Financial Segment Analysis

Which industry portions ought to be independently announced in the section report, expecting that Branson characterizes its working fragment dependent on the significant business (item/portion) legitimize your answer.

Data about fragment practical benefit and misfortune, from the reason for benefit and misfortune sections, the standard assigned administration approach concentrating on essential inner leadership be utilized to estimate the divided benefit and misfortune. The things that should be considered incorporated (Dziechciarz et al., 2015).

Are you interested in an authentic copy of “Financial Segment Analysis accounting help”? Connect with us.

Incomes from outer clients, profits from different sections, premium income, cost deterioration and amortization cost salary charge expense, value pay from speculations, extraordinary things, and other irregular things (Muninova, 2015).

Data about the bases for estimation. Contrasts in evaluation among portions and the merged substance must be uncovered for money charges, suspended activities, unusual things, and the sections of benefits and misfortune (Muninova, 2015). Additionally, contrasts in estimation between section resources and the solidified resources must be revealed, assuming any. For instance, data on how together utilized resources are allotted to fragments might be expected to understand the portion of data (Muninova, 2015).

The premise ought to be revealed for any exchanges among portions, and any deviated allotments to sections should be clarified. At last, any progressions from the estimation techniques utilized in earlier periods must be unveiled, as their impacts on the fragments of benefit or misfortune (Dziechciarz et al., 2015).

Prepare a report to disclose required segment information under SFAS No./31IASC280J. Include the enterprise-wide disclosures.

The real goal of the administration approach is to encourage consistency among inside and outside announcing. The item or administrations, topographical region, client type, or lawful element might section the data. Firms must report segmental benefits or misfortune for each working section, income and costs, and segmental resources (Porowski et al., 2012).

Although there are worries that fragment division would give away the homestead, numerous investigators and different clients trusted the past guidelines under SEAS No 14 did not admirably function because the data announced did not identify with the real world, prompting undesired correspondence. The standard ought to be a success–win for the administration and expert and to impart inside (Muninova, 2015). They may even get familiar with a couple of things about their organizations.

Current GGAP doesn’t restrict segmental answering to financial information, as it were. It likewise requires discussing the company’s reason or strategy for classifying its activities into portions. This occurs just as in any distinction in estimation strategies between periods being accounted for; or between the sections and the whole element if the announcements are exhibited for more than one period, the required disaggregation of the individual firm information on the off chance that it has no merged backups (Carla et al., 2014).

Numerous organizations helped in their yearly report about the heap organizations they took an interest (Chervinsi, 2015) in financials as revealed in a single industry. There is no essential data about the organization that has its organizations separated into portions (Porowski et al., 2012). Isolating data similarly that administration takes a gander at a genuinely sensible demand and ought to keep organizations from guaranteeing they are just in one line of business (Porowski et al., 2012).

| Branson industries | |||||||

| Ltd | united states | Canada | |||||

| Items | |||||||

| A | B | C | D | E | |||

| Sales | $ 57,000.00 | $ 120,000.00 | $ 760,000.00 | $ 50,000.00 | $ 83,000.00 | ||

| Cost of goods sold | $ 20,000.00 | $ 75,000.00 | $ 400,000.00 | $ 9,400.00 | $ 49,000.00 | ||

| Administration expenses | $ 18,000.00 | $ 26,000.00 | $ 152,000.00 | $ 12,000.00 | $ 8,000.00 | ||

| Selling expenses | $ 7,000.00 | $ 44,000.00 | $ 172,000.00 | $ 12,600.00 | $ 20,000.00 | ||

| Total cost and expenses | $ 45,000.00 | $ 145,000.00 | $ 724,000.00 | $ 34,000.00 | $ 77,000.00 | ||

| Operation profit | $ 12,000.00 | $ 125,000.00 | $ 36,000.00 | $ 16,000.00 | $ 6,000.00 | ||

| Identifiable assets | $ 50,000.00 | $ 95,000.00 | $ 600,000.00 | $ 98,000.00 | $ 240,000.00 | ||

| Depreciation and amortization expenses | $ 6,400.00 | $ 10,700.00 | $ 76,000.00 | $ 12,200.00 | $ 26,400.00 | ||

| Capital expenditure | $ 5,600.00 | $ 8,000.00 | $ 39,000.00 | $ 20,000.00 | $ 25,000.00 | ||

Graphical representation of the segments

Graphical representation of the segments

Revelations are required for each portion, subject to the subjective edges and collection criteria displayed straightaway. Since the collection can happen before playing out the individual tests, the organization is relied upon first to present those criteria. A portion of the requirements could be received by (Chervinsi, 2015) accumulation criteria where it needs to total working fragments with comparable financial characteristics:

- The idea of their item and administrations

- The concept of the creation procedure

The kind of class of the client’s disclosures is required for each segment, subject to the qualitative thresholds and aggregation criteria presented next. The company must give those criteria first because aggregation can occur before performing the qualitative tests. Additionally, some of the requirements that could be adopted by the aggregation criteria, where it has to aggregate operating segments that have similar economic characteristics (Eugene & Denis, 2009):

- The nature of their product and services

- The nature of the production process

- The type of class of the customers

- The methods used to distribute products and provide services

- The nature of the regulatory environment (Dziechciarz et al., 2015).

