Memo on Strategic Financial Analysis

For your review and information, the following is a summary of the strategic financial analysis addressing how the Stan-Ford medicine company and its subsections have performed in the past fiscal years. The evaluation is based on the fiscal years from 2015 to 2018 based on the balance sheets and income statements analysis. In addition to the summary, recommendations have been provided to sort out and prevent negative variances (AREAS, 2018). The below findings and interpretation serve across all the company branches under Stanford Medicine, such as Stanford Healthcare, Stanford Children’s Hospital, and Lucile Packard Children’s Hospital Stan-Ford. The balance sheets and income statements have been examined based on the directional strategy of the company. The directional strategy examines the company according to its mission, vision, and goals to observe its financial performance and maintain a competitive advantage in the vast market.

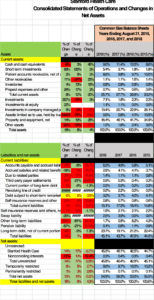

Based on the pattern in the line of items, a horizontal analysis was adopted to establish the different performance of items in each particular year. The horizontal analysis assisted in identifying the unusual findings in the different financial statements. The analysis criterion was also helpful in evaluating the trends in the different branches of Stanford Medicine. Based on the evaluation, some fiscal years expressed negative or unexpected differences that require the management to take quick action to sort out the problems(AREAS, 2018). The differences were noted in the percentage differences between 2018 and 2017, especially in the trustee’s assets. The massive difference of -100% should be fixed to avoid affecting the company’s performance. The other negative variances were also noticed on the line pattern of the assets held by the trustee. They indicate that there has been a constant increase in the assets held by the trustee. On this item, accounting personnel should notice the increasing negative variances as the fiscal years progressed. The negative variances have been indicated on the below financial statements with the red mark. The favorable variances in the different patterns of the line items illustrate a positive growth that enhances the business’s performance. A constant increase in the percentage ratios of prepaid expenses and others illustrates a favorable variance.

Alongside the horizontal analysis, the findings were also based on the vertical analysis, which helped restate each value in the income statement. The vertical analysis gives a company a heads-up on whether the cost of goods and expenses is higher than the actual sales. Reviewing the comparisons, the accounting staff will be able to identify and isolate strategies and initiate actions that can sort the problems. It is better to base a detailed analysis of 2015 to 2018 to develop a meaningful analysis. Based on the figure below, the total assets have increased due to favorable variances, increasing as the fiscal year’s pro- guessed (Khudyk, 2016). The positive increment in the total assets indicates a positive trend analysis on the performance of the business. There is an increase of 2 percent in the percentage change between 2018 and 2017 and the percentage change value between 2017 and 2016. The accounting staff should keep on to maintain an upward trend in the company’s net assets. Based on the financial statement below, the company expresses an increase in the accounts payable from -8% to -46%. The increased values indicate that the company has an increased debt that must be paid. The same situation was also experienced in 2015 and 2016. The accounting staff should fix the problem to restrict the company from accruing huge debts and liabilities since it can cost its net income. The illustrations are clearly outlined in the figure below.

The Stanford Medicine company illustrates positive growth based on the different ratios on the balance sheets’ common. The balance sheet provides a pictorial illustration of the firm as- sets, liabilities, and the company’s current net worth. The ratio analysis technique was suitable for proper balance sheet analysis to provide the various ratios. The short-term investments’ common size ratios illustrate a positive trend analysis since, from the fiscal year 2015, there has been tremendous growth in the ratio until the fiscal year 2018. The positive growth in- dictates that the company has been engaging in sustainable short-term investments that boosted its net investments (Khudyk, 2016). The prepaid expenses also express a positive standard size within the balance sheet, and increased percentages of prepaid expenses are termed the com- pany’s assets. Prepaid assets boost the company’s investments for every fiscal year. The figure above illustrates how prepaid expenses grew as the fiscal years progressed. The trend shows the company has a certain amount for expenses arising each financial year. A negative trend is expressed on the assets limited to use, affecting the balance sheets’ standard size. An increase in the negative variance item’s pattern resulted in a constant decrease in the ratio percentage of the standard size balance sheets values from 10.5% in 2015 to 0.0% in 2018.

