Financial Analysis- Case of Apple Inc

The financial information obtained from the financial statements of any given institution can be used to offer insight into the organization’s financial health. The statements can be evaluated using various metrics, such as horizontal and vertical financial analyses, to obtain insight into crucial financial health aspects such as profitability, liquidity, and solvency. For this case study, the financial health of Apple Inc. is evaluated based on the mentioned criteria. The company’s financial statement for the year 2023 is evaluated. Further, Samsung Inc. was selected as a competitor company for comparison and enhanced analysis. The structure of the case study, as given below, entails the company background, vertical analysis, horizontal analysis, ratio analysis, competitor comparison, results synthesis, interpretation of the company’s health, and recommendations for improvement.

Company background

Apple Inc. is a multinational technology company that designs and produces personal computers, smartphones, accessories, and wearables. The American-based company boasts of significant market performance in the technological sector with its major products including iPad, Mac, and iPhone. The company was started in 1976 and is listed on the New York Stock Exchange (NYSE) trading as AAPL (Chen et al., 2). The company boasts of a strong share price for its stock with its price as of April 13 closing at $176.55. The company has a market capitalization of $2.73 trillion. The financial statements, as reported for the 2023 fiscal period, are obtained from the 10-K fillings at the securities exchange and used for the analysis of this paper (Apple Inc., 1 ). On the other hand, the competitor company Samsung Inc. is evaluated because it is a major competitor of Apple Inc. in the technology sector.

Vertical Analysis

Vertical analysis adopts the criteria of comparing each line item to the base value of a financial statement to obtain the relative proportions for each item. Essentially, the vertical analysis for Apple Inc. compares line items in the income statement taking revenue as the base value. For the statement of financial position, the value for total assets is taken as the base value. The analysis for the fiscal period ended 2023 is as given below:

Income statement analysis

| Item | Amount (in millions) | Proportion of net sales |

| Total net sales | $383,285 | |

| Total cost of sales | $169,148 | 44% |

| Operating expenses | $54,847 | 14% |

| Operating income | $114,301 | 30% |

| Net income | $96,995 | 25% |

The vertical analysis, as shown in the table above, indicates that the cost of sales aspect consumed the largest portion of Apple Inc.’s total net sales. Notably, this is slightly higher than the industry average of 54.2%, indicating a stellar company performance. For the balance sheet analysis, the breakdown below is provided:

| Item | Amount (in millions) | Proportion of net sales |

| Total assets | $352,583 | |

| Current assets | $143,566 | 40.71% |

| Non-current assets | $209,017 | 59.28% |

| Inventories | $6,331 | 1.79% |

The vertical analysis, as shown above, indicates that non-current assets comprise a better part of Apple Inc.’s total assets. Notably, this shows that the liquidity position of the company is not strong. Compared to the industry average of 62%, the company is performing excellently.

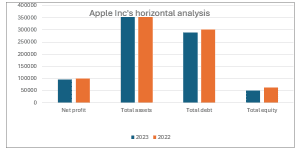

Horizontal Analysis

Horizontal analysis evaluates the performance of a company in various fiscal periods. For the case of Apple Inc., the performance of the company between the years 2022 and 2023 is compared. Various metrics are adopted from the four selected financial statements for the periods and compared as given in the chart below.

From the illustration, the company’s net profit and total shareholder’s equity declined from 2022 to 2023. Notably, this indicates a declined financial performance. However, there was an improvement in the total assets and total debt in the same period.

