Audit Risk and Engagement – Evaluating Internal Controls and Ethical Implications

Section B – Question 2

Question 2(a)

One of the techniques I would employ in the recording of the internal control for Primrose is a trial balance. In the trial balance technique, there would be a double entry in the books of accounts. This method will ensure there is a balance in the writing of accounts. However, it is possible to still have errors and fraud taking place in the double-entry system of recording internal control. The trial balances will play a vital role in the infusion of reliability into the control system. Such will be achieved through keeping an internal record of the credits and the debits.

The second technique for the recording of the internal control in Primrose is reconciliation. Reconciliation should take place on the banks, suppliers’ statements, and credit cards. There is a need to have a better understanding of which of the items have been cleared, which are in transit, and which ones have not yet been posted. Recording will be essential in identifying fraud and errors. Equally, with the use of reconciliation as a continuous recording strategy for internal control, strategic business decisions will be made, along with day-to-day operations.

The last technique for internal control recording will be data backups. Accurate financial data requires the incorporation of technology, which will assist in the creation of interactions between platforms. When there is a loss of financial input, the recordings will be skewed, and the audits will be muddled. In addition, when there is a failure in technology, past information can be lost. Such will create a delay in reporting and cause impairment in various accounting functions such as auditing. Backing up the available data will create extra copies, minimizing cases of data loss. This technique will ensure efficient and effective recording of internal control.

Question 2(b)

One of the controls expected at the store level is filling. This control measure focuses on keeping receipts and other transaction documents in order. Filling as a control measure will assist in the reconciliation technique. All the payments made to the bank and the suppliers will be recorded and available for auditing through reconciliation. When the receipts are kept in order, it would be easier to detect any form of error and fraud.

Another control expectation is the creation of formal policies. It would not be easy to implement a recording of internal control techniques such as data backup without providing the employees with the needed education. The employees need to be aware of whom they can report to when they are suspicious.

Also, templates need to be created at the store level. Such models will be vital in the standardization of the commercial recordings and thus create consistency. This will make standardization very easy, especially during the auditing process. With this control measure, a standard template would be created and used to estimate invoices and purchase orders.

The fourth control expectation will be the incorporation of physical audits of assets at the store level. This measure will involve cash drawer verifications, verification of the raw materials, and auditing of the assets. This on-site audits will take place regularly to ensure there is accuracy in the financial statements.

The last control measure at the store level is the approval of the requirements. There will be designated managers who will be responsible for the authorization of transactions. This measure will funnel the purchase decisions made and will take place through some of the most trusted employees. To ensure smooth running, the approvals will be implemented for large payments, unusual expenses, and increases in unexpected costs.

Question 4

Pack and Gove will be negatively impacted by the dispute between Islington plc and Torquay. As an auditor, their integrity and conduct will be questioned by both client companies. None of the companies will trust the auditors as they have taken part in auditing both of the companies. The auditor may be caught up in a mess by being accused of favoring one of the companies. As a result, the auditor might not be able to effectively carry out their auditing procedures due to the pressure arising from both companies. The best step for the auditors to take is to withdraw from providing services to both companies until they successfully settle their disputes.

Sheila and Jones will face the challenge of errors and mistakes being made in the auditing process. With a reduction in the auditing time, the auditors will be operating under pressure to try and meet the new deadline. The auditors’ focus will shift from the detection of errors and fraud to meeting the new deadline. Auditing is a slow process, and it requires a step-by-step analysis of each of the financial documents. When there is no time to go through all the financial reports, it will not be easy to detect errors and mistakes made in the financial records—the best strategy for Sheila and Jones to use is to increase the workforce for auditing Exeter Ltd. When the workforce is increased, labor will be distributed, and the auditors will manage to meet the new deadline.

If the audit engagement team decided to attend the special boat trip organized by Torquay Ltd, it would be considered a bribe and might ruin the reputation of Diana and Frank’s audit engagement team. When the final audit is carried out, and there are errors and fraud, the engagement team could be sued. This is because it would be perceived that the trip was intentional, and the main aim was to make the team intentionally ignore the errors during the interim audit. It can be implied that the trip was a form of bribe and persuasion for the engagement team not to expose the company’s fraud. The auditors will be negatively affected as there is a lack of ethical practices, given the two companies are different. Auditors are expected to be loyal to their clients during the audit. They are not to engage with another company unless stated otherwise—the best recommendation for the engagement team is to decline the boat trip offer. If possible, they should ask for other ways of compensation for the busy schedule and the good work done. The reward can be in the form of an increase in wages or tokens of appreciation.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

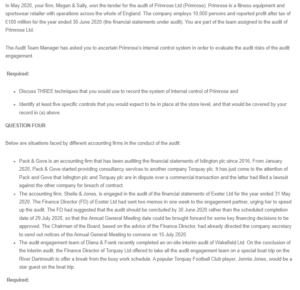

In May 2020, your firm, Megan & Sally, won the tender for the audit of Primrose Ltd (Primrose). Primrose is a fitness equipment and sportswear retailer with operations across the whole of England. The company employs 10,000 persons and reported profit after tax of £100 million for the year ended 30 June 2020 (the financial statements under audit). You are part of the team assigned to the audit of Primrose Ltd.

Evaluating Internal Controls and Ethical Implications

The Audit Team Manager has asked you to ascertain Primrose’s internal control system in order to evaluate the audit risks of the audit engagement.

Required:

- Discuss THREE techniques that you would use to record the system of internal control of Primrose and

- Identify at least five specific controls that you would expect to be in place at the store level, and that would be covered by your record in (a) above.

QUESTION FOUR

Below are situations faced by different accounting firms in the conduct of the audit:

- Pack & Gove is an accounting firm that has been auditing the financial statements of Islington plc since 2016. From January 2020, Pack & Gove started providing consultancy services to another company Torquay plc. It has just come to the attention of Pack and Gove that Islington plc and Torquay plc are in dispute over a commercial transaction and the latter had filed a lawsuit against the other company for breach of contract.

- The accounting firm, Sheila & Jones, is engaged in the audit of the financial statements of Exeter Ltd for the year ended 31 May 2020. The Finance Director (FD) of Exeter Ltd had sent two memos in one week to the engagement partner, urging her to speed up the audit. The FD had suggested that the audit should be concluded by 30 June 2020 rather than the scheduled completion date of 29 July 2020, so that the Annual General Meeting date could be brought forward for some key financing decisions to be approved. The Chairman of the Board, based on the advice of the Finance Director, had already directed the company secretary to send out notices of the Annual General Meeting to convene on 15 July 2020.

- The audit engagement team of Diana & Frank recently completed an on-site interim audit of Wakefield Ltd. On the conclusion of the interim audit, the Finance Director of Torquay Ltd offered to take all the audit engagement team on a special boat trip on the River Dartmouth to offer a break from the busy work schedule. A popular Torquay Football Club player, Jonnie Jones, would be a star guest on the boat trip.

Required:

Explain the implication of each of the above situations for the work of the auditor and advise on the steps that the auditor should take in the circumstances.