Changes in Monetary Policy

- The bank must hold 8% in reserve and lend out the remaining 92%.

- That is, 0.08 × $90,000 = $7,200

- The Bank of Ecoville must hold $7,200 in reserve and lend the remaining $82,000, which will make its way back to the banking system. Thus, the maximum amount of new loans that the banks can make is $82,000

New Balance Sheet

| Balance Sheet for Ecoville International Bank | |||

| ASSETS | LIABILITIES | ||

| Cash | $33,000 | Demand Deposits | $82,000 |

| Loans | $73,200 | ||

Change in Money supply

- Foremost, Money Multiplier = 1/reserve ratio

- Money Multiplier = 1/8% = 0.125

- Change in Money Supply = Change in Reserve × Money Multiplier

- Change in Money Supply = $82,000 × 0.125 = $10,250

- The money supply increased by $10,250

In Case the Money Multiplier is 5

- The amount the banks will make = maximum change in money supply × 5

- = $82,000 × 5

- = $410,000

- The event will create $410,000 + $10,250 = $420,250

Implementing a Contractionary Monetary Policy Using Reserve Requirement

The Fed would implement contractionary monetary policy using reserve requirements in three ways. One of these is increasing the interest rates, which reduces inflation by limiting the money supply in the economy (Park & Van Horn, 2015). Another approach involves selling government securities. Typically, the Fed reduces the money supply when it takes money out of the financial system by selling bonds (Glocker & Towbin, 2012). Additionally, the Fed can raise the reserve requirement for banks. Glocker and Towbin (2012) observe that the money that a bank can potentially lend reduces with increased reserve requirements. An increase in reserve ratio is a contractionary monetary policy since the excess cash in the economy can shore up a bank’s balance sheet.

References

Glocker, c., & Towbin, P. (2012). Reserve requirements for price and financial stability – When are they effective? SSRN Electronic Journal, 8(1), 65-113. https://doi.org/10.2139/ssrn.2008665

Park, H., & Van horn, P. (2015). Did the Reserve Requirement Increases of 1936-37 Reduce Bank Lending? Evidence from a Quasi-Experiment. Journal of Money, Credit and Banking, 47(5), 791-818. https://doi.org/10.1111/jmcb.12235

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Changes in Monetary Policy

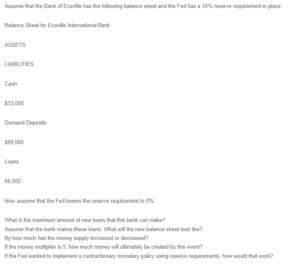

Assume that the Bank of Ecoville has the following balance sheet and the Fed has a 10% reserve requirement in place:

Balance Sheet for Ecoville International Bank

ASSETS

LIABILITIES

Cash

$33,000

Demand Deposits

$99,000

Loans

66,000

Now assume that the Fed lowers the reserve requirement to 8%.

What is the maximum amount of new loans that this bank can make?

Assume that the bank makes these loans. What will the new balance sheet look like?

By how much has the money supply increased or decreased?

If the money multiplier is 5, how much money will ultimately be created by this event?

If the Fed wanted to implement a contractionary monetary policy using reserve requirements, how would that work?