Based on the directional strategy, the company’s financial statements express a positive trend toward achieving its goals and meeting its vision and mission. A proper income statement will promote the company from meeting its mission of implementing innovative discovery and new knowledge transformation. If the company expresses a positive performance, as illustrated by the vertical analysis, the company will allocate funds to boost innovative discovery (Pavlatos & Kostakis, 2018). The company has expressed an increase in prepaid expenses, which can serve as a company’s additional investment. The prepaid expenses can also be utilized to meet the company’s mission. The minimal negative variances observed from the financial statements indicate that the company is on the right track in establishing its objectives. The de- tailed standard size of the balance sheet that compares assets, liabilities, and net worth illustrates the most positive ratios, demonstrating that the company’s net worth level is worthy of successfully maintaining the mission and vision to their prospective customers. The income statement also expresses excellent financial performance, which maintains the normal functioning of the company.

The accounting management has performed a fair strategy to promote and help the company meet the set objectives, mission, and vision. Their strategies support the directional strategy of the company in meeting the set goals. The accounting management should look at the negative variances to reduce them to enhance robust financial performance. The variances can be re- reduced by reducing the limitations of using the assets held by the trustee. The company should also engage in insurance covers to sort the issue of third-party payor settlements.

References

AREAS, B. (2018). Financial analysis. Growth, 30, 10. Retrieved from https://www.bde.es/bde/en/secciones/informes/boletines/articulos-analit/analisis- financ/index2018.html

Khudyk, O. (2016). Theoretical and Methodological Principles Of the Strategic Financial Analysis Of Capital. The USV Annals of Economics and Public Administration, 16(3), 118-123.

Pavlatos, O., & Kostakis, X. (2018). The impact of top management team characteristics and historical financial performance on strategic management accounting. Journal of Accounting & Organizational Change.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

The purpose of this assignment: to familiarize you with financial statements, the need to align the financials and the strategic direction of the firm, and the process of performing horizontal and vertical analyses of a company’s balance sheets and income statements.

Memo on Strategic Financial Analysis

You will be provided with a scenario and a variances analysis. You will use both information to create a memo demonstrating your audit financial statements and expenditures based on organizational priorities.

Instructions

Scenario

You’re a healthcare administration fellow at the prestigious Stanford Healthcare. You have been rotating through the various departments over the past nine months, and now you have the honor of working under the mentorship of Chief Financial Officer Linda Hoff.

Stanford Medicine includes Stanford Healthcare, Stanford Children’s Hospital, and Lucile Packard Children’s Hospital Stanford. This organization uses an integrated approach to strategic planning, incorporating jointly agreed-upon strategic priorities from its various entities. It also ensures a high degree of unity in strategic focus by each entity.

Before outlining the strategic priorities for Stanford Medicine, it is essential to note that a firm’s directional strategy comprises three discrete yet interwoven components: vision, mission, and goals (or, in this case, priorities). Armed with this knowledge, you have familiarized yourself with the vision, mission, and priorities of Stanford Medicine. Below is what you found.

When examining a company’s financials, it is prudent to keep the directional strategy of the company in mind. After all, to advance many strategic priorities, which include fulfilling the mission and positioning the organization to achieve its vision for the future, proper management of the firm’s scarce resources is vital. Failure to properly manage the organization’s financial performance can compromise the company’s ability to maintain a competitive advantage in the marketplace.

Our Vision

Precision Health: Predict. Prevent. Cure. Precisely.

By leading the biomedical revolution in precision health, we will heal humanity through science and compassion.

Our Mission

Improving Human Health Through Discovery and Care.

