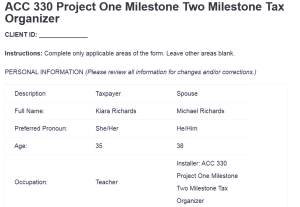

ACC 330 Project One Milestone Two Milestone Tax Organizer

CLIENT ID: ______________

Instructions: Complete only applicable areas of the form. Leave other areas blank.

PERSONAL INFORMATION (Please review all information for changes and/or corrections.)

| Description | Taxpayer | Spouse |

| Full Name: | Kiara Richards | Michael Richards |

| Preferred Pronoun: | She/Her | He/Him |

| Age: | 35 | 38 |

| Occupation: | Teacher | Installer: ACC 330 Project One Milestone Two Milestone Tax Organizer |

| Citizen/U.S. Resident Status: | U.S Citizen | U.S. Citizen |

| Marital Status: | Married | Married |

CONTACT INFORMATION (Please verify information and change if necessary.)

| Description | Information |

| Mailing or Street Address: | 45510 north Lane road

Gatlinburg, TN 37738 |

DEPENDENT INFORMATION (Please include all information for new dependents.)

| Full Name | SSN (if new) | Age | Relationship |

| Lori Richards | *–2227 | 10 | Daughter |

| Michaela Richards | *–2225 | 8 | Daughter |

| Ives Richards | *–2226 | 6 | Son |

TAX YEAR RETURN QUESTIONS (For any question answered “Yes,” please include support.)

| Personal Information: | Yes | No |

| Did your marital status change? | X | |

| Can you or your spouse be claimed as a dependent by someone else? | X | |

| Dependents: | ||

| Were there any changes in dependents from the prior year? | X | |

| Did you or your spouse pay for childcare while either of you worked? | X | |

| Do you have any children under age 18 with unearned income greater than $1,100? | X | |

| Do you have any children aged 18 or older (or students aged 19-23) who did not provide more than half of their cost of support with unearned income greater than $1,100? | X | |

| Education: | ||

| Did you or your spouse pay any student loan interest? | X | |

| Did you, your spouse, or your dependents incur any post-secondary education expenses, such as tuition? | X | |

| Gifts: | ||

| Did you or your spouse make any gifts (including birthday, holiday, anniversary, graduation, etc.) with a total value in excess of $15,000 to an individual? | ||

| Did you or your spouse make any gifts of difficult-to-value assets (such as non-publicly traded stock) to any person regardless of value? | ||

| Retirement or Severance: | ||

| Did you or your spouse contribute to a Roth IRA, convert an existing IRA into a Roth IRA, or roll any other distributions into a Roth IRA? | ||

| Did you or your spouse turn age 70 ½ and have money in an IRA or other retirement account without taking any distribution? | ||

| Personal Residence: | ||

| Did your address change? If yes, please provide the new address. | ||

| Did you or your spouse take out a home equity loan? If yes, please provide the purpose. | ||

| Did you or your spouse have an outstanding home equity loan at year-end?

If so, provide the principal balance and interest rate at the beginning and end of the year. |

||

| Are you claiming a deduction for mortgage interest paid to a financial institution and someone else received the Form 1098? | ||

| Did you sell your home? If yes, provide all closing documents and forms. | ||

| Miscellaneous: | ||

| Were you or your spouse notified by the Internal Revenue Service or other taxing authority of any changes in prior year returns? | ||

| Did you or your spouse sell, acquire, or exchange any virtual currencies? If so, please provide information regarding these activities. | ||

| Did you, your spouse or your dependents receive an identity protection PIN from the IRS? If so, please include this information. |

WAGES, SALARIES & TIPS (Please include all W-2 forms.)

| Employer Name | Wages | Federal Withheld | State Withheld |

| Employer 1 | $121,005 | $10,232 | – |

| Employer 2 | $12,161 | – | – |

SOCIAL SECURITY BENEFITS (Please include all 1099s.)

| Gross Benefits Received | Federal Withheld | State Withheld | Medicare Premiums | Medicare Part D – Drug Cov. | |

| Taxpayer | $0 | $0 | $0 | $0 | $0 |

| Spouse |

INCOME FROM RETIREMENT (Please include all 1099s.)

