Environmental Sustainability Project

| Month | Recycle | Trash | Compost | Total |

| July | 0 | 95.52 | 0 | 95.52 |

| August | 0 | 86.5 | 0 | 86.5 |

| September | 2.89 | 84.93 | 0 | 87.82 |

| October | 9.33 | 110.57 | 0 | 119.9 |

| November | 17.47 | 74.41 | 0 | 91.88 |

| December | 5.83 | 59.93 | 0 | 65.76 |

| January | 17.82 | 70.69 | 0 | 88.51 |

| February | 9.85 | 85.21 | 0 | 95.06 |

| March | 19.83 | 96.82 | 6.35 | 123 |

| April | 11.89 | 87.33 | 19.31 | 118.53 |

| May | 26.11 | 91.61 | 6.85 | 124.57 |

| June | 17.53 | 85.93 | 16.05 | 119.51 |

| 138.55 | 1029.45 | 48.56 | 1216.56 | |

| No. of tons | No. of yards | Cost per $35 yard compactor | Total cost | |

| 1216.56 | 32753.53846 | $150 | $4,913,030.77 | |

| No. of tons | Haulage Cost per Ton | Total Cost | ||

| 1216.56 | $59 | $71,777.04 | ||

| No. of containers | Cost per Container | Total container cost | ||

| 22.5 | $6.66 | $149.85 | ||

| Total cost | $4,984,957.66 |

Do you need an unpublished version of “Environmental Sustainability Project essay”? Get in touch with us.

ThisMarriott’seks to evaluate the viability of Marriott’s environmental sustainability project by performing an NPV analysis on the project’s cost. The NPV will be undertaken hypothetically in two scenarios. First, it will be carried out assuming zero initial cost. Secondly, it will be undertaken at an estimated cost. This analysis is essential in capital budgeting as it facilitates the selection of viable projects (Goldratt & Cox 2016). Usually, projects that yield zero NPV are rejected by the firm.

TMarriott’shree types of costs arise from Marriott’s environmental sustainability project. This project seeks to reduce waste by 20% and is part of the sustainability strategy implemented by Marriott. These costs include haulage, cargo, and container costs. The waste is categorized into recyclable materials, trash, and compost. Recyclable accounts for 138.5 tons, trash accounts for 1029.4 tons, and compost accounts for 48.56 tons; the total waste amounts to 1216.56 tons. Trash is weighed in terms of compactors, costing $150 per 35-yard compactor of waste removed. The hauling cost is $59 per ton. Given the firm has to acquire containers, it would cost the company 6.66 dollars for the 22.5 containers required. Thus as illustrated in the Excel worksheet, the total cost for the mentioned items is $4,913,030.77.

The NPV analysis determined whether the project was to be accepted or rejected. If this project did not have an initial investment cost, the maximum allowed expenditure on this project is $4,800,151.81. Any amount above this figure would translate to negative cash flows and subsequent losses. The discount rate employed in the calculation of NPV was 3.85%. This rate was selected as it would be used against the junk bond obtained from Meryl Lynch Bank. If the company undertakes this project, it has to seek external sources of funds to raise the financial requirement. The most viable alternative is the bond offered at Meryl Lynch at a discount rate of 3.85%. Thus, the NPV calculation used this rate in the analysis.

Furthermore, the bonds mature in ten years; the project is expected to take 10 years. If the company were to spend $35,000 as the initial investment, it would be required to spend a maximum of $4,765,151.81 for the project to be viable. I would advise abandoning the project since the maximum allowed cost is lower than the actual firm. In the event of zero investment cost, the project is expected to spend a minimum of $4,800,000, yet in actual sense, the costs arising from the project total $4,913,030. The firm should seek a waste management approach with lower costs. Alternatively, the firm could engage in a differenfirm’sainability project that enhances the firm’s financial value.

Other Related Post: Biblical Worldview of Accounting

References

Goldratt, E. M., & Cox, J. (2016). The Goal: A Process of OngoWe’llmprovement. Routledge.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Team Project

Total Points: 20 points (Report: 10 points, Presentation: 10 points)

Environmental SustainaMarriott’sject

The benefit of Sustainability: Cost-saving approach

Marriott’s environmental commitments aim to reduce energy and water consumption by 20%. Marriott Marquis initiated a long-term project to reduce waste by 20% to meet the goals. (We here refer that the maximum conversion rate, 𝛾𝛾𝑚𝑚𝑚𝑚𝑚𝑚. is 20%)

Considerations for cost analysis

- The annual cost of waste for Marriott MarqMarquis’shotel): The following table illustrates Marriott Marquis’s average monthly weights for recycling, trash, and compost for recent All weights are marked in tons. Recycling and trash amounts are measured in 35-yard compactors. It costs $150 to haul a 35-yard compactor plus $59 per tonnage. The compost amount is measured based on a 35-gal container. 22.5 containers are required for cargo. It costs $6.66 per recycled container with delivery costs of $59 per tonnage. The 35-yard compactor can be shared for recycling and trash. (Assume that recycling and trash & compost marquis’s process is implemented once a month.)

