Entities Taxation Case

Assuming that Richardson Company is operated as a sole proprietorship, determine Richardson’s final federal income tax liability (including any self-employment tax) (Note – the assumption that the pension contribution on Tony’s behalf is 10% of the $65,000 “reasonable salary” is somewhat unrealistic (usually, the amount would be based on the sole proprietorship income). Still, this assumption is made to make the four entity results roughly comparable).

Are you looking for a uniquely done copy of “Entities Taxation Case”? Feel free to reach out to us.

| Income Calculation = Revenue – Expenditure = 520000-485,430 = 34,570

|

|

| Income (Income-Expenses) | $34,570 |

| Employment Income | $41,300 |

| Interest | $1,400 |

| Dividend | $1,200 |

| Property Income | $9,200 |

| Total Income | $87,670 |

| Losses, gifts of assets to charities | $10,300 |

| Net Income | $77,670 |

| Personal Allowances | $26,400 |

| Taxable Income | $104,070 |

| Tax Liability 10% | $10,407 |

| Less Tax Credit On Dividends (5% of 5,000) | ($250) |

| Repayable | $6,527 |

Assuming that Richardson Company is operated as a partnership (assuming that Tony Richardson is essentially a 100% partner, with a minimal interest held by Ellen), determine Richardson’s final federal income tax liability (including any self-employment tax). For these purposes, allocate 100% of all partnership items to Tony Richardson. (The same pension contribution assumption mentioned in “a” also applies here.)

| Income (Income-Expenses) | $34,570 |

| Employment Income Ellen’s Salary | $41,300 |

| Interest | $1,400 |

| Dividend | $1,200 |

| Property Income | $9,200 |

| Total Income | $87,670 |

| Reliefs | ($15,000) |

| Losses, gifts of assets to charities | ($2,600) |

| Net Income | $70,070 |

| Personal Allowances | $20,000 |

| Taxable Income | $90,070 |

| Tax Liability (10% of $101,770) | $9007 |

| Less Tax Credit On Dividends (5% of 5,000) | ($250) |

| Tax Payable | $8757 |

Assuming that Richardson Company is operated as an S corporation (with Tony Richardson [DD] as essentially a 100% shareholder), determine Richardson’s final federal income tax liability and any FICA taxes paid on Tony’s compensation by Tony and by Richardson Company Once again, allocate 100% of all S corporation items to Tony Richardson.

| Income (Income-Expenses) | $34,570 |

| Employment Income Ellen’s Salary | $41,300 |

| Interest | $1,400 |

| Dividend | $1,200 |

| Property Income | $9,200 |

| Total Income | $87,670 |

| Reliefs | ($15,000) |

| Losses, gifts of assets to charities | ($2,600) |

| Net Income | $70,070 |

| Personal Allowances | 0 |

| Taxable Income | $70,070 |

| Tax Liability (10% of $16,770) | $7007 |

| Less Tax Credit On Dividends (5% of 5,000) | ($250) |

| Tax Payable | $62,813 |

Assuming that Richardson Company is operated as a C corporation (with Tony Richardson (DD) as a 100% shareholder), determine the final corporate income tax liability of Richardson Co., Richardson’s absolute federal income tax liability, any FICA taxes paid on Tony’s compensation by Tony and by Richardson Company

| Gross profit (Income-Expenses) | $34,570 |

| Dividends from 10% Owned Corporation | $4,300 |

| Interest | $400 |

| Gain on Sale of Depreciable Property | $200 |

| Installment on the gain on sale of property | $1,200 |

| Gross Income | $40,470 |

| Operating Expenses | $15,000 |

| Depreciation | $2,600 |

| Amortization on property | $16,770 |

| Dividends Received | 4,000 |

| Taxable Income | $9,560 |

| Regular Tax Liability (10% of $16,770) | $9,560 |

| Less Tax Credit On Dividends (5% of 5,000) | $478 |

| Tax Payable | $478 |

Answer Summary

| S. Propr | P’ship | S Corp | C Corp | |

| Corporate Income Taxes Paid | NA | NA | NA | $478 |

| FICA Tax on TR – Paid by TR | NA | NA | $1,770 | $478 |

| FICA Tax on TR – Paid by Company | NA | NA | $70 | $26 |

| Unemp. Tax on TR – Paid by Company | NA | NA | $86 | $46 |

| Self-Employment Tax Paid by TR | $1,287 | $896 | NA | NA |

| Fed Inc Tax Paid by Richardsons | $10,407 | $6,400 | $140 | $28 |

| Total Taxes | $11,694 | $7,296 | $2,066 | $1,056 |

Prepare a tax memo and draft a client letter indicating your recommendation to the Richardsons as the preferred entity. Provide the appropriate tax citations and explain why you believe this method will be best. Your tax partner wants the material provided in an easy-to-read format for these clients.

