Financial Reports Comparison

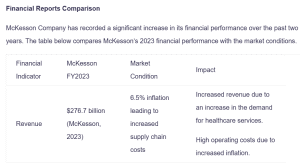

McKesson Company has recorded a significant increase in its financial performance over the past two years. The table below compares McKesson’s 2023 financial performance with the market conditions.

| Financial Indicator | McKesson FY2023 | Market Condition | Impact |

| Revenue | $276.7 billion (McKesson, 2023) | 6.5% inflation leading to increased supply chain costs | Increased revenue due to an increase in the demand for healthcare services.

High operating costs due to increased inflation. |

| Net Income | $3.5 billion (McKesson, 2023) | Increased Federal interest rates from 3.75% to 5% | Increased borrowing costs due to high interest rates. However, McKesson’s ability to maintain cash flow and its position in the market protects its net income. |

| Earnings Per Share | $27.14 billion (McKesson, 2023) | Tight monetary policy including reduced quantitative easing | High stock price volatility because of the Federal Reserve policy leading limited Earnings Per Share growth. |

| Debt Levels | $6.8 billion (Stable) (McKesson, 2023) | Higher borrowing costs because of the increase in interest rates. | Stable debt levels because of strong financial reserves and cash flow despite the high borrowing costs. |

| Operating Income | $5.2 billion (McKesson, 2023) | High inflation and disruptions in the supply chain. | Reduced operational income because of high input costs. |

| Market condition overview | Growth in the United States pharmaceutical sector. | Accommodative monetary policy supporting the growth of pharmaceutical companies despite disruptions in the supply chain.

Tight monetary policy to reduce inflation and potential recession concerns affecting demand and revenue. |

Decrease in revenue due to increased inflation. |

The table above suggests that McKesson financial performance is favorable compared to market conditions. The company is likely to experience an increase in revenue despite the high inflation rate due to its strong net income influenced by the company’s strategic expansion int specialty therapies and oncology. The company has also maintained a steady operating income, but operational costs could increase due to inflation.

References

McKesson. (2023). McKesson Corporation. AnnualReports.com. https://www.annualreports.com/Comp any/mckesson-corporation

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Continue your work with the company you selected in Week 1.

In preparation for the Week 4 Summative Assessment, research your company’s financial reports from the past fiscal year, along with the market conditions from that same year.

Financial Reports Comparison

In a 1- to 2-page chart, compare your company’s current financial reports with the market conditions from the previous fiscal year. Focus on interest rates, Federal Reserve Bank monetary policy changes, or other market conditions relevant to the company you selected.