Case Study – Monopoly and Antitrust Regulation

The market is defined as the medium through which the buyers and sellers meet each other. Scarcity is a significant point of discussion in economics, and people are faced with choices. They lack resources, and decisions need to be made by utilizing the limited resources effectively. An example of a market that is growing is the fishing market. Opportunity cost is known as the best alternative which is being given up as a result of an activity. Hence, the opportunity cost in the fishing market is the effort and the time dedicated as the time spent catching the fish could miss the opportunity to buy more improved nets and new boats. Scarcity is expected in the fishing market. That is because nets or vessels are limited, and fish need to be caught within these restricted resources. The supply in the fishing market is related to the seller’s position, and hence, the number of fish sold constitutes this, and the demand is the consumers buying the fish in stores or on the market. The marginal benefit is the additional gain or utility resulting from producing more fish by an additional unit, and the marginal cost is the expense associated with another capital raised in the fishing market. Hire our assignment writing services in case your assignment is devastating you. We offer assignment help with high professionalism.

The opportunity cost for the fishing market is the best alternative, which is being given up in activities such as fish production. The opportunity cost for the fisherman is the time and dedication to catching fish, and hence, the time could be spent on new equipment, such as better equipment or improved nets.

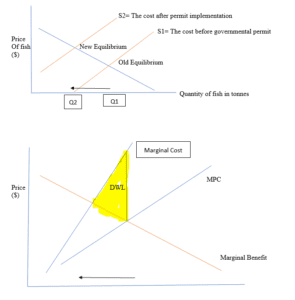

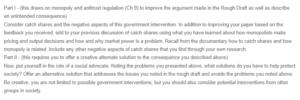

The common problem is seen in the fishing market, and this is the average reduction in the total quality of the fish being produced and the consumption by the people, which at the point of exceeding the consumption can lead to a lack of quality and the catch as well. The fishing market is a rival and a non-excludable good since a fisherman can produce in the market; hence, this does not need to be public and is unique to specific target customers consuming the fish. Deadweight loss can result in an imbalance of supply and demand and can occur when the supply of fish is less in the season due to a natural disaster, and the demand could be higher, or the demand would decrease, and supply would be more. A socially optimal point is fish production, which takes into account the expenses and the benefits with the consideration of the externalities which have occurred. Market equilibrium is the buyer and seller intersection in the fishing market, and this would happen in the long run when the pricing converges to equilibrium, such as a surplus, which can happen when fish sold is more than the demand for fish and the price higher will lower to equilibrium and can occur vice versa when the demand is more than supply, so prices rise to approach equilibrium. Catch share solution is related to the utilization of the specific land and is seen in the fishing market where the governmental factors allow the use of the property, such as the exclusivity in the production of fish, so each fisher will be able to own the property and produce fish without the land to be occupied.

Socially efficient Free Market

Q2 Q1

The introduction of catch shares in the fisheries market is meant to solve the problems brought about by an open access system. In an open system, people tend to exploit the benefit of free riding. One of the common mistakes associated with the system is short-sightedness on the part of the fishermen (Milliken, n.p). Short-sightedness leads fishers to overfish and destroy species, which eventually limits the vital resource. In an open system, one could fish as long as they have a boat and fishing gear. However, the newly introduced regulatory system prevents the problems with an open system, although it also has its weaknesses.

The benefits of catch shares are many, but the regulatory framework also costs. In the short run, the regulatory framework brings biological benefits since the fish are now better protected, and there is a low likelihood that some species may be unnecessarily killed. However, regulatory actions bring economic inefficiencies for the fishermen in the long run. A common consequence is that fishers have to increase their efforts to attain the productivity they previously achieved (Milliken, n.p). One of the reasons that contribute to this is that fishers are now required to cover an expansive area than they previously covered to achieve similar results. Because they operate in an open-ended market, the maximum resource use will eventually overwhelm them and their resources. Additionally, the method costs more since the equipment used under the regulatory framework is expensive to acquire. There is an incentive not to exploit fishing resources under this method, unlike in an open system where one will not find the fish they fail to catch today the next day.

Moreover, regulations create an incentive to overfish and fish illegally whenever an opportunity arises. Since a regulatory framework now limits fishers, most tend to look for ways to circumvent the economic inefficiencies posed by the regulation (Milliken,n.p). Those who successfully avoid the economic inefficiencies overfish a factor that puts pressure on genuine fishers. The practice also causes fish stocks to fall since rogue fishers use illegal means to exploit the resource. However, as stated earlier, others have to device means to catch up with the cut-throat competition. Once genuine fishers follow the illegal path, the regulations become self-defeating, only adding up to the fishing costs.

Using catch shares has also proven to increase costs significantly. Unlike a free market, a managed industry incurs costs mostly paid for by industry players (Grimm et al., pp. 644–657. Sometimes, the costs are passed on to the final consumer through increased fish prices.

The implementation of catch shares regulation leads to social problems. Only those who can afford to buy quotas are allowed to fish in a given area, a factor that effectively locks out those who cannot afford to buy shares (Grimm et al., pp. 644–657. The consequences of implementing catch shares in the fisheries industry are similar to those that happen when public companies are privatized.