To: Richardson Company

From

Re: Richardson’s Recommendations

The enterprise’s entity determines the tax code governing businesses, and it could either be a C or S company. C Companies are the most expensive in operation and maintenance costs (Law, 10). At the same time, C companies have a high establishment cost and involve more legal processes. Nevertheless, they exhibit the most cost benefits, for instance, fringe benefits that incur more significant tax costs in sole proprietorships, partnerships, and limited liabilities. However, the tax costs are lower for C corporations than for S (Bohan et al., 2013).

Furthermore, another advantage is some categories; for instance, health insurance does not comprise income tax. Therefore, the tax charged on the gross income is less. Notably, the gross income can be divided between the founders of Richardson Company to reduce taxable income (Collins et al., 1995). moreover, the founders could issue a public offer of shares of the firm as a way of acquiring finances to expand the firm

Client letter

To: Richardson Company

The tax benefits should be compared with the additional operational costs, complex tax regulations, and the bureaucratic administration operations franchise corporate tax is a requirement in the incorporation of a company. The establishment f a C venture is incorporated as Corporation; if the shareholders are willing to be taxed, it can be altered into an S corporation (Sinn, 1987). Therefore, I recommend C incorporation into Richardson Company if the enterprise has been profitable. Nonetheless, I would recommend S incorporation if it incurs losses (Ayers et al., 2003). The reason being the losses can be transferred to the shareholder. I would, therefore, recommend S incorporation, given that the enterprise incurred a loss.

Other Related Post: Aaron Feuerstein Case Study

References

Law, P. A. (10). Code of federal regulations.

Bohan, B., McCarthy, F., & McLoughlin, A. (2013). Bohan and McCarthy-Capital Acquisitions Tax. A&C Black.

Ayers, B. C., Lefanowicz, C. E., & Robinson, J. R. (2003). Shareholder taxes in acquisition premiums: The effect of capital gains taxation. The Journal of Finance, 58(6), 2783-2801.

Sinn, H. W. (1987). Capital income taxation and resource allocation. Amsterdam et al.

Collins, J. H., Shackelford, D. A., & Wahlen, J. M. (1995). Bank differences in the coordination of regulatory capital, earnings, and taxes. Journal of accounting research, 33(2), 263-291.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

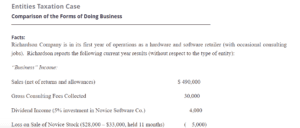

Entities Taxation Case

Comparison of the Forms of Doing Business

Entities Taxation Case

———————————————————————————-

Facts:

Richardson Company is in its first year of operations as a hardware and software retailer (with occasional consulting jobs). Richardson reports the following current year results (without respect to the type of entity):

“Business” Income:

Sales (net of returns and allowances) $ 490,000

Gross Consulting Fees Collected 30,000

Dividend Income (5% investment in Novice Software Co.) 4,000

Loss on Sale of Novice Stock ($28,000 – $33,000, held 11 months) ( 5,000)

“Business” Expenses and Costs:

Cost of Goods Sold (142,200)

Salaries of 5 employees other than owner Tony Richardson ($30,000 each) (150,000)

Payroll taxes paid on employees [($150,000 x .0765) + ($35,000 x .062)] ( 13,645)

Health insurance coverage for employees ($3,000 x 5) ( 15,000)

Retirement plan contributions for employees (10% of salaries) ( 15,000)

MACRS depreciation on various company assets ( 35,748)

Interest, rent, utilities, insurance, supplies, and miscellaneous expenses ( 59,337)

Contributions to public charities ( 13,300)

Compensation to Owners of “Business”:

Reasonable salary compensation to Tony Richardson ( 65,000)

Other cash payments to owners ( 20,000)

Health insurance coverage for Tony Richardson ( 3,000)

Retirement plan contribution for the owner (10% of “reasonable salary”) ( 6,500)

Tony and Ellen Richardson (age 53) file a joint federal income tax return in the current tax year. They do not have any dependents. In addition to any compensation/income from the business described above, Ellen received a salary of $41,300 from ED Industries. Tony and Ellen also received $1,400 personal interest on a joint account, $1,200 private dividends from jointly-held Thomson Company stock, and $9,200 from the sale of 100 shares of Thomson stock (acquired initially five years ago for $3,100).

