Case Study – Tesla Dividends Pay Out

Tesla’s stock model is dividend growth rather than a dividend-paying stock model. The reason is that Tesla is still in its growth stage and, as a result, has substantially high financial requirements that can’t be met by internal financing only (Ciura, 2018). Also, the fact that the company has been incurring losses in the past would impede it from paying out dividends. Nonetheless, as the firm grows, it will attain a maturity level characterized by a stable financial performance that will allow it to pay out dividends.

Given that Tesla is a high-tech firm, it may take a significant period before the first dividends are paid. As observed from other companies of a similar nature, for instance, Apple Inc. first ventured into the capital market in the 1980s by issuing its first IPO but paid its first dividends in 2012 (Smith, 2018). It took the firm approximately eight decades before it could pay out its first dividends. The same should be expected of Tesla, judging by its past financial performance.

Based on my own judgment, if Tesla meets its sales targets, and earn the revenue it has been projecting for a significant period, it could be high dividend payer. Just like Apple, the firm has the potential of profitability once it reaches the maturity stage. On the contrary, continued poor performance, would render the firm bankrupt, and it would never have to pay dividends to its shareholders.

Even though Tesla has not been paying out dividends, investors have been making earnings from the stock in the form of capital gains, given the value of Tesla’s share has been on the increase from the onset of the firm’s establishment. An investment of $1000 in Tesla’s stock in 2010 during its first IPO would be worth $12,000 today, equivalent to twelve times the amount invested (Carter, 2018). Presently, Tesla requires significant capital finances for its operations. Thus, in the event of profits from the same, the earnings would be reinvested into the firm’s operations rather than paid out to shareholders. On the same note, policies and regulations on dividend requirements for Tesla are non-existent.

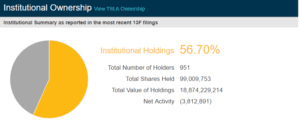

The image below indicates that 56.7% of the firm’s stock is owned by institutional holdings (Nasdaq, n.d). The main objective of these holdings is wealth maximization attained through capital gain. Thus, even in the absence of dividend payouts, investors would still be better off. The primary concern is the financial performance of the firm and its prospects for growth. In fact, the holdings would be against dividends payouts to the firm’s shareholders, given the firm has been struggling to raise finances for its operations.

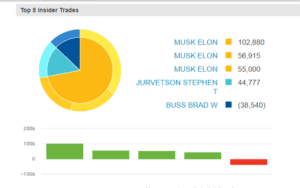

The image below showcases Tesla’s top shareholders, with Elon Musk heading the list. Part of Musk’s ownership has been declared through his brother’s name. Given that Musk is a top shareholder and, at the same time, Tesla’s CEO, he would be less interested in dividend payouts from the firm’s earnings since he is focused on Tesla’s future growth prospects. He has been working towards leading the electric car and solar panel manufacturing market.

Tesla mostly relies on debt and equity financing for its operations, given its cash flows are unreliable. Nonetheless, Tesla will require minimum funding from the two, given it reduced its budget as it abandoned projects that required significant financing. For instance, the firm postponed the manufacture of its semi-electric truck to an unstated date in the future. The firm’s CEO explained that the firm was focused on clearing its debt and, as a result, would minimize capital financial requirements. Also, part of the compensation plan constitutes paying creditors using the company’s stock. This compensation would result in a decline in Tesla’s stock, making it an unviable source of financing in the near future.

In the event that Tesla pays dividends for its shares, it uses dividend signaling to increase the finances earned through equity. Dividend signaling manifests as a positive indication of the firm’s future prospects. Thus, if the firm announced that it would increase the amount of dividend payout, more investors would be willing to buy Tesla’s stock at a significantly high price. Thus, signaling can be used to enhance equity and increase finances.

Currently, Tesla has a massive debt amounting to $920 million. If the valuation of Tesla stock is equal to the value of debt, the debt will be converted to stock. If Tesla’s stock valuation is lower, then Tesla would have to make the repayments in from of cash to clear its massive debt. Tesla’s shares would be diluted and would no longer be attractive to investors. Hence, equity financing would no longer be an effective approach in raising finances in future.

References

Carter. S. M (2018). If you invested $1,000 in Tesla in 2010, here’s how much you’d have now. Make It. Retrieved from https://www.cnbc.com/2018/06/01/if-you-invested-1000-in-tesla-in-2010-heres-what-youd-have-now.html

Ciura. B (2018). Will Tesla Ever Pay A Dividend? Sure Dividend. Retrieved from https://www.suredividend.com/tesla-dividend/.

Nasdaq (n.d). Tesla. Retrieved from https://www.nasdaq.com/symbol/tsla/ownership-summary

Smith. Y (2018). Apple’s “Capital Return Program”: Rewarding the Wrong People. Retrieved from https://www.nakedcapitalism.com/2018/11/apples-capital-return-program-rewarding-wrong-people.html

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

You are to complete the Live Case Study at the end of Chapter 10. You will be completing the Live Case Studies for the remainder of the term by researching the company that you have selected. In answering the questions in Live Case Study, you are to answer the questions as laid out in the Framework for Analysis, such as 1,2,3,4,5,…..Also, the sub-sections need to be bulleted. If there is an item that is not applicable, you are to clearly state that. After you have submitted your weekly study, I will grade it and make comments that you need to incorporate into your Case Study.

Case Study – Tesla Dividends Pay Out

Researching a particular company will help support your weekly readings. I would suggest that you take a look at Yahoo Finance for information on your researched company. You may also want to go to the company’s website and take a look at Investor Relations, which will give you access to the annual financial statement, SEC filings, and the prospectus of the company, along with other information that you will find useful in completing the requirements of the Live Study.

When you are working on your case study, I expect that you will be inserting financial statements and other tables to support your research. These are readily available in Yahoo Finance or the company’s web site under Investor Relations, where you will also find financial statements.