market confidence and financial stability. The act’s focus revolves around instituting laws that prevent excessive risk-taking in areas where the negative externalities can be passed on to unsophisticated consumers and reducing the informational asymmetry between unsophisticated consumers and sophisticated financial institutions. These are consistent with the goals of financial regulation. However, below we discuss some side effects against the rationale of financial regulation.

Unintended consequences of the act and contrast against intended effects

One of the unintended consequences of the act is that the Volcker rule has reduced liquidity in the markets due to the capital restrictions placed by the legislation. This surfaces in the bond markets, as banks have cut back on permissible and borderline bond trading as they have shed their proprietary trading businesses. As more and more activity moves into the shadow banking system, proprietary trading could become less regulated, defeating the initial intentions of the Volcker Rule (Skeel). This goes against the rationale of financial regulation of providing stable markets as well as protecting consumer interests.

Similarly, the ability to invest in marketable securities was diminished because banks have to maintain a higher proportion of their assets in cash relative to what was previously allowed. This action effectively limits the role of bond market-making traditionally held by these institutions. Since banks no longer play market-makers position, seeking to counteract sellers is more difficult for potential buyers. In fact, Dodd-Frank makes it harder for prospective sellers to find counteracting buyers, thus reducing liquidity in the markets. Likewise, reduced liquidity also goes against stable markets.

Another unintended consequence of the act is reducing the potential of profit-marketing in the economy and decreasing U.S. companies’ competitiveness on the global market when compared to foreign counterparts. Additionally, companies are spending more money to ensure that they remain in regulatory compliance, so the general economy has less of it available. This is because the money for regulation will come from taxpayers bearing the costs (Chon, G).

Conclusion

The global financial crisis was caused by a market environment of low-interest rates, a deregulated environment, excessive risk-taking and exotic derivatives. When interest rates rose, it triggered a cascading effect of market turbulence and falling asset prices, which crippled the financial system. Regulators then implemented many relief programs through aggressive monetary policy and deep liquidity programs to stabilize the financial system. Later, policies were put in place to prevent making the same mistakes. Our primary observation is excessive deregulation can lead to irresponsible risk-taking in pursuit of profits, as firms abandon ethical considerations for the bottom line. While deregulation has benefits, certain aspects of the market, especially in regions of fairness and principal-agent problems related to consumers, should be sufficiently regulated for the public’s best interests. This dialectic truth for regulation applies to the MBS as well. Although they have potential benefits, reckless risk-taking when it came to the MBS led them to begin the primary driver for the GFC.

Reference

Aliber, Robert Z., and Charles P. Kindleberger. Manias, Panics, and Crashes: a History of Financial Crises. Palgrave Macmillan UK, 2015.

Amadeo, Kimberly. “8 Ways a Dodd-Frank Repeal Hurts You.” The Balance, The Balance, 21 Aug. 2019, www.thebalance.com/dodd-frank-wall-street-reform-act-3305688.

Amadeo, Kimberly. “Causes of the 2008 Global Financial Crisis.” The Balance, 14 2019, www.thebalance.com/what-caused-2008-global-financial-crisis-3306176.

Amadeo, Kimberly. “Dodd-Frank Wall Street Reform Act” The Balance, The Balance, 21 2019, https://www.thebalance.com/dodd-frank-wall-street-reform-act-3305688

Baird Webel and Marc Labonte, “Government Interventions in Response to Financial Turmoil,” 2010 Board of Governors of the Federal Reserve System, 16 Mar. 2020, federalreserve.gov/monetarypolicy/openmarket.htm.

Carla, Tard. “Collateralized Debt Obligation (CDO).” Investopedia, Investopedia, 3 2020, Retrieved from https://www.investopedia.com/terms/c/cdo.asp

Chon, G. (2016, September 9). Critics Are Lining Up to Oppose Changes to Dodd-Frank Law. Retrieved from https://www.nytimes.com/2016/09/10/business/dealbook/critics-are-lining-up-to-oppose- changes-to-dodd-frank-law.html

David S. Huntington et al. Summary of Dodd-Frank Financial Regulation Legislation. Harvard Law School Forum, July 07, 2010. Retrieved from https://corpgov.law.harvard.edu/2010/07/07/summary-of-dodd-frank-financial-regulation-legislation/

“Dodd-Frank Wall Street Reform and Consumer Protection Act.” Wikipedia, Wikimedia Foundation, 10 May, 2020, https://en.wikipedia.org/wiki/Dodd%E2%80%93Frank_Wall_Street_Reform_and_Consu mer_Protection_Act#Subtitle_A%E2%80%94Increasing_Investor_Protection

Douglas Holtz-Eakin. The Growth Consequences of Dodd-Frank. AAF, May 2015. http://americanactionforum.aaf.rededge.com/uploads/files/research/The_Growth_Conseq uences_of_Dodd_5-6-15.pdf

“Key UCITS Terms.” Eurobank, n.a., www.eurobank.gr/-/media/eurobank/private/amoivaia-kefalaia/ekpaideutiko-uliko-pdf/ke y-ucits-terms.pdf.

“Lex Access to European Union Law.” EUR, 23 Jan. 2019, eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32011L0061.“About the FCA.