Tony and Ellen’s expenses for the year include $2,600 in personal property taxes, $12,400 in state income taxes, 10,300 charitable contributions (not including the amounts mentioned above), $8,800 interest on a private home mortgage, and $2,600 of unreimbursed employee expenses by Ellen.

Required:

- For each entity assumption, determine the total taxes paid for the tax year by completing the schedule shown below. Also, please direct all of your calculations.

- Assuming that Richardson Company is operated as a sole proprietorship, determine Richardson’s final federal income tax liability (including any self-employment tax) (Note – the assumption that the pension contribution on Tony’s behalf is 10% of the $65,000 “reasonable salary” is somewhat unrealistic (usually, the amount would be based on the sole proprietorship income). Still, this assumption is made to make the four entity results roughly comparable).

- Assuming that Richardson Company is operated as a partnership (assuming that Tony Richardson is essentially a 100% partner, with a minimal interest held by Ellen), determine Richardson’s final federal income tax liability (including any self-employment tax). For these purposes, allocate 100% of all partnership items to Tony Richardson. (The same pension contribution assumption mentioned in “a” also applies here.)

- Assuming that Richardson Company is operated as an S corporation (with Tony Richardson [DD] as essentially a 100% shareholder), determine Richardson’s final federal income tax liability and any FICA taxes paid on Tony’s compensation by Tony and by Richardson Company Once again, allocate 100% of all S corporation items to Tony Richardson.

- Assuming that Richardson Company is operated as a C corporation (with Tony Richardson (DD) as a 100% shareholder), determine the final corporate income tax liability of Richardson Co., Richardson’s absolute federal income tax liability, any FICA taxes paid on Tony’s compensation by Tony and by Richardson Company.

Answer Summary

| Tax year being compared: _________ | S. Propr | P’ship | S Corp | C Corp |

| Corporate Income Taxes Paid | NA | NA | NA | |

| FICA Tax on TR – Paid by TR | NA | NA | ||

| FICA Tax on TR – Paid by Company | NA | NA | ||

| Unemp. Tax on TR – Paid by Company | NA | NA | ||

| Self-Employment Tax Paid by TR | NA | NA | ||

| Fed Inc Tax Paid by Richardsons | ||||

| Total Taxes |

Prepare a tax memo and draft a client letter indicating your recommendation to the Richardsons as the preferred entity. Provide the appropriate tax citations and explain why you believe this method will be best. Your tax partner wants the material provided in an easy-to-read format for these clients.

Grading Rubric (30% of Grade)

| Project Case | ||||

| Grading Rubric | ||||

| Maximum | Earned | Percentage | ||

| Total Points | 100 | 0 | 0% | |

| Tax Summary Chart – Correct Answer for Full credit if calculations provided | ||||

| Sole Proprietor | 10 | |||

| Partnership | 10 | |||

| S-Corporation | 10 | |||

| Corporation | 10 | |||

| Tax Memo | ||||

| Facts of Case Presented | 1 | |||

| Identification of Issues | 7 | |||

| Assessing tax law sources | 7 | |||

| Arriving at possible solutions | 9 | |||

| Recommendations | 7 | |||

| Draft Client Letter | ||||

| Header and Salutation | 1 | |||

| Opening | 1 | |||

| Statement of the Issue | 2 | |||

| Short Review of facts | 2 | |||

| Review of tax law sources | 2 | |||

| Assumptions used | 2 | |||

| Recommendations | 2 | |||

| References | 2 | |||

| Other considerations | ||||

| Spelling | 3 | |||

| APA citations correct | 2 | |||

| APA references correct | 2 | |||

| Grammar and punctuation | 3 | |||

| Calculations Provided | 5 | |||