The operating segment of Branson will be considered to be similar in their prospects are expected to be essentially the same. Thus, the similarity of the economic characteristics is evaluated based on opportunities and nods simply on current indicators (Dziechciarz et al., 2015); for instance, segments that do not currently have gross margins and sales tren may be aggregated when the economic characteristics and the other five criteria are med (Porowski et al., 2012).

Similarly, suppose the segments are not expected to have similar future economic characteristics but have identical gross margins or sales in the current years. In that case, the segments should not be aggregated for the recent year segment disclosures (Carle et al., 2014). For example, in the case of Branson Ltd segments by its results. The result should be evaluated from the standpoint of comparability of (Carle et al., 2014) and (Porowski et al., 2012). Thus, a segment that has been significant in the past and is expected to be substantial in the future should be treated as a reportable segment even though it fails to meet a test in the current year (Eugene & Denis, 2009).

Further, suppose the organization’s structure changes so that the reportable segments are redefined; in that case, the information presented from prior periods should be restated to be comparable with the current system (Dziechciarz et al., 2015). In such circumstances, the firm should explicitly disclose why the earlier periods have been restated. Also, suppose a segment previously not considered significant becomes significant in the current period. In that case, segmental data should be presented for that segment for the prior periods and client one (Muninova, 2015).

- The techniques used to convey items and give administrations.

- The idea of the administrative condition(Eugene & Denis, 2009)

The working section of the Branson will be viewed as comparative in their prospects are relied upon to be equivalent (Porowski et al., 2012). In this manner, the comparability of the financial attributes is assessed dependent on future opportunities and not founded primarily on current markers. For example, sections don’t have net edges and deal patterns when the monetary qualities and the other five criteria are met, and the fragment might be collected (Eugene & Denis, 2009). If the sections are not expected to have comparable future financial qualities yet have equivalent gross edges or deals inclines in the current year, the fragments ought not to be accumulated for the current year portion divulgences (Porowski et al., 2012).

For instance, on account of BransLtdltd portions by its outcomes. The outcome ought to be assessed from the standpoint of a likeness of (Muninova, 2015; Carlea et al., 2014). Therefore, a fragment that has been critical previously and is required to be huge before and is relied upon to be huge later on ought to be treated as a reportable portion even though it neglects to meet a test in the current year (Porowski, Rudy, & Teodorczyk, 2012). Further, if the structure of the association changes, so the reportable sections are reclassified, the data displayed from earlier periods ought to be repeated so that it is equivalent to the present structure (Carlea et al., 2014). In such cases, the firm should reveal how and why the prior periods have been repeated.

Additionally, if a specific section that was already not considered critical ends up huge in the present time frame, at that point, segmental information ought to be introduced for that fragment for the earlier periods just as the customer one (Carlea et al., 2014).

Similar Post: ZOU Fencing

References

Carlea, Filip, Teodoreanu, Dan , I., Iancu, & Iulian. (2014). Analysis of Financial Parameters for a Combined Photovoltaic/LED Intelligent Lighting Low Voltage Distributed.

Chervinski , Y. A. (2015). Import substitution policy: concept methods of analysis and main areas for improvement.

Dziechciarz , A., Lesiak, P., & Bak, D. (2015). An analysis of the potential for using RizEx-2 software to simulate emergencies such as the Gas.

Eugene, N., & Denis, S. (2009). The Automated Analysis of Header Files for Support of the Standardization Process.

Muninova, N. (2015). Segmental analysis of the market potential of the textile industry of Uzbekistan.

Porowski, R., Rudy, W., & Teodorczyk, A. (2012). Analysis of experimental methods for explosion limits of flammable liquids.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

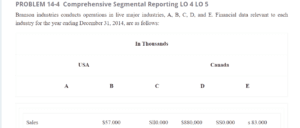

PROBLEM 14-4 Comprehensive Segmental Reporting LO 4 LO 5

BransonIndustriess conducts operations in major live industries, A, B, C, D, and E. Financial data relevant to each sector for the year ending December 31, 2014, are as follows:

|

In Thousands |

|||||

|

USA |

Canada |

||||

| A | B | C | D | E | |

|

Included if segments C and sales E are intersegment sales of $120,000 and anS40,00000, respectively. Corporate offices have assets of $95,000 and incurred general corporate expenses of $76.000.

Financial Segment Analysis

All corporate assets are located in the United States, and depreciation on corporate assets was $10,000. No single customer represents more than 10% of sales. There is no intercompany inventory in the beginning or ending list. The intersegment sales are included in the measures reviewed by the chief operating decision maker, as are the capital expenditures, depreciation, and amortization.

Problems

Required:

- Which industry portions ought to be independently announced in the section report, expecting that Branson characterizes its working fragment dependent on the significant business (item/portion) legitimize your answer.

- Prepare a report to disclose required segment information under SFAS No./31IASC280J. Include the enterprise-wide disclosures.