Strategic Financial Management Positioning Report

In the dynamic landscape of healthcare, strategic financial management plays a pivotal role in ensuring the sustainability and success of hospitals (Kourtis et al., 2021). The decision to initiate an in-service handbook stems from the recognition of the current challenges hospitals face and the need for a comprehensive understanding of financial management principles. This report explores critical issues confronting hospitals, the evolving role of financial decision-making in the health services sector, and its impact on planning and operations. Addressing these issues seeks to establish the groundwork for strategic repositioning and strong financial management practices.

Current Issues or Challenges Confronting Hospitals Today

The healthcare landscape is fraught with difficulties, each of which has far-reaching ramifications for hospitals. Financial constraints resulting from increased prices and reimbursement difficulties provide a substantial challenge. The ongoing paradigm shift in healthcare reform adds a layer of complexity that necessitates adaptability and creativity. While technological breakthroughs promise better patient outcomes, they need significant expenditure. Population health management emphasizes the importance of preventative care and community health. Furthermore, staffing constraints highlight the critical need for strategic repositioning to ensure efficient and effective healthcare delivery.

The Role of Financial Management Decision-Making in the Health Services Sector and Its Evolution Over Time

Financial management decision-making in the health services sector has evolved into a multifaceted and strategic function. Traditionally seen as a supporting entity, financial management has transcended its role to become a critical driver of organizational success (Donnellan, 2013). Historically, decisions were predominantly centered around budgeting and cost control. However, in contemporary healthcare, financial decision-making extends to strategic planning, investment analysis, and risk management. The CFO’s role has shifted from a transactional focus to a strategic partner, influencing organizational policies and fostering financial sustainability.

How Financial Management Decisions Affect the Planning and Operations of Healthcare Delivery Services

Financial management decisions influence the planning and execution of healthcare delivery services. Budget allocations affect staffing numbers, resource purchases, and infrastructure development. Capital investment decisions impact modern medical technology acceptance, facility expansion, and overall patient care quality. Efficient financial management ensures that money is allocated wisely, avoiding resource shortages and improving service performance. Furthermore, comprehensive financial planning enables hospitals to respond to changing healthcare landscapes, maintaining long-term viability and resilience in the face of uncertainty.

Where Vision and Mission Statements Fall Regarding Financial Management

Vision and mission statements serve as guiding principles for hospitals, reflecting their core values, aspirations, and commitment to the community. In the realm of financial management, these statements provide a strategic foundation. Vision statements outline the desired future state, encompassing financial health, sustainability, and community impact. Mission statements define the hospital’s purpose, emphasizing the provision of quality care and community service. Financial decisions align with these statements by ensuring responsible resource utilization, ethical financial practices, and the fulfillment of the hospital’s broader societal role (Rego et al., 2015).

Financial Goals for a Typical Hospital

Financial goals for hospitals are multifaceted, requiring a delicate balance between maximizing shareholder wealth and ensuring the hospital’s ongoing financial viability (Gapenski & Pink, 2015). Maximizing shareholder wealth involves enhancing the value of the hospital for investors, often measured by stock prices. Concurrently, financial viability necessitates maintaining stability, solvency, and the ability to fulfill the hospital’s mission.

Crafting these goals involves considering various factors. One critical aspect is profitability, which entails striking a balance between generating profits to attract investors and allocating resources for patient care. Profitability is not only a financial metric but also a strategic consideration that influences the hospital’s ability to reinvest in facilities, technology, and personnel, ultimately enhancing the quality of patient services. Another key element in financial goal setting is liquidity. Hospitals must ensure sufficient liquid assets to cover operational needs and emergencies without compromising long-term investments. A robust liquidity position provides the flexibility needed to navigate unforeseen challenges, such as patient volume fluctuations, reimbursement rate changes, or unexpected capital expenditures. Another key element in financial goal setting is solvency, which involves maintaining a strong financial position to meet long-term obligations and strategic investments. Hospitals often incur substantial debt for capital projects, and maintaining solvency ensures the ability to honor these commitments while continuing to invest in infrastructure and technology to meet evolving healthcare needs.