| Payer Name | Distribution Amount | Federal Withheld | State Withheld | State |

| $ | $ | $ | ||

STATE AND LOCAL TAX REFUNDS (Please include all 1099s.)

| Source (State or City) | Tax Year | Refund Amount |

| $ | ||

PASSTHROUGH INCOME (Please include all K-1s.)

| Entity Name | Rcvd | Entity Name | Rcvd |

OTHER SOURCES OF INCOME (Please include all 1099s or supporting documentation.)

| Payer Name and/or Nature & Source

(List any other items and amounts below) |

Amount | Federal Withheld | State Withheld | State |

| Unemployment Income (Form 1099-G) | $ | $ | $ | |

| Alimony Received | ||||

| Jury Duty Pay | ||||

| Gambling Income (Form W-2G) | ||||

| Cancellation of Debt (1099-C) | ||||

| Other (Describe): | ||||

INTEREST INCOME (Please include all 1099s.)

| Payer Name | Interest Income | U.S. Bond Interest | Tax-Exempt Interest |

| $ | $ | $ | |

DIVIDEND INCOME (Please include all 1099s.)

| Payer Name | Ordinary Dividends | Qualified Dividends | Capital Gain Distributions |

| $ | $ | $ | |

CAPITAL GAINS & LOSSES (Please include all 1099s.)

| Property Description | Date Acquired | Date Sold | Gross Sales Price | Cost Basis |

| $ | $ | |||

PROFIT OR LOSS FROM BUSINESS – SCHEDULE C (Please include all 1099s.)

| Name of Business: | |

| Principal Product or Service: | |

| Tax ID: | |

| Business Income (List Below): | Amount |

| Gross Receipts or Sales | $ |

| Other (Describe): | |

| Cost of Goods Sold (List Below): | Amount |

| Cost of Labor | $ |

| Purchases and Materials | |

| Other (Describe): | |

| Business Expenses (List Below): | Amount |

| Advertising | |

| Auto Expenses | |

| Actual Expenses | |

| Standard Mileage | |

| (Business Miles x Mileage Rate) | |

| Commissions and Fees | |

| Contract Labor | |

| Employee Benefit Programs | |

| Insurance (Other than Health) | |

| Interest Expense | |

| Legal and Professional Services | |

| Office Expenses | |

| Pension and Profit-Sharing Plans | |

| Rent or Lease of Machinery and Equipment | |

| Rent or Lease of Real Estate | |

| Repairs and Maintenance | |

| Supplies | |

| Taxes and Licenses | |

| Travel (Hotel, Airfare, Parking, Etc.) | |

| Meals | |

| Utilities | |

| Wages (Please include W-2s) | |

| Dues and Subscriptions | |

| Other (Describe): | |

ITEMIZED DEDUCTIONS (SCHEDULE A)

| Medical Expenses | Taxpayer/Joint | Spouse |

| Prescription Medicines and Drugs | $ | $ |

| Health Insurance Premiums Paid | ||

| Long-Term Care Insurance Premiums Paid | ||

| Insurance Reimbursements Paid to You | ||

| Medical Miles ( ____________________ x $____) | ||

| Lodging | ||

| Doctors, Dentists, Etc. | ||

| Hospitals | ||

| Lab Fees | ||

| Eyeglasses and Contacts | ||

| Other (Describe): | ||

| Taxes Paid | Taxpayer/Joint | Spouse |

| Real Estate Taxes | $ | $ |

| General Sales Tax Paid on Specified Items | ||

| Other (Describe): | ||

| Mortgage & Investment Interest Paid (List Institution Paid) | Taxpayer/Joint | Spouse |

| $ | $ | |

| Cash Contributions (List Organization Paid) | Taxpayer/Joint | Spouse |

| $ | $ | |

| Noncash Contributions (List Organization & Description) | Taxpayer/Joint | Spouse |

| $ | $ | |

STUDENT LOAN INTEREST EXPENSE (Please include Form 1098-E)

| Payee Name | Amount |

| $ | |

RETIREMENT CONTRIBUTIONS (Please include all supporting documentation.)