Through innovative discovery and the translation of new knowledge, Stanford Medicine improves human health locally and globally. We serve our community by providing outstanding and compassionate care. We inspire and prepare the future leaders of science and medicine.

Strategic Priorities

A collaborative endeavor involving the entire community, the Stanford Medicine integrated strategic planning process yielded a human-centered and discovery-led framework focused on three overarching priorities for our enterprise.

Enhancing our strengths and achieving our goals in these priority areas will amplify our preeminence and remain uniquely positioned to lead the biomedical revolution in precision health, ensuring our continued ability to guide healthcare through significant global changes.

Value Focused

Provide a highly personalized patient experience.

Ensure a seamless Stanford Medicine experience.

Digitally Driven

Amplify the impact of Stanford innovation globally.

Deliver human-centered, high-tech, high-touch care and revolutionize biomedical discovery.

Lead in population health and data science.

Uniquely Stanford

Accelerate discovery in and knowledge of human biology.

Discovered here, used everywhere: advanced fundamental human knowledge, translational medicine, and global health.

Ensure preeminence across all our mission areas.

Variance Analyses

Typically, managers are expected to examine positive and negative variances and then speculate on possible explanations for the observed variances. Following this initial assessment, managers would be expected to dig deeper into those variances of most significant concern to the organization to uncover the actual causes, then implement necessary corrective actions. Digging into all variances would be costly and, quite frankly, misusing time and energy.

The CFO asked one of her financial analysts to conduct a variance analysis of the company’s consolidated balance sheets and income statements for fiscal years 2015, 2016, 2017, and 2018, which has been completed. The analyst determined the variances for each account (line item) captured in the financials. Now that this first step has been accomplished, the CFO would like you to pay particular attention to the negative variances contained in the spreadsheet and focus on those variances you believe to be potentially the most impactful to Stanford.

The financial analyst completed your variance analysis over time, referred to as a horizontal analysis, and then proceeded to create a common-size balance sheet and income statement for each of the four fiscal years (2015-2018). The common-sized financials are captured in the provided spreadsheet.

Financial Management and Strategic Direction

Once you’ve completed your horizontal and vertical analyses of the financial statements, you should understand how healthy management has managed the company’s financial resources in support of its strategic direction. The strategic direction of a business should be evident in its vision, mission statements, and priorities. The strategic priorities should support the company’s mission, and the mission should help advance the firm’s vision for the future. Failure to effectively manage the company’s financial resources can seriously compromise its ability to fulfill its mission and, subsequently, its vision.

Submission

Based on the scenario, create a 3-4 page business memorandum to Linda Hoff, Stanford’s CFO. For guidance on writing a memo, see attached doc.

In your memo, codify your findings and interpretations from the horizontal and vertical analyses and the level of alignment in the company’s fiscal management and strategic direction. Include the provided Excel spreadsheet you used to complete your analysis as an attachment to the memo. In this memo, you will:

- Review the year-over-year variances in the audited Stanford balance sheets and income statements for fiscal years 2015-2018 in the Week 5 Assignment Spreadsheet [XLSX] Download Week 5 Assignment Spreadsheet [XLSX]. You’ll be expected to pay particular attention to the negative variances (color-coded in red) that you believe to be potentially the most impactful to Stanford and provide a rationale for that belief.

- Hypothesize as to the reasons for the negative variances. Be sure the hypothesis is supported by evidence from the scenario, the balance sheets, and income statements.

- Explain the proportional changes in the standard size results over the four fiscal years and identify notable changes in the ratios. Also include a hypothesis, supported by a rationale, to suggest why these anomalies may exist.

- Identify notable patterns and variances that warrant further investigation and justify both with evidence from the three years. Specify the potential consequences of the variances to justify the need to examine these variances further.

- Assess whether the organization’s vision, mission, and goals align with its current financial position and explain why it does or does not align. Provides specifics from the variance analysis to support the assessment.