Econland – Rollercoaster Scenarios

Introduction

For the benefit of the incoming administration, I submit this report to document, analyze, and interpret the macroeconomic policy decisions I made as the chief economic policy advisor of Econland. The purpose of this document is to further our national prosperity by deepening our understanding of the relationship between macroeconomic policies and their consequences for our citizens. The report includes a thorough accounting of the major fiscal and monetary policy decisions made over each of the seven years of my term, as well as an explanation of the underlying rationales for those decisions and the resulting impacts of those policies.

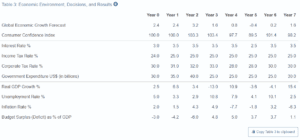

Table 1.1

The table above summarizes the macroeconomic climate of Econland over my term. The roller coaster scenario, based on rapid economic growth and volatility, is the basis for this analysis. Overall, I successfully kept the economy stable and achieved a strong approval rating of 70. It was lower than expected, but it permits me to continue forward and make modifications to help Econland’s economy grow even more.

Fiscal Policy: Taxation

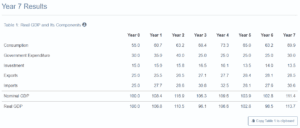

Table 2.1

As a result of the inflation standing at only 2%, there was an arguably fair economic balance at the beginning. The rate of unemployment was also down by 5%. There was an opportunity to increase taxes on both corporations and individuals by a small margin at the starting point. The increase aimed to keep both unemployment and inflation low as they are inherently associated.

Unfortunately, the attained impact on investment was not expected. The amount of money available for re-investment was significantly reduced by corporate taxes. Notably, this would have a devastating effect on unemployment. For every year, decisions had to be incurred on maintaining the level of investment and consumption sustainable both at individual and company dimensions.

Policies of taxation might both stifle and stimulate economic development, depending on how it is done and the economy’s current condition. Further, a tax wage reduction can fuel the need for people to work extra, and more savings will be made when lower rates are applied. On the other hand, a tax reduction may result in unplanned increases in taxable income, making people reduce their work rates (Junior et al., 2022). Notably, this is referred to as the income effect, whereby marginal tax rates at lower levels encourage people to work more for better incomes as opposed to the substitution effect, which connotes a situation where lower marginal tax rates increase increased financial gains from work.

Fiscal Policy: Government Expenditure

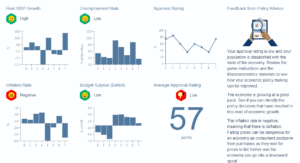

Figure 3.1

Figure 3.2

Government expenditure was monitored keenly throughout the seven years to prevent maintaining a big surplus or deficit. Spending was raised and lowered based on the previous effects of alterations on GDP. While the deficit rose, expenditure was lowered, and as the deficit dwindled, spending was raised.

To create a widening economic condition for Econland, the fiscal policy adopted both government expenditure and taxation. In fact, both policy effects were intended to influence aggregate demand. According to Mankiw (2021), reducing company taxation supports investment spending and hence increases aggregate demand. In figure 3.2, this causes a shift to the right. Similarly, individual taxation and government expenditure borrow into the shift.

Monetary Policies

Figure 4.1

Changes in investment and savings resulted in a fall and a rise in interest rates. Notably, the interest rates remained similar in the beginning years due to their strong economic status. However, they changed in the fourth year when a decline in investments set in. There was a reduction in interest rates in tandem with tax rates to evaluate the effect, but due to a lackluster response in the fourth year, relatively more aggressive changes were needed going into the next two years. By the end of the term, things had leveled off with positive results. The shifts in the rate of inflation had an impact on all items associated with the economy, specifically the inflation rate. However, the inflation rate increased when a cut was administered on interest rates.

In contemporary economic settings composed of many challenges, such as the COVID-19 pandemic, the Federal Reserve ensures that interest rates remain low until full employment and a target of a 2% inflation rate is attained (Plosser, 2020). Despite this being a volatile action, it is anticipated that the economy will continue gainfully by 2023 when everyone is vaccinated globally. Econland suffered a strained demand but was relieved by reduced lending rates. As a result, the equilibrium was re-established, and a demand increase was incurred.