| Payee Name | Traditional | Roth | SEP/SIMPLE |

| $ | $ | $ | |

CHILD AND DEPENDENT CARE EXPENSES (Please include all supporting documentation.)

| Provider Name | Provider Address | SSN or EIN | Amount Paid |

| $ | |||

OTHER POTENTIALLY DEDUCTIBLE ITEMS (Please include all supporting documentation.)

| Nature and Source | Taxpayer/Joint | Spouse |

| Educator Expenses | $ | $ |

| Health Savings Account Contributions (Include form 1099-SA) | ||

| Alimony Paid (List Recipient & SSN) | ||

| Gambling Losses | ||

| Tuition Expenses (Include Form 1098-T) | ||

| §529 Plan Contributions to M.A.C.S. & M.P.A.C.T. | ||

| Prior Year Tax Preparation Fees | ||

| Other (Describe): | ||

FEDERAL TAX PAYMENTS

| Detail | Amount Paid | Date Paid |

| Prior Year Overpayment Applied | $ | |

| 1st Quarter Estimate (Due 4/15) | ||

| 2nd Quarter Estimate (Due 6/15) | ||

| 3rd Quarter Estimate (Due 9/15) | ||

| 4th Quarter Estimate (Due 1/15) | ||

| Extension Payment (Due 4/15) | ||

| Other (Describe): |

TAX PLANNING INFORMATION FOR NEXT TAX YEAR

| Do you expect any of the following to occur NEXT YEAR? (If yes, explain below) | Yes | No |

| A change in marital status | X | |

| A change in dependents | X | |

| A substantial change in income | X | |

| A substantial change in withholding | X | |

| A substantial change in deductions | X |

OTHER ITEMS OF SIGNIFICANCE

| Please include any other information that might be of significance. |

|

|

I (we) have submitted this information for the sole purpose of preparing my (our) tax return(s). Each item can be substantiated by receipts, canceled checks or other documents. This information is true, correct, and complete to the best of my (our) knowledge.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

ACC 330 Project One Milestone Two Guidelines and Rubric

Overview

Tax organizers are used to help perform due diligence and provide an opportunity for tax planning. They assist in organizing the information provided by the client and provide insight into possible tax planning opportunities. Sometimes they are prepared by the tax firm with prior year information that is later confirmed by the client (such as confirming if there are any changes to address, telephone number(s), dependents, or bigger items such as income or deductions). For first-year clients, the tax firm can fill out a tax organizer with the information they obtain from the client, or they can request the client fill in a blank tax organizer with any relevant information.

Directions

Review the six profiles provided in Client Tax Profiles A Descriptions found in the Supporting Materials section. Choose three client profiles to compare using the Project One Milestone Two template found in the What to Submit section. Once you have compared these profiles you will select one of them and complete the Tax Organizer template also located in the What to Submit section below.

Use the Tax Organizer to document the information you have from your selected client to prepare their tax return. In this assignment, you are using the Tax Organizer to organize the information from your client profile to prepare for the tax returns you will complete in Project One. You will not be given feedback on this assignment related to that project; however, this will be a helpful way for you to gather your knowledge of the client’s situation and to plan and prepare the client’s tax return.

Note: Once the Tax Organizer has been completed, you will need to return to the Project One Milestone Two template to complete the Tax Planning Considerations, item #6.

ACC 330 Project One Milestone Two Milestone Tax Organizer

Specifically, you must address the following rubric criteria:

- Compare three tax positions using the table provided.

- Summarize the features of each of the three tax positions.

- Identify your chosen client’s tax position.

- Explain the characteristics of the client profile you selected to use in the Tax Organizer.

- Complete the Tax Organizer for the chosen tax position.

- Use only the information provided in the client profile.

- Explain tax planning opportunities based on the completed tax organizer.

- List several bulleted points to consider.

What to Submit

Submit two documents for this assignment:

- Project One Milestone Two Template should be a 2-page Word document with double spacing, 12-point Times New Roman font, and one-inch margins. Any sources should be cited according to APA style

- Project One Milestone Two Tax Organizer template with appropriate areas of the form filled in.