Furthermore, financial goals extend beyond purely economic considerations to encompass the hospital’s community impact. Balancing financial objectives with community service is integral to fulfilling the hospital’s broader role. Hospitals play a vital role in promoting community health, addressing health disparities, and contributing to the overall well-being of the populations they serve. Aligning financial decisions with community impact reinforces the hospital’s commitment to social responsibility and ensures that financial success translates into tangible benefits for the communities it serves.

Considerations for Composing the Financial Goals

Composing financial goals for hospitals involves a nuanced approach, aligning them with the hospital’s mission, vision, and broader societal responsibilities. Alignment with mission and vision is paramount, ensuring that financial goals resonate with the hospital’s overarching objectives (Marr & Creelman, 2011). This alignment fosters a cohesive strategy that integrates financial success with the fulfillment of healthcare needs, creating a symbiotic relationship between economic viability and mission-driven service. In addition to mission alignment, financial goals should embody social responsibility. Hospitals bear a duty to the communities they serve, and their financial objectives should reflect a commitment to providing accessible, quality care to all, including those with limited resources. By prioritizing social responsibility in financial goals, hospitals contribute to the broader goal of improving community health and addressing healthcare disparities.

Additionally, ethical considerations play a crucial role in shaping financial goals for hospitals, with financial decisions required to adhere to ethical standards, ensuring that profitability does not compromise patient care or violate principles of fairness. Upholding ethical considerations is integral to maintaining trust with patients, staff, and the community, reinforcing the hospital’s commitment to ethical healthcare practices. Moreover, financial goals should exhibit adaptability to the evolving healthcare landscape, given the industry’s dynamic nature with changes in regulations, technology, and patient needs. Financial goals that are flexible and responsive can better accommodate these changes, positioning the hospital to navigate uncertainties and capitalize on emerging opportunities. Adaptability in financial goals is essential for hospitals to remain resilient and agile in a constantly evolving healthcare environment.

Functional Areas of Responsibility Centers in the Hospital

Identifying functional areas or responsibility centers within a hospital is crucial for effective financial management and operational efficiency (Ginn & Lee, 2006). These centers represent distinct units responsible for specific aspects of hospital functions. In a hospital, these responsibility centers typically include clinical services, encompassing medical departments such as surgery, internal medicine, and specialized services. Financial management in this center involves budgeting for medical supplies, equipment, and staffing to ensure the delivery of high-quality medical care. Support Services constitute another critical responsibility center, covering administrative functions like human resources, finance, and information technology. Efficient financial decisions in this center ensure the smooth operation of essential support functions, contributing to the overall effectiveness and efficiency of the hospital’s administrative processes.

Thirdly, patient services also represent a crucial responsibility center, covering nursing units, patient care, and related services. Financial planning in this area involves budgeting for staffing, training, and ensuring patient satisfaction while carefully balancing costs to maintain high-quality healthcare services. Diagnostic and Ancillary Services, including radiology, laboratory, and other diagnostic services, also form a distinct responsibility center. Financial considerations in this center revolve around equipment maintenance, technology upgrades, and ensuring accuracy in billing processes to support effective diagnostic services.

Facilities Management is another key responsibility center, focusing on the maintenance of the physical hospital infrastructure, utilities, and compliance with safety standards. Financial decisions in this center include budgeting for facility upgrades, utilities cost management, and adherence to regulatory requirements to provide a safe and conducive environment for patient care. Lastly, research and development constitute a specialized responsibility center for hospitals engaged in research activities. This center deals with funding allocations for research projects, ensuring alignment with the hospital’s mission and contributing to medical advancements that enhance the hospital’s reputation and contribute to scientific knowledge.

Conclusion

In conclusion, strategic financial management is indispensable for hospitals navigating the complex landscape of contemporary healthcare. The challenges hospitals face today, from evolving regulations to financial uncertainties, demand a proactive and informed approach. Financial management decision-making in the health services sector plays a pivotal role in steering hospitals toward sustainability and growth. Over the years, this role has evolved from a predominantly administrative function to a strategic partner influencing the broader healthcare landscape. The impact of financial management decisions resonates across the entire spectrum of healthcare delivery services. From planning budgets that support clinical excellence to optimizing support services for operational efficiency, financial decisions are integral to effective healthcare provision.