Ratio Analysis

Ratio analysis uses various metrics that offer insight into the financial performance of the company. The current ratio is used to evaluate the liquidity of the company, while the gross margin is used to evaluate the profitability of the company. Additionally, the debt-to-asset ratio is used to evaluate the solvency of the company. The ratios for Apple Inc. and Samsung Inc. are calculated below.

| Ratio | Formula | Apple Inc. | Samsung Inc. | Industry Average | ||

| Liquidity | Current Ratio | Current assets/Current liabilities | 0.99 | 2.79 | 2.05 | |

| Quick ratio | (Current assets-inventory)/current liabilities | 0.94 | 1.91 | 1.47 | ||

| Profitability | Gross margin | (Gross profit*100)/Net sales | 44.13% | 37.12% | 40.22% | |

| Net profit margin | (Net profit*100)/net sales | 25.31% | 18.11% | 22.12% | ||

| Solvency | Debt to assets ratio | Total debt/total assets | 0.32 | 0.30 | 0.57 | |

| Debt to equity ratio | Total debt/total equity | 1.79 | 1.46 | 0.28 | ||

The table above summarizes the ratio analysis for Apple Inc. for the period that ended in September 2023. Regarding liquidity, the company has poor financial performance as the values for both the current ratio and quick ratios are below 1. Notably, this indicates that the company may not be able to meet its short-term maturing obligations as and when they fall due (Syarifah, 3). The ratios are way below the industry averages which indicates that the company is likely to face liquidity problems if the problem is not addressed. Regarding profitability, the company has performed excellently. It managed a gross margin of 44.13% and a net profit margin of 25.31%, which indicates positive performance for stockholders. The company proved profitable during this period by beating the industry average and, thus, achieving a stellar and healthy financial performance.

Regarding solvency, the company’s performance indicates a good balance between debt and assets. Only 32% of its assets are financed by debt which is a better financial performance as compared to the industry average. Lastly, the company relies more on debt to finance its operations than equity, which is a good financial performance when the debt-to-assets ratio is considered. When compared to Samsung Inc. Apple Inc. has better financial performance for the period considered regarding profitability. The company achieved a better gross profit margin and net profit margin than Samsung Inc. However, Apple Inc. has lower performance when the liquidity position is considered. The two companies have almost the same performance regarding solvency and are better off than the industry average.

Results Synthesis and Interpretation

Apple Inc. has a healthy financial performance based on vertical, horizontal, and ratio analysis. The performance is better than average in the ratio metrics which shows a healthy financial position. When compared to its competitor Samsung Inc., the results are vindicated. Essentially, this offers stakeholders insight into Apple Inc., which is a good investment destination. With the strong level of profitability that is posted, investors can consider purchasing the company’s stocks. The company faces a liquidity risk based on the liquidity analysis. However, the debt-to-asset ratio indicates that the company has minimal debt levels and, thus, fewer risks for investors.

Recommendations for Improvement

Apple Inc. can consider various measures to improve its financial performance. First, the company should reduce the level of current liabilities to enhance its liquidity position and boost investor confidence. An example that is common in the industry is the avoidance of short-term loans. Second, the company should ensure its current revenue channels are enhanced to increase profits that, in turn, attract more investors. For example, it should open new outlets in new countries. Lastly, Apple Inc. should innovate new products to enhance revenue channels. As an example, it can evaluate to enter other industries, such as the motor vehicle industry, to enhance revenues.

References

Apple Inc. (2023). Annual Report: https://www.sec.gov/Archives/edgar/data/320193/000032019323000106/aapl-20230930.htm#i1cb1ba018cb1455aa66bd3f9ab0c5b1a_73

Chen, K. (2023). Analysis On the Development of Apple Inc. Based on SWOT- Highlights in Business, Economics and Management, 20, 351-355.

Syarifah, S. (2021). Effect of Earnings Management, Liquidity Ratio, Solvency Ratio and Ratio Profitability of Bond Ratings in Manufacturing:(Case Study Sub-Sector Property and Real Estate Sector Companies listed on the Indonesia Stock Exchange (IDX)). International Journal of Business, Economics, and Social Development, 2(2), 89-97

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Financial statements are reports that summarize all the accounting transactions that have taken place during a specific period.

Financial Analysis- Case of Apple Inc

Choose a publicly held company and, using the Internet, review its most current annual report. Evaluate the health of the corporation you picked