Part 2

One of the consequences of implementing fishing quotas stated above is that fishers who get the quotas are incentivized to overfish and engage in other illegal fishing activities. Such practices may increase bycatch, the unintended catching and disposal of fish and other animals not targeted (Environmental Defense Fund, n.p.). Fishing managers ought to prioritize reducing bycatch to sustain the marine ecosystem. Unlike conventional fishing methods, reducing bycatch requires specifics about the use of gear and in what conditions the fishers will use the fishing gear. For instance, fishing managers can mandate circle hooks to protect turtles. Also, fishers can use nets with wider meshes to avoid catching juvenile fish. There are two proven ways to reduce bycatch. First, the fisheries management body can implement bycatch quotas which will require the management body to monitor and control fishing. Another strategy is the introduction of rewards to fishers who are least wasteful and those who observe bycatch regulations.

Moreover, fisheries managers ought to pay attention to the needs of fishers and the local community while implementing limited access privilege programs (LAPPS). In the US, the Magnuson-Stevens Act requires that the local community and fishers deserve protection from the adverse implications resulting from the implementation of LAPPs (Environmental Defense Fund, n.p.). Jobs and local businesses that rely on the fisheries industry should not be adversely affected by implementing catch shares management. Currently, the fisheries labour market is mainly dominated by part-time and seasonal jobs whose importance in society cannot be overstated. To counter the challenges, fisheries managers ought to create full-time and more stable jobs. Also, regulators are required to abide by a balancing act to ensure that the total yield per boat increases to cover the decline in the number of fishers. The target is to reverse the adverse effects resulting from implementing the catch-share program.

Additionally, fishing managers can focus on days at sea, a guideline that limits the time fishers are allowed to fish. The strategy does not focus on the gear type used or area management. Instead, the days-at-sea system allocates individual fishermen time to access waters (Brewer, n.p). Although the days-at-sea strategy is not entirely a catch share per se, it offers personal fishing rights ownership. The days-at-sea system brings more benefits than just controlling the amount of fish one can fish in a day. Under the traditional fishing regime, captains could risk their safety by working late into the night to attain targets or to compensate for the time their equipment malfunctions (Brewer, n.p). Fishing late into the night has severe implications for fishers since there are high chances for accidents during these times. Besides, one can easily drown while fishing in the dark. That is likely to also lead to economic efficiency since fishers now target areas rich in fisheries instead of wandering through the entire area, well aware the clock is ticking.

Another fishing quota-related problem that needs attention is that some merchants buy so many catch shares that a single individual owns a significant part of the fishery. That is likely to disadvantage other prospective buyers who wish to own fishing rights. Monopoly in the fisheries sector disadvantages other fishers since once a lord buys so many shares, they create a barrier to entry. Also, the monopoly in fishing at the source may lead to price hikes since the monopolist enjoys market power. Fisheries managers should require that the shareowner accompany their boats whenever they go fishing to prevent an individual from owning so many shares. However, this may not necessarily work as some fishermen find a way to circumvent such requirements. For instance, some may board a boat for a limited time and then leave it to their employees to fish. Nonetheless, the requirement may prevent individuals from controlling the entire market.

Conclusion

Implementing catch shares in fisheries management has both biological and economic benefits. The biological benefits result from regulations that reduce bycatch and the extraction of juvenile fish. On the other hand, catch share incentivizes fishers to adopt economically efficient fishing practices since they know they stand to lose if they do not embrace efficiency. However, the program breeds a monopoly in the fishing sector. Moneyed individuals may buy so many shares that they end up controlling an entire fishing area. Another potential adverse consequence of introducing catch shares is job losses. The system tends to do away with many part-time and seasonal jobs and instead brings fewer full-time jobs, thus disadvantaging the community. Fisheries managers can defeat such problems by adopting a management system limiting share ownership to reduce monopoly power.

Works Cited

Brewer, Jennifer F. “Paper Fish and Policy Conflict: Catch Shares and Ecosystem-Based Management in Maine’s Groundfishery.” Ecology and Society, vol. 16, no. 1, 2011, https://doi.org/10.5751/es-03765-160115.

Environmental Defense Fund. An Evaluation of Incentive-Based Management Sustaining America’s Fisheries and Fishing Communities.

Grimm, Dietmar, et al. “Assessing Catch Shares’ Effects Evidence from Federal United States and Associated British Columbian Fisheries.” Marine Policy, vol. 36, no. 3, May 2012, pp. 644–657, https://doi.org/10.1016/j.marpol.2011.10.014. Accessed 4 Dec. 2019.

Milliken, William J. “Individual transferable fishing quotas and antitrust law.” Ocean and Coastal Law Journal 1.1 (1994): 3.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Monopoly and Antitrust Regulation

Part I – (this draws on monopoly and antitrust regulation (Ch 9) to improve the argument made in the Rough Draft as well as describe an unintended consequence)

Consider catch shares and the negative aspects of this government intervention. In addition to improving your paper based on the feedback you received, add to your previous discussion of catch shares using what you have learned about how monopolists make pricing and output decisions and how and why market power is a problem. Recall from the documentary how to catch shares and how monopoly is related. Include any other negative aspects of catch shares that you find through your own research.

Part II – (this requires you to offer a creative alternate solution to the consequence you described above)

Now, put yourself in the role of a social advocate. Noting the problems you presented above, what solutions do you have to help protect society? Offer an alternative solution that addresses the issues you noted in the rough draft and avoids the problems you noted above. Be creative; you are not limited to possible government interventions, but you should also consider potential interventions from other groups in society.