Compute and Interpret Present And Future Values

How does a lump sum’s present value compare to an annuity?

The present value of a lump sum refers to the total amount that will be required today at a specific discount in order to get a certain amount in the future. When one wants to conceptualize the value necessary as one amount, it is referred to as a lump sum. For instance, one may want to know the amount required today to earn a specific future amount at a specified interest rate. In a situation where the amount will be raised annually, the amount is referred to as the present value of an annuity. The difference between the two is the way discount is factored for. The deal is calculated wholesomely in the case of lumpsum, with the annual discount rate acting as the power in the agreement radical. In the present value of an annuity, the energy is negative of the annual discount rate. The administration is divided by the yearly discount rate (Arnold,2013).

Are you searching for an authentic copy of “Compute and Interpret Present And Future Values”? Don’t hesitate to get in contact if you need additional assistance.

How does the future value of an ordinary annuity compare to the future value of an annuity due?

The future value of an ordinary annuity, according to Arnold (2013), refers to the amount that we expect after investing a certain amount at present. It will increase if you have a specific amount of money and decide to support it at a particular interest rate. The amount accumulating at a specified future date is the future value of an ordinary annuity. In contrast, if the assistance is already due, it translates as the amount already determined and is scheduled for use. The only issue here is that the future value has not been determined.

How does the present value of an annuity compare to the present value of an annuity due?

The difference between the PV of an annuity and the PV of an annuity is that the PV of an annuity represents the present value of a future lump sum that is discounted using an annual rate. The goal is to know the money that should be held to have a specified amount in the future. The present value of an annuity due is a different concept. As Arnold (2013) points out, the present value of an annuity is the periodic payment that should be made periodically, for instance, monthly, to meet the required obligation for the future value. The main factors here are the present value of the annuity, the number of periods, and the immediate cash flow. To get the present value of an annuity due, the quick cash flow is added to the present worth to get the unpaid amount.

What’s the value today of $500 received in 3 years if the going interest rate is 10% per year?

Present value (PV) = C1/(1 +r)n

=500/(1.1)3

= $375.6574

The amount of $375.6574 means getting $500 in 3 years at an interest rate of 10% calculated annually, and one should have $375.6574 at present.

An individual has $3,000 today. What will that be worth in 7 years if the going interest rate is 4% annually?

Future value = PV*(1 +r)n

= 3000* (1.04)7

= $3,947.80

The above calculations represent the future amount that can be obtained by investing $3000 for seven years at an annual rate of 4% per year. In this case, we can establish that the future value is the inverse of the present value.

What’s the value of $250 received at the end of each year for the next eight years if the interest rate is 4.5% annually?

PV of an amount due = p + p [1 – (1 + r)-(n-1)]/r

= 250 + 250[1 – 1.045-7]/0.045

=$1,723.1752

Other Related Post: Interpersonal Reflection

References

Arnold, S (2013) Fundamentals of financial planning; present value, future value, and discounting; London: Taylor and Francis publishers.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

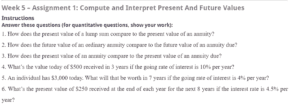

Week 5 – Assignment 1: Compute and Interpret Present And Future Values

Instructions

Compute and interpret present and future values

Answer these questions (for quantitative questions, show your work):

- How does a lump sum’s present value compare to an annuity?

- How does the future value of an ordinary annuity compare to the future value of an annuity due?

- How does the present value of an annuity compare to the present value of an annuity due?

- What’s the value today of $500 received in 3 years if the going interest rate is 10% per year?

- An individual has $3,000 today. What will that be worth in 7 years if the going interest rate is 4% annually?

- What’s the value of $250 received at the end of each year for the next eight years if the interest rate is 4.5% annually?

Length: 1-2 pages.