Corporate Financial Statements

Corporate financial statements include balance sheets, income statements, cash flow statements, and statements of shareholder’s equity. These financial statements contain various valuable information for multiple stakeholders, such as investors, creditors, managers, and government authorities. Some of the information found in these statements is as follows: First, they show the firm’s performance at a given time (Dragusin & Maria, 2014). One of the primary purposes of being in business is to make profits. Through these statements, a company or the investors could establish whether a company is making profits and, hence, is worth investing in (Vătăşoiu, 2010). When a firm’s performance is promising, investors would want to invest; however, when the performance is poor in terms of return on investment, the investors would shun investing in such a firm.

Secondly, financial statements have information that shows a firm’s financial position. The financial position of a firm helps the creditors gauge whether it is worth lending. For example, a balance sheet summarizes the assets, liabilities, and equity of a firm to reveal its financial position (Dragusin & Maria, 2014). Accordingly, an excellent financial position assures the lenders that the firm will be able to repay the borrowed money. Thirdly, financial statements have information that reveals the cash flow of the business. The cash flow statement informs the stakeholders of the firm’s liquidity and the ease with which the firm can offset its short-term liabilities (Franklin, Graybeal, & Cooper, 2019). A firm with a good cash flow will quickly pay its expenses; hence, it will have to operate more effectively and efficiently.

The financial statements are used by many users, including investors, lenders, suppliers, government agencies, and other business partners. Investors check on the firm’s profitability for them to decide whether to invest in a firm or not (Dragusin & Maria, 2014). Similarly, lenders check the company’s financial position to gauge whether it can repay when it borrows. Finally, government agencies use the information to determine if the firms adhere to both local and international financial recording standards.

References

Dragusin, c & maria, c. (2014). THE IMPORTANCE OF THE ACCOUNTING INFORMATION IN HIGHER EDUCATION INSTITUTIONS MANAGEMENT. Research Gate. University of Târgu Jiu, Economy Series.

Franklin, M., Graybeal, P., & Cooper, D. (2019). Principles of Accounting, Volume 2: Managerial Accounting. Rice University.

Vătăşoiu, C.I., (2010). Accounting Information – The Base of Financial Analysis in Investment Decisions, Analele Universităţii „Constantin Brâncuşi” din Târgu Jiu, Seria Economie, Nr. 4/2010.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

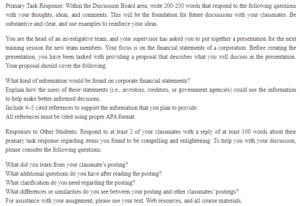

Primary Task Response: Within the Discussion Board area, write 200-250 words that respond to the following questions with your thoughts, ideas, and comments. This will be the foundation for future discussions with your classmates. Be substantive and clear, and use examples to reinforce your ideas.

Corporate Financial Statements

You are the head of an investigative team, and your supervisor has asked you to put together a presentation for the next training session for new team members. Your focus is on the financial statements of a corporation. Before creating the presentation, you have been tasked with providing a proposal that describes what you will discuss in the presentation. Your proposal should cover the following:

What kind of information would be found on corporate financial statements?

Explain how the users of these statements (i.e., investors, creditors, or government agencies) could use the information to help make better-informed decisions.

Include 4–5 cited references to support the information that you plan to provide.

All references must be cited using proper APA format.

Responses to Other Students: Respond to at least 2 of your classmates with a reply of at least 100 words about their primary task response regarding items you found to be compelling and enlightening. To help you with your discussion, please consider the following questions:

What did you learn from your classmate’s posting?

What additional questions do you have after reading the posting?

What clarification do you need regarding the posting?

What differences or similarities do you see between your posting and other classmates’ postings?

For assistance with your assignment, please use your text, Web resources, and all course materials.