Financial Performance Measurement

The most important goal of any business in today’s competitive business environment is the creation of shareholders’ value and wealth. Modern economic theories, such as EVA, have replaced the accounting data-based criteria in measuring shareholders’ wealth and value. EVA evaluates the performance of the company based on the residual income. The EVA determines a company’s economic profit over a period of time, calculated based on the net operating profit after tax and the overall company’s cost. When net operating profit after tax is more than the cost of capital, then this implies that the company is generating profits, thus increasing the shareholders’ value. When net operating profit after tax is less than the cost of capital, then it means that the company is making losses, thus a decrease in the shareholders’ value. In other words, a positive EVA indicates that the business creates shareholders’ value, while a negative EVA indicates that shareholders’ value and the general value of the firm have decreased. Hire our assignment writing services in case your assignment is devastating you.

| Particulars | Amount/percentage |

| Cost of risk-free debt (%) | 7.50 |

| Market premium | 7.00 |

| Beta variant | 0.78 |

| Cost of equity (%) | 12.96 |

| Average debt/Total capital (%) | – |

| Cost of debt – net of tax (%) | N/A |

| Weighted average cost of capital (%) | 12.96 |

| Average capital employed | 6.177 |

| PAT as a percentage of average capital employed (%) | 40.14 |

| Economic Value Added: | |

| Operating profit (excluding extraordinary income) | 2,654.00 |

| Less: Taxes | 313.00 |

| Less: Cost of capital | 801.00 |

| EVA | 1,540.00 |

| Ratios | |

| EVA as a percentage of average capital employed (%) | 24.93 |

From the above table, it is observed that the EVA is positive both in dollars and percentages. It is also observed that operating profit after tax is greater than the cost of capital. Therefore, Infosys is creating value for its shareholders.

EVA versus Net Income Performance Metric

A good measure of performance evaluates the performance of the organization in relation to its objectives. The primary objective of Infosys is to maximize its shareholders’ wealth; the performance measure should be able to evaluate this (Abdel Al, 2013). Net income is used as a financial measure of companies, but there are two problems relating to the measure: ignoring the cost of equity. Firms only create wealth when they generate returns greater than the return required by the equity and debt holders. The calculation process of net income in the financial statements only takes into account the cost of debt but ignores the cost of equity.

The calculation of net profit is done in accordance with the accounting standards. The resulting figure does not truly reflect the wealth created since the figure might be subjected to manipulations by accountants and also uses the accrual basis of accounting, while many investors are only interested in the cash flows (Sunarni, 2013). EVA tends to overcome the two problems associated with net income measurement.

Comparing the PAT or Profit After Tax and EVA to the Average Capital Employed

| Operating profit (excluding extraordinary income) | 2,654.00 |

| Less: Taxes | 313.00 |

| Net operating profit after tax | 2,341.00 |

| Average capital employed | 6,177.00 |

| EVA | 1,540.00 |

| Profit after tax to average capital employed (%) | 40.14 |

| EVA to average capital employed (%) | 24.93 |

Profit after tax to average capital employed is higher than the EVA; this is because the calculation process does not account for the cost of equity, while EVA calculation takes into account the cost of equity. For this reason, the amount of profit after tax is greater than the amount of EVA. In both measurements, the company is creating the shareholders’ value because profit after tax is greater than the cost of equity, and the EVA of the company is positive (Kaplan, 2015). In conclusion, EVA measurement is better than the profit measurement because EVA measures how well the company maximizes its shareholders’ wealth (the primary objective of the company), while net income only measures profitability.

References

Abdel Al, S. F. (2013). Strategy and Management Accounting Practices Alignment and Its Effect on Organizational Performance. Journal of Accounting, Business & Management, 20(1).

Kaplan, R. S. (2015). Advanced management accounting. PHI Learning.

Sunarni, C. W. (2013). Management accounting practices and the role of management accountant: Evidence from manufacturing companies throughout Yogyakarta, Indonesia. Review of Integrative Business and Economics Research, 2(2), 616.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

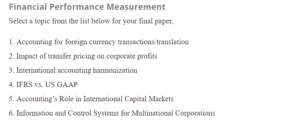

Financial Performance Measurement

Select a topic from the list below for your final paper,

- Accounting for foreign currency transactions/translation

- Impact of transfer pricing on corporate profits

- International accounting harmonization

- IFRS vs. US GAAP

- Accounting’s Role in International Capital Markets

Financial Performance Measurement

- Information and Control Systems for Multinational Corporations

- Impact of Currency Fluctuations on Financial Reporting and Control

- Comparative Ethics in International Auditing and Business

- Impact of International Taxation on Accounting and Finance

- Foreign Exchange Risk Management

- Methods of foreign currency translation – provide history and argument for which method is best.

- Refer to the APA guidelines at http://owl.english.purdue.edu/owl/resource/560/15/ for proper format and referencing. Paper should include a title page, table of contents, abstract, introduction, body, conclusion and reference page.Type should be double spaced, Times New Roman, 12-point font, one-inch margins. Introduction, body and conclusion of paper should be a minimum of four and a maximum of six pages.A few pointers:

-

- Your paper should not consist primarily of direct quotes from sources. Content and analysis is a large part of the grading (50%).

- Proper referencing according to APA guidelines should be followed. Mechanics represent 15% of the grade.

- The overall paper and individual paragraphs should be effectively organized with introduction, body & conclusion for the paper and topic sentences in the paragraphs. Organization is 20% of the grade.

- The list of references should be credible ones – not Wikipedia, Investopedia or any other “pedia” sources. The submitted file should be in a Word document. Please indicate your name in the file for submission.