Table: Marriott Marquis’ weights for recycling, trash, and compost

| Month | Recycle | Trash | Compost | Total |

| July | – | 95.52 | – | 95.52 |

| August | – | 86.5 | – | 86.5 |

| Sept | 2.89 | 84.93 | – | 87.82 |

| Oct | 9.33 | 110.57 | – | 119.9 |

| Nov | 17.47 | 74.41 | – | 91.88 |

| Dec | 5.38 | 59.93 | – | 65.31 |

| Jan | 17.82 | 70.69 | – | 88.51 |

| Feb | 9.85 | 85.21 | – | 95.06 |

| March | 19.83 | 96.82 | 6.35 | 123 |

| April | 11.89 | 87.33 | 19.31 | 118.53 |

| May | 26.11 | 91.61 | 6.85 | 124.57 |

| June | 17.53 | 85.93 | 16.05Let’s | 51 |

| Total | 138.1 | 1029.45 | 48.56 | 1216.11 |

- Expected Cash Flows: Let’s denote total annual cost savings (recycling, trash, and compost) for Marriott Marquis as 𝐶𝐶𝑠𝑠, discount rate as 𝑟𝑟, and maximum conversion rate is γmax (𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺 M𝐺𝐺𝑀𝑀).

Suppose the annual conversion rate, 𝛾𝛾 (𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺), is increasing linearly each year over 10 years. That is, 𝛾𝛾 = 0.1𝛾𝛾𝑚𝑚𝑚𝑚𝑚𝑚 in the first year, 0.2𝛾𝛾𝑚𝑚𝑚𝑚𝑚𝑚 in the second year, ⋯, 𝛾𝛾𝑚𝑚𝑚𝑚𝑚𝑚 in the last (10th) year.

The expected cash flow (𝐶𝐶𝐶𝐶) is 𝐶𝐶𝑠𝑠 × (𝛾𝛾𝑚𝑚𝑚𝑚𝑚𝑚 × 0.1) in the first year, 𝐶𝐶𝑠𝑠 × (𝛾𝛾𝑚𝑚𝑚𝑚𝑚𝑚 × 0.2) in the second year, ⋯, 𝐶𝐶𝑠𝑠 × (𝛾𝛾𝑚𝑚𝑚𝑚𝑚𝑚 × 1) in the last (10th) year.

- Discount rate: According to the effective yield of the Bank of America Merrill Lynch US Corporate 7-10 Year Index that compiles all securities with a remaining term to maturity of greater than or equal to 7 years and less than 10 years, 10-year Marriott’sbond yield is 3.85%.

- Typical project length: Many of Marriott’s hotels have a form of committees or independent CSR work. Each work group has launched and is currently working on relevant projects to enhance business sustainability, with a typical project lasting about 10 years.

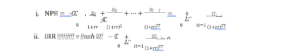

- Net Present Value (NPV) and Internal Rate of Return (IRR): NPV determines the sum of the present values of cash inflow and outflows throughout the project. NPV calculates an estimate of the profitability of a project or investment. The formula can be written as

Formula

where − 𝐶𝐶0 is initial cost (investment), 𝐶𝐶 is cash flow, r is the discount rate, and T is time.

The NPV method directly measures the dollar contribution to the investors, while the IRR method provides the return on the original money invested. NPV and IRR methods can give a conflicting ranking of projects when the IRR method is compared to NPV for mutually exclusive projects. Also, multiple IRR problems can occur when negative cash flows during the project lifetime.

Question for Project

You are now asked to prepare 2~3 page report (no more than 5 pages) for a board meeting in a week. You are allocated 12 minutes to speak for this agenda, and your report will be distributed to board members whose average age is slightly over 60. Thus, it would be best to consider the efficiency and visibility when writing your report1. Your report is expected to include answers to the following questions that the board members want to know:

Report (10 points)

Q1-1) What has been the annual cost of waste for Marriott Marquis in recent years? (1 Point)

Q1-2) Suppose there is no initial investment (cost), 𝐼𝐼0 = 0 (without any running cost). What is the maximum allowed annual investment, 𝐼𝐼𝑣𝑣, for this project to have a positive NPV? (2 Points)

Q1-3) Suppose an initial investment (cost)2, 𝐼𝐼0, of $35,000 is required. What is the maximum allowed annual investment, 𝐼𝐼𝑣𝑣, for this project to have a positive NPV? (2 Points)

Q2) Provide the financial analysis for answers that you have derived in Question 1. (3 points) Q3) Provide your final opinion (£ 1 paragraph length) as a project manager. (2 points)

Presentation (10 points)

You are only allowed 12 minutes to report to your boss. Please prepare your oral report.

1 A well-written and condensed (£ 1-page) summary may help your boss and board member understand your message.

2 Note that the significant cost item to deploy some practical ideas of sustainability in light of food waste and recycling is an initial investment concern to help better manage food waste. Incremental labor cost is not a significant concern.

Criteria for Evaluation:

1) Accuracy

Are the numbers that you have provided to your boss correct? (You should not lie when you report to your boss.) You will be asked to provide 3 numbers the board members want to know (Q1-1, Q1-2, and Q1-3). Up to 10% differences in your estimation will be allowed to get full credit.

2) Logic

- Do you use a reasonable financial analysis method properly?

- Do you use a valid discount rate?

- Do you use reasonably estimated cash flows?

3) Communication

- Presentation: Are you an efficient communicator? Is it persuasive?

- Final opinion paragraph: Based on your analysis, do you make a reasonable decision?

- Report Format