Global Context

Operating in a closed economy is easier than in an open economy due to a lack of exposure to eternal influence. If it were a case of an open economy, it would be challenging to operate since international businesses and commerce set in. When they set in, other business factors also set in, such as politics associated with multinational companies and foreign exchange rates. Policymakers manage to concentrate better on matters pertaining to their local economy when it is closed as they do not encounter external forces. As a result, both monetary and fiscal policy becomes easier to use and implement. In an open economy scenario, fiscal and monetary policies get complicated. A direct influence on the consumption of the GDP sets in and increases significantly. Notably, an open economy avails more goods and services to individuals and businesses, and as a result, the state of the economy booms.

Conclusions

Econland maintained a favorable economic condition from the start to the end. However, this does not imply a lack of economic difficulties. It indicates that the economic decisions made and implemented ensured that Econland moved forward despite the challenges. The end results fall into the maintained expectations of completing the seven years. Based on an optimistic view, the next period of seven years will kick off on a high note. It was interesting to observe how changes and decisions adopted had no immediate or little influence, while others had immense effects. For instance, in the third year, a boost of $ 5 billion in government expenditure led Econland into a significant deficit even though overall growth was observed. Notably, this was interesting because the second year did not have any impact, stimulating one into making more expenditure.

Across the seven-year period, consumer confidence remained considerably high. The policy changes adopted during the period were justified, and approvals did not have problems. Further, the changes resulted in significant impacts. Therefore, it is notable that consumer confidence plays an important role when making policy decisions, and it should be subjected to a thorough examination. If consumers have no confidence in the economy, consumption and spending are more likely to decline. In other words, when the confidence is high, it is more likely to have increased spending, investment, and consumption. In the light of fiscal and monetary policies, decision-makers must pay attention to these factors.

References

Junior, C. J. C., Garcia-Cintado, A. C., & Junior, K. M. (2022). A modern approach to monetary and fiscal policy. International Review of Economics Education, 39, 100232.

Mankiw, N. G. (2021). Principles of economics (9th ed.). Cengage Learning.

Plosser, C. I. (2020). Operating regimes and fed Independence. Cato J., 40, 361.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Econland – Rollercoaster Scenarios

Competencies

In this project, you will demonstrate your mastery of the following competencies:

- Make decisions informed by macroeconomic principles and the business cycle

- Determine the economic impact of historical and current events using models of macroeconomics

- Assess how changes to macroeconomic policies impact the economy

Scenario

You have just completed your seven-year term as the chief economic policy advisor responsible for managing the economy of the nation of Econland. You are expected to create a report for the incoming administration. In this outgoing report, you will summarize your macroeconomic policy decisions and the economic outcomes for Econland. The purpose of this report is to share the lessons you’ve learned over your term and promote sound macroeconomic decision-making moving forward.

Directions

First, assemble the materials that you will need to complete this assignment:

- Access the Macroeconomics Simulation: Econland from Harvard Business Review and select either the Rollercoaster or Stagnation scenarios. Once you have completed the final year of your seven-year term, you can access the final reports under the Dashboard and Reports tabs at the top of the webpage. You will use these charts, graphs, and other visualizations to illustrate your report in the indicated areas of the template (for example, Table 1.1). Reach out to your instructor if you have any questions about accessing these resources.

- Review and use the Project Template located in the What to Submit section.

- The cover page, Table of Contents, and Introduction sections of your report are provided and should remain standard in all submissions except where indicated in the template. You should read the brief Introduction section, as it provides insight into the purpose and structure of the deliverable, and add the high-level descriptions where prompted.

- There are placeholders in the template for your data visualizations (e.g., charts, graphs, tables, etc.). These placeholders are meant to give you a rough approximation of the placement of the visualizations that are required. You should replace the placeholders with the appropriate, indicated images in each case. To create an isolated image from the simulation data, it is recommended that you use a snipping tool or other image-editing software to copy and paste your data visualizations into the template. See the relevant tutorials in the Supporting Materials section for more information.

