CAPM and Black Scholes

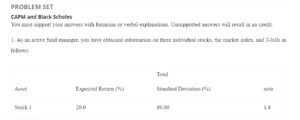

As an active fund manager, you have obtained information on three individual stocks, the market index, and T-bills as follows:

|

Asset |

Expected Return (%) |

Total

Standard Deviation (%) |

ncta |

| Stock 1 | 20.0 | 80.00 | 1.8 |

| Stock 2 | 16.0 | 60.00 | 1.4 |

| Stock 3 | 6.0 | 50.00 | 0.8 |

| Market Index | 10.0 | 40.00 | 1.0 |

| T-bills | 4.0 | 0.00 | 0.0 |

You decide to use the above information to form an optimal active portfolio, consisting of the three individual stocks. Determine the corresponding weights for the three stocks in the optimal active portfolio. Show your work.

CAPM

E[Ri] = Rf + βi(E[Rm] − Rf)

20% = 0.8+1.8(0.2) -rf

= 0.8+1.8(0.2)/0.2

= 5.8

= 5.8/40.08*100 = 14.47

CAPMa

E[Ri] = Rf + βi(E[Rm] − Rf)

16% = 1.4(0.16) -rf

= (0.6+0.224}/0.16

= 5.15

5.18/40.08*100 = 12

CAPM

E[Ri] = Rf+βi(E[Rm]−Rf)

6% = 0.2 + 0.8(0.06)-rf

= (0.2+0.048)/0.06

= 4.13

4.13/40.08*100 = 10.3

CAPM

E[Ri] = Rf + βi(E[Rm]−Rf)

10%= 0.2+0.4(0.1)-rf

= (0.2+0.04)/0.01

= 24

24/40.08*100 = 59.88

CAPM

E[Ri]=Rf+βi(E[Rm]−Rf)

4% = 0.0 + 0.0(0.4)

= 1

= 2.49

As an option trader on GM stock, you have collected the following information:

-

GM stock’s current price is S =$100.

-

GM’s future prices follow a two-state path with u – 1.1052 (in Up state) and d = 0.9048 (in Down state) in each period.

-

The one-period risk free holding period return is R = 1.01.

Consider two American options on G.M stock (a Put and a Call), both have a strike price of $110 and 5 periods before expiration.

What is the value of the American Put today? Show your work.

Start by Calculating the volatility

Deviation square

100-0.9048 99.0952 0.9048 0.8187

100 0 0

100+1.1052 101.1052 -1.1052 1.2215

0.8187 + 0+1.2215

= 2.0402

Divide by the number of observations

2.0402/= 0.68

Stock price = 110

Exercise price = 100

Time = 5

R = 5.05

D1 = ln (62/60) + (0.04+0.5(0.32)2] (40/365)

= 0.0404

D2 = 0.404-0.32* root (40/365)

D2 = 0.298

What is the value of the American Call today? Show your work.

N (0.40) = 0.6554 N (0.30) = 0.6179

VC = (62) (0.6554)- [(60)/(E0.04*(40/365)](0.6179)

VC = 40.63- [60/1.004393] (0.6179)

VC = $3.72

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

PROBLEM SET

CAPM and Black Scholes

You must support your answers with forrnuias or verbal explanations. Unsupported answers will result in no credit.

CAPM and Black Scholes

- As an active fund manager, you have obtained information on three individual stocks, the market index, and T-bills as follows:

|

Asset |

Expected Return (%) |

Total

Standard Deviation (%) |

ncta |

| Stock 1 | 20.0 | 80.00 | 1.8 |

| Stock 2 | 16.0 | 60.00 | 1.4 |

| Stock 3 | 6.0 | 50.00 | 0.8 |

| Market Index | 10.0 | 40.00 | 1.0 |

| T-bills | 4.0 | 0.00 | 0.0 |

You decide to use the above information to form an optimal active portfolio, consisting of the three individual stocks. Determine the corresponding weights for the three stocks in the optimal active portfolio. Show your work. —— –

- As an option trader on GM stock, you have collected the following information:

- GM stock’s current price is S =$100.

- GM ‘s future prices follow a two-state path with u – 1052 (in Up state) and d = 0.9048 (in Down state) in each period.

- The one-period risk free holding period return is R = 1.01.

Consider two American options on G.M stock (a Put and a Call), both have a strike price of $110 and 5 periods before expiration.

- What is the value of the American Put today? Show your wo

- What is the value of the American Call today? Show your work.