Critical Thinking – Renting or Buying a Condominium

The worksheet has been completed by taking into account the available facts and evaluating whether to rent or buy. The evaluation indicates that purchasing a Condominium is cheaper as compared to renting. Therefore, a decision should be made by Julie upon comparing these two options.

Learning that Condos like the one that Julie is considering purchasing are appreciating in value at a rate of 3.5 percent will influence the rent-or-buy decision to be made. Notably, this is so because if the condo continues to appreciate over time, Julie might not be able to buy it in the future compared to the present. Therefore, purchasing the Condo at present is more cost-efficient than in the future. Further, the appreciation rate is likely to apply to all matters surrounding the purchase of the Condo. For instance, the insurance, maintenance expenses, and property taxes will increase when the Condo appreciates in value, making it even more expensive for Julie to acquire the Condo in the future than in the present.

Several other factors should be considered when making a rent-or-buy decision. First, the location of the property being considered for purchase is essential. Location can play a role in understanding the housing market in which the property is sold (Khan, 2020). Therefore, conducting a market survey on the prices of houses in that location and other expenses such as maintenance fees, utilities, down payments, and property taxes will be necessary. Further, location is an important factor that can drive the demand and supply of houses in certain places. For instance, renting will be a better option in a location where houses are cheaper than in a location where house prices are high.

Another factor to consider in the rent-or-buy decision is the return on investment likely to be achieved from the decision. A rental house may have a better return on investment in the short term, while a purchased house will likely offer a better return on investment in the long run as its cost continues to appreciate (Billingsley et al., 2020). Therefore, considering this fact ensures that people evaluate whether they need to obtain their returns on investment in the short or long term. Lastly, it is important to consider the move-in costs associated with rent-or-buy decisions. For the case of renting, move-in costs tend to be lower as they involve things such as administration fees and application fees. However, the same cannot be said about purchasing a house. Various costs accumulate when moving in, such as property taxes, insurance premiums, and security.

Considering the two alternatives regarding rent-or-buy, I would advise Julie to buy the Condo for long-term benefits. Purchasing a condominium may appear costly at the moment, but when other variables are considered, such as the property’s rise in value over time, it is worthwhile. Additionally, the evaluation indicates that renting a house is expensive even though it seems affordable at the moment. Therefore, Julie should continue with the current rental living while planning to acquire the Condominium.

References

Billingsley, R. S., Gitman, L. J., & Joehnk, M. D. (2020). Pfin7: Personal finance. Cengage Learning.

Khan, S. (2014). Renting versus Buying a Home. Housing/Finance & Capital Markets. Khan Academy. https://www.youtube.com/watch?v=JNL6f1xkie4

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Critical Thinking – Renting or Buying a Condominium

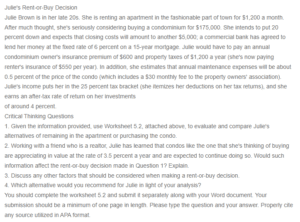

Julie’s Rent-or-Buy Decision

Julie Brown is in her late 20s. She is renting an apartment in the fashionable part of town for $1,200 a month. After much thought, she’s seriously considering buying a condominium for $175,000. She intends to put 20 percent down and expects that closing costs will amount to another $5,000; a commercial bank has agreed to lend her money at the fixed rate of 6 percent on a 15-year mortgage. Julie would have to pay an annual condominium owner’s insurance premium of $600 and property taxes of $1,200 a year (she’s now paying renter’s insurance of $550 per year). In addition, she estimates that annual maintenance expenses will be about 0.5 percent of the price of the condo (which includes a $30 monthly fee to the property owners’ association). Julie’s income puts her in the 25 percent tax bracket (she itemizes her deductions on her tax returns), and she earns an after-tax rate of return on her investments

of around 4 percent.

Critical Thinking Questions

1. Given the information provided, use Worksheet 5.2, attached above, to evaluate and compare Julie’s alternatives of remaining in the apartment or purchasing the condo.

2. Working with a friend who is a realtor, Julie has learned that condos like the one that she’s thinking of buying are appreciating in value at the rate of 3.5 percent a year and are expected to continue doing so. Would such information affect the rent-or-buy decision made in Question 1? Explain.

3. Discuss any other factors that should be considered when making a rent-or-buy decision.

4. Which alternative would you recommend for Julie in light of your analysis?

You should complete the worksheet 5.2 and submit it separately along with your Word document. Your submission should be a minimum of one page in length. Please type the question and your answer. Properly cite any source utilized in APA format.