- You are expected to reference any source material used in your report with appropriate citations. To support you, a References page has been added to the project template with the citation for the course’s reading already provided. Any other references you add should be cited according to APA format.

Once you have assembled the required materials listed above, you can now begin drafting your economic summary report by completing the following steps:

- The first section of your report is the Introduction, in which you will personalize the provided content with the particular information related to your term (i.e., your simulation results) as the chief economic policy advisor for the nation of Econland. Follow the instructions in the template for contextualizing this section, including adding Table 3 from your simulation report to the indicated area of the template (i.e., Table 1.1). Then, add a two- to three-sentence summary specifying which underlying scenario you chose and your overall performance and approval rating.

- Taxation Policies: In the Fiscal Policies: Taxation section of your report, discuss the taxation policies of Econland for the public and your successor. Within this section, you should add an image of Table 1 from your simulation results to the indicated area of the template (i.e., Table 2.1). Then, answer the following questions in the paragraphs below the table:

- Explain your intent for the taxation policy decisions you made over your seven-year term. What were the macroeconomic principles or models that influenced your decision-making?

- Identify the impact of your changes to the income and corporate tax rates. How were consumption and investment affected by your tax policy decisions? Explain these dynamics using specific macroeconomic principles from the course reading.

- Compare and contrast the impact of your tax policy decisions with those of current or historical examples in the United States. What do these examples demonstrate about the validity of macroeconomic models? Be sure to cite your research appropriately. (See the Supporting Materials section.)

- Government Spending: In the Fiscal Policies: Government Expenditure section of your report, discuss government spending policies of Econland for the public and your successor. Within this section, you should add an image of the “Real GDP Growth” and “Unemployment Rate” graphs from your simulation results and use an aggregate demand and aggregate supply (AD/AS) model to the indicated area of the template (i.e., Figures 3.1 and 3.2). Images of the AD/AS model can be found in the course reading or any reputable online source. Then, answer the following questions in the paragraphs below the figures:

- Explain your decision-making regarding government expenditure and how it changed based on the macroeconomic conditions. What was the intent of your fiscal policy decisions in response to the given economic climate?

- Evaluate your fiscal policy decisions, including how they impacted key macroeconomic factors such as real GDP growth and unemployment. To what extent did your policies yield positive or negative outcomes?

- Refer to the AD/AS model to support your analysis in this section of your report.

- Monetary Policies: In the Monetary Policies section of your report, discuss the monetary policies of Econland for the public and your successor. Within this section, you should add an image of the “Inflation Rate” graph from your simulation results to the indicated area of the template (i.e., Figure 4.1). Then, answer the following questions in the paragraphs below the figure:

- Explain how you changed the interest rate levels and how these changes impacted other macroeconomic factors such as inflation, consumption, investments, GDP, and foreign trade. Provide specific examples to help illustrate.

- Compare and contrast the impact of your monetary policies with those of current or historical examples in the United States. What do these examples demonstrate about the validity of macroeconomic models? Be sure to cite your research appropriately. (See the Supporting Materials section.)

- Global Context: In the Global Context section of your report, you will expand your discussion from the particular case of Econland to consider the wider global context. Analyze the impacts of openness to trade in general. Why and how are the impacts of monetary and fiscal policies different in a closed economy versus an open economy? Support your claims with specific details from the course reading.

- Conclusions: In the Conclusions section of your report, draw your overall conclusions about the relevance and significance of macroeconomics for the public and your successor.

- Assess the effectiveness of your economic policy decisions. Did your economic policy decisions produce the anticipated results? Did your macroeconomic principles and models behave in ways that you expected? Provide specific examples to illustrate.

- Evaluate how consumer confidence might have impacted the outcomes of your policy decisions for the economy of Econland. Why is consumer confidence a relevant factor for making informed macroeconomic decisions?