Discussion – Analyzing a Financial Statement

Factors Driving Improved Performance

An evaluation of the annual income statement shows that the organization’s net margin has grown from 2.40% to 3.82% over the past year. Strategic management of revenue growth and expense control have been critical in improving the net margin (Evans et al., 2023). Some of the key drivers of this improved performance include an increase in gross patient revenue, which was up by 22 % for outpatient ancillary and 27 % for in-patient ancillary. Additionally, there were reductions in deductions from revenue, such as government allowance DRG, which decreased by 17%, and charitable allowances, which decreased by 9%. Moreover, while operating expenses rose by 22%, the organization managed to accrue steady and moderate salary and benefits expenses, along with an impressive 100% reduction in supplies costs that, in turn, had made a considerable impact on the improvement of the net income from the operation.

Concerns Regarding the Current Financial Performance of this Organization

Despite the impressive growth in net margin, several concerns regarding the current financial performance of the organization must be addressed. First, operational costs, which rose by 22% compared as compared to last year’s figure, are alarming. Indeed, salaries, which can be considered one of the key components of these costs, went up by 14% on average. However, such expenditures in human capital are essential, and the organization must ensure that these costs stay safe and continue the organization’s future profitability. Thus, every healthcare facility bears labour costs as a paramount expense category while striving to optimize its performance and remain financially healthy (Mohiuddin, 2020). Another concern is the increase in bad debt, which increased by 16%, which might point to problems with revenue collection. The management of bad debt and the effectiveness of the healthcare facility’s revenue cycle are paramount (Famiglietti & Scott, 2023). Addressing these areas is essential to ensure the organization’s long-term financial stability and continued growth

Priority Issues

As an executive leader within this organization, some of the potential priorities as to what to tackle would include improving the revenue cycle to minimize bad debt and managing expenses to rein in increasing operating costs. The increase in the proportion of bad debt by 16 % thus implies that there are problems with the payment collection from customers and that it can be controlled through training and implementing advanced billing systems. Moreover, operating expenses have gone up by 22% in the year under review, with salaries increasing by 14%, and this calls for a critical evaluation of the expenses with a view to optimizing costs without compromising on quality services. There is a positive correlation between healthcare organizations’ ability to manage their labour expenses relative to their operational efficiency and sustainable financial status for long-term expansion (Yang et al., 2023). Therefore, focusing on these areas will be crucial to ensuring the organization’s financial stability and continued success.

Impression of the Reported Financial Performance

My impression of the reported financial performance is relatively favourable since the net margin has improved from 2.40% to 3.82%, and the net revenue from the patients has increased by 24%. These improvements are evidence of good policies in the management of revenues as well as efficient operation. Nonetheless, there is a 16 % increase in the number of bad debts as well as a 22 % rise in operating expenses that may have effects on the business if not addressed promptly. The control of labour costs is known to assist with financial solvency, while the financial health of an organization depends on the management of bad debt (Gupta et al., 2023). In summary, based on these aspects, though the financial performance has revealed a positive sign, it is and will be significant to pay much attention to these to ensure ongoing stability.

References

Evans, J., Leggat, S. G., & Samson, D. (2023). A systematic review of the evidence of how hospitals capture the financial benefits of process improvement and the impact on hospital financial performance. BMC Health Services Research, 23(1). https://doi.org/10.1186/s12913-023-09258-1

Famiglietti, L., & Scott, M. (2023). Mismanaged Money in American Healthcare: Problems and Solutions. McFarland.

Gupta, M. J., Makwana, D. C., Naik, D. S., & Rao, D. W. R. (2023). Fundamentals of Financial Management. AG PUBLISHING HOUSE (AGPH Books).

Mohiuddin, A. K. (2020). The Role of the Pharmacist in Patient Care: Achieving High Quality, Cost-Effective and Accessible Healthcare Through a Team-Based, Patient-Centered Approach. Universal-Publishers.

Yang, C.-H., Chen, Y.-C., Hsu, W., & Chen, Y.-H. (2023). Evaluation of smart long-term care information strategy portfolio decision model: the national healthcare environment in Taiwan. 326(1), 505–536. https://doi.org/10.1007/s10479-023-05358-7

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

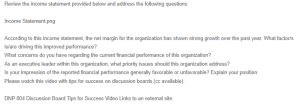

Review the income statement provided below and address the following questions:

Income Statement.png

Analyzing a Financial Statement

According to this income statement, the net margin for the organization has shown strong growth over the past year. What factor/s is/are driving this improved performance?

What concerns do you have regarding the current financial performance of this organization?

As an executive leader within this organization, what priority issues should this organization address?

Is your impression of the reported financial performance generally favorable or unfavorable? Explain your position.

Please watch this video with tips for success on discussion boards (cc available):

DNP 804 Discussion Board Tips for Success Video Links to an external site.