Evaluation of Tesla’s Stock

Tesla, Inc is an automotive firm specializing in the manufacture and distribution of electric cars. The company was founded in 2003 by Martin Eberhard and Marc Tarpenning (Tesla, n.d), and is headquartered in California. The current owners, Elon Musk and Straubel, who are the current owners, joined Tesla as co-owners after its inception. The purpose of this paper is to evaluate investments in the company’s stock. Do you need any help for completing your assignment ? Contact us at eminencepapers.com. We endeavor to provide you with excellent service.

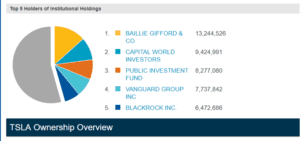

Stakeholder composition

Figure 1. Nasdaq (n.d).Tesla Inc. Ownership Structure. Retrieved from https://www.nasdaq.com/symbol/tsla/ownership-summary

As illustrated in the figure above, a significant portion of Tesla’s stock is held by institutional holdings. The portion of each institution is indicated in the above figure. According to the figures, Tesla’s CEO, CTO, and CFO own a significant portion of Tesla’s shares, which grants them decision-making powers. The firm’s three major stakeholders are also responsible for running it.

Tesla business risk exposures

Tesla is exposed to various business risks, which can be categorized into firm-specific, sector-wide, and market-wide groupings. The firm encounters difficulty in grasping a significant market share due to the high cost of the cars manufactured. These cars have high price tags that range between $68,000 and $138,000, which is beyond the purchasing power of the average consumer (Ross, 2018). Additionally, even the recently launched Model 3 version, the company’s low-end car, still has a considerably high price of $45,000. Potential customers are thus inclined to purchase vehicles from rival firms that are reasonably priced. Tesla incurs high costs in manufacturing to the extent of incurring losses in the manufacture. For instance, the company suffered a loss of $14,000 for every Model 3 car sold, which amounted to a big loss in its financial reports (Ross, 2018). Therefore, Tesla faces the business risk of not making sales, which decreases the revenues and may lead to losses.

Tesla has also been experiencing a shortage of batteries for its lithium-powered cars, which manifests as a firm-specific risk. To remedy this, Tesla established a project in Nevada dubbed “gigafactory” that would facilitate the production of batteries that would power at least 500,000 cars yearly (Ross, 2018). Nonetheless, the length of the project is unknown, as a disruption in Tesla’s supply of batteries could adversely affect the firm’s operations. In a report, the firm’s CEO hinted that Tesla requires more than one Gigafactory. Thus, Tesla faces the risk of disruption of operations in the event of a total shortage of lithium batteries.

Among the sector-based risks is increased competition in the manufacture of electric cars. Tesla is among the pioneering firms in the industry, which led to its success. Nonetheless, other companies have ventured in the industry. For instance, Nissan ventured into the industry through its Leaf model, which retails at $29,999, which is cheaper than Tesla’s low-cost car (Ross, 2018). The competitors are offering more than Tesla’s products at competitive prices. Other vehicle manufacturers like Subaru, Volkswagen, and even BMW have declared their intentions of venturing into the manufacture of electric cars as well. Thus, Tesla faces the risk of losing its market share and dilution of profits if more firms join the industry.

Tesla’s stock Volatility

Tesla’s standard deviation stands at 27.81, which is significantly higher compared to figures posted by some of its peers. For instance, Intuit Inc. is at 20.3, while Vertex Pharmaceuticals Incorporated’s volatility index is at 12.05 (Netcials, 2019). Standard deviation is a measure of the stock’s volatility; thus, Tesla’s high standard deviation indicates that the company’s stock is highly volatile.

Tesla Bond rating

Tesla’s bond notes trade at 91.175 cents at a rate of 5.3% and a maturity date of August 2025 (Assis, 2018). The company has been making losses, and its future profitability is unpredictable. Given that bondholders focus on a firm’s financial performance and its ability to repay its interest from its cash flows, investors have been shying from Tesla’s bonds. The firm has unstable cash flow and appears to be relying more on funds from market capitalization to repay the interest bonds. Nonetheless, Tesla has managed to secure several bonds with a maturity date of 2025.

References

Assis. C, (2018). Here’s what the junk-bond market says about Tesla going private. Marketwatch. Retrieved from https://www.marketwatch.com/story/heres-what-the-junk-bond-market-is-saying-about-teslas-going-private-proposal-2018-08-09

Nasdaq (n.d).Tesla Inc. Ownership Structure. Retrieved from https://www.nasdaq.com/symbol/tsla/ownership-summary

Netcials, (2019). Tesla Inc Stock Volatility. Netcials, Retrieved from https://www.netcials.com/stock-volatility-nasdaq/TSLA-Tesla-Inc-/

Ross (2018). 6 Big Risks of Investing in Tesla Stock. Retrieved from https://www.investopedia.com/articles/markets/102815/biggest-risks-investing-tesla-stock.asp

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Evaluation of Tesla’s Stock

You are to complete the Live Case Study at the end of Chapter 3. You will be completing the Live Case Studies for the remainder of the term by researching the company that you have selected. In answering the questions in Live Case Study, you are to answer the questions as laid out in the Framework for Analysis, such as 1,2,3,4,5,…..Also, the sub-sections need to be bulleted. If there is an item that is not applicable, you are to clearly state that. After you have submitted your weekly study, I will grade it and make comments that you need to incorporate into your Case Study. As a general rule of thumb, each “Framework for Analysis” section must be a titled section in your paper referenced in the Table of Contents. Each question asked in these sections must be answered under those sections. The results of this Live Case Study will be included in your final course project, due on or before Class Day 1 of week 10. I will provide the general structure of how I want to see the final report laid out.

Researching a particular company will help support your weekly readings.

When you are working on your case study, I expect that you will be inserting financial statements and another table to support your research.

Company: Tesla