Discussion 7-2

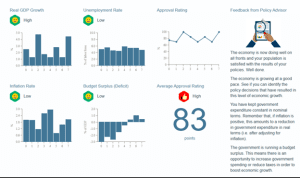

The simulation exercise was challenging and interesting at the same time. I managed to achieve favorable performance in the economy, and the population felt satisfied with the results. Stable economic growth was attained using constant government expenditure, which indicates a good performance. Maintaining government expenditure constant can be the most successful policy as it helps the government attain a budget surplus pending economic growth: Discussion 7-2.

Essentially, this policy was successful because the economy improved, and more money was collected in the form of taxes. However, the increased collection was not used to enhance government expenditure. Therefore, the government is flexible to make adjustments that can boost economic activity.

The simulation provides an economic outlook for each year to reflect how interconnected economies are where both national and global economic outlooks are visible. For instance, government expenditure is based on the government’s budget, which only offers a national outlook. Furthermore, a few aspects, such as inflation, have a close association with global economic dynamics. A change in global inflation rates influences the national inflation rate.

Subsequently, an open economy influences government policies by paying attention to trade balances, interest rates, and exchange rates. Policymakers must pay attention to these metrics to govern the economy. On the contrary, a closed economy seeks self-sufficiency through influencing demand and government expenditure. According to Mankiw (2024), open economies adapt to global trends, while closed economies prioritize national stability.

The provision of consumer sentiment at the end of each year reflects the public confidence in the economy. Notably, it is a crucial aspect because it determines the spending behavior of the public. According to Kiderlin & Conlon (2024), when consumer sentiment is high, people will spend more, which would result in reduced consumption when it is law. Policymakers and economy drivers often rely on consumer sentiment to adjust interest rates while driving the economies toward growth.

References

Kiderlin, S. C., & Conlon, S. (2024). Treasury yields rise after consumer inflation sentiment

darkens, January wages surge. CNBC. https://www.cnbc.com/2025/02/07/us-treasury-yields-ahead-of-key-january-jobs-report.html

Mankiw N. G. (2024). Principles of economics (10th ed.). Cengage Learning.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Discussion 7-2 Instructions:

For this discussion, play your second run of the Macroeconomics Simulation: Econland (from Harvard Business Publishing), in which you act as a the chief economic policy advisor for the fictional country of Econland. Select either the Rollercoaster or Stagnation scenario option. You may play the simulation as many times as you like. This will directly support your success in your course project, due in Module Eight.

Discussion 7-2

In your initial post, include an image of your simulation report. (See Module Seven Simulation Discussion Screenshot Instructions PDF.) Then address the following:

- Share your experience in the simulation. In your opinion, which policy decisions were more successful and why?

- Why does the simulation provide you with a global economic outlook for each year? How does an open economy versus a closed economy impact government policy decisions? Use information from the textbook or the news to support your answer.

- At the end of each year, the simulation highlights changes in consumer confidence. Why is the economic indicator “consumer sentiment” relevant for making successful policy decisions? Use news sources to support your answer.