Subsequently, vision and mission statements, the guiding principles of a hospital, need to align seamlessly with financial management strategies to ensure a harmonious pursuit of both financial viability and the overarching mission of healthcare delivery. Financial goals for a typical hospital should strike a balance between maximizing shareholder wealth and ensuring the institution’s long-term financial viability. Considerations for composing these financial goals must not only encompass profitability but also factors such as community impact, quality of care, and adherence to ethical standards. Identifying responsibility centers within the hospital, each with specific financial considerations, is crucial for streamlining operations and maintaining fiscal responsibility. As hospitals grapple with the intricacies of the modern healthcare landscape, the judicious integration of financial management principles is imperative. This secures the financial health of the institution and also enhances its ability to fulfill its mission of providing quality healthcare services to the community.

References

Donnellan, J. J. (2013). A moral compass for management decision making: A healthcare CEOʼs reflections. Frontiers of Health Services Management, 30(1), 14–26. https://doi.org/10.1097/01974520-201307000-00003

Gapenski, L. C., & Pink, G. H. (2015). Understanding healthcare financial management. Health Administration Press.

Ginn, G. O., & Lee, R. P. (2006). Community orientation, strategic flexibility, and financial performance in hospitals. Journal of Healthcare Management, 51(2), 111–121. https://doi.org/10.1097/00115514-200603000-00009

Marr, B., & Creelman, J. (2011). Aligning financial management with strategic goals. More with Less, 134–156. https://doi.org/10.1057/9780230300408_7

Rego, A., Araújo, B., & Serrão, D. (2015). The mission, vision, and values in hospital management. Journal of Hospital Administration, 5(1), 62. https://doi.org/10.5430/jha.v5n1p62

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

For the next 5 weeks, you will have a project that will begin in Unit 1, continue through all units, and end in Unit 5. Your discussion and project will be connected each week, so you must complete your discussion work on time.

Strategic Financial Management Positioning Report

The following is a schedule of each week’s topics:

| Unit # | Topic |

| Unit 1 | Significant changes in healthcare from a financial standpoint |

| Unit 2 | The influence of qualitative and quantitative data |

| Unit 3 | Ethical and legal dilemmas |

| Unit 4 | Relevance of data and data sources |

| Unit 5 | Overall operational plan for profitability |

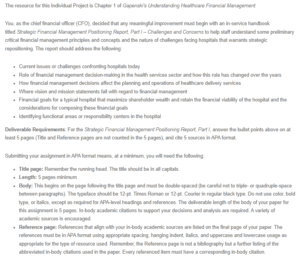

The resource for this Individual Project is Chapter 1 of Gapenski’s Understanding Healthcare Financial Management.

You, as the chief financial officer (CFO), decided that any meaningful improvement must begin with an in-service handbook titled Strategic Financial Management Positioning Report, Part I – Challenges and Concerns to help staff understand some preliminary critical financial management principles and concepts and the nature of challenges facing hospitals that warrants strategic repositioning. The report should address the following:

- Current issues or challenges confronting hospitals today

- Role of financial management decision-making in the health services sector and how this role has changed over the years

- How financial management decisions affect the planning and operations of healthcare delivery services

- Where vision and mission statements fall with regard to financial management

- Financial goals for a typical hospital that maximize shareholder wealth and retain the financial viability of the hospital and the considerations for composing these financial goals

- Identifying functional areas or responsibility centers in the hospital

Deliverable Requirements: For the Strategic Financial Management Positioning Report, Part I, answer the bullet points above on at least 5 pages (Title and Reference pages are not counted in the 5 pages), and cite 5 sources in APA format.

Submitting your assignment in APA format means, at a minimum, you will need the following:

- Title page: Remember the running head. The title should be in all capitals.

- Length: 5 pages minimum

- Body: This begins on the page following the title page and must be double-spaced (be careful not to triple- or quadruple-space between paragraphs). The typeface should be 12-pt. Times Roman or 12-pt. Courier in regular black type. Do not use color, bold type, or italics, except as required for APA-level headings and references. The deliverable length of the body of your paper for this assignment is 5 pages. In-body academic citations to support your decisions and analysis are required. A variety of academic sources is encouraged.

- Reference page: References that align with your in-body academic sources are listed on the final page of your paper. The references must be in APA format using appropriate spacing, hanging indent, italics, and uppercase and lowercase usage as appropriate for the type of resource used. Remember, the Reference page is not a bibliography but a further listing of the abbreviated in-body citations used in the paper. Every referenced item must have a corresponding in-body citation.