” FCA, 5 May 2020, www.fca.org.uk/about/the-fca.

“Federal Deposit Insurance Corporation.” FDIC, Oct. 2018, fdic.gov/news/news/speeches/spoct2918.html.

“Financial crisis of 2007-2008.” Wikipedia, Wikimedia Foundation, 24 April, 2020, https://en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%9308#Government_res ponses.

Haughwout, Andrew, et al. “The Supply Side of the Housing Boom and Bust of the ” Housing and the Financial Crisis, Mar. 2012, pp. 69–104., doi:10.7208/Chicago/9780226030616.003.0003.

“Implementing the Dodd Frank Act.” gov | Implementing the Dodd-Frank Act, www.sec.gov/spotlight/dodd-frank-section.shtml.

Julia, Kagan.” Mortgage-Backed Security (MBS). “ Investopedia, Investopedia, 25 2020, Retrieved from https://www.investopedia.com/terms/m/mbs.asp

Kaminsky, Graciela, L., and Carmen M. Reinhart. “The Twin Crises: The Causes of Banking and Balance-of-Payments Problems.” American Economic Review, 89 (3): 473-500. 1999, DOI: 10.1257/aer.89.3.473

Kenton, Will. “Financial Crisis.” Investopedia, Investopedia, 16 Mar. 2020, investopedia.com/terms/f/financial-crisis.asp.

Martin Neil Baily; Aaron Klein; Justin Schardin (January 2017). “The Impact of the Dodd-Frank Act on Financial Stability and Economic Growth”. The Russell Sage Foundation Journal of the Social Sciences. 3 (1): 20. doi:7758/RSF.2017.3.1.02.

Skeel, David Arthur. “Five Years after Dodd-Frank: Unintended Consequences and Room for Improvement.” Wharton Public Policy Initative, publicpolicy.wharton.upenn.edu/issue-brief/v3n10.php.

Stephen G. Cecchetti, “CRISIS AND RESPONSES: THE FEDERAL RESERVE AND THE FINANCIAL CRISIS OF 2007-2008”, 2008

Taylor, John B. “THE FINANCIAL CRISIS AND THE POLICY RESPONSES: AN EMPIRICAL ANALYSIS OF WHAT WENT WRONG”, 2009

Taylor, Mark. “Chapter 1 Why Regulate? – University of Warwick.” Https://Warwick.ac.uk/Research/Warwickcommission/Financialreform/Report/chapter_1.Pdf, warwick.ac.uk/research/warwickcommission/financialreform/report/chapter_1.pdf

“U.S. Department of the Treasury.” About FIO, 7 May 2020, home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service e/federal-insurance-office/about-fio.

Wolak, Frank. How Should Financial Markets Be Regulated?

internationalbanker.com/finance/how-should-financial-markets-be-regulated/.

Yeager, Tim. “Impact of the Gramm-Leach-Bliley Act.” The University of Arkansas News, University of Arkansas, 31 Jan. 2007, news.uark.edu/articles/10167/impact-of-the-gramm-leach-bliley-act.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Research Topic: (Choose only one)

· Financial Markets

Mortgage-backed securities

· Capital Allocation Process

· Debt, Equity, and Derivative

· Securitization

· Mortgage-backed securities

· Federal Reserve Policy

· Investment Fund

· Regulation of Financial Institution

· U.S. Stock Market

· Financial Statements & Reports

· Working Capital

· Sarbanes-Oxley and Financial Fraud

· Performance Evaluation

· Return on invested capital

· The Federal Income Tax System

· Corporate Capital Gains

· Financial Analysis & Financial Ratios

· Common Size Analysis & Trend Analysis

· Comparative Ratios & Benchmarking

· Time Value of Money

· Perpetuities & Annuities

· What loans really cost

· The Great Recession of 2007

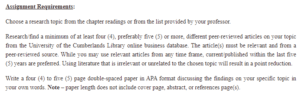

Assignment Requirements:

Choose a research topic from the chapter readings or from the list provided by your professor.

Research/find a minimum of at least four (4), preferably five (5) or more, different peer-reviewed articles on your topic from the University of the Cumberlands Library online business database. The article(s) must be relevant and from a peer-reviewed source. While you may use relevant articles from any time frame, current/published within the last five (5) years are preferred. Using literature that is irrelevant or unrelated to the chosen topic will result in a point reduction.

Write a four (4) to five (5) page double-spaced paper in APA format discussing the findings on your specific topic in your own words. Note – paper length does not include cover page, abstract, or references page(s).

Structure your paper as follows:

Cover page

An overview describing the importance of the research topic to current business and professional practice in your own words.

The purpose of Research should reflect the potential benefit of the topic to the current business and professional practice and the larger body of research.

Review the Literature summarized in your own words. Note that this should not be a “copy and paste” of literature content, nor should this section be substantially filled with direct quotes from the article. A literature review is a summary of the major points and findings of each of the selected articles (with appropriate citations). Direct quotations should be used sparingly. Normally, this will be the largest section of your paper (this is not a requirement, just a general observation).

Practical Application of the Literature. Describe how your findings from the relevant research literature can shape, inform, and improve current business and professional practices related to your chosen topic.

Conclusion in your own words

References formatted according to APA style requirements